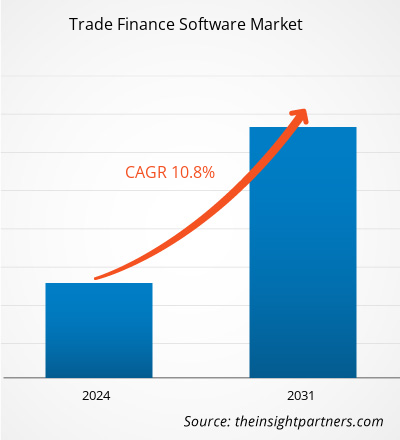

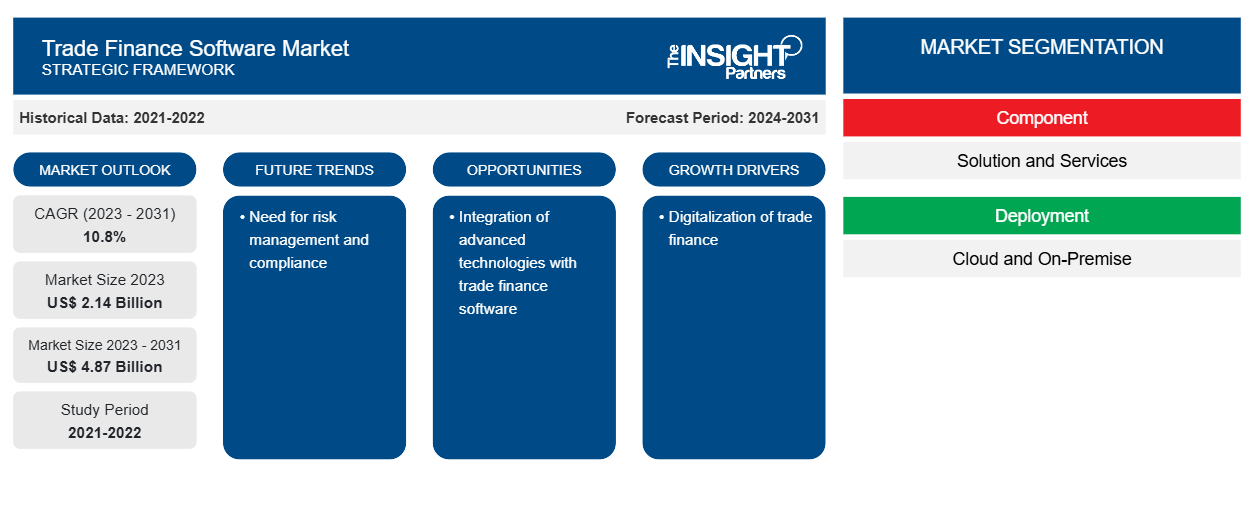

Se prevé que el tamaño del mercado de software de financiación comercial alcance los 4.870 millones de dólares en 2031, frente a los 2.140 millones de dólares en 2023. Se espera que el mercado registre una CAGR del 10,8 % entre 2023 y 2031. Es probable que la creciente digitalización y la adopción de tecnologías basadas en la nube sigan siendo tendencias clave en el mercado de software de financiación comercial.

Análisis del mercado de software de financiación del comercio

La creciente digitalización de los procesos de financiación del comercio es un factor importante que impulsa el crecimiento del mercado de software de financiación del comercio. Con una mayor eficiencia y menores costos, la documentación electrónica y las soluciones de financiación del comercio basadas en la nube están reemplazando cada vez más a los métodos tradicionales basados en papel, lo que contribuye al crecimiento del mercado.

Descripción general del mercado de software de financiación comercial

La necesidad de transparencia y cumplimiento de las normas de comercio internacional ha impulsado la adopción de soluciones de software con funciones de supervisión y generación de informes en tiempo real. Con el objetivo de proporcionar soluciones de vanguardia que satisfagan las necesidades cambiantes del comercio internacional, el mercado de software de financiación del comercio está preparado para una mayor expansión a medida que el panorama comercial mundial sigue cambiando y las empresas buscan operaciones de financiación del comercio más seguras y eficientes.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Factores impulsores y oportunidades del mercado del software de financiación del comercio

Digitalización de la financiación del comercio para favorecer el mercado

A medida que las empresas de una variedad de industrias se dan cuenta de que necesitan soluciones de vanguardia para agilizar y mejorar sus operaciones de comercio internacional, el mercado se está expandiendo significativamente. Este mercado incluye programas de software diseñados para mejorar y automatizar los procedimientos de financiación del comercio , como la financiación de la cadena de suministro, la gestión del cumplimiento, la factorización de facturas y la gestión del crédito. Las organizaciones han recurrido al software de financiación del comercio para reducir las tareas manuales y que consumen mucho tiempo, mejorar la precisión y minimizar los riesgos asociados con el comercio internacional como resultado de la creciente complejidad y el volumen de las transacciones comerciales, lo que conduce aún más a la adopción de software de financiación del comercio por parte de los actores del mercado. Por ejemplo, en noviembre de 2023, Finastra, un proveedor global de aplicaciones de software financiero y mercados, anunció que CQUR Bank, un banco corporativo internacional, se había asociado con Finastra para cumplir con su estrategia tecnológica. Con la implementación de las soluciones líderes en el mercado de Finastra, Trade Innovation y Corporate Channels, CQUR Bank ofrece a sus clientes corporativos un nuevo portal de banca en línea para una experiencia de usuario perfecta, introdujo nuevos flujos de trabajo digitales y brinda soluciones de integración de host a host.

Necesidad de gestión de riesgos y cumplimiento normativo

La creciente necesidad de mejorar la gestión de riesgos y el cumplimiento normativo es otro factor que impulsa el crecimiento del mercado de software de financiación del comercio. El software de financiación del comercio ofrece herramientas sofisticadas, como detección de fraudes, comprobaciones contra el blanqueo de dinero (AML) y cumplimiento de las leyes y sanciones comerciales, para rastrear y reducir los riesgos relacionados con el comercio internacional. La necesidad de estas soluciones de software sigue creciendo a medida que las empresas e instituciones financieras intentan gestionar los desafíos del comercio internacional y, al mismo tiempo, mantener el cumplimiento legal y normativo.

Informe de mercado de software de financiación comercial Análisis de segmentación

Los segmentos clave que contribuyeron a la derivación del análisis del mercado de software de financiamiento comercial son los componentes, la implementación, el tamaño de la empresa y el uso final.

- Según el componente, el mercado se segmenta en soluciones y servicios. El segmento de soluciones tuvo una mayor participación de mercado en 2023.

- Por implementación, el mercado se segmenta en nube y local. El segmento de la nube tuvo una mayor participación de mercado en 2023.

- Por tamaño de empresa, el mercado se segmenta en grandes empresas y pymes. Se espera que el segmento de pymes crezca con la CAGR más alta.

- Por uso final, el mercado se segmenta en bancos, comerciantes y otros. El segmento de los bancos tuvo una mayor participación de mercado en 2023.

Análisis de la cuota de mercado del software de financiación del comercio por geografía

El alcance geográfico del informe del mercado de software de financiamiento comercial se divide principalmente en cinco regiones: América del Norte, Asia Pacífico, Europa, Medio Oriente y África, y América del Sur/América del Sur y Central.

En términos de ingresos, América del Norte representó la mayor participación en el mercado de software de financiación comercial en 2023. América del Norte es una de las primeras en adoptar soluciones tecnológicas, lo que lleva a su creciente participación en el mercado. La adopción de tecnologías basadas en la nube por parte de las pymes conduce al crecimiento del mercado. La creciente digitalización en los bancos exige aún más software de financiación comercial, lo que impulsa la participación en el mercado de financiación comercial de América del Norte.

Perspectivas regionales del mercado de software de financiación comercial

Los analistas de Insight Partners explicaron en detalle las tendencias y los factores regionales que influyen en el mercado de software de financiación comercial durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de software de financiación comercial en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

- Obtenga datos regionales específicos para el mercado de software de financiación comercial

Alcance del informe sobre el mercado de software de financiación comercial

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2023 | US$ 2,14 mil millones |

| Tamaño del mercado en 2031 | 4.870 millones de dólares estadounidenses |

| CAGR global (2023 - 2031) | 10,8% |

| Datos históricos | 2021-2022 |

| Período de pronóstico | 2024-2031 |

| Segmentos cubiertos |

Por componente

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de software de financiación comercial: comprensión de su impacto en la dinámica empresarial

El mercado de software de financiación comercial está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y una mayor conciencia de los beneficios del producto. A medida que aumenta la demanda, las empresas amplían sus ofertas, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

La densidad de actores del mercado se refiere a la distribución de las empresas o firmas que operan dentro de un mercado o industria en particular. Indica cuántos competidores (actores del mercado) están presentes en un espacio de mercado determinado en relación con su tamaño o valor total de mercado.

Las principales empresas que operan en el mercado de software de financiación comercial son:

- CGI Inc

- Comarca SA

- Tecnología financiera IBS

- SISTEMAS FINANCIEROS ICS LTD

- MITech - Haz que la tecnología sea intuitiva en SA

- Newgen Software Technologies Ltd.

Descargo de responsabilidad : Las empresas enumeradas anteriormente no están clasificadas en ningún orden particular.

- Obtenga una descripción general de los principales actores clave del mercado de software de financiación comercial

Noticias y desarrollos recientes del mercado de software de financiación comercial

El mercado de software de financiación comercial se evalúa mediante la recopilación de datos cualitativos y cuantitativos a partir de una investigación primaria y secundaria, que incluye publicaciones corporativas importantes, datos de asociaciones y bases de datos. A continuación, se incluye una lista de los avances del mercado:

- En septiembre de 2022, Newgen Software, un proveedor líder mundial de productos de transformación digital, lanzó la primera plataforma de financiación comercial de código bajo del mundo en la reunión de clientes en Mumbai. La financiación comercial es un proceso complejo, ya que implica mucho papeleo, múltiples partes interesadas y requisitos de cumplimiento. La plataforma de financiación comercial integral, configurable y preparada para el futuro de Newgen ayuda a los bancos a prescindir del papel y agilizar sus procesos comerciales de extremo a extremo, al tiempo que garantiza el cumplimiento de las regulaciones nacionales e internacionales. (Fuente: CXOtoday, comunicado de prensa, 2022)

- En febrero de 2024, Finastra, un proveedor global de aplicaciones y mercados de software financiero, y Tesselate, una consultora e integradora de transformación digital global, anunciaron el lanzamiento de un servicio preempaquetado de extremo a extremo para una digitalización más rápida y sencilla de la financiación comercial. Tegula Trade Finance as a Service, impulsado por Finastra Trade Innovation y Corporate Channels, permite a los bancos estadounidenses automatizar los procesos manuales y adaptarse a las nuevas demandas con un tiempo de comercialización y valor más rápido. A través de FusionFabric.cloud de Finastra, los bancos también pueden integrar sin problemas aplicaciones fintech que utilizan las últimas tecnologías, como inteligencia artificial, blockchain y herramientas de automatización. (Fuente: Finastra, comunicado de prensa, 2024)

Informe sobre el mercado de software de financiación comercial: cobertura y resultados

El informe “Tamaño y pronóstico del mercado de software de financiación comercial (2021-2031)” proporciona un análisis detallado del mercado que cubre las siguientes áreas:

- Tamaño del mercado y pronóstico a nivel global, regional y nacional para todos los segmentos clave del mercado cubiertos bajo el alcance

- Dinámica del mercado, como impulsores, restricciones y oportunidades clave

- Principales tendencias futuras

- Análisis detallado de las cinco fuerzas de Porter y PEST y FODA

- Análisis del mercado global y regional que cubre las tendencias clave del mercado, los principales actores, las regulaciones y los desarrollos recientes del mercado.

- Análisis del panorama de la industria y de la competencia que abarca la concentración del mercado, el análisis de mapas de calor, los actores destacados y los desarrollos recientes

- Perfiles detallados de empresas

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de software de financiación del comercio

Obtenga una muestra gratuita para - Mercado de software de financiación del comercio