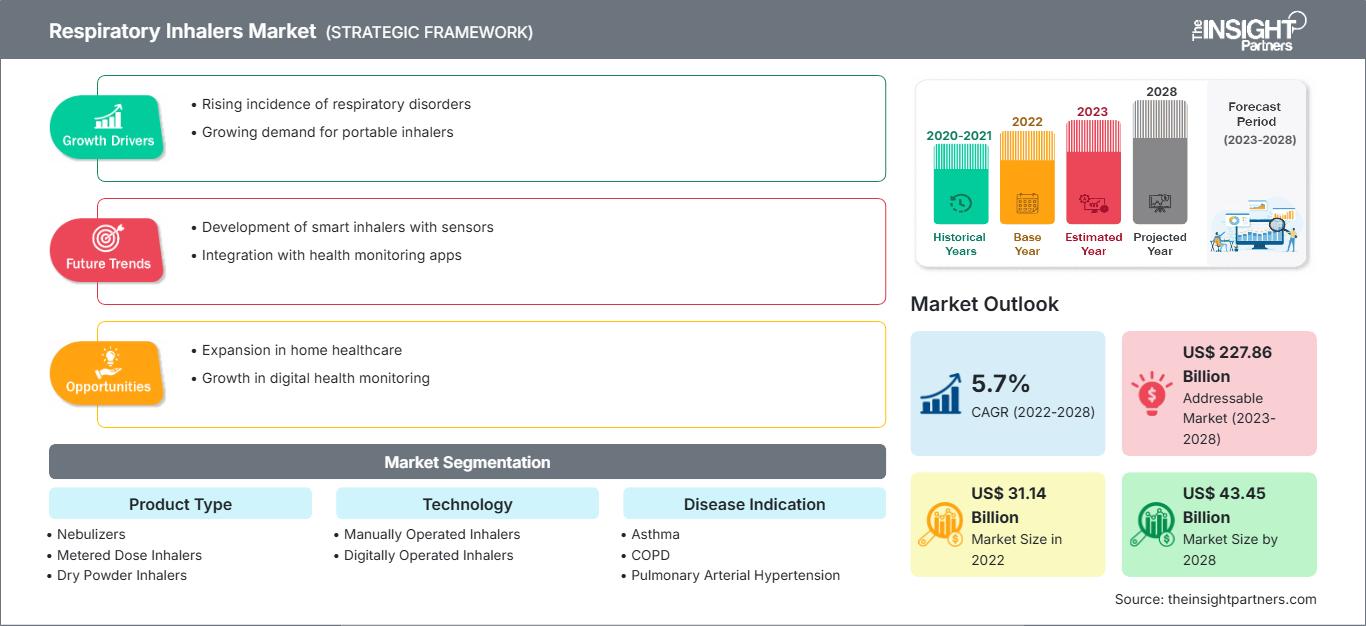

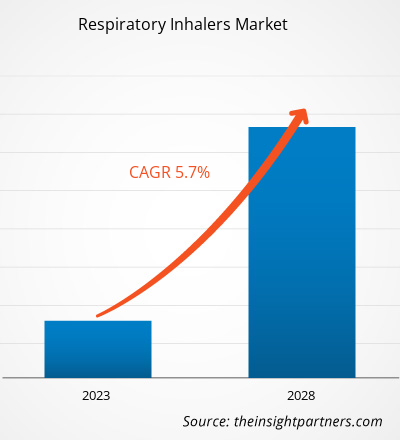

Der Markt für Ateminhalatoren soll von 31.144,56 Millionen US-Dollar im Jahr 2022 auf 43.446,19 Millionen US-Dollar im Jahr 2028 wachsen; von 2022 bis 2028 wird ein durchschnittliches jährliches Wachstum von 5,7 % erwartet.

Ateminhalatoren dienen zum Inhalieren von Medikamenten, die ein wesentlicher Bestandteil der Behandlung chronischer Lungenerkrankungen sind. Sie werden sowohl zur Vorbeugung als auch zur Behandlung von Exazerbationen dieser chronischen Erkrankungen eingesetzt. Sie bieten den Vorteil, dass eine systemische Medikamentenexposition vermieden wird und die Medikamente gleichzeitig direkt in die Lunge gelangen. Zahlreiche Produkte wie Trockenpulverinhalatoren, Dosieraerosole (MDIs), Vernebler und Soft-Mist-Inhalatoren geben Medikamente direkt in die Atemwege ab. Aufgrund der zunehmenden Verbreitung von Atemwegserkrankungen wie Asthma, chronisch obstruktiver Lungenerkrankung (COPD), Mukoviszidose, Asthma-COPD-Überlappungssyndrom und anderen wird für den Markt für Ateminhalatoren ein Wachstum erwartet.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

Markt für Ateminhalatoren: Strategische Einblicke

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst Datenanalysen, die von Markttrends bis hin zu Schätzungen und Prognosen reichen.

Markteinblicke zu Inhalationsinhalatoren

Zunehmende Akzeptanz generischer Inhalatoren treibt Wachstum des Marktes für Inhalationsinhalatoren voran

Inhalationsmedikamente mit einer breiten Palette an Inhalationsgeräten sind die Hauptstütze der pharmakologischen Behandlung von Asthma und COPD. Patienten mit Asthma und COPD benötigen oft täglich ein oder mehrere Inhalatoren, um ihre Atemwege gesund zu halten. Daher sind Angehörige der Gesundheitsberufe besorgt über den Wechsel zwischen Medikamenten, da dieser die Krankheitskontrolle durch mangelnde Therapietreue und Missbrauch von Aerosolabgabegeräten negativ beeinflussen kann. Angesichts des zunehmenden Drucks auf die Gesundheitsbudgets und des gleichzeitigen Ablaufs von Patenten auf etablierte Inhalationsbehandlungen werden weltweit mehrere generische Ersatzprodukte hergestellt und vertrieben. Mehrere Inhalationsmittel zur Behandlung von Asthma enthalten generische Formulierungen wie Albuterol, Levalbuterol, Ipratropium, Budesonid und Fluticason/Salmeterol. Die generischen Inhalatoren sind bioäquivalent zu den Markenversionen und haben die gleiche Wirkung auf den Körper. Die Anzahl generischer Asthmainhalatoren steigt mit ablaufendem Patent weiter an. Am 3. März 2020 hat die Food and Drug Administration (FDA) generische Asthmainhalatoren und generisches inhalatives Kortikosteroidpulver zugelassen. Im April 2020 genehmigte die FDA einen generischen Inhalator auf Basis von Albuterolsulfat, um den Bedürfnissen von COVID-19-Patienten mit Atembeschwerden gerecht zu werden. Da mehr Generika auf den Markt kommen, wird mit einem verstärkten Wettbewerb gerechnet, was wiederum zu niedrigeren Medikamentenkosten führt. Kostensenkungen können auch durch die Einführung eines „zugelassenen Generikums“ erzielt werden. Die zunehmende Verwendung von generischen Inhalatoren und Asthmamedikamenten verbessert die Medikamenteneinnahmetreue und treibt so den Markt für Ateminhalatoren voran.

Produkttypbasierte Erkenntnisse

Basierend auf dem Produkttyp ist der Markt für Ateminhalatoren in Vernebler, Dosieraerosole und Pulverinhalatoren unterteilt. Das Segment der Pulverinhalatoren ist weiter unterteilt in Mehrdosis- und Einzeldosis-Trockenpulverinhalatoren. Das Segment der Dosieraerosole (MDI) ist weiter unterteilt in Druckdosieraerosole und vernetzte Dosieraerosole. Das Segment der Vernebler ist weiter unterteilt in Druckluftvernebler, Mesh-Luftvernebler und Ultraschall-Luftvernebler. Im Jahr 2022 hatte das Segment der Pulverinhalatoren den größten Marktanteil. Es wird jedoch erwartet, dass das Segment der Dosieraerosole (MDI) im Prognosezeitraum die höchste durchschnittliche jährliche Wachstumsrate (CAGR) verzeichnen wird.

Technologiebasierte Erkenntnisse

Der Markt für Ateminhalatoren ist technologisch in manuell und digital betriebene Inhalatoren unterteilt. Das Segment der manuell betriebenen Inhalatoren hatte 2022 einen größeren Marktanteil und wird im Prognosezeitraum voraussichtlich eine höhere CAGR verzeichnen.

Ateminhalatoren

Regionale Einblicke in den Markt für AteminhalatorenDie Analysten von The Insight Partners haben die regionalen Trends und Faktoren, die den Markt für Ateminhalatoren im Prognosezeitraum beeinflussen, ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die geografische Lage in Nordamerika, Europa, dem asiatisch-pazifischen Raum, dem Nahen Osten und Afrika sowie Süd- und Mittelamerika erörtert.

Umfang des Marktberichts zu Ateminhalatoren

| Berichtsattribut | Einzelheiten |

|---|---|

| Marktgröße in 2022 | US$ 31.14 Billion |

| Marktgröße nach 2028 | US$ 43.45 Billion |

| Globale CAGR (2022 - 2028) | 5.7% |

| Historische Daten | 2020-2021 |

| Prognosezeitraum | 2023-2028 |

| Abgedeckte Segmente |

By Produkttyp

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für Ateminhalatoren: Verständnis ihrer Auswirkungen auf die Geschäftsdynamik

Der Markt für Ateminhalatoren wächst rasant. Die steigende Nachfrage der Endverbraucher ist auf Faktoren wie veränderte Verbraucherpräferenzen, technologische Fortschritte und ein stärkeres Bewusstsein für die Produktvorteile zurückzuführen. Mit der steigenden Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um den Bedürfnissen der Verbraucher gerecht zu werden, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

- Holen Sie sich die Markt für Ateminhalatoren Übersicht der wichtigsten Akteure

Indikationsbasierte Erkenntnisse

Basierend auf der Indikation ist der globale Markt für Inhalationsgeräte in Asthma, COPD, pulmonale arterielle Hypertonie und andere unterteilt. Das Asthmasegment hatte 2022 den größten Marktanteil und wird im Prognosezeitraum voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen.

Unternehmen im Markt für Inhalationsgeräte setzen häufig auf anorganische und organische Strategien wie Fusionen und Übernahmen. Nachfolgend sind einige wichtige Marktentwicklungen der letzten Zeit aufgeführt:

- Im September 2022 brachte Beximco Pharmaceuticals ONRIVA TRIO BEXICAP auf den Markt, eine Trockeninhalationskapsel. ONRIVA TRIO BEXICAP ist ein Präparat aus Indacaterol (150 µg), Glycopyrronium (50 µg) und Mometason (160 µg). Es wirkt auf drei Arten zur Kontrolle von Asthmasymptomen. Indacaterol und Glycopyrronium helfen den Muskeln der Atemwege, entspannt zu bleiben, um einer Bronchokonstriktion vorzubeugen, während Mometason hilft, Entzündungen zu lindern. ONRIVA TRIO BEXICAP ist als Erhaltungstherapie bei schwerem persistierendem Asthma indiziert.

- Im Juni 2021 gab Cipla bekannt, dass es von der US-amerikanischen Food and Drug Administration die endgültige Genehmigung für seinen Abbreviated New Drug Application (ANDA) für Arformoteroltartrat-Inhalationslösung 15 µg/2 ml erhalten hat. Die Arformoteroltartrat-Inhalationslösung 15 µg/2 ml von Cipla ist eine AN-bewertete generische, therapeutisch gleichwertige Version von Brovana von Sunovion Pharmaceuticals Inc.

- Im Februar 2022 gaben AstraZeneca und Honeywell ihre Pläne bekannt, gemeinsam Ateminhalatoren der nächsten Generation mit dem Treibmittel HFO-1234ze zu entwickeln, das ein um bis zu 99,9 % geringeres Treibhauspotenzial (GWP) aufweist als Treibmittel, die derzeit in Atemwegsmedikamenten verwendet werden.

- Im Januar 2023 erteilte die FDA in den USA die Zulassung für Airsupra [Druckgasinhalator mit Dosierpumpe (pMDI)] zur bedarfsgerechten Behandlung oder Vorbeugung von Bronchokonstriktion. Airsupra ist ein erstklassiges Druckgasinhalator-Dosiergerät (pMDI), ein Notfallmedikament mit fester Dosiskombination, das Albuterol, einen kurzwirksamen Beta2-Agonisten (SABA), und Budesonid, ein entzündungshemmendes inhalatives Kortikosteroid (ICS), in den USA enthält.

Firmenprofile

- AstraZeneca Plc

- Beximco Pharmaceuticals Ltd.

- Boehringer Ingelheim International GmbH

- Cipla Ltd.

- GSK Plc

- Koninklijke Philips NV

- OMRON Corp

- PARI Respiratory Equipment, Inc.

- Teva Pharmaceutical Industries Ltd.

- OPKO Health, Inc.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für Ateminhalatoren

Kostenlose Probe anfordern für - Markt für Ateminhalatoren