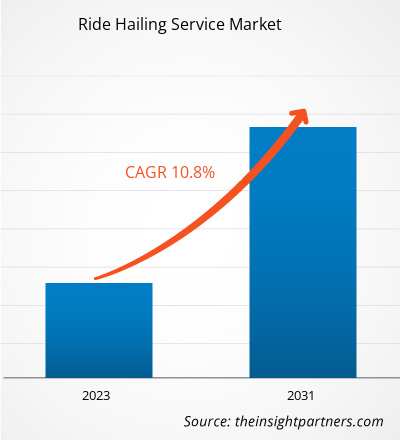

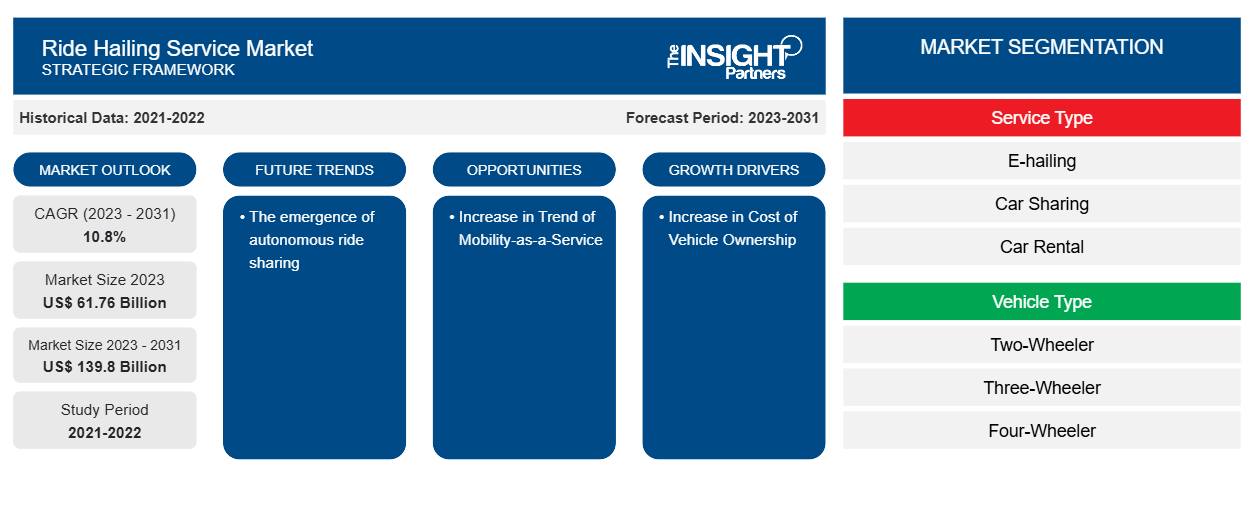

Se prevé que el tamaño del mercado de servicios de transporte compartido alcance los 139.800 millones de dólares en 2031, frente a los 61.760 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 10,8 % durante el período 2023-2031. Es probable que el surgimiento de los servicios de transporte compartido autónomo siga siendo una tendencia clave en el mercado.

Análisis del mercado de servicios de transporte compartido

Se espera que el aumento de la tendencia de los servicios de transporte a pedido en todo el mundo impulse el crecimiento del mercado en los próximos años. Además, se espera que el aumento del costo de propiedad del vehículo impulse la demanda de servicios de transporte compartido durante el período de pronóstico. Además, se prevé que un aumento en la tendencia de la movilidad como servicio en todo el mundo impulse aún más el crecimiento del mercado de servicios de transporte compartido de 2023 a 2031.

Descripción general del mercado de servicios de transporte compartido

Los actores clave en el ecosistema del mercado de servicios de transporte en coche incluyen proveedores de soluciones tecnológicas, proveedores de servicios de transporte en coche y usuarios finales. Los proveedores de soluciones tecnológicas incluyen dispositivos conectados u otros fabricantes de hardware y desarrolladores de software. El aumento en el número de proveedores de soluciones tecnológicas está impulsando críticamente la digitalización en el transporte en coche. Se espera que los servicios de transporte en coche aumenten después de COVID debido a la creciente tendencia de los servicios de transporte a pedido, la creación de oportunidades de empleo y la baja tasa de propiedad de automóviles entre los millennials. Además, los avances tecnológicos en vehículos conectados y automáticos para reducir las emisiones de CO2 y los aumentos sustanciales en las ventas de estos vehículos inteligentes y eficientes para el uso de servicios de transporte en coche impulsan el crecimiento del mercado global. Los proveedores de servicios de transporte en coche toman servicios de proveedores de soluciones tecnológicas. Con los crecientes desarrollos tecnológicos en el transporte en coche, la demanda de un mercado de servicios de transporte en coche está aumentando.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Impulsores y oportunidades del mercado de servicios de transporte compartido

Aumento del coste de propiedad de vehículos favorece al mercado

Las finanzas, el combustible, el mantenimiento, la matriculación/impuestos y el mantenimiento, así como la depreciación, contribuyen al coste de propiedad de un automóvil. El gasto de poseer un vehículo aumenta año tras año. La depreciación representa más del 43% del coste total de propiedad, según la Asociación Estadounidense del Automóvil (AAA). Sin embargo, los demás costes, como el mantenimiento y la gasolina , representan el 25%. El aumento de los precios del combustible y los costes de mantenimiento han aumentado drásticamente en los últimos 10 años y se espera que aumenten en los próximos años. Aunque la propiedad de automóviles aumentó durante la pandemia, se espera que disminuya después de 2021 y vuelva a los niveles previos a la pandemia. Esto permite a los proveedores de viajes compartidos beneficiarse de este desarrollo demográfico, ya que la nueva generación conocedora de la tecnología se encuentra entre los usuarios más activos de estos servicios.pre-pandemic levels. This allows ride-hailing providers to benefit from this demographic development, as the new technology-savvy generation is among the most active users of these services.

Aumento de la tendencia de la movilidad como servicio

Los clientes que no pueden comprar el vehículo pueden experimentar un viaje sin inconvenientes a través de los servicios de movilidad. La movilidad como servicio reduce el costo de propiedad y operación al maximizar el costo del uso compartido de automóviles y el transporte en vehículos particulares. Además, el rápido ritmo de urbanización ya está generando congestión de tráfico. El concepto de movilidad como servicio (MaaS) puede ser una mejor opción para minimizar la congestión del tráfico mediante un mayor uso de la red de transporte público y privado existente. La demanda urgente y creciente de soluciones efectivas para gestionar el tráfico en las ciudades inteligentes, a su vez, se espera que impulse el crecimiento del mercado de servicios de transporte en vehículos particulares hasta 2031. Por lo tanto, se espera que la creciente tendencia de la movilidad como servicio (MaaS) impulse el crecimiento del mercado mundial de servicios de transporte en vehículos particulares.MaaS) concept may be a better choice for minimizing traffic congestion by greater use of existing public and private transportation network. The urgent and increased demand for effective solutions to handle traffic in smart cities which in turn is expected to fuel ride hailing service market growth through 2031. Therefore, the increasing trend of mobility as a Service (MaaS) is expected to fuel the growth of the global ride-hailing service market.

Análisis de segmentación del informe de mercado de servicios de transporte compartido

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de servicios de transporte son el tipo de servicio, el tipo de vehículo, la ubicación y el usuario final.

- Según el tipo de servicio, el mercado de servicios de transporte en coche se divide en e-hailing, uso compartido de vehículos, alquiler de vehículos y movilidad en estaciones. El segmento de e-hailing tuvo la mayor participación de mercado en 2023.

- Por tipo de vehículo, el mercado se segmenta en vehículos de dos ruedas, de tres ruedas, de cuatro ruedas y otros. El segmento de vehículos de cuatro ruedas tuvo la mayor participación del mercado en 2023.

- En función de la ubicación, el mercado se divide en urbano y rural. El segmento urbano tenía una participación significativa del mercado en 2023.

- Por usuario final, el mercado se segmenta en institucional y personal. El segmento institucional tuvo la mayor participación del mercado en 2023.

Análisis de la cuota de mercado de los servicios de transporte por aplicación por geografía

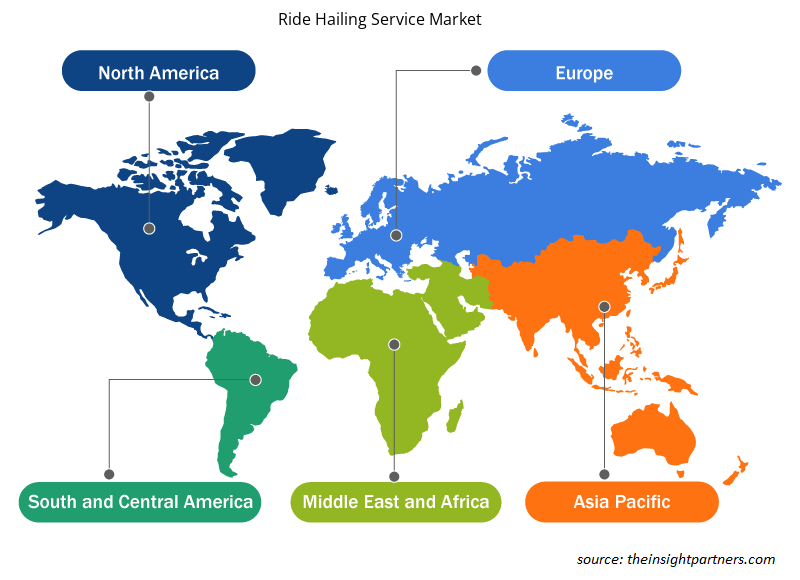

El alcance geográfico del informe del mercado de servicios de transporte compartido se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur.

El alcance del informe del mercado de servicios de transporte en coche incluye América del Norte (EE. UU., Canadá y México), Europa (Alemania, Francia, Italia, España, Reino Unido y resto de Europa), Asia Pacífico (China, India, Australia, Japón, Corea del Sur y resto de Asia Pacífico), Oriente Medio y África (Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos y resto de Oriente Medio y África) y América del Sur (Brasil, Argentina y resto de América del Sur). En términos de ingresos, Asia Pacífico dominó la cuota de mercado de servicios de transporte en coche en 2023. América del Norte fue el segundo mayor contribuyente de ingresos al mercado mundial de servicios de transporte en coche, seguida de Europa.UAE, and Rest of Middle East & Africa), and South America (Brazil, Argentina, and the Rest of South America). In terms of revenue, Asia Pacific dominated the ride hailing service market share in 2023. North America was the second-largest revenue contributor to the global ride hailing service market, followed by Europe.

Perspectivas regionales del mercado de servicios de transporte compartido

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de servicios de transporte en coche durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de servicios de transporte en coche en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de servicios de transporte compartido

Alcance del informe de mercado de servicios de transporte compartido

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 61,76 mil millones |

| Tamaño del mercado en 2031 | US$ 139.8 mil millones |

| CAGR global (2023 - 2031) | 10,8% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2023-2031 |

| Segmentos cubiertos |

Por tipo de servicio

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado: comprensión de su impacto en la dinámica empresarial

El mercado de servicios de transporte en taxi está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de servicios de transporte compartido son:

- ANI Technologies, sociedad privada limitada

- Daimler AG

- Tecnologías Delphi PLC

- DiDi Global Inc.

- Obtener

- Compañía de Grab Holdings Inc.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de servicios de transporte compartido

Noticias y desarrollos recientes del mercado de servicios de transporte compartido

El mercado de servicios de transporte en coche se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye importantes publicaciones corporativas, datos de asociaciones y bases de datos. A continuación, se enumeran algunos de los avances en el mercado de servicios de transporte en coche:

- El proveedor de servicios de transporte con conductor Kakao Mobility amplió su presencia con el lanzamiento de servicios de transporte con conductor en Asia y Oriente Medio. (Fuente: Kakao Mobility, comunicado de prensa, noviembre de 2023)

- DiDi Global Inc. inició el proceso de registro de conductores en Ciudad del Cabo, Sudáfrica, y comenzó a brindar servicios de transporte a consumidores en la segunda ciudad más grande del país. (Fuente: DiDi Global Inc., comunicado de prensa, marzo de 2021)

Informe sobre el mercado de servicios de transporte compartido y resultados finales

El informe “Tamaño y pronóstico del mercado de servicios de transporte compartido (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado de servicios de transporte compartido y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Tendencias del mercado de servicios de transporte compartido, así como dinámicas del mercado, como impulsores, restricciones y oportunidades clave

- Análisis PEST y FODA detallados

- Análisis del mercado de servicios de transporte compartido que abarca las tendencias clave del mercado, el marco global y regional, los principales actores, las regulaciones y los desarrollos recientes del mercado

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes del mercado de servicios de transporte compartido

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de servicios de transporte compartido

Obtenga una muestra gratuita para - Mercado de servicios de transporte compartido