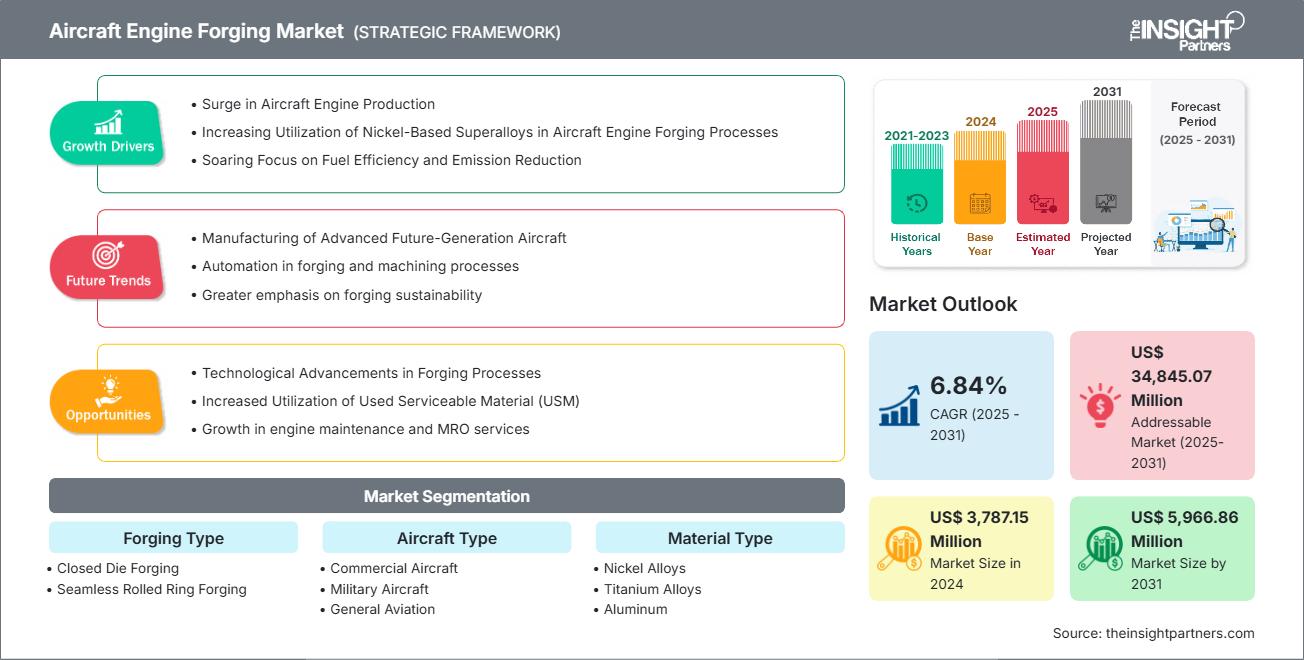

Le marché du forgeage des moteurs d'avion devrait atteindre 5 966,86 millions de dollars américains d'ici 2031, contre 3 787,15 millions de dollars américains en 2024. Le marché devrait enregistrer un TCAC de 6,84 % entre 2025 et 2031.

Analyse du marché du forgeage des moteurs d'avionL'essor de la production de moteurs d'avion, l'utilisation croissante de superalliages à base de nickel dans les processus de forgeage des moteurs d'avion et l'attention croissante portée à l'efficacité énergétique et à la réduction des émissions sont des facteurs clés de la croissance du marché du forgeage des moteurs d'avion. Les avancées technologiques dans les processus de forgeage et l'utilisation de matériaux utilisables (USM) devraient créer une opportunité pour le marché à l'avenir. La fabrication d'avions de nouvelle génération devrait devenir une tendance clé du marché dans les années à venir.

Aperçu du marché du forgeage de moteurs d'avionLe forgeage de moteurs d'avion est un procédé de fabrication permettant de produire des composants haute résistance et hautes performances pour moteurs d'avion. Il consiste à façonner le métal, généralement du titane, des alliages à base de nickel ou de l'acier inoxydable, sous une pression extrême à l'aide de marteaux, de presses ou de matrices. Ce procédé aligne la structure granulaire du métal avec la forme de la pièce, améliorant ainsi les propriétés mécaniques telles que la résistance mécanique, la résistance à la fatigue et la durabilité, essentielles dans les conditions de fonctionnement difficiles des moteurs à réaction.

Le forgeage permet de créer des pièces de moteur telles que des disques de turbine, des aubes de compresseur, des arbres et des carters. Ces composants doivent résister à des températures extrêmes, à des vitesses de rotation élevées et à d'énormes contraintes. Comparé au moulage ou à l'usinage, le forgeage offre une intégrité structurelle supérieure et moins de défauts internes, ce qui le rend idéal pour les applications aérospatiales où la sécurité et la performance sont primordiales. Les techniques de forgeage avancées, telles que le forgeage isotherme et le forgeage de précision, permettent des tolérances strictes et des géométries complexes, minimisant ainsi le recours à l'usinage supplémentaire. Face à la demande croissante de moteurs économes en carburant et légers, les pièces forgées sont essentielles à la conception de moteurs modernes, notamment ceux utilisés dans les avions commerciaux et militaires. Globalement, le forgeage est essentiel dans l'industrie aérospatiale, garantissant fiabilité et sécurité dans des environnements moteurs exigeants.

Vous bénéficierez d’une personnalisation sur n’importe quel rapport - gratuitement - y compris des parties de ce rapport, ou une analyse au niveau du pays, un pack de données Excel, ainsi que de profiter d’offres exceptionnelles et de réductions pour les start-ups et les universités

Marché du forgeage des moteurs d'avion: Perspectives stratégiques

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché du forgeage des moteurs d'avion

Moteurs du marché

-

Augmentation du trafic aérien et expansion de la flotte

L'augmentation du trafic aérien mondial de passagers et de fret stimule la demande de nouveaux avions, augmentant ainsi le besoin de composants de moteur forgés offrant résistance et durabilité. -

Demande de moteurs économes en carburant

Les compagnies aériennes accordent la priorité à l'efficacité énergétique pour réduire les coûts d'exploitation et les émissions, ce qui conduit à une adoption accrue de pièces forgées qui prennent en charge les conceptions de moteurs légers et hautes performances. -

Normes de sécurité et de performance strictes

La réglementation aéronautique exige des composants de haute fiabilité. Le forgeage garantit l'intégrité structurelle et la résistance à la fatigue, ce qui le rend essentiel pour les pièces de moteur critiques. -

Croissance de l'aviation de défense

Les programmes d'avions militaires se développent à l'échelle mondiale, nécessitant des composants de moteur robustes pour résister à des conditions extrêmes, ce qui stimule encore l'expansion du marché. -

Progrès technologiques dans les matériaux et les procédés

Les innovations dans les alliages à base de titane et de nickel et les techniques de forgeage de précision améliorent les performances et le cycle de vie des moteurs.

Opportunités de marché

-

Programmes d'avions de nouvelle génération

Les futures plateformes d'avions commerciaux et de défense offrent aux fournisseurs de forgeage des opportunités d'intégrer des matériaux et des conceptions avancés. -

Initiatives pour une aviation durable

La promotion de carburants d'aviation durables et de systèmes de propulsion hybrides électriques nécessitera de nouveaux composants forgés optimisés pour les nouvelles architectures de moteurs. -

Services après-vente et MRO

En tant qu'acteur mondial Français Les flottes vieillissent, la demande de maintenance, de réparation et de révision (MRO) des composants de moteur augmente, créant une opportunité constante sur le marché des pièces de rechange. -

Expansion des marchés émergents

La croissance rapide de l'aviation en Asie-Pacifique, au Moyen-Orient et en Afrique stimule les capacités régionales de fabrication et de forgeage. -

Fabrication numérique et automatisation

L'adoption des technologies de l'industrie 4.0 dans les processus de forgeage peut améliorer l'efficacité, réduire les déchets et permettre un contrôle qualité en temps réel.

Le marché du forgeage des moteurs d'avion est divisé en différents segments pour donner une vision plus claire de son fonctionnement, de son potentiel de croissance et des dernières tendances. Vous trouverez ci-dessous l'approche de segmentation standard utilisée dans la plupart des rapports sectoriels.

Par type de forgeage

-

Forgeage en matrice fermée

Utilisé pour la production de composants complexes à haute résistance, aux dimensions précises. Idéal pour les aubes de turbine, les disques et les arbres des moteurs d'avion. Offre d'excellentes propriétés mécaniques et une excellente utilisation des matériaux.

-

Forgeage d'anneaux laminés sans soudure

Préféré pour les composants circulaires de grande taille, tels que les segments de moteur et les chemins de roulement. Il offre une intégrité structurelle supérieure et une résistance à la fatigue et aux contraintes thermiques, essentielles pour les moteurs à réaction hautes performances.

Par type de matériau

-

Alliage de nickel

Dominant le marché en raison de sa résistance aux températures élevées, de sa résistance à la corrosion et de sa durabilité. Essentiel pour les sections de turbine exposées à une chaleur et une pression extrêmes.

-

Alliage de titane

Apprécié pour sa légèreté et son rapport résistance/poids élevé. Largement utilisé dans les aubes de soufflante et les sections de compresseur pour améliorer le rendement énergétique et réduire le poids du moteur.

-

Aluminium

Utilisé dans les composants de moteur à faible contrainte. Offre une rentabilité et une facilité d'usinage, mais est limité dans les applications à haute température.

-

Autres (par exemple, acier, alliages de cobalt)

Matériaux spéciaux utilisés dans des applications de niche nécessitant des propriétés mécaniques ou thermiques uniques. Souvent présents dans les moteurs militaires ou expérimentaux.

Par type d'avion

-

Avions commerciaux

Le segment le plus important est tiré par la demande mondiale de transport aérien. Nécessite des composants forgés avec précision et en grande quantité pour des moteurs fiables et économes en carburant.

-

Avions militaires

Se concentre sur les performances dans des conditions extrêmes. Utilise des alliages et des techniques de forgeage avancés pour la durabilité, la furtivité et les capacités à grande vitesse.

-

Aviation générale

Comprend les jets privés et les petits avions. La demande de composants forgés légers et économiques, alliant performance et accessibilité, est en hausse.

Par application

- Carter de ventilateur

- Carter extérieur de chambre de combustion

- Disque de turbine

- Rotors

- Autres

Par zone géographique

- Amérique du Nord

- Europe

- Asie-Pacifique

- Amérique latine

- Moyen-Orient et Afrique

Le marché du forgeage des moteurs d'avion en Asie-Pacifique connaît une croissance significative.

Aperçu régional du marché du forgeage des moteurs d'avionLes tendances régionales et les facteurs influençant le marché du forgeage de moteurs d'avion tout au long de la période de prévision ont été analysés en détail par les analystes de The Insight Partners. Cette section aborde également les segments et la géographie du marché du forgeage de moteurs d'avion en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu'en Amérique du Sud et en Amérique centrale.

Portée du rapport sur le marché du forgeage des moteurs d'avion

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2024 | US$ 3,787.15 Million |

| Taille du marché par 2031 | US$ 5,966.86 Million |

| TCAC mondial (2025 - 2031) | 6.84% |

| Données historiques | 2021-2023 |

| Période de prévision | 2025-2031 |

| Segments couverts |

By Type de forgeage

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché de la forge de moteurs d'avions : comprendre son impact sur la dynamique commerciale

Le marché du forgeage de moteurs d'avion connaît une croissance rapide, porté par une demande croissante des utilisateurs finaux, due à des facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une meilleure connaissance des avantages du produit. Face à cette demande croissante, les entreprises élargissent leur offre, innovent pour répondre aux besoins des consommateurs et capitalisent sur les nouvelles tendances, ce qui alimente la croissance du marché.

- Obtenez le Marché du forgeage des moteurs d'avion Aperçu des principaux acteurs clés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché du forgeage des moteurs d'avion

Obtenez un échantillon gratuit pour - Marché du forgeage des moteurs d'avion