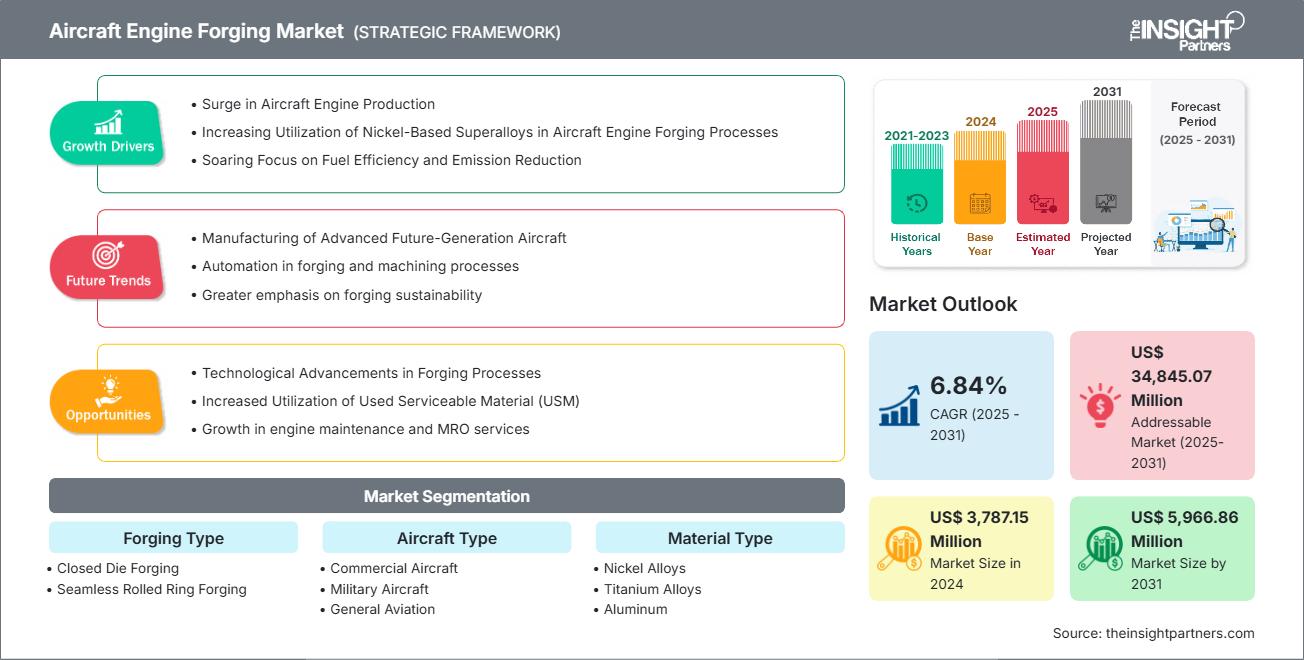

Si prevede che il mercato della forgiatura di motori aeronautici raggiungerà i 5.966,86 milioni di dollari entro il 2031, rispetto ai 3.787,15 milioni di dollari del 2024. Si prevede che il mercato registrerà un CAGR del 6,84% tra il 2025 e il 2031.

Analisi del mercato della forgiatura di motori aeronauticiLa crescente produzione di motori aeronautici, il crescente utilizzo di superleghe a base di nichel nei processi di forgiatura dei motori aeronautici e la crescente attenzione all'efficienza del carburante e alla riduzione delle emissioni sono fattori chiave che guidano la crescita del mercato della forgiatura di motori aeronautici. Si prevede che i progressi tecnologici nei processi di forgiatura e l'utilizzo di materiali riutilizzabili (USM) creeranno opportunità per il mercato in futuro. La produzione di aeromobili avanzati di futura generazione è destinata a emergere come una tendenza chiave per il mercato nei prossimi anni.

Panoramica del mercato della forgiatura di motori aeronauticiLa forgiatura di motori aeronautici è un processo di produzione utilizzato per realizzare componenti ad alta resistenza e alte prestazioni per motori aeronautici. Consiste nella modellazione di metalli, in genere titanio, leghe a base di nichel o acciaio inossidabile, sotto pressione estrema utilizzando martelli, presse o stampi. Questo processo allinea la struttura granulare del metallo alla forma del pezzo, migliorando proprietà meccaniche come resistenza, resistenza alla fatica e durata, fondamentali nelle difficili condizioni operative dei motori a reazione.

La forgiatura crea componenti del motore come dischi di turbine, pale di compressori, alberi e involucri. Questi componenti devono resistere a temperature estreme, elevate velocità di rotazione e sollecitazioni enormi. Rispetto alla fusione o alla lavorazione meccanica, la forgiatura garantisce una maggiore integrità strutturale e un minor numero di difetti interni, rendendola ideale per applicazioni aerospaziali in cui sicurezza e prestazioni sono fondamentali. Tecniche di forgiatura avanzate, come la forgiatura isotermica e la forgiatura di precisione, consentono tolleranze ristrette e geometrie complesse, riducendo al minimo la necessità di ulteriori lavorazioni meccaniche. Con la crescente domanda di motori leggeri ed efficienti nei consumi, i componenti forgiati sono essenziali nella progettazione di motori moderni, compresi quelli utilizzati nei jet commerciali e negli aerei militari. In generale, la forgiatura è fondamentale nel settore aerospaziale, garantendo affidabilità e sicurezza in ambienti motore difficili.

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato della forgiatura dei motori aeronautici: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

Fattori e opportunità del mercato della forgiatura dei motori aeronautici

Fattori di mercato

-

Aumento del traffico aereo e dell'espansione della flotta

L'aumento del traffico aereo globale di passeggeri e merci sta stimolando la domanda di nuovi aeromobili, aumentando la necessità di componenti per motori forgiati che offrano resistenza e durata. -

Domanda di motori a basso consumo di carburante

Le compagnie aeree danno priorità all'efficienza del carburante per ridurre i costi operativi e le emissioni, portando a una maggiore adozione di parti forgiate che supportano progetti di motori leggeri e ad alte prestazioni. -

Standard rigorosi di sicurezza e prestazioni

Le normative aeronautiche richiedono componenti ad alta affidabilità. La forgiatura garantisce l'integrità strutturale e la resistenza alla fatica, rendendola essenziale per le parti critiche del motore. -

Crescita nell'aviazione da difesa

I programmi per aerei militari si stanno espandendo a livello globale, richiedendo componenti motore robusti per resistere a condizioni estreme, stimolando ulteriormente l'espansione del mercato. -

Progressi tecnologici nei materiali e nei processi

Le innovazioni nelle leghe a base di titanio e nichel e le tecniche di forgiatura di precisione migliorano le prestazioni e il ciclo di vita del motore.

Opportunità di mercato

-

Programmi per aeromobili di nuova generazione

Le prossime piattaforme per aeromobili commerciali e da difesa offrono ai fornitori di forgiatura l'opportunità di integrare materiali e design avanzati. -

Iniziative per l'aviazione sostenibile

La spinta verso carburanti sostenibili per l'aviazione e sistemi di propulsione ibridi-elettrici richiederà nuovi componenti forgiati ottimizzati per nuove architetture di motori. -

Servizi aftermarket e MRO

Con l'invecchiamento delle flotte globali, aumenta la domanda di manutenzione, riparazione e revisione (MRO) dei componenti dei motori, creando una costante opportunità di aftermarket. -

Espansione nei mercati emergenti

La rapida crescita dell'aviazione in Asia Pacifico, Medio Oriente e Africa stimola le capacità di produzione e forgiatura regionali. -

Produzione digitale e automazione

L'adozione delle tecnologie dell'Industria 4.0 nei processi di forgiatura può migliorare l'efficienza, ridurre gli sprechi e consentire il controllo della qualità in tempo reale.

Il mercato della forgiatura dei motori aeronautici è suddiviso in diversi segmenti per offrire una visione più chiara del suo funzionamento, del suo potenziale di crescita e delle ultime tendenze. Di seguito è riportato l'approccio di segmentazione standard utilizzato nella maggior parte dei report di settore.

Per tipo di forgiatura

-

Forgiatura a stampo chiuso

Utilizzata per la produzione di componenti complessi ad alta resistenza con dimensioni precise. Ideale per pale di turbine, dischi e alberi nei motori aeronautici. Offre eccellenti proprietà meccaniche e un utilizzo ottimale dei materiali.

-

Forgiatura ad anello laminato senza saldatura

Preferita per componenti circolari di grandi dimensioni come anelli motore e piste di cuscinetti. Offre un'integrità strutturale superiore e resistenza alla fatica e alle sollecitazioni termiche, essenziali per i motori a reazione ad alte prestazioni.

Per tipo di materiale

-

Lega di nichel

Domina il mercato grazie alla sua resistenza alle alte temperature, alla resistenza alla corrosione e alla durevolezza. Fondamentale per le sezioni delle turbine esposte a calore e pressione estremi.

-

Lega di titanio

Apprezzata per la sua leggerezza e l'elevato rapporto resistenza/peso. Ampiamente utilizzata nelle pale delle ventole e nelle sezioni dei compressori per migliorare l'efficienza del carburante e ridurre il peso del motore.

-

Alluminio

Utilizzato nei componenti dei motori a basso stress. Offre economicità e facilità di lavorazione, ma è limitato nelle applicazioni ad alta temperatura.

-

Altri (ad esempio, acciaio, leghe di cobalto)

Materiali speciali utilizzati in applicazioni di nicchia richiedono proprietà meccaniche o termiche uniche. Spesso presenti nei motori militari o sperimentali.

Per tipo di aeromobile

-

Aerei commerciali

Il segmento più ampio è trainato dalla domanda globale di viaggi aerei. Richiede componenti forgiati con precisione e in grandi volumi per motori affidabili ed efficienti nei consumi.

-

Aerei militari

Si concentra sulle prestazioni in condizioni estreme. Utilizza leghe avanzate e tecniche di forgiatura per garantire durata, furtività e capacità ad alta velocità.

-

Aviazione generale

Include jet privati e piccoli aerei. La domanda di componenti forgiati leggeri e convenienti che bilancino prestazioni e convenienza è in crescita.

Per applicazione

- Cassa ventola

- Cassa esterna camera di combustione

- Disco turbina

- Rotori

- Altri

Per area geografica

- Nord America

- Europa

- Asia Pacifico

- America Latina

- Medio Oriente e Africa

Il mercato della forgiatura di motori aeronautici nell'area Asia-Pacifico sta assistendo a una crescita significativa.

Approfondimenti regionali sul mercato della forgiatura dei motori aeronauticiLe tendenze regionali e i fattori che influenzano il mercato della forgiatura dei motori aeronautici durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la geografia del mercato della forgiatura dei motori aeronautici in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America meridionale e centrale.

Ambito del rapporto sul mercato della forgiatura dei motori aeronautici

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2024 | US$ 3,787.15 Million |

| Dimensioni del mercato per 2031 | US$ 5,966.86 Million |

| CAGR globale (2025 - 2031) | 6.84% |

| Dati storici | 2021-2023 |

| Periodo di previsione | 2025-2031 |

| Segmenti coperti |

By Tipo di forgiatura

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato della forgiatura dei motori aeronautici: comprendere il suo impatto sulle dinamiche aziendali

Il mercato della forgiatura di motori aeronautici è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato della forgiatura dei motori aeronautici Panoramica dei principali attori chiave

Analisi della quota di mercato della forgiatura di motori aeronautici per area geografica

Il mercato della forgiatura di motori aeronautici è segmentato in cinque regioni principali: Nord America, Europa, Asia Pacifico (APAC), Medio Oriente e Africa (MEA) e Sud America. Il Nord America ha dominato il mercato nel 2024, seguito da Europa e Asia Pacifico.

Il Nord America, in particolare gli Stati Uniti, domina il mercato della forgiatura di motori aeronautici. La regione ospita alcuni dei maggiori produttori aerospaziali e appaltatori della difesa al mondo, tra cui General Electric Aviation e Pratt & Whitney. Grazie ai rigorosi standard di sicurezza e prestazioni nell'aviazione commerciale e militare, queste aziende stimolano la domanda di componenti forgiati ad alte prestazioni, come dischi per turbine e pale per compressori. Una solida base industriale, l'accesso a tecnologie di forgiatura avanzate e gli investimenti nella ricerca e sviluppo aerospaziale contribuiscono alla leadership del Nord America. Il Canada svolge un ruolo di supporto, con aziende specializzate nella produzione di componenti aerospaziali e nell'ingegneria di precisione.

Di seguito è riportato un riepilogo della quota di mercato e delle tendenze per regione

1. Nord America

-

Quota di mercato

Dominante grazie alla produzione aerospaziale avanzata e alla spesa per la difesa. -

Fattori chiave

- Forte presenza di OEM di aeromobili e fornitori di forgiatura.

- Elevata domanda di aerei commerciali e militari.

- Leadership tecnologica nei processi e nei materiali di forgiatura.

-

Tendenze

Crescita nella forgiatura di leghe di titanio e nichel; maggiori investimenti in tecnologie aeronautiche sostenibili.

2. Europa

-

Quota di mercato

Significativa, supportata da Airbus e dai programmi di difesa. -

Fattori chiave

- Focus su motori leggeri e a basso consumo di carburante.

- Forte spinta normativa per l'aviazione a basse emissioni.

- R&S collaborativa tra le nazioni dell'UE.

-

Tendenze

Espansione della capacità di forgiatura per motori di nuova generazione; enfasi sull'economia circolare e sul riciclo dei materiali.

3. Asia-Pacifico

-

Quota di mercato

Regione in più rapida crescita grazie all'aumento del traffico aereo e all'espansione della flotta. -

Fattori chiave

- Rapida crescita nei mercati dell'aviazione nazionale (Cina e India).

- Aumento delle capacità produttive e di manutenzione, riparazione e revisione locali.

- Sostegno governativo allo sviluppo del settore aerospaziale.

-

Tendenze

Crescente domanda di forgiati in alluminio e titanio; nascita di hub regionali di forgiatura.

4. Medio Oriente e Africa

-

Quota di mercato

Mercato emergente con investimenti strategici nell'aviazione. -

Fattori chiave

- Espansione delle compagnie aeree nazionali e delle infrastrutture aeroportuali.

- Crescente interesse per l'aviazione da difesa.

- Partnership con aziende aerospaziali globali.

-

Tendenze

Investimenti in impianti di forgiatura; attenzione ai materiali ad alte prestazioni per ambienti difficili.

5. Sud America

-

Quota di mercato

Modesta ma in crescita, guidata dall'industria aerospaziale brasiliana. -

Fattori chiave

- Domanda di jet regionali e aviazione generale.

- Sviluppo di catene di fornitura aerospaziali locali.

- La ripresa economica sta guidando la modernizzazione della flotta.

-

Tendenze

Crescita nella forgiatura dell'alluminio; maggiore partecipazione ai programmi aerospaziali globali.

Densità di mercato e concorrenza medie

La concorrenza è media a causa della presenza di operatori affermati come All Metals & Forge Group, OTTO FUCHS KG, Pacific Forge Incorporated, Precision Castparts Corp., Safran SA, VSMPO-AVISMA Corp, Farinia Group, Doncasters Group, LISI GROUP e Allegheny Technologies Inc.

Questo livello medio di concorrenza spinge le aziende a distinguersi offrendo

- Diversi tipi di prodotti e materiali soddisfano le diverse esigenze dei consumatori, aumentando la rivalità.

- Le basse barriere all'ingresso consentono a molti piccoli operatori regionali di entrare nel mercato.

- La domanda di personalizzazione spinge i marchi a innovare e differenziarsi costantemente.

- La forte presenza di produttori globali e locali intensifica la concorrenza su prezzi e caratteristiche.

- La crescita dell'e-commerce consente vendite dirette al consumatore, aumentando la saturazione del mercato.

- I progressi tecnologici come i capannoni intelligenti e i design modulari aumentano la posta in gioco dell'innovazione.

- I consumatori sensibili al prezzo spingono a prezzi aggressivi e promozioni strategie.

Opportunità e mosse strategiche

-

Sviluppo di leghe avanzate

Investire in materiali ad alte prestazioni come alluminuri di titanio e superleghe a base di nichel per soddisfare le esigenze dei motori aeronautici di nuova generazione. -

Supporto per l'aviazione sostenibile

Forgiare componenti ottimizzati per motori alimentati con carburanti per l'aviazione sostenibile (SAF) e sistemi di propulsione ibridi-elettrici. -

Tecnologie di forgiatura digitale

Integrare intelligenza artificiale, IoT e gemelli digitali per il monitoraggio in tempo reale, la manutenzione predittiva e l'ottimizzazione dei processi nelle operazioni di forgiatura. -

Progettazione di componenti modulari per motori

Sviluppare parti forgiate modulari che semplificano la manutenzione e gli aggiornamenti, in particolare per gli aeromobili dell'aviazione regionale e generale. -

Espansione nei mercati emergenti

Creare impianti di forgiatura nell'Asia Pacifica, in Medio Oriente e in Sud L'America per soddisfare la crescente domanda regionale e ridurre i rischi della catena di approvvigionamento. -

Innovazione nei componenti leggeri

Concentrarsi sulla forgiatura di componenti leggeri per migliorare l'efficienza del carburante e ridurre le emissioni degli aerei commerciali e militari. -

Crescita del mercato post-vendita e MRO

Sfruttare la crescente domanda di servizi di manutenzione, riparazione e revisione (MRO) fornendo parti di ricambio forgiate. -

Iniziative di ricerca e sviluppo collaborative

Collaborare con OEM, istituti di ricerca ed enti governativi per sviluppare congiuntamente tecnologie di forgiatura per i futuri sistemi di propulsione. -

Automazione e produzione intelligente

Adottare la robotica e linee di forgiatura automatizzate per migliorare la produttività, la coerenza e la scalabilità. -

Conformità agli standard globali

Allineare i processi di forgiatura agli standard internazionali di sicurezza aerea e ambientali per garantire l'accesso al mercato globale.

- All Metals & Forge Group

- OTTO FUCHS KG

- Pacific Forge Incorporated

- Precision Castparts Corp.

- Safran SA

- VSMPO-AVISMA Corp

- Farinia Group

- Doncasters Group

- LISI GROUP

- Allegheny Technologies Inc

Disclaimer Le aziende elencate sopra non sono classificate in alcun ordine particolare. Altre aziende analizzate nel corso della ricerca

- Mettis Aerospace Limited.

- FRISA

- ELLWOOD Texas Forge Houston

- Wuxi Paike New Materials Technology Co., Ltd.

- SIFCO Forge

- SQuAD Forging India

- Canton Forge

- Carlton Forge Works

- Weldaloy Specialty Forging Company

- MATTCO FORGE INC.

- Arconic Corporation

- Consolidated Industries, Inc.

- Forgital Group

- Bharat Forge

- Voestalpine Bohler Aerospace GmbH & Co KG

- Howmet Aerospace

Safran Aircraft Engine ha firmato un accordo con HAL

Safran Aircraft Engines ha firmato un accordo con Hindustan Aeronautics Limited (HAL), azienda leader in India nel settore aerospaziale e della difesa, per l'industrializzazione e la produzione di parti rotanti per i motori LEAP. Questo accordo supporta la politica governativa "Make in India". Fa seguito al memorandum d'intesa firmato da Safran Aircraft Engines e HAL nell'ottobre 2023 per sviluppare la cooperazione industriale nella produzione di componenti per motori LEAP, nonché al contratto firmato lo scorso febbraio da entrambi i partner per la produzione di parti forgiate. Safran Aircraft Engines continua ad espandere la sua presenza in India e sta ampliando la portata della sua cooperazione con HAL attraverso la produzione di componenti in Inconel.

ATI Inc. ha firmato un accordo con Airbus

Nel maggio 2025, ATI Inc. ha annunciato di aver firmato un accordo pluriennale con Airbus, garantendo all'azienda la fornitura di piastre, fogli e billette in titanio, mentre continua ad aumentare la produzione di aeromobili a fusoliera stretta e larga. Posiziona ATI come fornitore leader di prodotti laminati piani e lunghi in titanio per Airbus.

Copertura e risultati del rapporto sul mercato della forgiatura dei motori aeronauticiIl rapporto "Dimensioni e previsioni del mercato della forgiatura dei motori aeronautici (2021-2031)" fornisce un'analisi dettagliata del mercato che copre le seguenti aree:

- Dimensioni e previsioni del mercato della forgiatura dei motori aeronautici a livello globale, regionale e nazionale per tutti i segmenti di mercato chiave coperti dall'ambito

- Tendenze del mercato della forgiatura dei motori aeronautici, nonché dinamiche di mercato come driver, vincoli e opportunità chiave

- Analisi PEST e SWOT dettagliate

- Analisi del mercato della forgiatura dei motori aeronautici che copre le principali tendenze del mercato, il quadro globale e regionale, i principali attori, le normative e i recenti sviluppi del mercato

- Analisi del panorama industriale e della concorrenza che copre la concentrazione del mercato, l'analisi della mappa termica, i principali attori e i recenti sviluppi per il mercato della forgiatura dei motori aeronautici

- Dettagli sull'azienda profili

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato della forgiatura dei motori aeronautici

Ottieni un campione gratuito per - Mercato della forgiatura dei motori aeronautici