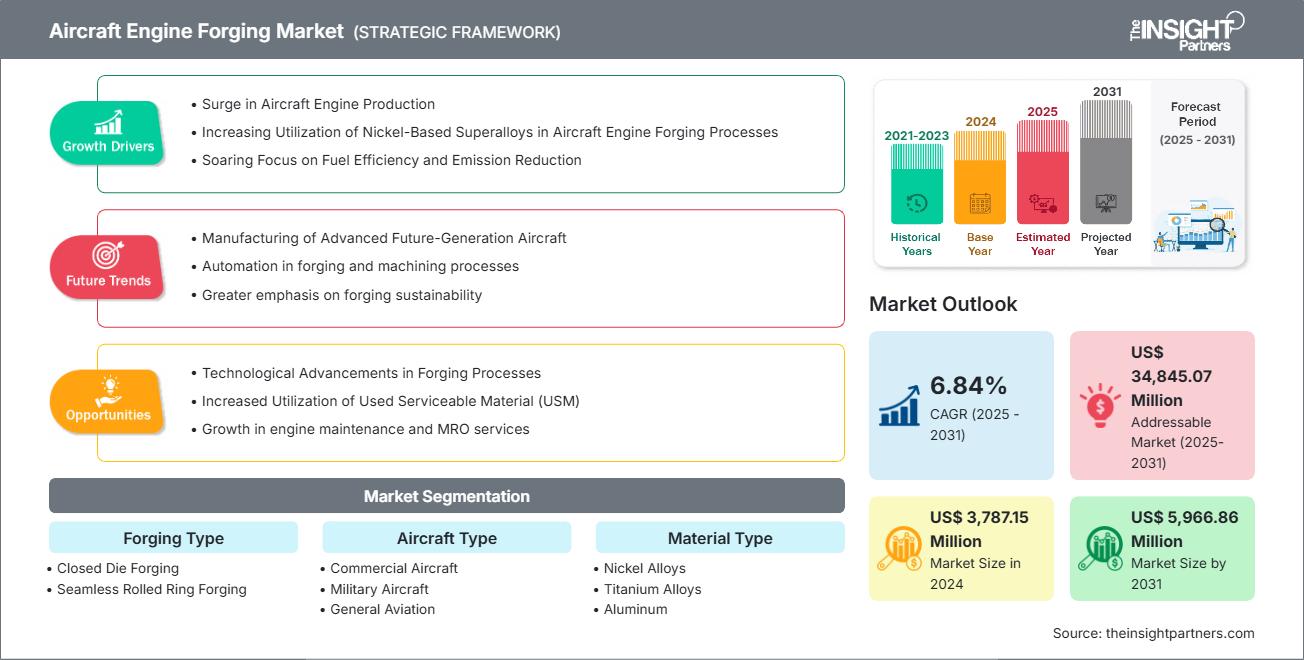

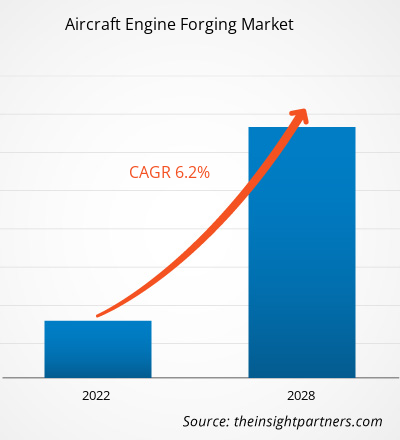

预计到2031年,飞机发动机锻件市场规模将从2024年的37.8715亿美元增至59.6686亿美元。预计2025年至2031年期间,该市场的复合年增长率将达到6.84%。

飞机发动机锻件市场分析飞机发动机产量的激增、镍基高温合金在飞机发动机锻造工艺中的应用不断增加,以及对燃油效率和减排的日益重视,是推动飞机发动机锻件市场增长的关键因素。锻造工艺和可维护材料(USM)使用的技术进步预计将为未来的市场创造机遇。制造先进的未来一代飞机很可能成为未来几年市场的主要趋势。

飞机发动机锻造市场概览飞机发动机锻造是一种用于生产高强度、高性能飞机发动机部件的制造工艺。它涉及使用锤子、压力机或模具在极高的压力下对金属(通常是钛、镍基合金或不锈钢)进行成型。该工艺使金属的晶粒结构与零件的形状保持一致,从而增强强度、抗疲劳性和耐用性等机械性能,这些性能对于喷气发动机的恶劣工作条件至关重要。

锻造可制造涡轮盘、压缩机叶片、轴和机匣等发动机部件。这些部件必须承受极端温度、高转速和巨大应力。与铸造或机加工相比,锻造具有卓越的结构完整性和更少的内部缺陷,使其成为安全和性能至关重要的航空航天应用的理想选择。先进的锻造技术,例如等温锻造和精密模锻,可以实现严格的公差和复杂的几何形状,从而最大限度地减少后续加工的需求。随着对燃油效率和轻量化发动机的需求日益增长,锻造零件在现代发动机设计中至关重要,包括商用喷气式飞机和军用飞机中使用的零件。总而言之,锻造在航空航天工业中至关重要,它确保了发动机在严苛环境下的可靠性和安全性。

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

航空发动机锻件市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

飞机发动机锻件市场驱动因素和机遇

市场驱动因素

-

不断增长的空中交通量和机队扩张

全球客运和货运空中交通量的增加推动了对新飞机的需求,从而增加了对具有强度和耐用性的锻造发动机部件的需求。 -

对节油发动机的需求

航空公司优先考虑燃油效率以降低运营成本和排放,从而导致越来越多地采用支持轻量化、高性能发动机设计的锻造部件。 -

严格的安全和性能标准

航空法规要求高可靠性组件。锻造可确保结构的完整性和抗疲劳性,因此对于关键的发动机部件来说至关重要。 -

国防航空的增长

军用飞机项目正在全球范围内扩展,需要坚固的发动机部件来承受极端条件,这进一步推动了市场扩张。 -

材料和工艺的技术进步

钛基和镍基合金以及精密锻造技术的创新提高了发动机的性能和生命周期。

市场机遇

-

下一代飞机项目

即将推出的商用和国防飞机平台为锻造供应商提供了整合先进材料和设计的机会。 -

可持续航空计划

可持续航空燃料和混合电力推进系统的发展将需要针对新型发动机架构优化的新型锻造部件。 -

售后市场和 MRO 服务

随着全球机队的老化,对发动机部件的维护、维修和大修 (MRO) 需求上升,创造了稳定的售后市场机会。 -

新兴市场扩张

亚太、中东和非洲地区航空业的快速增长推动了区域制造和锻造能力的发展。 -

数字化制造和自动化

在锻造过程中采用工业 4.0 技术可以提高效率、减少浪费并实现实时质量控制。

飞机发动机锻造市场分为不同的细分市场,以便更清楚地了解其运作方式、增长潜力和最新趋势。以下是大多数行业报告中使用的标准细分方法。

按锻造类型

-

闭式模锻

用于生产具有精确尺寸的复杂、高强度部件。适用于制造飞机发动机的涡轮叶片、涡轮盘和涡轮轴。具有优异的机械性能和材料利用率。

-

无缝轧制环锻件

适用于制造大型圆形部件,例如发动机环和轴承座圈。它具有卓越的结构完整性以及抗疲劳和热应力的能力,这对于高性能喷气发动机至关重要。

按材料类型

-

镍合金

因其高温强度、耐腐蚀性和耐用性而占据市场主导地位。对于暴露在极端高温和高压下的涡轮部件至关重要。

-

钛合金

因其重量轻和高强度重量比而备受推崇。广泛用于风扇叶片和压缩机部件,以提高燃油效率并减轻发动机重量。

-

铝

用于低应力发动机部件。具有成本效益且易于加工,但在高温应用中受到限制。

-

其他(例如,钢、钴合金)

利基应用中使用的特种材料需要独特的机械或热性能。通常用于军用或实验发动机。

按飞机类型

-

商用飞机

最大的细分市场是由全球航空旅行需求驱动的。需要大批量、精密锻造的部件,以制造节油可靠的发动机。

-

军用飞机

注重极端条件下的性能。使用先进的合金和锻造技术来实现耐用性、隐身性和高速性能。

-

通用航空

包括私人飞机和小型飞机。市场对兼顾性能与价格的轻质、经济高效的锻造部件的需求日益增长。

按应用

- 风扇机匣

- 燃烧室外壳

- 涡轮盘

- 转子

- 其他

按地域

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

亚太地区的飞机发动机锻件市场正在经历显著增长。

航空发动机锻件市场区域洞察The Insight Partners 的分析师已详尽阐述了预测期内影响飞机发动机锻件市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的飞机发动机锻件市场细分和地域分布。

航空发动机锻件市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2024 | US$ 3,787.15 Million |

| 市场规模 2031 | US$ 5,966.86 Million |

| 全球复合年增长率 (2025 - 2031) | 6.84% |

| 历史数据 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 |

By 锻造类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

航空发动机锻造市场参与者密度:了解其对业务动态的影响

航空发动机锻件市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 航空发动机锻件市场 主要参与者概述

按地区划分的飞机发动机锻件市场份额分析

飞机发动机锻件市场分为五大区域:北美、欧洲、亚太地区 (APAC)、中东和非洲 (MEA) 和南美。2024 年,北美占据市场主导地位,其次是欧洲和亚太地区。

北美,尤其是美国,在飞机发动机锻件市场占据主导地位。该地区拥有一些世界上最大的航空航天制造商和国防承包商,包括通用电气航空和普惠公司。由于商用和军用航空的严格安全和性能标准,这些公司推动了对高性能锻造部件(如涡轮盘和压缩机叶片)的需求。完善的工业基础、先进的锻造技术以及对航空航天研发的投资,共同造就了北美的领导地位。加拿大扮演着辅助角色,其公司专门从事航空航天部件制造和精密工程。

以下是按地区划分的市场份额和趋势的摘要

1. 北美

-

市场份额

由于先进的航空航天制造和国防开支而占据主导地位。 -

关键驱动因素

- 飞机原始设备制造商和锻造供应商的强大影响力。

- 对商用和军用飞机的需求很高。

- 在锻造工艺和材料的技术领先地位。

-

趋势

钛合金和镍合金锻造的增长;对可持续航空技术的投资增加。

2.欧洲

-

市场份额

巨大,由空客和国防计划支持。 -

关键驱动因素

- 专注于轻型、省油的发动机。

- 强有力的监管推动低排放航空。

- 欧盟国家的合作研发。

-

趋势

扩大下一代发动机的锻造能力;重视循环经济和材料回收利用。

3.亚太地区

-

市场份额

由于空中交通量上升和机队扩张,亚太地区成为增长最快的地区。 -

关键驱动因素

- 国内航空市场(中国和印度)快速增长。

- 提高本地制造和 MRO 能力。

- 政府对航空航天业发展的支持。

-

趋势

铝和钛锻件需求激增;区域锻造中心的出现。

4.中东和非洲

-

市场份额

具有战略航空投资的新兴市场。 -

关键驱动因素

- 国家航空公司和机场基础设施的扩张。

- 对国防航空的兴趣日益浓厚。

- 与全球航空航天公司的合作。

-

趋势

投资锻造设施;专注于适用于恶劣环境的高性能材料。

5.南美洲

-

市场份额

市场份额不大,但正在增长,主要由巴西航空航天工业主导。 -

关键驱动因素

- 对支线喷气式飞机和通用航空的需求。

- 发展本地航空航天供应链。

- 经济复苏推动机队现代化。

-

趋势

铝锻造的增长;全球航空航天项目的参与度增加。

中等市场密度和竞争

由于 All Metals & Forge Group、OTTO FUCHS KG、Pacific Forge Incorporated、Precision Castparts Corp.、Safran SA、VSMPO-AVISMA Corp、Farinia Group、Doncasters Group、LISI GROUP 和 Allegheny Technologies Inc.

这种中等水平的竞争促使公司通过提供

- 多样化的产品类型和材料来脱颖而出,以满足不同的消费者需求,从而加剧了竞争。

- 较低的进入门槛允许许多小型和区域性参与者进入市场。

- 定制需求推动品牌不断创新和差异化。

- 全球和本地制造商的强大存在加剧了价格和功能竞争。

- 电子商务的增长实现了直接面向消费者的销售,提高了市场饱和度。

- 智能棚屋和模块化设计等技术进步提高了创新风险。

- 对价格敏感的消费者推动激进的定价和促销活动战略。

机遇与战略举措

-

先进合金开发

投资高性能材料,例如钛铝化物和镍基高温合金,以满足下一代飞机发动机的需求。 -

支持可持续航空

锻造针对使用可持续航空燃料 (SAF) 和混合电力推进系统的发动机优化的部件。 -

数字锻造技术

集成人工智能、物联网和数字孪生,用于锻造操作中的实时监控、预测性维护和工艺优化。 -

模块化发动机部件设计

开发模块化锻造零件,简化维护和升级,尤其适用于支线和通用航空飞机。 -

拓展新兴市场

在亚太地区、中东和南美建立锻造工厂以满足不断增长的区域需求并降低供应链风险。 -

轻量化部件创新

专注于锻造轻量化部件,以提高燃油效率并减少商用和军用飞机的排放。 -

售后市场和维护、修理和大修 (MRO) 增长

通过提供锻造替换零件,充分利用日益增长的维护、维修和大修 (MRO) 服务需求。 -

合作研发计划

与原始设备制造商 (OEM)、研究机构和政府机构合作,共同开发未来推进系统的锻造技术。 -

自动化和智能制造

采用机器人技术和自动化锻造生产线,提高生产率、一致性和可扩展性。 -

符合全球标准

使锻造工艺符合国际航空安全和环境标准,以确保全球市场准入。

- All Metals & Forge Group

- OTTO FUCHS KG

- Pacific Forge Incorporated

- Precision Castparts Corp.

- Safran SA

- VSMPO-AVISMA Corp

- Farinia Group

- Doncasters Group

- LISI GROUP

- Allegheny Technologies Inc

免责声明:以上列出的公司并未按照任何特定顺序排列。研究过程中分析的其他公司

- Mettis Aerospace Limited.

- FRISA

- ELLWOOD Texas Forge Houston

- 无锡派克新材料科技有限公司

- SIFCO Forge

- SQuAD Forging India

- Canton Forge

- Carlton Forge Works

- Weldaloy Specialty Forging Company

- MATTCO FORGE INC.

- Arconic Corporation

- Consolidated Industries, Inc.

- Forgital Group

- Bharat Forge

- Voestalpine Bohler Aerospace GmbH &

- Howmet Aerospace

赛峰航空发动机公司与印度斯坦航空有限公司(HAL)签署协议

赛峰航空发动机公司与印度领先的航空航天和国防公司印度斯坦航空有限公司(HAL)签署了一项协议,旨在实现LEAP发动机旋转部件的工业化生产。该协议支持政府的“印度制造”政策。该协议遵循了赛峰航空发动机公司与HAL于2023年10月签署的谅解备忘录,旨在开展LEAP发动机部件制造领域的工业合作,以及双方去年2月签署的生产锻件的合同。赛峰飞机发动机公司正在继续扩大其在印度的业务,并通过生产因科镍合金零件扩大与 HAL 的合作范围。

ATI 公司与空客签署协议

2025 年 5 月,ATI 公司宣布已与空客签署了一项多年期协议,以确保该飞机制造商供应钛板、薄板和钢坯,以继续提高窄体和宽体飞机的产量。它将 ATI 定位为空客钛合金扁平材和长材的顶级供应商。

飞机发动机锻件市场报告覆盖范围和交付成果《飞机发动机锻件市场规模和预测(2021-2031)》报告提供了详细的市场分析,涵盖以下领域

- 涵盖范围内所有主要细分市场的全球、区域和国家/地区飞机发动机锻件市场规模和预测

- 飞机发动机锻件市场趋势以及市场动态,例如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 飞机发动机锻件市场分析,涵盖主要市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者和飞机发动机锻件市场的最新发展

- 详细的公司个人资料

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 航空发动机锻件市场

获取免费样品 - 航空发动机锻件市场