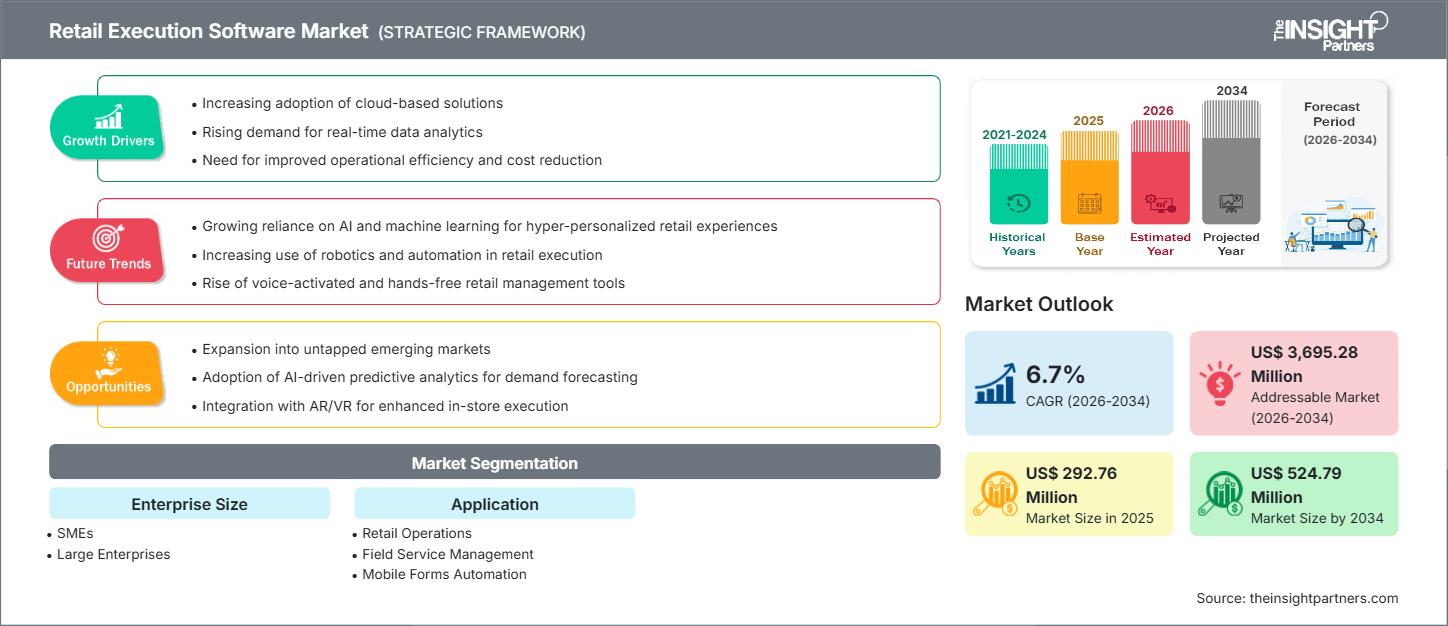

El mercado de software de ejecución minorista se valoró en US$292,76 millones en 2025. Se espera que alcance los US$524,79 millones para 2034, registrando una CAGR del 6,7% durante 2026-2034.

Análisis del mercado de software de ejecución minorista

El pronóstico para el mercado de software de ejecución minorista indica un fuerte crecimiento, impulsado por la creciente demanda de análisis en tiempo real, operaciones de campo móviles y una ejecución eficiente en tienda. Entre los factores clave para este crecimiento se encuentran la creciente adopción de la transformación digital en el comercio minorista, la creciente necesidad de automatización de tareas en los equipos de campo y la integración del aprendizaje automático para obtener información predictiva. Además, la transición de las auditorías manuales tradicionales de tienda a plataformas de ejecución minorista basadas en datos está impulsando la expansión del mercado.

Descripción general del mercado de software de ejecución minorista

El software de ejecución minorista es una clase de soluciones digitales diseñadas para optimizar y automatizar las operaciones en tienda, las actividades de venta en campo, la comercialización y la gestión del cumplimiento normativo. Estas plataformas ayudan a las empresas de bienes de consumo, minoristas y distribuidores a coordinar equipos de campo, gestionar las visitas a tiendas, automatizar los flujos de trabajo y recopilar datos en tiempo real (p. ej., auditorías de estanterías y cumplimiento de promociones). Al agilizar la toma de decisiones, reducir la carga de trabajo manual y mejorar la consistencia de la ejecución en tienda, estas herramientas optimizan la eficiencia operativa e impulsan el rendimiento de las ventas.

Personalice este informe según sus necesidades

Obtenga PERSONALIZACIÓN GRATUITAMercado de software de ejecución minorista: perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado del software de ejecución minorista

Factores impulsores del mercado:

- Demanda de información minorista en tiempo real: los minoristas y las empresas de bienes de consumo aprovechan cada vez más el software para obtener visibilidad en vivo del rendimiento de las estanterías, el cumplimiento de los productos y las métricas de auditoría de las tiendas.

- Habilitación de fuerza laboral de campo móvil: los equipos de ventas de campo, comercialización y tiendas están adoptando aplicaciones móviles para administrar tareas, informar problemas y recopilar datos directamente de las tiendas.

- Adopción de inteligencia artificial y aprendizaje automático: el aprendizaje automático se está utilizando para predecir la demanda, optimizar la asignación de tareas e identificar patrones de ejecución, lo que impulsa decisiones minoristas más inteligentes.

- Transformación digital en el comercio minorista: a medida que los minoristas tradicionales digitalizan las operaciones de sus tiendas, existe una creciente necesidad de software de ejecución que se integre con ERP, POS y otros sistemas backend.

Oportunidades de mercado:

- Implementación basada en la nube: la adopción de software de ejecución minorista basado en la nube ofrece escalabilidad, menores costos de infraestructura y sincronización en tiempo real entre equipos distribuidos.

- Expansión en mercados emergentes: los minoristas en las economías emergentes (por ejemplo, India, China, América Latina) están invirtiendo cada vez más en plataformas de ejecución minorista para agilizar las operaciones en las tiendas y mejorar la comercialización.

- Automatización de tareas impulsada por IA: la incorporación de la automatización impulsada por IA para el cumplimiento del planograma, la programación de tareas y la detección de anomalías presenta importantes ganancias de eficiencia.

- Integración con Analytics y CRM: el software de ejecución minorista integrado con CRM, análisis y sistemas de gestión de promoción comercial puede proporcionar información empresarial de mayor nivel y optimización del rendimiento.

Análisis de segmentación del informe de mercado de software de ejecución minorista

El mercado está segmentado para ayudar a comprender su estructura, áreas de crecimiento y tendencias de adopción:

Por tamaño de empresa:

- PYMES

- Grandes empresas

Por aplicación:

- Operaciones minoristas

- Gestión de servicios de campo

- Automatización de formularios móviles

- Ventas de campo

- Gestión de promoción comercial

- Compromiso de los empleados

Por geografía:

- América del norte

- Europa

- Asia Pacífico

- Oriente Medio y África (MEA)

- América del Sur y Central

Perspectivas regionales del mercado de software de ejecución minorista

Los analistas de The Insight Partners han explicado detalladamente las tendencias y los factores regionales que influyen en el mercado de software de ejecución minorista durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de software de ejecución minorista en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de software de ejecución minorista

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2025 | US$ 292,76 millones |

| Tamaño del mercado en 2034 | US$ 524,79 millones |

| CAGR global (2026-2034) | 6,7% |

| Datos históricos | 2021-2024 |

| Período de pronóstico | 2026-2034 |

| Segmentos cubiertos |

Por tamaño de empresa

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de software de ejecución minorista: comprensión de su impacto en la dinámica empresarial

El mercado de software de ejecución minorista está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de software de ejecución minorista

Análisis de la cuota de mercado del software de ejecución minorista por geografía

- Norteamérica: En 2019, Norteamérica representó aproximadamente el 31,13 % del mercado. Su liderazgo se basa en una infraestructura minorista consolidada, una alta adopción de la movilidad laboral y una sólida integración con los sistemas minoristas empresariales.

- Europa: Adopción significativa debido a cadenas minoristas y de bienes de consumo envasados (CPG) establecidas, operaciones digitalmente avanzadas y demanda de consistencia en la ejecución en todas las tiendas.

- Asia Pacífico (APAC): Se prevé un crecimiento a la CAGR más alta durante el período de pronóstico. El crecimiento está impulsado por la creciente digitalización del comercio minorista (especialmente en China e India), la proliferación de equipos de campo que priorizan la movilidad y la expansión del comercio minorista moderno.

- América del Sur y Central: Oportunidades debido a la modernización del comercio minorista tradicional, la creciente adopción de dispositivos móviles y la necesidad de mejores sistemas de ejecución en redes distribuidas.

- Medio Oriente y África: potencial emergente impulsado por la expansión de la red minorista, la creciente inversión en tecnología y la necesidad de cumplimiento y gestión del rendimiento en las tiendas.

Densidad de actores del mercado de software de ejecución minorista: comprensión de su impacto en la dinámica empresarial

Existe un panorama de mercado competitivo, con una combinación de proveedores de software empresarial establecidos y proveedores centrados en software de ejecución de nichos.

Estrategias de diferenciación competitiva:

- Integración con sistemas ERP, CRM y POS para proporcionar información integral.

- Ofrecemos plataformas móviles optimizadas para equipos de campo, automatización de tareas y capacidad sin conexión.

- Incorporación de IA/ML para enrutamiento inteligente de tareas, análisis predictivo y detección de anomalías.

- Escalabilidad a través de implementaciones en la nube para atender tanto a pymes como a grandes empresas.

Principales empresas que operan en el mercado de software de ejecución minorista:

- Bizom (Mobisy Technologies Private Limited)

- EdgeCG (StayinFront, Inc.)

- Inteligencia minorista

- Mobisoft

- Sonda POP

- Soluciones móviles Spring, Inc.

- Soluciones tecnológicas Trax Pte Ltd.

- Valomnia

- GANARLO

Otros jugadores analizados

- Respuestas

- YOOBIC

- Movista

- GoSpotCheck

- SAP SE

- IBM

- Microsoft

- Fuerza de ventas

- Pepperi

- Quédate al frente

Noticias y desarrollos recientes del mercado de software de ejecución minorista

- Según los comunicados de prensa, el aprendizaje automático se identifica como una tendencia clave para el mercado de software de ejecución minorista, revolucionando la forma en que se recopilan y analizan los datos de campo.

Informe de mercado sobre software de ejecución minorista: cobertura y resultados

El informe "Pronóstico del mercado de software de ejecución minorista" de The Insight Partners abarca:

- Tamaño del mercado y pronóstico (global, regional) de 2021 a 2034

- Dinámica del mercado: factores impulsores, restricciones, oportunidades y tendencias (incluido el impacto de la COVID-19)

- Perspectivas estratégicas sobre el desempeño regional (América del Norte, Europa, Asia-Pacífico, Oriente Medio y África, América del Sur y Central)

- Segmentación por tamaño de empresa (PYME vs. Grandes Empresas)

- Segmentación basada en aplicaciones (operaciones minoristas, ventas de campo, promoción comercial, etc.)

- Panorama competitivo y perfil empresarial de los principales actores

- Desarrollos recientes y análisis de tendencias (IA, aprendizaje automático, dispositivos móviles)

- Posiblemente análisis FODA y PEST (típicos en los informes de Insight Partners, aunque no completamente detallados en el resumen público)

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de software de ejecución minorista

Obtenga una muestra gratuita para - Mercado de software de ejecución minorista