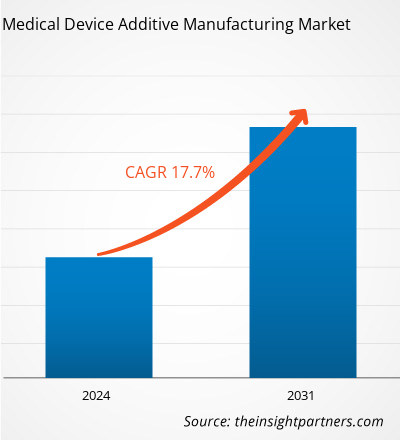

Le marché de la fabrication additive de dispositifs médicaux devrait atteindre 25,62 milliards USD d'ici 2031, contre 6,93 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 17,7 % au cours de la période 2023-2031. Le développement de nouveaux dispositifs médicaux utilisant la CFAO et l'impression 3D et la demande de médecine personnalisée devraient rester des tendances clés du marché.CAGR of 17.7% during 2023–2031. The development of novel medical devices using CAD-CAM and 3D printing and the demand for personalized medicine are likely to remain key trends in the market.

Analyse du marché de la fabrication additive de dispositifs médicaux

La méthode de fabrication additive (FA), également connue sous le nom d’impression 3D, a le potentiel de produire des dispositifs et instruments médicaux innovants, notamment des orthèses, des prothèses, des modèles médicaux, des implants inertes et des produits de biofabrication. La FA permet aux entreprises de proposer une personnalisation poussée en fonction des besoins individuels des patients pour les applications médicales en économisant du temps et en réduisant le gaspillage de matières premières. Cette technique permet de surmonter les contraintes des méthodes de fabrication conventionnelles, principalement associées à la personnalisation de masse, à la fabrication, au fraisage, au moulage, au forgeage, etc. De plus, les avancées récentes dans le domaine des biomatériaux catalysent les implications cliniques des produits de santé utilisant la technologie FA.

Aperçu du marché de la fabrication additive de dispositifs médicaux

Comme le souligne le rapport médical annuel AM3D Printing de l'AS of Mechanical Engineers (ASME), l'extrusion de matériaux s'est avérée être la catégorie la plus populaire avec 55 % d'utilisation en 2022, suivie de la photopolymérisation en cuve avec 57 % et de la fusion sur lit de poudre avec un taux d'acceptation de 51 %. Les autres processus ont eu une contribution plus courte dans le secteur médical. La Food and Drug Administration (FDA) des États-Unis encourage l'utilisation de technologies avancées, notamment la fabrication additive de dispositifs médicaux, pour obtenir de meilleurs résultats. Par exemple, en juin 2023, la FDA a créé un laboratoire de fabrication additive pour améliorer sa préparation à gérer les problèmes liés aux dispositifs médicaux pendant les phases de pré-commercialisation et d'après-commercialisation. Par conséquent, les investissements croissants dans la recherche en sciences de la vie et la technologie des dispositifs médicaux par le gouvernement et le secteur privé favorisent la croissance du marché de la fabrication additive de dispositifs médicaux.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Facteurs moteurs et opportunités du marché de la fabrication additive de dispositifs médicaux

La demande croissante de fabrication additive dans les secteurs orthopédique et dentaire devrait favoriser le marché

Des implants orthopédiques permanents tels que des prothèses articulaires pour le genou, la hanche ou le poignet ou certains dispositifs de fixation temporaires tels que des plaques, des broches, des vis et des fils peuvent être insérés dans le corps pour permettre aux os fracturés de guérir dans un court laps de temps. Ces dispositifs sont conçus à l'aide de technologies de fabrication additive et offrent des avantages tels que le choix de la personnalisation, la possibilité d'utiliser une large gamme de matériaux appropriés et la possibilité de concevoir des formes et des structures complexes. L'augmentation des interventions orthopédiques et des opérations endodontiques est un moteur important de la part de marché de la fabrication additive de dispositifs médicaux.

Demande de médecine personnalisée

Le secteur de la santé se concentre de plus en plus sur l'obtention de meilleurs résultats pour les patients grâce à des dispositifs médicaux personnalisés qui correspondent à l'anatomie ou à la physiologie de chaque patient. Les implants orthopédiques et les emboîtures prothétiques pour les jambes en sont des exemples. Les dispositifs médicaux personnalisés offrent plusieurs avantages, notamment la réduction du coût des soins, l'amélioration de la fonctionnalité et de l'esthétique et l'augmentation de la répartition de la charge. Les technologies avancées telles que la fabrication additive et l'imagerie médicale peuvent soutenir la conception et la fabrication. Selon un article publié par les MDPI Journals en avril 2022, l'adaptation des doses de médicaments, des formes posologiques et des ajustements de libération des médicaments aux patients individuels peut optimiser leur thérapie. Les techniques d'impression 3D basées sur l'extrusion , telles que la fabrication de filaments fondus (FFF) et l'extrusion semi-solide (SSE), sont polyvalentes, précises, réalisables et rentables. Par conséquent, la technologie AM semble avoir un impact positif sur le marché, car elle offre la possibilité de personnaliser les dispositifs médicaux pour répondre aux besoins spécifiques des patients.

Analyse de segmentation du rapport sur le marché de la fabrication additive de dispositifs médicaux

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché de la fabrication additive de dispositifs médicaux sont la technologie, le produit et l’application.

- Le marché de la fabrication additive de dispositifs médicaux est segmenté en fonction de la technologie en frittage laser, fusion par faisceau d'électrons, stéréolithographie et extrusion. Le segment du frittage laser détenait la plus grande part de marché en 2023.

- Par produit, le marché est segmenté en guides chirurgicaux, instruments chirurgicaux, implants et prothèses, ingénierie tissulaire et autres produits. Le segment des instruments chirurgicaux détenait la plus grande part du marché en 2023.

- En fonction des applications, le marché est segmenté en dentaire, orthopédique, bio-ingénierie et craniomaxillo-facial. Le segment orthopédique détenait une part importante du marché en 2023.

Analyse des parts de marché de la fabrication additive de dispositifs médicaux par zone géographique

La portée géographique du rapport sur le marché de la fabrication additive de dispositifs médicaux est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud et centrale. L'Asie-Pacifique devrait connaître le TCAC le plus élevé dans les années à venir.

Le marché de la fabrication additive de dispositifs médicaux en Amérique du Nord est analysé en fonction des trois principaux pays : les États-Unis, le Canada et le Mexique. On estime que les États-Unis détiennent une part plus importante du marché nord-américain de la fabrication additive de dispositifs médicaux en 2023. La croissance dans cette région est caractérisée par une demande accrue de dispositifs personnalisés et des avancées dans les technologies des dispositifs médicaux soutenues par de nombreux investisseurs et financements gouvernementaux.

De plus, l’accent croissant mis sur l’intégration de méthodes avancées dans les soins de santé, les initiatives gouvernementales et privées pour la promotion du diagnostic précoce des maladies et l’accent croissant mis sur la recherche sur les dispositifs médicaux personnalisés devraient également stimuler la croissance et contribuer à la génération de revenus exceptionnels pour le marché de la fabrication additive de dispositifs médicaux en Amérique du Nord.

Aperçu régional du marché de la fabrication additive de dispositifs médicaux

Les tendances et facteurs régionaux influençant le marché de la fabrication additive de dispositifs médicaux tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché de la fabrication additive de dispositifs médicaux en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché de la fabrication additive de dispositifs médicaux

Portée du rapport sur le marché de la fabrication additive de dispositifs médicaux

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 6,93 milliards de dollars américains |

| Taille du marché d'ici 2031 | 25,62 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 17,7% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par technologie

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché : comprendre son impact sur la dynamique des entreprises

Le marché de la fabrication additive de dispositifs médicaux connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché de la fabrication additive de dispositifs médicaux sont :

- Systèmes 3D, Inc.

- Additifs GE

- Materialise NV

- Fabrication additive 3T limitée

- Renishaw plc

- Stratasys Ltée

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de la fabrication additive de dispositifs médicaux

Actualités et développements récents du marché de la fabrication additive de dispositifs médicaux

Le marché de la fabrication additive de dispositifs médicaux est évalué en collectant des données qualitatives et quantitatives issues de recherches primaires et secondaires, qui comprennent des publications d'entreprise essentielles, des données d'association et des bases de données. Quelques-uns des développements du marché de la fabrication additive de dispositifs médicaux sont répertoriés ci-dessous :

- Precision ADM, Inc. a reçu l'approbation de Santé Canada pour ses écouvillons nasopharyngés CANSWAB, les premiers produits de dépistage de la COVID-19 fabriqués au Canada. Les écouvillons imprimés en 3D ont été testés cliniquement et se sont avérés aussi efficaces que les écouvillons floqués traditionnels. Precision ADM a obtenu une installation pour fabriquer et expédier des centaines de milliers d'écouvillons nasopharyngés CANSWAB chaque semaine. (Source : Precision ADM, Inc, communiqué de presse, juillet 2020)

- Armadillo Additive, un fabricant sous contrat basé à Granbury, au Texas, aux États-Unis, a inauguré une nouvelle usine de fabrication additive métallique avancée. L'usine se concentre sur l'ingénierie de précision pour le secteur des dispositifs médicaux. L'entreprise a installé une machine de fabrication additive FormUp 350 Laser Beam Powder Bed Fusion (PBF-LB) d'AddUp et se spécialise dans la production de produits en titane Ti-6Al-4V Grade 23. (Source : Armadillo Additive, Inc., communiqué de presse, février 2024)

Rapport sur le marché de la fabrication additive de dispositifs médicaux : couverture et livrables

Le rapport « Taille et prévisions du marché de la fabrication additive de dispositifs médicaux (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille et prévisions du marché de la fabrication additive de dispositifs médicaux aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Tendances du marché de la fabrication additive de dispositifs médicaux, ainsi que la dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché de la fabrication additive de dispositifs médicaux couvrant les principales tendances du marché, le cadre mondial et régional, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents sur le marché de la fabrication additive de dispositifs médicaux

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Rapports connexes

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de la fabrication additive de dispositifs médicaux

Obtenez un échantillon gratuit pour - Marché de la fabrication additive de dispositifs médicaux