Africa VSAT (Very Small Aperture Terminal) Market Analysis and Opportunities by 2030

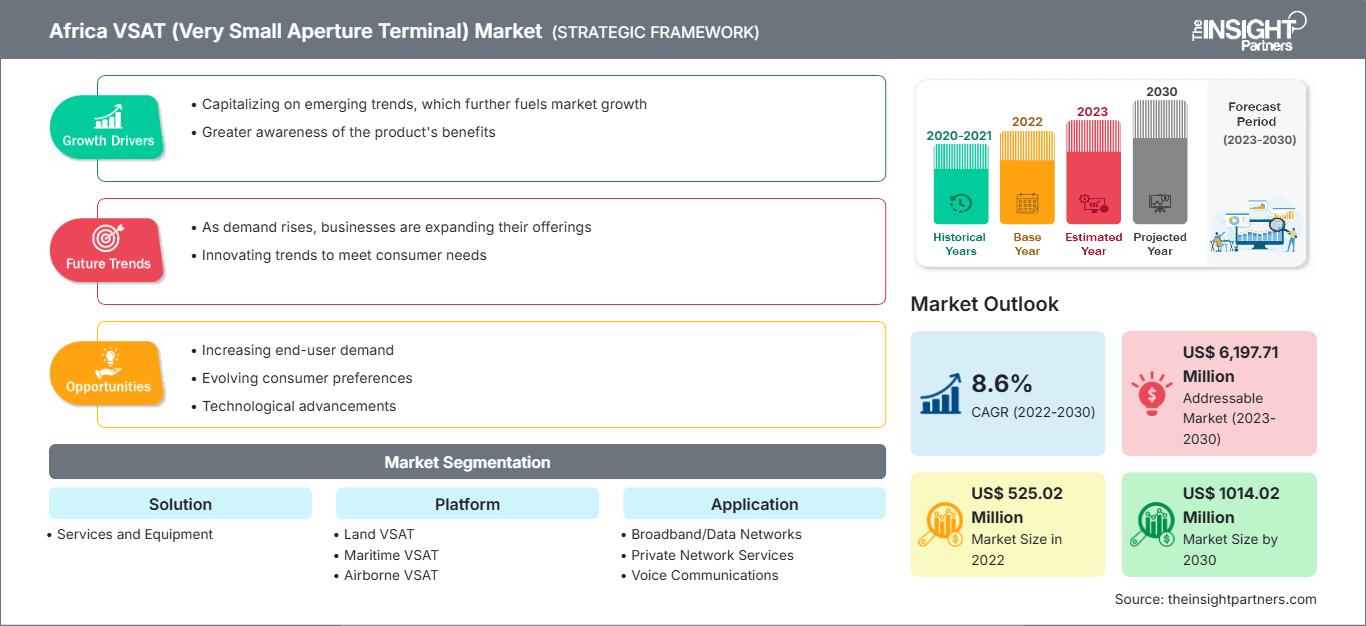

Africa VSAT (Very Small Aperture Terminal) Market Size and Forecasts (2020 - 2030), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Solution (Services and Equipment), Platform (Land VSAT, Maritime VSAT, and Airborne VSAT), and Application (Broadband/Data Networks, Private Network Services, Voice Communications, Broadcast, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Feb 2024

- Report Code : TIPRE00038986

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 117

The Africa Very Small Aperture Terminal (VSAT) market size was valued at US$ 525.02 million in 2022 and is expected to reach US$ 1014.02 million by 2030; it is estimated to record a CAGR of 8.6% from 2022 to 2030.

Analyst Perspective:

A very small aperture terminal (VSAT) technology offers value-added satellite access that can transmit data for Internet/intranet applications, video, voice over IP, and public or private networks. VSAT technology is increasingly being utilized to create networks for private, public/governmental, and business applications due to its flexibility, rapid deployment, and low setup and operational costs. The Africa VSAT market forecast can aid internet service providers in evaluating broadband internet facilities to extend coverage in remote areas of the world.

Africa VSAT Market Overview:

The study predicts noticeable growth of the Africa VSAT market size by recording a CAGR of 8.6% during 2022–2030. A VSAT is a compact ground station utilized to transmit and receive data, voice, and video signals via a satellite communication network. It comprises two primary components: an outdoor transceiver that must have an unobstructed line of sight to the satellite and an indoor device that connects the transceiver to the end user's communication equipment, such as a PC.

The transceiver establishes communication with a satellite transponder located in space. In contrast, the satellite serves as a relay for signals between the transceiver and a central ground station computer, which acts as a central hub for the system. This network configuration forms a star topology, with each end user being connected to the hub station via the satellite. The VSAT technology offers flexible, dependable, and cost-effective connectivity solutions for broadband internet access, point-of-sale transactions, remote access, and various other communication requirements. Despite challenges such as cybersecurity concerns, the Africa VSAT market is predicted to flourish owing to expanding applications in remote industries and government sectors. Moreover, the Africa VSAT market players are constantly upgrading their strategies to stay competitive as the demand for satellite internet access expands in remote areas.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAfrica VSAT (Very Small Aperture Terminal) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Africa VSAT Market Driver:

Growing Demand for Safe Communications for Maritime IoT Applications Drives Africa VSAT Market Growth

As IoT devices gain traction in maritime operations, secure and seamless communication between these devices and onshore systems becomes crucial. The VSAT technology has emerged as a valuable resource for maritime applications, enabling two-way satellite communication for the Internet, data, and telephony. VSAT systems offer a reliable and robust communication infrastructure that ensures the uninterrupted functioning of maritime IoT applications. The maritime sector heavily relies on essential functions such as real-time monitoring, remote management, and data exchange. The Africa VSAT market growth is, therefore, driven by the increasing demand for safe communication in maritime applications.

The companies operating in the Africa VSAT market are expanding their business across the region. In August 2020, Cobham Satcom, a renowned provider of radio and satellite communication solutions for the maritime and land sectors, expanded its SAILOR XTR portfolio. This expansion includes introducing two new Ka-band antenna systems designed specifically for Telenor Satellite's THOR 7 VSAT services. The one-meter SAILOR 1000 XTR Ka and the 65-centimeter SAILOR 600 XTR Ka are newly introduced systems incorporating Cobham Satcom's cutting-edge VSAT technology platform. These systems ensure high-speed broadband service on the THOR 7 satellite, which supports several network applications, including cloud-based big data management, thereby facilitating the expansion of the Africa VSAT market share.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Africa VSAT Market Report Segmentation:

Based on solution, the Africa VSAT market is segmented into services and equipment. VSAT services include shared bandwidth TDMA VSAT services; internet access C-band, Ku-band, and Ka-band; shared bandwidth services with 1:1, 1:4, and 1:10 contention ratios; iDirect, Newtec, and Hughes DVB platforms; dedicated bandwidth SCPC VSAT services (Comtech, Newtec, UHP Romantis modems); star (VSAT terminal to Hub Earth Station) and mesh configuration (from VSAT terminal to VSAT terminals); point-to-point or point-to-multipoint connectivity; power supply options: portable generator and solar panel technology; secured private VPNs; and installation services. Further, VSAT connections are usually billed monthly, just like a regular terrestrial-based internet provider; however, unusual arrangements can be made for usage only at certain times of the day/week or only to be used during emergency settings.

The internet service offered by VSATs is one of the cheaper satellite internet connections available in the Africa VSAT market. VSAT equipment encompasses a range of hardware components facilitating satellite communication, such as VSAT antenna; Block Upconverter (BUC) – BUC units convert low-energy signals into high-energy signals and are used to "send" the signal from the VSAT; Low-Noise Block Downconverter (LNB) – LNBs convert high energy signals to low-energy signals and are used to convert data received from the satellite into a signal for the modem; and Outdoor Unit (ODU), Indoor Unit (IDU), modem – proprietary hardware that decodes the signal from the satellite into usable data for a computer network or a computer hub, and network operations center (NOC). LNB, BUC, and modems all require some form of external power, though usually relatively low.

An organization or base that faces multiple power outages must consider battery backup for the VSAT if satellite-provided internet is required every time. Additionally, BUC and LNB units are placed outside and easily accessible. By platform, the market is divided into land VSAT, maritime VSAT, and airborne VSAT. In terms of application, the VSAT market in Africa is categorized into broadband/data networks, private network services, voice communications, broadcast, and others.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Africa VSAT Market Analysis by Region:

The Africa VSAT market is driven by factors such as increasing demand for high-speed internet connectivity, advancements in satellite communication technology, and the need for reliable communication networks in remote areas.

In November 2019, Communication Services FZCO (InterSAT), a company that specializes in providing VSAT services in Africa, selected the Hughes Jupiter System to support its newly launched SkyFi satellite broadband service. This service is aimed at consumers and micro/small-to-medium enterprises (MSME/SME) in sub-Saharan Africa. As per the agreement, InterSAT is expected to deploy the latest-generation JUPITER gateway and numerous high-speed customer terminals to ensure efficient and fast connectivity for its users.

In August 2020, Paratus South Africa, a subsidiary of Paratus Africa (a prominent pan-African telecommunications service provider), announced its plans to make significant investments in the South African satellite market. These investments aim to provide high-quality connectivity to South Africa and the Rest of Africa. Paratus is leveraging satellite technology to offer Internet Service Providers (ISPs) and businesses a versatile, dependable, and cost-effective communication solution that caters to a wide range of needs. Thus, such initiatives are expected to benefit the overall Africa VSAT market size.

In terms of revenue, Nigeria dominated the Africa VSAT market share. The utilization of VSAT technology in Nigeria has garnered considerable attention and significance. In Nigeria, VSATs serve various purposes, encompassing satellite internet access, point-of-sale transactions, telemedicine, and video communication. Recognizing its value, the Nigerian government has implemented policies to equip citizens with the necessary digital skills for a globally competitive digital economy. Moreover, in a bid to enhance the widespread adoption of broadband connectivity in Nigeria, the federal government announced plans to provide training for 600 Nigerian youths in VSAT installations and essential skills in March 2021. The Minister of Communications and Digital Economy announced the official launch of the National Policy on installations of VSAT solutions in Abuja. The policy aims to facilitate the implementation of VSAT installation training programs for the youth across the country to empower them with the necessary expertise.

Africa VSAT Market Players: Competitive Landscape:

GlobalTT SaRL, NTvsat, Talia Communications Ltd, Afrikanet Oxford Consultech UK Ltd, Norsat International Inc, Sandstream Telecoms, VSATmena FZCO, Echostar Corp, and Link Communications Systems Ltd are among the prominent players profiled in the Africa VSAT market report. Mergers & acquisitions, partnerships, and R&D activities are key strategies adopted by players to mark their position in the market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Africa VSAT market. A few recent key market developments are listed below:

- In April 2020, Norsat International announced the launch of a new satellite antenna in its WAYFARER series of portable and easy-to-deploy commercial terminals.

- In January 2024, Es'hailSat, the Qatar Satellite Company, expanded its partnership with Viasat Energy Services for VSAT connectivity throughout the Middle East & North Africa (MENA). The agreement makes use of the capabilities of the Es'hail-1 satellite, which is located at 25.5 degrees east and is specifically targeted to diverse sectors such as government, maritime, oil & gas, and energy.

Africa VSAT (Very Small Aperture Terminal) Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 525.02 Million |

| Market Size by 2030 | US$ 1014.02 Million |

| CAGR (2022 - 2030) | 8.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered |

Africa

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For