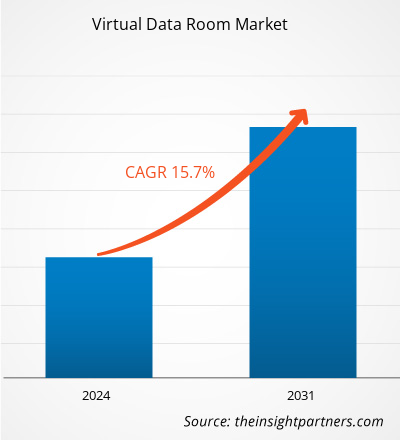

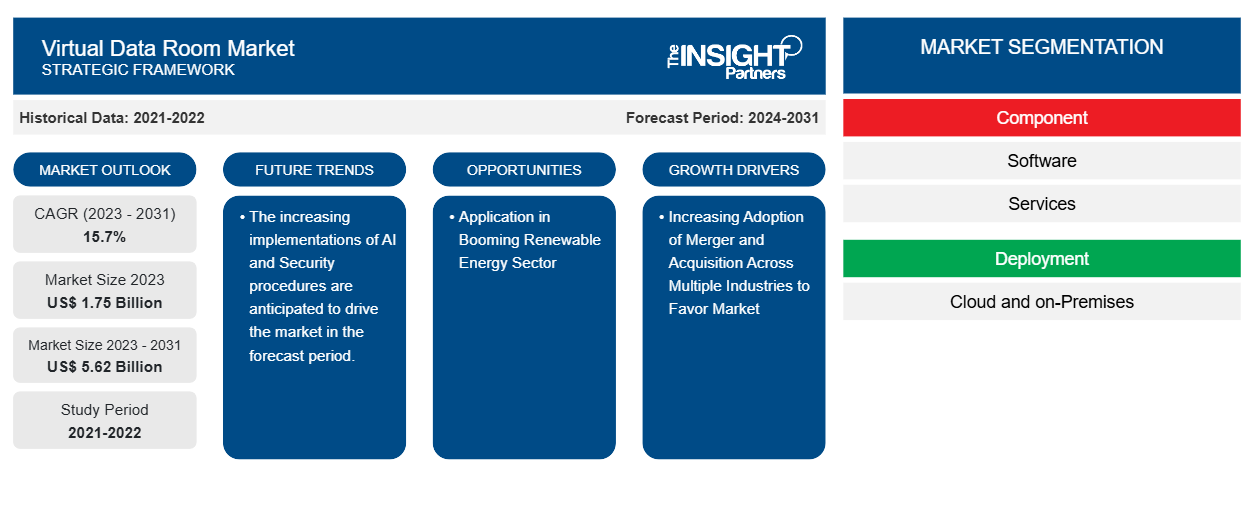

Si prevede che la dimensione del mercato delle virtual data room raggiungerà i 5,62 miliardi di dollari entro il 2031, rispetto ai 1,75 miliardi di dollari del 2023. Si prevede che il mercato registrerà un CAGR del 15,7% nel periodo 2023-2031. La crescente adozione di fusioni e acquisizioni in più settori e lo sviluppo di una tecnologia VDR avanzata per la due diligence rimarranno probabilmente tendenze e driver chiave nel mercato.

Analisi di mercato della data room virtuale

Il mercato delle virtual data room sta vivendo una crescita significativa a livello globale. Questa crescita è attribuita a fattori quali la crescente adozione di fusioni e acquisizioni in più settori e lo sviluppo di una tecnologia VDR avanzata per la due diligence. Inoltre, si prevede che l'applicazione nel fiorente settore delle energie rinnovabili e l'implementazione di procedure di sicurezza e AI offriranno diverse opportunità nel mercato delle virtual data room.

Panoramica del mercato delle data room virtuali

Una virtual data room (VDR), considerata anche una deal room, è un archivio online sicuro per la distribuzione e l'archiviazione di documenti. Viene tipicamente utilizzata durante il processo di due diligence, avviando una fusione o un'acquisizione per rivedere, condividere e divulgare la documentazione aziendale.

Personalizza questo report in base alle tue esigenze

Riceverai la personalizzazione gratuita di qualsiasi report, comprese parti di questo report, o analisi a livello nazionale, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

-

Scopri le principali tendenze di mercato in questo rapporto.Questo campione GRATUITO includerà analisi di dati che spaziano dalle tendenze di mercato alle stime e alle previsioni.

Driver e opportunità del mercato delle data room virtuali

Crescente adozione di fusioni e acquisizioni in più settori per favorire il mercato.

La crescente adozione di fusioni e acquisizioni in diversi settori sta effettivamente guidando il mercato delle virtual data room. Le VDR sono generalmente utilizzate dalle aziende quando si fondono, lavorano a un progetto o hanno qualsiasi altra joint venture che necessita di accesso a dati condivisi. Inoltre, varie organizzazioni sono impegnate in attività come fusioni e acquisizioni. Ad esempio, a giugno 2024, una società denominata Waste Management ha acquisito Stericycle con un'operazione di 7,2 miliardi di dollari. Analogamente, a giugno 2024, una società denominata Becton Dickinson ha acquisito Edwards con un'operazione di 4,2 miliardi di dollari. Pertanto, considerando i parametri di cui sopra, la crescente adozione di fusioni e acquisizioni in diversi settori sta effettivamente guidando il mercato delle virtual data room.

Applicazione nel fiorente settore delle energie rinnovabili.

Si prevede che l'applicazione nel fiorente settore delle energie rinnovabili offrirà diverse opportunità per il mercato delle virtual data room nei prossimi anni. Il settore delle energie rinnovabili sta vivendo una crescita sostanziale, promossa da progressi innovativi e dal passaggio mondiale a fonti di energia sostenibili. VDR è uno strumento essenziale che supporta questo progresso, una piattaforma online sicura per l'archiviazione, la gestione e la condivisione di documenti riservati. VDR offre diversi vantaggi, come lo sviluppo efficiente di progetti, la protezione della proprietà intellettuale, la navigazione della conformità normativa, la semplificazione delle attività di M&A, l'aumento dei finanziamenti e della raccolta fondi, l'ottimizzazione della gestione patrimoniale e altro. Pertanto, considerando i fattori di cui sopra, si prevede che il mercato offrirà diverse opportunità per le virtual data room.

Analisi della segmentazione del rapporto di mercato della Virtual Data Room

I segmenti chiave che hanno contribuito alla derivazione dell'analisi di mercato della data room virtuale sono: componente, distribuzione, dimensione dell'organizzazione, funzione aziendale e utente finale.

- In base al componente, il mercato delle virtual data room è suddiviso in software e servizi. Si prevede che il segmento software manterrà una quota di mercato significativa nel periodo di previsione.

- In base all'implementazione, il mercato delle virtual data room è diviso in on-premises e cloud. Si prevede che il segmento on-premises detenga una quota di mercato significativa nel periodo di previsione.

- In base alle dimensioni dell'organizzazione, il mercato è segmentato in PMI e grandi imprese. Si prevede che i segmenti PMI deterranno una quota di mercato significativa nel periodo di previsione.

- In base alla funzione aziendale, il mercato delle virtual data room è suddiviso in fusioni e acquisizioni, finanza, marketing e vendite, conformità e legale, gestione della forza lavoro e altri. Si prevede che il segmento fusioni e acquisizioni detenga una quota di mercato significativa nel periodo di previsione.

- In base all'utente finale, il mercato è segmentato in BFSI, IT e telecomunicazioni, sanità, energia e potenza, vendita al dettaglio e altri. Si prevede che i segmenti energia e potenza deterranno una quota di mercato significativa nel periodo di previsione.

Analisi della quota di mercato delle data room virtuali per area geografica

L'ambito geografico del rapporto di mercato sulle data room virtuali è suddiviso principalmente in cinque regioni: Nord America, Asia Pacifico, Europa, Medio Oriente e Africa, Sud e Centro America.

Il Nord America ha dominato il mercato delle virtual data room. Il mercato dei virtual data nordamericano è segmentato in Stati Uniti, Canada e Messico. Il mercato sta vivendo una crescita significativa guidata da fattori quali la crescente adozione di fusioni e acquisizioni in più settori e lo sviluppo di una tecnologia VDR avanzata per la due diligence. Inoltre, una forte enfasi sulla ricerca e sviluppo nelle economie sviluppate di Stati Uniti e Canada sta costringendo i player nordamericani a portare sul mercato soluzioni tecnologicamente avanzate. Inoltre, gli Stati Uniti hanno un gran numero di player del mercato delle virtual data room che si sono sempre più concentrati sullo sviluppo di soluzioni innovative. Tutti questi fattori contribuiscono alla crescita del mercato delle virtual data room nella regione.

Approfondimenti regionali sul mercato delle data room virtuali

Le tendenze regionali e i fattori che influenzano il mercato delle Virtual Data Room durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di Insight Partners. Questa sezione discute anche i segmenti e la geografia del mercato delle Virtual Data Room in Nord America, Europa, Asia Pacifico, Medio Oriente e Africa, e America Centrale e Meridionale.

- Ottieni i dati specifici regionali per il mercato delle data room virtuali

Ambito del rapporto di mercato sulla data room virtuale

| Attributo del report | Dettagli |

|---|---|

| Dimensioni del mercato nel 2023 | 1,75 miliardi di dollari USA |

| Dimensioni del mercato entro il 2031 | 5,62 miliardi di dollari USA |

| CAGR globale (2023-2031) | 15,7% |

| Dati storici | 2021-2022 |

| Periodo di previsione | 2024-2031 |

| Segmenti coperti |

Per componente

|

| Regioni e Paesi coperti |

America del Nord

|

| Leader di mercato e profili aziendali chiave |

|

Densità dei player del mercato delle data room virtuali: comprendere il suo impatto sulle dinamiche aziendali

Il mercato del Virtual Data Room Market sta crescendo rapidamente, spinto dalla crescente domanda degli utenti finali dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando le loro offerte, innovando per soddisfare le esigenze dei consumatori e capitalizzando sulle tendenze emergenti, il che alimenta ulteriormente la crescita del mercato.

La densità degli operatori di mercato si riferisce alla distribuzione di aziende o società che operano in un particolare mercato o settore. Indica quanti concorrenti (operatori di mercato) sono presenti in un dato spazio di mercato in relazione alle sue dimensioni o al valore di mercato totale.

Le principali aziende che operano nel mercato delle Virtual Data Room sono:

- Gruppo Ansarada Limited

- Gruppo BMC, Inc.

- Azienda

- Collegato a Cap

- EthosData

- Gruppo Soluzioni iDeals

Disclaimer : le aziende elencate sopra non sono classificate secondo un ordine particolare.

- Ottieni una panoramica dei principali attori del mercato delle Virtual Data Room

Notizie di mercato e sviluppi recenti sulla Virtual Data Room

Il mercato delle virtual data room viene valutato raccogliendo dati qualitativi e quantitativi dopo ricerche primarie e secondarie, che includono importanti pubblicazioni aziendali, dati associativi e database. Di seguito sono elencati alcuni degli sviluppi nel mercato delle virtual data room:

- Il collaboratore basato su file Egnyte ha impostato un servizio di data room virtuale (VDR) sicuro per la condivisione di documenti sensibili con terze parti, con l'idea di eliminare la necessità di servizi di trasferimento file simili a MOVEit. (Fonte: Egnyte, sito Web aziendale, ottobre 2023)

- SentinelOne sta ampliando la sua offerta in India. L'azienda ha annunciato il lancio di un data center virtuale a Mumbai che consentirà al crescente numero di aziende indiane che si affidano a SentinelOne di proteggere la propria attività dagli attacchi informatici in modo semplice e conforme. (Fonte: sito Web aziendale SentinelOne, luglio 2023)

Copertura e risultati del rapporto di mercato sulla Virtual Data Room

Il rapporto "Dimensioni e previsioni del mercato delle data room virtuali (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato delle data room virtuali a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato delle data room virtuali e dinamiche di mercato come driver, vincoli e opportunità chiave

- Analisi dettagliata delle cinque forze PEST/Porter e SWOT

- Analisi di mercato della data room virtuale che copre le principali tendenze di mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa di calore, i principali attori e gli sviluppi recenti per il mercato delle data room virtuali

- Profili aziendali dettagliati

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle data room virtuali

Ottieni un campione gratuito per - Mercato delle data room virtuali