Acrylic Teeth Market Share, Demand & Forecast by 2034

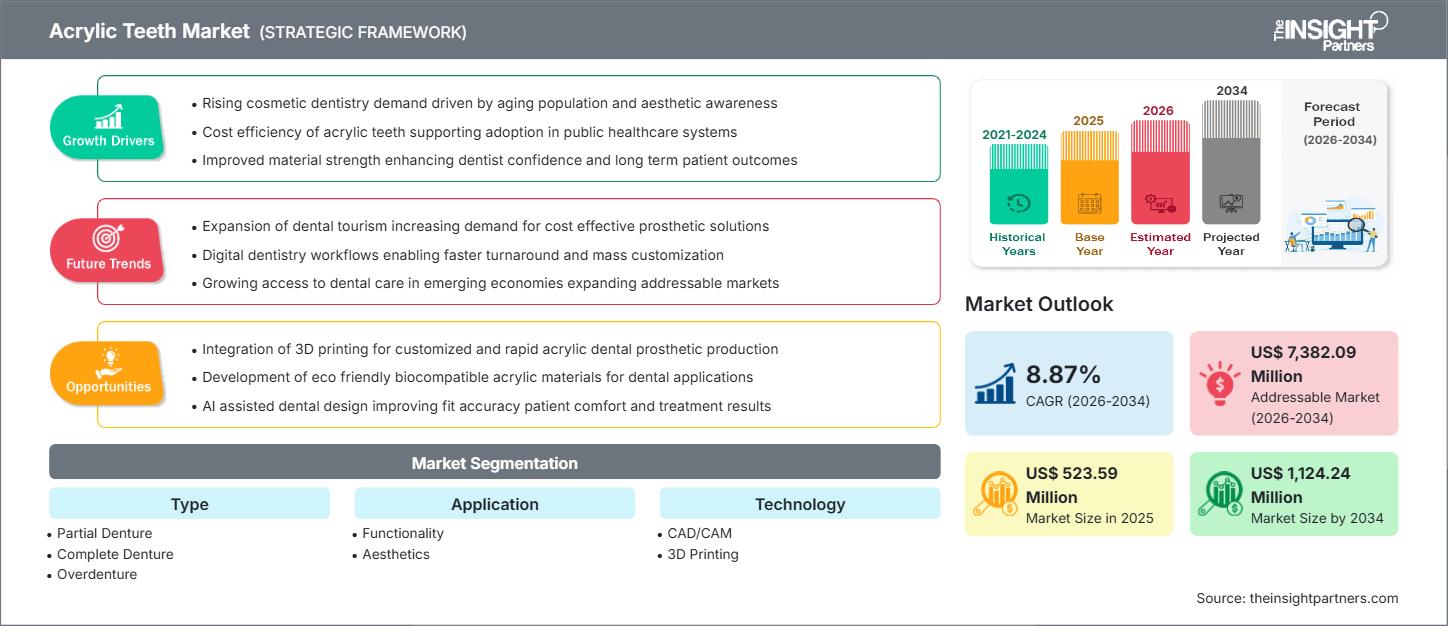

Acrylic Teeth Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Partial Denture, Complete Denture, and Overdenture), Application (Functionality and Aesthetics), and Technology (CAD/CAM and 3D Printing)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00017670

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

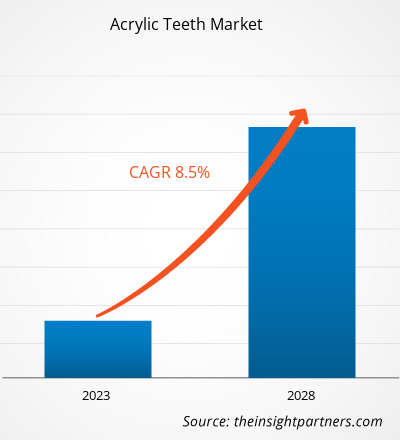

The acrylic teeth market size is expected to reach US$ 1,124.24 million by 2034 from US$ 523.59 million in 2025. The market is anticipated to register a CAGR of 8.87% during 2026–2034.

Acrylic Teeth Market Analysis

The acrylic teeth market forecast indicates steady growth, driven by the rising prevalence of dental disorders, increasing demand for affordable and aesthetic dental prosthetics, and advancements in denture fabrication technologies. The market expansion is supported by the growing geriatric population, higher adoption of removable dentures, and cost-effectiveness compared to ceramic alternatives. Additionally, the integration of CAD/CAM technology, improved material durability, and customization options for patient-specific needs further boost market growth.

Acrylic Teeth Market Overview

Acrylic teeth are synthetic dental components primarily used in dentures and prosthetic applications to replace missing teeth. Made from polymethyl methacrylate (PMMA), these teeth offer advantages such as lightweight structure, ease of adjustment, and affordability. Acrylic teeth are widely preferred in full and partial dentures due to their compatibility with various denture bases and ability to mimic natural aesthetics. Their role in restorative dentistry is critical, as they provide functional and cosmetic solutions for patients, especially in aging populations. Emerging markets in Asia Pacific and Latin America present significant opportunities due to expanding dental care access.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAcrylic Teeth Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Acrylic Teeth Market Drivers and Opportunities

Market Drivers:

- Rising Prevalence of Edentulism and Dental Disorders: Globally, edentulism (complete tooth loss) is a growing concern, particularly among the elderly population. According to WHO estimates, oral diseases affect nearly 3.5 billion people worldwide, with tooth loss being one of the most common issues. This trend is driving the demand for dentures and prosthetic solutions, where acrylic teeth serve as a cost-effective and widely available option.

- Cost-Effectiveness and Ease of Fabrication: Acrylic teeth are significantly more affordable compared to ceramic or composite alternatives, making them the preferred choice in low- and middle-income countries. Their ease of fabrication and adaptability to different denture bases allow dental technicians to produce customized solutions quickly, reducing turnaround time for patients.

- Increasing Awareness and Access to Dental Care: Government initiatives and private sector investments in oral health programs are improving access to dental care in emerging markets. This is leading to higher adoption of dentures and prosthetic solutions, further boosting acrylic teeth demand.

Market Opportunities:

- Integration of CAD/CAM and Digital Dentistry: The adoption of computer-aided design and manufacturing (CAD/CAM) technologies in dental labs is revolutionizing denture production. Digital workflows enable precise customization of acrylic teeth, improving fit, aesthetics, and patient comfort. This trend is expected to accelerate in developed markets and gradually penetrate emerging economies.

- Development of High-Strength Acrylic Materials: Traditional acrylic teeth have limitations in terms of wear resistance and fracture toughness. Manufacturers are investing in advanced PMMA formulations and hybrid acrylic materials to enhance durability and longevity, creating opportunities for premium product segments.

- Growing Demand for Aesthetic and Customized Solutions: Patients increasingly seek dentures that mimic natural teeth in color, translucency, and shape. This demand for aesthetic appeal is driving innovation in acrylic teeth design and pigmentation techniques, opening new avenues for differentiation.

Acrylic Teeth Market Report Segmentation Analysis

The acrylic teeth market share is analyzed across multiple segments to provide a comprehensive understanding of its structure, growth drivers, and emerging trends. Below is the standard segmentation approach applied in industry reports:

By Type:

- Partial Denture: Acrylic teeth used in partial dentures replace one or more missing teeth while preserving the remaining natural teeth. They are commonly chosen for affordability and ease of customization, making them suitable for patients who require functional restoration without full-mouth replacement.

- Complete Denture: Complete dentures incorporate acrylic teeth to replace all teeth in the upper or lower jaw. These are widely adopted among edentulous patients, particularly in aging populations, due to their cost-effectiveness and natural appearance.

- Overdenture: Overdentures combine acrylic teeth with support from natural teeth or implants, offering improved stability and comfort. This hybrid solution is gaining popularity for its enhanced functionality and patient satisfaction compared to traditional dentures.

By Application:

- Functionality:

Acrylic teeth designed for functionality prioritize durability, bite strength, and resistance to wear. They are ideal for patients seeking long-term performance and efficient chewing capability. - Aesthetics: Aesthetic-focused acrylic teeth aim to replicate the natural look of teeth, including color, translucency, and shape. These solutions cater to patients who prioritize cosmetic appeal alongside functional restoration.

By Technology:

- CAD/CAM: Computer-Aided Design and Manufacturing (CAD/CAM) technology enables precise customization of acrylic teeth, ensuring accurate fit and improved patient comfort. This technology is increasingly adopted in dental labs for efficiency and quality assurance.

- 3D Printing: 3D printing is revolutionizing denture fabrication by allowing rapid prototyping and production of acrylic teeth with complex geometries. It reduces turnaround time and supports personalized dental solutions at scale.

Acrylic Teeth Market Regional Insights

The regional trends and factors influencing the Acrylic Teeth Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Acrylic Teeth Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Acrylic Teeth Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 523.59 Million |

| Market Size by 2034 | US$ 1,124.24 Million |

| Global CAGR (2026 - 2034) | 8.87% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Acrylic Teeth Market Players Density: Understanding Its Impact on Business Dynamics

The Acrylic Teeth Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Acrylic Teeth Market top key players overview

Acrylic Teeth Market Share Analysis by Geography

North America

- Market Share: Holds the largest share due to strong dental infrastructure and high adoption of advanced prosthetic materials.

- Key Drivers:

• Growing demand for full and partial dentures

• Rising elderly population

• Early adoption of digital dental technologies - Trends: Increasing shift toward premium, multilayer acrylic teeth and implant-supported overdentures.

Europe

- Market Share: Significant share driven by established dental services and rising prosthetic procedures.

- Key Drivers:

• Favorable reimbursement for dental prosthetics in some countries

• High awareness of oral healthcare

• Growing adoption of CE-certified dental materials - Trends: Rising preference for natural-looking prosthetics and integration of CAD/CAM technologies in dental labs.

Asia Pacific

- Market Share: Fastest-growing region due to expanding dental tourism and increasing expenditure on oral health.

- Key Drivers:

• Growing geriatric population in China and Japan

• Rising number of dental clinics and labs

• Increased affordability of acrylic denture solutions - Trends: Rapid adoption of 3D-printed denture bases and acrylic teeth integration in digital workflows.

South & Central America

- Market Share: Emerging region with rising dental care awareness.

- Key Drivers:

• Growth in private dental clinics

• Affordability of acrylic-based prosthetics

• Growing emphasis on cosmetic dentistry - Trends:

Economy acrylic teeth are gaining traction due to cost-conscious patient populations.

Middle East & Africa

- Market Share: Developing market with expanding healthcare infrastructure.

- Key Drivers:

• Rising investment in dental healthcare

• Growing dental tourism in Gulf countries

• Increasing demand for removable dentures - Trends: Shift toward higher-quality, imported acrylic teeth to meet dental patient expectations.

Acrylic Teeth Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The market of acrylic teeth is highly competitive because a number of global manufacturers are involved in the manufacturing of denture materials and dental prosthetics. Product innovation, improved aesthetics, and the development of biocompatible materials characterize the competition.

Vendors differentiate through:

- High-translucency, multilayer acrylic teeth

- Digital workflows supported by CAD/CAM systems

- Improved abrasion resistance and life span

- Customizable shades and anatomical designs

Opportunities and Strategic Moves

- Strategic partnerships with dental laboratories and dental service organizations (DSOs).

- Expanding into emerging markets with more affordable product lines

- Investment in CAD/CAM-compatible acrylic solutions

- Development of 3D-printable acrylic teeth for digital denture workflow

Major Companies Operating in the Acrylic Teeth Market Are:

- Dentsply Sirona

- Ivoclar Vivadent AG

- Kulzer GmbH

- Yamahachi Dental Mfg. Co.

- New Stetic S.A.

- Shofu Dental Corporation

- Modern Dental Group

- Shanghai Pigeon

- Toros Dental Ltd

Acrylic Teeth Market News and Recent Developments

- In September 2024, 3D Systems announced that the U.S. Food and Drug Administration (FDA) had granted 510(k) clearance for its multi-material, monolithic (one-piece) jetted denture solution. This first-to-market innovation combines two specially developed materials- NextDent® Jet Denture Teeth and NextDent® Jet Denture Base, along with 3D Systems' advanced jetting technology, software, and services. The solution enables the efficient production of durable, long-wear dentures featuring high-quality acrylic teeth with superior aesthetics. By adopting this FDA-cleared jetted denture system, dental laboratories can streamline workflows and deliver dentures faster, resulting in improved patient experience and enhanced clinical outcomes.

- In December 2024, the University of Colorado School of Dental Medicine (CU SDM) received a $6 million Anschutz Acceleration Initiative grant to develop a novel one-step, 3D inkjet printing process that combines high-strength photopolymers suitable for acrylic teeth with antimicrobial properties targeting Streptococcus mutans.

Acrylic Teeth Market Report Coverage and Deliverables

The "Acrylic Teeth Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Acrylic Teeth Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Acrylic Teeth Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Acrylic Teeth Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Acrylic Teeth Market

- Detailed company profiles

Frequently Asked Questions

2. Asia Pacific is the fastest-growing region, driven by dental tourism, rising disposable incomes, and increased affordability of acrylic denture solutions.

1. CAD/CAM technology for precise customization and improved fit.

2. 3D printing for rapid prototyping and production of dentures with acrylic teeth.

These innovations enable faster turnaround, better aesthetics, and enhanced patient comfort.

1. Rising prevalence of edentulism and dental disorders globally.

2. Cost-effectiveness and ease of fabrication compared to ceramic alternatives.

3. A growing geriatric population and increased access to dental care.

4. Adoption of digital dentistry technologies like CAD/CAM and 3D printing.

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For