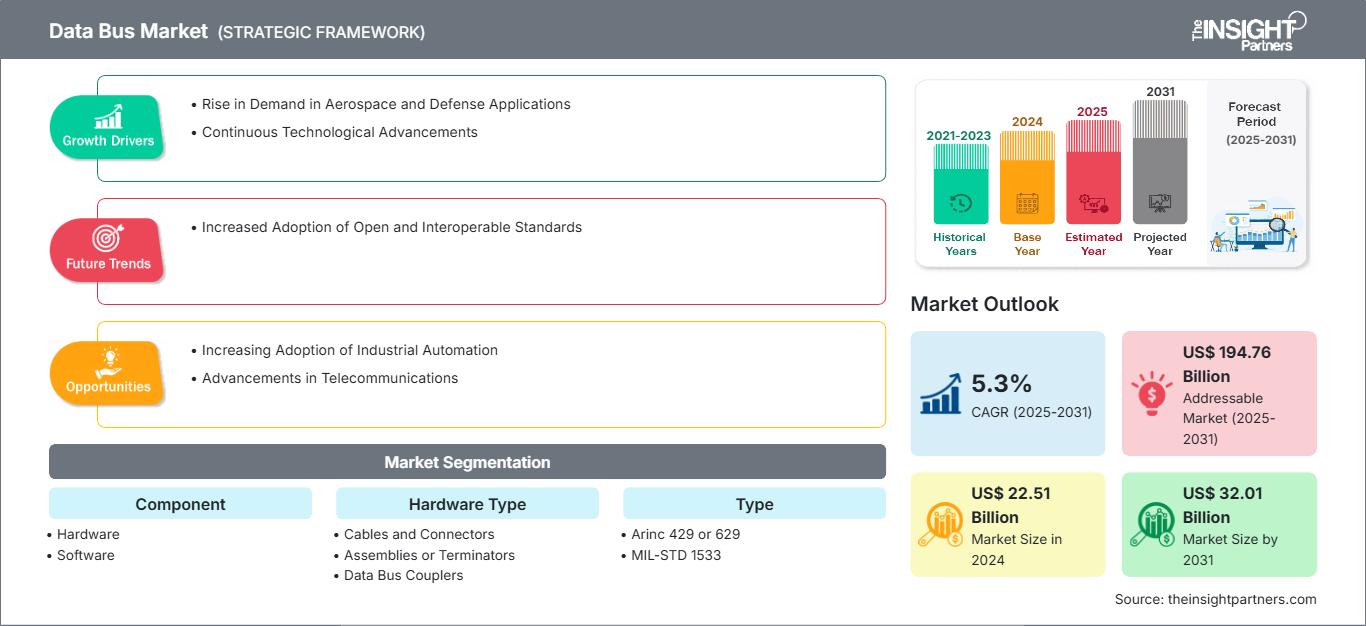

Le marché des bus de données était évalué à 22,51 milliards de dollars américains en 2024 et devrait atteindre 32,01 milliards de dollars américains d'ici 2031 ; il devrait enregistrer un TCAC de 5,3 % entre 2025 et 2031. L'adoption croissante de normes ouvertes et interopérables devrait entraîner une nouvelle tendance du marché.

Analyse du marché des bus de données

Des facteurs tels que la hausse de la demande dans les applications aérospatiales et de défense et les avancées technologiques continues stimulent le marché des bus de données. Le marché devrait croître au cours de la période de prévision en raison de l'adoption croissante de l'automatisation industrielle et des progrès des télécommunications. L'adoption croissante de normes ouvertes et interopérables devrait être l'une des principales tendances du marché. Cependant, les coûts de mise en œuvre élevés peuvent freiner la croissance du marché des bus de données.

Aperçu du marché des bus de données

Un bus de données est un sous-système essentiel d'un ordinateur ou d'un système numérique qui facilite le transfert de données entre divers composants, tels que l'unité centrale de traitement (CPU), la mémoire et les périphériques. Il se compose d'un ensemble de fils parallèles ou de voies électriques qui transportent des informations binaires (bits) et peuvent transférer des données dans les deux sens selon l'architecture et les exigences du système. La largeur d'un bus de données, mesurée en bits (par exemple, 8 bits, 16 bits, 32 bits, 64 bits), détermine la quantité de données pouvant être transmise simultanément, ce qui affecte directement les performances globales et le débit de données du système. Un bus plus large permet de transférer davantage de données simultanément, ce qui accélère le traitement et la communication entre les éléments matériels. Contrairement aux bus d'adresses, qui véhiculent des informations sur la destination des données, et aux bus de contrôle, qui véhiculent des signaux pour gérer les opérations, le bus de données est spécifiquement responsable du mouvement réel des données. Dans les systèmes informatiques modernes, le bus de données fonctionne en coordination avec les bus d'adresses et de contrôle, sous la supervision de l'horloge système et du jeu d'instructions, afin de garantir une communication de données synchronisée, précise et efficace au sein de l'architecture informatique.

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché des bus de données: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché des bus de données

Augmentation de la demande dans les applications aérospatiales et de défense

Le marché des bus de données connaît une expansion accélérée, en grande partie en raison du besoin croissant de communications sécurisées et à haut débit dans les environnements critiques. Le protocole MIL-STD-1553B, malgré son origine vieille de plusieurs décennies, continue de trouver une nouvelle pertinence grâce à ses performances déterministes et à sa robustesse éprouvée, en particulier dans les applications où la panne n'est pas une option. Les transformateurs de bus de données 1553B ne sont pas de simples composants hérités, mais des catalyseurs de communication numérique moderne dans des environnements où la redondance, la résilience aux interférences électromagnétiques et l'isolation des pannes sont primordiales. Leur adoption continue soutient les tendances en matière d'évolutivité et de modularisation des systèmes aérospatiaux et de défense, où les architectures ouvertes et les capacités définies par logiciel deviennent la norme. Ainsi, la demande croissante de bus de données dans les applications aérospatiales et de défense stimule la croissance du marché des bus de données.

Progrès technologiques continus

L'un des principaux moteurs du marché mondial des bus de données est le progrès technologique continu axé sur la résolution des goulots d'étranglement dans le calcul haute performance et les systèmes de transfert de données basés sur l'IA. Un exemple récent convaincant vient de NEO Semiconductor, qui, le 5 août 2024, a dévoilé sa technologie de puce 3D X-AI, une innovation révolutionnaire conçue pour réduire la congestion des bus de données dans les charges de travail d'IA en intégrant le traitement de l'IA directement dans la DRAM 3D. Cette innovation n'est pas une simple mise à niveau matérielle ; Français Il représente un changement de paradigme dans la gestion des données entre la mémoire à large bande passante (HBM) et les GPU lors de tâches de calcul intensives telles que celles effectuées dans les environnements d'IA générative et d'apprentissage automatique.

Alors que les vitesses de traitement et les volumes de données augmentent dans des secteurs tels que l'IA, les systèmes autonomes, les centres de données et l'informatique avancée, le besoin de systèmes de bus de données plus efficaces n'a jamais été aussi critique. La solution NEO, tout en allégeant la pression sur les bus de données traditionnels, renforce également l'évolution du marché vers les architectures de bus hybrides, les systèmes de mémoire intelligents et le traitement embarqué, des tendances qui alimentent l'innovation à tous les niveaux. Elle catalyse également la recherche et le développement de nouvelles technologies de bus de données adaptatives qui peuvent compléter ou s'intégrer à ces architectures de mémoire d'IA embarquées.

Analyse de segmentation du rapport sur le marché des bus de données

Les principaux segments qui ont contribué à l'élaboration de l'analyse du marché des bus de données sont les composants, le type et l'application.

- En fonction des composants, le marché est divisé en matériel et logiciel. Français Le segment du matériel détenait une part de marché plus importante des bus de données en 2024.

- En termes de type, le marché est segmenté en ARINC 429/629, MIL-STD-1553 et autres. Le segment MIL-STD-1553 détenait la plus grande part de marché des bus de données en 2024.

- En fonction des applications, le marché est segmenté en marine, automobile, aviation commerciale et aviation militaire. Le segment de l'aviation militaire détenait la plus grande part du marché des bus de données en 2024.

Analyse des parts de marché des bus de données par zone géographique

- Le marché des bus de données est segmenté en cinq grandes régions : Amérique du Nord, Europe, Asie-Pacifique (APAC), Moyen-Orient et Afrique (MEA) et Amérique du Sud et centrale. L'Amérique du Nord a dominé le marché en 2024. L'Europe est le deuxième contributeur au marché mondial des bus de données, suivie de l'Asie-Pacifique.

- L'Amérique du Nord occupe une position dominante sur le marché mondial des bus de données, largement tirée par les États-Unis, qui abritent la plus grande industrie de défense et d'aérospatiale au monde. La présence d'acteurs majeurs tels que Lockheed Martin, Raytheon Technologies, Northrop Grumman et Boeing alimente des investissements soutenus dans des systèmes de bus de données de pointe, en particulier dans l'aviation militaire, les véhicules aériens sans pilote (UAV) et l'exploration spatiale. Le ministère américain de la Défense impose des normes strictes telles que MIL-STD-1553 pour une communication de données sécurisée et tolérante aux pannes dans les applications critiques. L'Amérique du Nord est également un pôle d'innovation dans les architectures de bus Ethernet et hybrides, soutenu par des institutions telles que la NASA, la DARPA et la Federal Aviation Administration (FAA). Français De plus, le marché croissant des véhicules connectés et l'intégration des systèmes avancés d'aide à la conduite (ADAS) aux États-Unis et au Canada ont conduit à l'adoption croissante de bus de données tels que CAN, FlexRay et Automotive Ethernet. Une activité de recherche et développement robuste, un écosystème mature d'entrepreneurs de la défense et des cadres réglementaires solides positionnent collectivement l'Amérique du Nord comme un leader mondial du développement technologique et de l'adoption commerciale de systèmes de bus de données avancés.

- L'Asie-Pacifique émerge comme un marché en pleine croissance et stratégiquement important pour les technologies de bus de données, stimulé par une industrialisation rapide, des budgets de défense en hausse et l'expansion des industries aérospatiale et automobile. La Chine, l'Inde, le Japon et la Corée du Sud sont à l'avant-garde, avec des capacités de production nationales croissantes et une attention croissante portée à la modernisation de la défense. Par exemple, les initiatives indiennes dans le cadre de Make in India et d'Atmanirbhar Bharat ont donné lieu à des programmes locaux impliquant des avions de défense, des plateformes navales et le développement de satellites, créant une forte demande pour des systèmes de bus de données compatibles MIL-STD-1553 et ARINC. Des organisations telles que DRDO, ISRO et HAL travaillent en étroite collaboration avec des partenaires technologiques nationaux et internationaux pour renforcer leurs infrastructures de communication de données. En Chine, la croissance rapide des plateformes aérospatiales commerciales et militaires de haute technologie a entraîné une augmentation de la production locale et de l'intégration d'architectures de bus de données avancées.

Portée du rapport sur le marché des bus de données

Actualités et développements récents du marché des bus de données

Le marché des bus de données est évalué en collectant des données qualitatives et quantitatives issues de recherches primaires et secondaires, notamment d'importantes publications d'entreprises, des données d'associations et des bases de données. Voici quelques-unes des principales évolutions du marché des bus de données :

- Keysight et SPHEREA ont uni leurs forces pour offrir à leurs clients des capacités de test améliorées dans les secteurs de l'aérospatiale et de la défense. Cette nouvelle collaboration s'appuie sur l'expertise de Keysight en matière de systèmes de test et de mesure électroniques hautes performances et sur les capacités de conception et d'intégration de SPHEREA pour fournir aux clients des solutions locales basées sur une technologie fiable. (Source : Keysight, communiqué de presse, mai 2025)

- Emerson a dévoilé les derniers ajouts à sa gamme d'acquisition de données (DAQ), en présentant les châssis Ethernet NI cDAQ-9187 et cDAQ-9183 et le module d'entrée NI 9204. Outre un référentiel GitHub pour les plug-ins logiciels NI FlexLogger DAQ, ces nouvelles solutions offrent des options rentables pour le déploiement de systèmes de test et de mesure hautes performances sur Ethernet.

(Source : Emerson, communiqué de presse, février 2025)

Couverture et livrables du rapport sur le marché des bus de données

Le rapport « Taille et prévisions du marché des bus de données (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines mentionnés ci-dessous :

- Taille et prévisions du marché des bus de données aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Tendances du marché des bus de données, ainsi que dynamiques du marché telles que les moteurs, les contraintes et les opportunités clés

- Analyse PEST et SWOT détaillée

- Analyse du marché des bus de données couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché et la carte thermique Analyse, acteurs importants et développements récents du marché des bus de données

- Profils d'entreprise détaillés

Aperçu régional du marché des bus de données

Les tendances régionales et les facteurs influençant le marché des bus de données tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché des bus de données en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché des bus de données

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2024 | US$ 22.51 Billion |

| Taille du marché par 2031 | US$ 32.01 Billion |

| TCAC mondial (2025 - 2031) | 5.3% |

| Données historiques | 2021-2023 |

| Période de prévision | 2025-2031 |

| Segments couverts |

By Composant

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des bus de données : comprendre son impact sur la dynamique des entreprises

Le marché des bus de données connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché des bus de données Aperçu des principaux acteurs clés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des bus de données

Obtenez un échantillon gratuit pour - Marché des bus de données