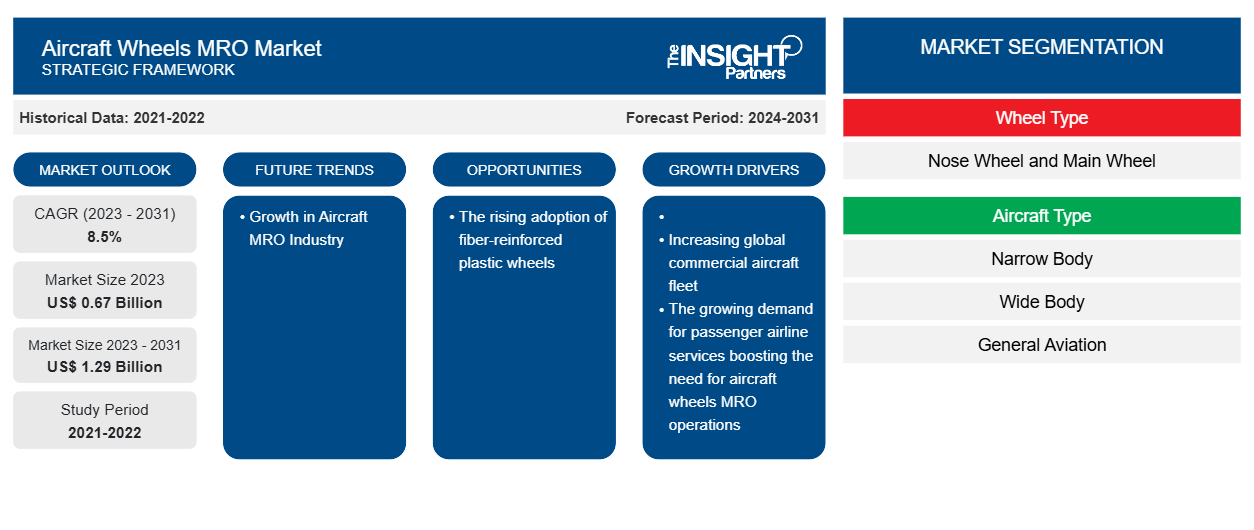

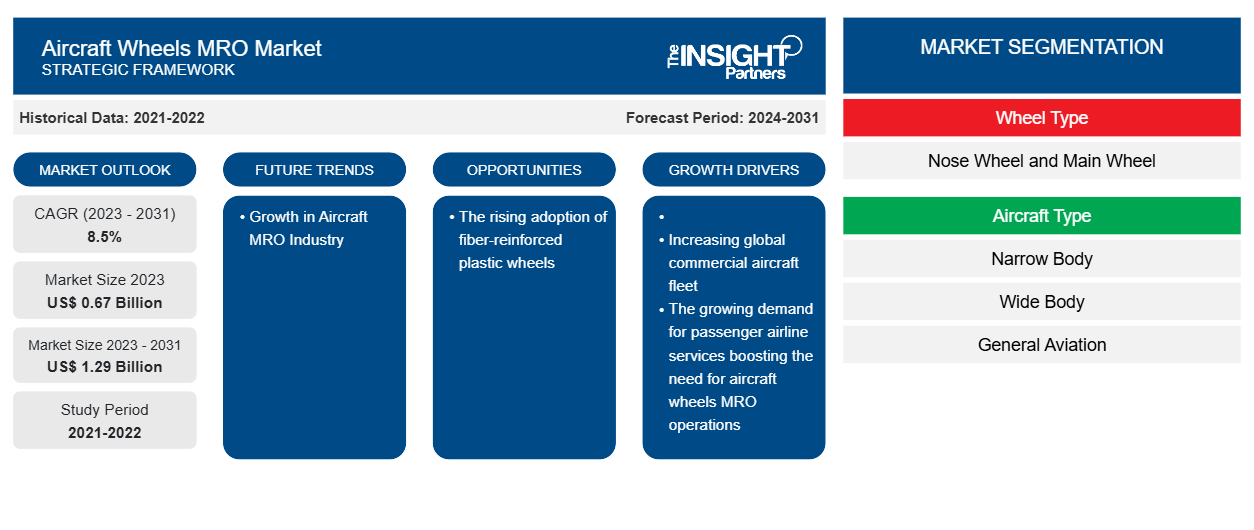

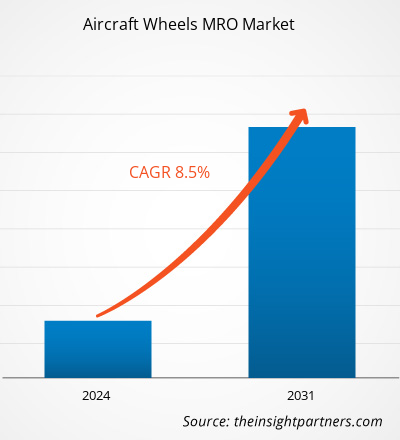

The aircraft wheels MRO market size is projected to reach US$ 1.29 billion by 2031 from US$ 0.67 billion in 2023. The market is expected to register a CAGR of 8.5% during 2023–2031. The rising adoption of fiber-reinforced plastic wheels is likely to remain a key trend in the market.

Aircraft Wheels MRO Market Analysis

The aerospace and defense industry across the globe encompass several numbers of well-established aircraft manufacturers accounting substantially large market share in the respective aircraft market. Since there is availability of large number of aircraft wheels MRO service providers in the market, small as well as well-established aircraft operators have a substantial bargaining power to avail aircraft wheels MRO service with high-quality at a competitive price. As a result, the bargaining power of buyers in the aircraft wheels MRO market is high due to their functional requirement and presence of substantial number of service providers.

Aircraft Wheels MRO Market Overview

The aircraft wheels MRO market ecosystem comprises of following stakeholders- aircraft wheels manufacture, aircraft wheels MRO companies, and end-users. The aircraft wheels manufacturers procure raw materials and components such as steel, aluminum, and magnesium alloy and components such as nuts and bolts among others and manufactures aircraft wheels. Further, aircraft wheels MRO companies procures aircraft wheels from aircraft wheels manufacturers. These aircraft wheels MRO companies are the key market players and holds a significant amount of share of the market. Few of the prominent players who are operating in the market are AAR Corp, Aerorepair Corp, AMETEK Inc, Lufthansa Technik, TP Aerospace, among others. End-users such as airline companies, armed forces, general aviation companies, and others are the final stakeholder of this ecosystem chain and they retrofit aircraft wheels from aircraft wheels MRO companies.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Wheels MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aircraft Wheels MRO Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Aircraft Wheels MRO Market Drivers and Opportunities

Increasing Global Commercial Aircraft Fleet

The rising commercial aircraft deliveries across different regions is driving the growth of wheels MRO market. The production of commercial aircraft in large numbers is generating the demand for installation of new wheels across different regions. For instance, Airbus delivered around 735 aircraft in 2023 and witnessed an 11% hike compared to the 2022 deliveries. Moreover, the rise in global commercial aircraft fleet is further driving the growth for wheels MRO worldwide. For instance, according to The Insight Partners’ secondary research the global commercial aircraft fleet in 2023 stood at 27,385 aircraft that further reached to 28,398 aircaft in 2024. In addition, this fleet is likely to reach en estimated figure of around 36,413 aircraft by the end of 2034. This is further likely to drive the wheels MRO market in the coming years worldwide.

Growth in Aircraft MRO Industry

With the rapidly growing aviation industry from the past few years, the demand for airline MRO services is also increasing. Emerging economies, such as those in APAC, are highly focused on extending MRO services to commercial as well as military aircrafts. Economic growth, increasing air passengers, and growing aviation infrastructure spending in APAC countries are the major factors driving the growth of the aircraft MRO services, which is subsequently providing lucrative opportunities for the growth of the aircraft wheels MRO market. Moreover, accordinto The Insight Partner’s Analysis, the global aircraft MRO industry is likely to surpass US$ 140 billion by the end of 2034 which is further likely to generate new demand for aircraft wheels MRO in the coming years.

Aircraft Wheels MRO Market Report Segmentation Analysis

Key segments that contributed to the derivation of the aircraft wheels MRO market analysis are wheel type, aircraft type, and technology.

- Based on wheel type, the aircraft wheels MRO market is segmented into nose wheel and main wheel. The main wheel segment held a larger market share in 2023.

- Based on aircraft type, the aircraft wheels MRO market is segmented into narrow body, wide body, general aviation, military aircraft, and helicopter. The narrow body segment held a larger market share in 2023.

- Based on technology, the aircraft wheels MRO market is segmented into inspection, non-destructive testing, machining, and others. The non-destructive testing segment held a larger market share in 2023.

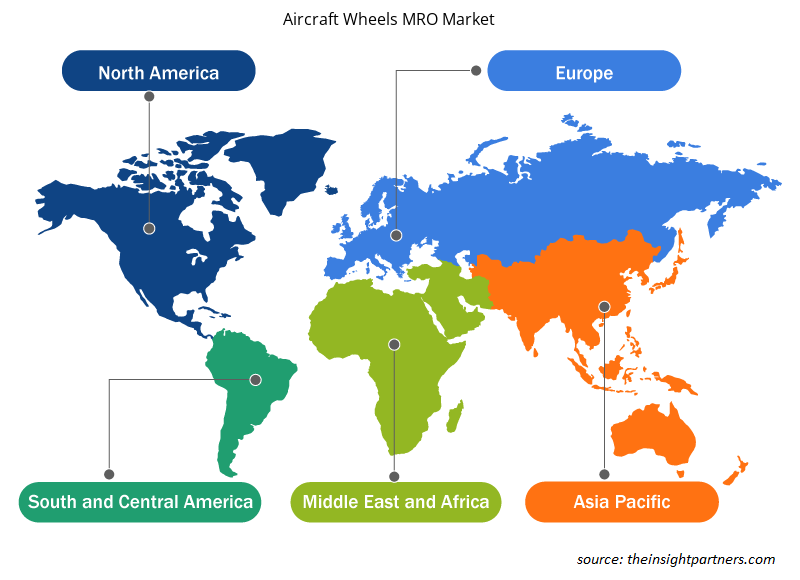

Aircraft Wheels MRO Market Share Analysis by Geography

The geographic scope of the aircraft wheels MRO market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific has dominated the market in 2023 followed by North America and Europe regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. China dominated the Asia Pacific aircraft wheels MRO market in 2023. The demand for wheels MRO market in China is mainly driven by the demand generated from MRO operations for the large number of fleet. For instance, in 2023, the commercial aircraft fleet across China stood at 3,821 which is further likely to reach around 6,321 aircraft by 2033. Moreover, according to the Airbus forecasts, more than 9,000 aircraft are likely to be delivered across China during 2023 to 2042. Such factors are likely to boost the fleet size across the country which is further expected to generate new opportunities for wheels MRO across the country in the coming years.

Aircraft Wheels MRO Market Report ScopeAircraft Wheels MRO Market Regional Insights

The regional trends and factors influencing the Aircraft Wheels MRO Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aircraft Wheels MRO Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aircraft Wheels MRO Market

Aircraft Wheels MRO Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 0.67 Billion |

| Market Size by 2031 | US$ 1.29 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Wheel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

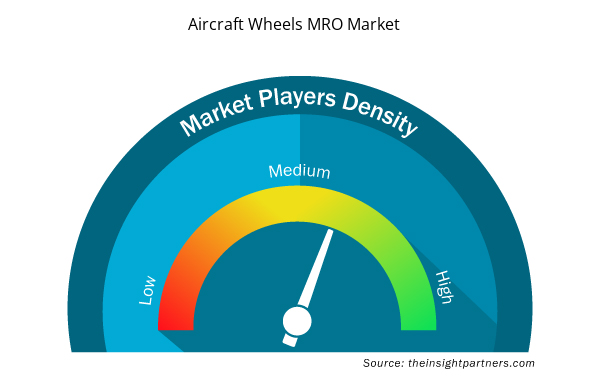

Aircraft Wheels MRO Market Players Density: Understanding Its Impact on Business Dynamics

The Aircraft Wheels MRO Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aircraft Wheels MRO Market are:

- AAR CORP

- AeroRepair Corp.

- AEROSPACE MRO CO., LTD.

- Air Atlanta Aviaservices

- AMETEK Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aircraft Wheels MRO Market top key players overview

Aircraft Wheels MRO Market News and Recent Developments

The aircraft wheels MRO market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the aircraft wheels MRO market are listed below:

- The long-term cooperation between Czech Airlines Technics and Air Serbia will continue in the future. This is confirmed by the new contract for maintenance, repairs and overhauls of wheels and brakes for the entire fleet of A330, A320, A319 and ATR of the Serbian carrier. (Source: Czech Airlines Technics, Press Release, July 2023)

- FL Technics and Wizz Air signed an agreement for wheels and brakes solutions to be provided over the course of 5 years.Starting from October, FL Technics will be providing wheels and brakes services for the carriers ever-expanding fleet of Airbus A320 aircraft family. (Source: FL Technics, Press Release, Oct 2022)

Aircraft Wheels MRO Market Report Coverage and Deliverables

The “Aircraft Wheels MRO Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Aircraft wheels MRO market market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Aircraft wheels MRO market market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Aircraft wheels MRO market market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the aircraft wheels MRO market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Emergency Department Information System (EDIS) Market

- Small Satellite Market

- Parking Management Market

- Fishing Equipment Market

- Electronic Shelf Label Market

- Oxy-fuel Combustion Technology Market

- Artificial Intelligence in Defense Market

- Small Internal Combustion Engine Market

- Arterial Blood Gas Kits Market

- Hydrocephalus Shunts Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Wheel Type, Aircraft Type and Technology

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the aircraft wheels MRO market ?

The aircraft wheels MRO market is likely to register of 8.5% during 2023-2031.

What would be the estimated value of the aircraft wheels MRO market by 2031?

The estimated value of the aircraft wheels MRO market by 2031 would be around US$ 1.29 billion.

What are the future trends of the aircraft wheels MRO market ?

The rising adoption of fiber-reinforced plastic wheels is one of the major trends of the market.

Which are the leading players operating in the aircraft wheels MRO market ?

AAR Corp, Aerorepair Corp, Aerospace MRO Co Ltd, Air Atlanta Aviaservices, AMETEK Inc, Lufthansa Technik, Röder Präzision GmbH, Technic Aviation, TP Aerospace, and World Aero are some of the key players profiled under the report.

What are the driving factors impacting the aircraft wheels MRO market ?

Increasing global commercial aircraft fleet and the growing aircraft MRO industry are some of the factors driving the growth for aircraft wheels MRO market.

Which region dominated the aircraft wheels MRO market in 2023?

Asia Pacific region dominated the aircraft wheels MRO market in 2023.

Get Free Sample For

Get Free Sample For