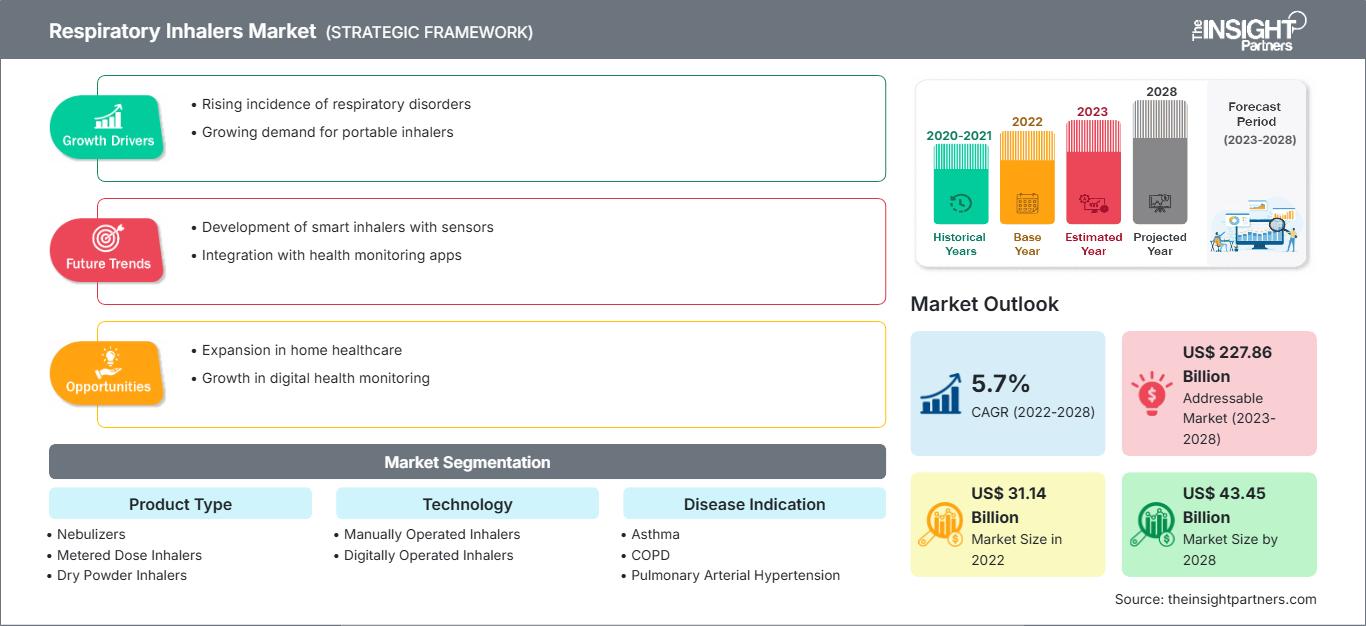

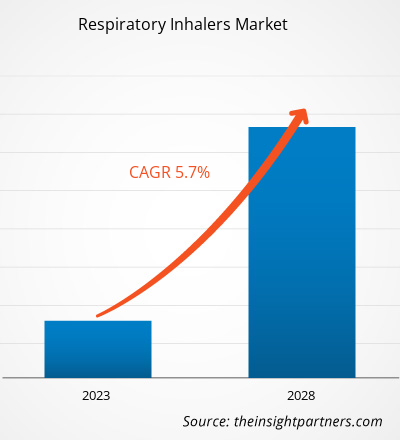

Le marché des inhalateurs respiratoires devrait passer de 31 144,56 millions de dollars américains en 2022 à 43 446,19 millions de dollars américains en 2028 ; il devrait enregistrer un TCAC de 5,7 % entre 2022 et 2028.

Les inhalateurs respiratoires sont utilisés pour inhaler des médicaments essentiels au traitement des maladies pulmonaires chroniques. Ils servent à la fois à prévenir et à traiter les exacerbations de ces maladies chroniques. Ils offrent l'avantage d'éviter l'exposition systémique aux médicaments tout en garantissant leur pénétration directe dans les poumons. De nombreux produits délivrent les médicaments directement dans les voies respiratoires, comme les inhalateurs à poudre sèche, les aérosols doseurs (MDI), les nébuliseurs et les inhalateurs à brouillard doux. Le marché des inhalateurs respiratoires devrait croître en raison de la prévalence croissante de maladies respiratoires telles que l’asthme, la bronchopneumopathie chronique obstructive (BPCO), la fibrose kystique, le syndrome de chevauchement asthme-BPCO et d’autres.

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché des inhalateurs respiratoires: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Analyse du marché des inhalateurs respiratoires

L'adoption croissante des inhalateurs génériques stimule la croissance du marché des inhalateurs respiratoires

Les médicaments inhalés, impliquant une large gamme de dispositifs d'inhalation, constituent la base du traitement pharmacologique de l'asthme et de la BPCO. Les patients souffrant d'asthme et de BPCO ont souvent besoin d'un ou plusieurs inhalateurs par jour pour préserver la santé de leurs voies respiratoires. Par conséquent, les professionnels de santé s'inquiètent du changement de médicament, car cela peut avoir un impact négatif sur le contrôle de la maladie en raison d'une faible observance et d'une mauvaise utilisation des dispositifs d'administration d'aérosols. Face à la pression croissante sur les budgets de santé et à l'expiration simultanée des brevets sur les traitements inhalés établis, plusieurs produits de remplacement génériques sont fabriqués et distribués dans le monde entier. Plusieurs inhalants utilisés pour traiter l'asthme comprennent des formulations génériques, telles que l'albutérol, le lévalbutérol, l'ipratropium, le budésonide et la fluticasone/salmétérol. Les inhalateurs génériques sont bioéquivalents aux versions de marque et ont le même effet sur l'organisme. Le nombre d'inhalateurs génériques pour l'asthme continue d'augmenter à mesure que les brevets expirent. Le 3 mars 2020, la Food and Drug Administration (FDA) a autorisé les inhalateurs génériques pour l'asthme et la poudre de corticostéroïde inhalée générique. En avril 2020, la FDA a approuvé un inhalateur générique à base de sulfate d'albutérol pour répondre aux besoins des patients atteints de la COVID-19 souffrant de difficultés respiratoires. L'arrivée de nouveaux médicaments génériques sur le marché devrait entraîner une concurrence accrue, ce qui entraînera une baisse des coûts des médicaments. Le lancement d'un « médicament générique approuvé » peut également entraîner des réductions de coûts. Ainsi, l'adoption croissante des inhalateurs génériques et des médicaments contre l'asthme améliore l'observance du traitement, stimulant ainsi le marché des inhalateurs respiratoires.

Informations par type de produit

Le marché des inhalateurs respiratoires est segmenté en fonction du type de produit : nébuliseurs, aérosols-doseurs et inhalateurs à poudre sèche. Le segment des inhalateurs de poudre sèche se divise en inhalateurs multidoses et en inhalateurs unidoses. Le segment des aérosols-doseurs (MDI) se divise en aérosols-doseurs sous pression et en aérosols-doseurs connectés. Le segment des nébuliseurs se subdivise en nébuliseurs à air comprimé, nébuliseurs à air à maille et nébuliseurs à air ultrasoniques. En 2022, le segment des inhalateurs de poudre sèche représentait la plus grande part de marché. Cependant, le segment des aérosols-doseurs (MDI) devrait enregistrer le TCAC le plus élevé au cours de la période de prévision.

Informations technologiques

Sur le plan technologique, le marché des inhalateurs respiratoires se divise en inhalateurs manuels et inhalateurs numériques. Le segment des inhalateurs manuels détenait une part de marché plus importante en 2022 et devrait enregistrer un TCAC plus élevé au cours de la période de prévision.

Aperçu régional du marché des inhalateurs respiratoires

Les tendances régionales et les facteurs influençant le marché des inhalateurs respiratoires tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché des inhalateurs respiratoires en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché des inhalateurs respiratoires

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2022 | US$ 31.14 Billion |

| Taille du marché par 2028 | US$ 43.45 Billion |

| TCAC mondial (2022 - 2028) | 5.7% |

| Données historiques | 2020-2021 |

| Période de prévision | 2023-2028 |

| Segments couverts |

By Type de produit

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché des inhalateurs respiratoires : comprendre son impact sur la dynamique commerciale

Le marché des inhalateurs respiratoires connaît une croissance rapide, portée par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché des inhalateurs respiratoires Aperçu des principaux acteurs clés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché des inhalateurs respiratoires

Obtenez un échantillon gratuit pour - Marché des inhalateurs respiratoires