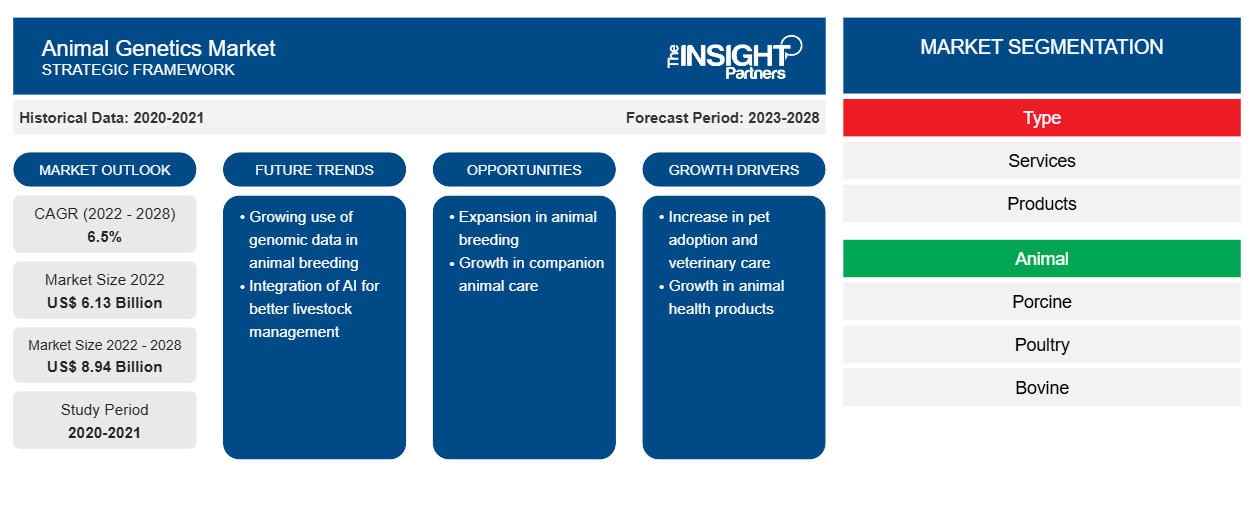

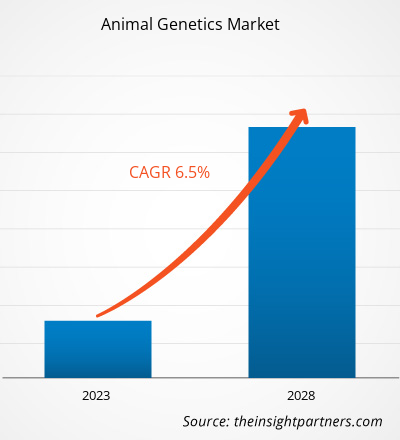

[Research Report] The animal genetics market is expected to grow from US$ 6,132.64 million in 2022 to US$ 8,941.90 million by 2028; it is estimated to grow at a CAGR 6.5% during 2022–2028.

Market Insights and Analyst View:

Technological advancements in the biotechnology industry are the primary factor supporting the growth of the animal genetics market. Intense research and development, and growing demand for poultry and bovine meat are the major trends in the animal genetics industry

In addition, the growing adoption of pet animals worldwide encourages animal genetics service providers to offer services for the development of different phenotypic features in pet animals. Animal genetics helps offer variations in the appearance of pets, in turn, attracting pet owners.Further, advancements in animal genetics help answer questions associated with the availability of genetically engineered animals on the market and the availability of food products derived from genetically engineered animals

Knowing about their availability has enabled researchers to offer good-quality meat products to the food industry and has helped enhance the health of livestock animals. Countries in which livestock production is one of the key businesses are receiving support from the respective governments through funding and infrastructure development efforts, which bolsters the animal genetics market size. This also encourages market players to focus on developments to propel the animal genetics market growth.Growth Drivers and Challenges:

The increasing population and rapid urbanization worldwide have resulted in a growing preference for animal-derived food products such as dairy products and meat. Several studies have proved that genetically modified (GM) cows can produce more milk and are less susceptible to common cattle diseases such as bovine respiratory disease complex and clostridial infection. As proteins play an important role in nutrition, the consumption of meat and meat products has increased worldwide. Animal-derived proteins assist in the synthesis of body tissues for renovation and faster growth. The amino acid profile of animal-derived proteins plays a significant role in immunity, environmental adaptability, and other biological functions. Genetically modified poultry such as broilers are easily digestible despite the high protein content.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Animal Genetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Animal Genetics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

According to the Food and Agriculture Organization of the United Nations (FAO) estimates, the global demand for meat products has increased by 58% from 1995 to 2020. The estimates also show that meat consumption has risen from 233 million metric ton in 2000 to 300 million metric ton in 2020. Similarly, milk consumption has increased from 568 million metric ton in 2000 to 700 million metric ton in 2020. The FAO also estimated that egg production has increased by 30% in 2020. China and Brazil are among the major developing countries propelling the demand for poultry, pig meat, and milk. In contrast, countries such as the US, Brazil, and Thailand are the largest producers of poultry, pig meat, and milk. Thus, animal genetics is serving to be a great tool to meet the growing demand for animal-derived food products.

On the other hand, growing concerns about animal-originated diseases and threats to livestock diversity have resulted in stringent government regulations for animal genetics in different countries. Constraints associated with the breeding, exporting, and conserving genetically modified animals are major restraining factors for the animal genetics market growth. The Convention on Biodiversity, Nagoya Protocol, and Commission on Genetic Resources for Food and Agriculture (CGRFA) are among the regulating agencies for genetically modified animals. Further, FAO’s Global Plan of Action for Animal Genetic Resources strictly monitors and evaluates animal genetic resources to conserve livestock biodiversity. FDA regulates these animals and is among the major agencies responsible for offering marketing approvals. The administration has put strict norms for the identification, characterization, manufacturing, and labeling of these animals. Additionally, each country has its regulation for the management of genetic animals. Therefore, stringent rules and regulations associated with animal breeding programs and genetic engineering experiments hinder the animal genetics market expansion.

Report Segmentation and Scope:

The “Global Animal Genetics Market” is segmented on the basis of type, genetic material, animal, and geography. Based on type, the market is bifurcated into products and services. Based on genetic material, the animal genetics market is bifurcated into semen and embryo. In terms of animal, the market is segmented into poultry, porcine, bovine, canine, and others. On the basis of geography, the animal genetics market is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on type, the animal genetics market is bifurcated into product and services. The services segment held a larger market share in 2022. The same segment is estimated to register the fastest CAGR in the animal genetics market during the forecast period. Further, the market for services is segmented into DNA typing, genetic trait tests, genetic disease tests, and others. The DNA typing segment held the largest share of the market for animal genetics services in 2022. The genetic disease tests segment is estimated to register the highest CAGR in the market during the forecast period. The growth of the market is driven by the increasing services for animal breeding to enhance the quality and production of animal-based food and non-food products. Many laboratories are offering cost-effective services that enable the growth of the market. In Houston, Texas, US, Laboratory Animal Genetic Services (LAGS)—supported by the Cancer Center Support Grant—offers cost-effective, customized genetic analysis for laboratory animal research and studies. Thus, the presence of such laboratories is contributing significantly to the growth of the market and is expected to show a similar trend in the coming years.

Based on genetic material, the animal genetics market is segmented into semen and embryo. The embryo segment held a larger share of the market in 2022. The semen segment is anticipated to register a higher CAGR in the market during the forecast period. The developments in animal breeding techniques are leading to increasing animal genetic testing

.

Based on animal, the animal genetics market is segmented into poultry, porcine, bovine, canine, and others. The porcine segment held the largest share of the market in 2022. On the other hand, the bovine segment is anticipated to register the highest CAGR in the market during the forecast period. The growth of the animal genetics market for the bovine segment is ascribed to the increasing number of companies offering cattle genetic testing servicesand the growingdemand for livestock DNA testing.

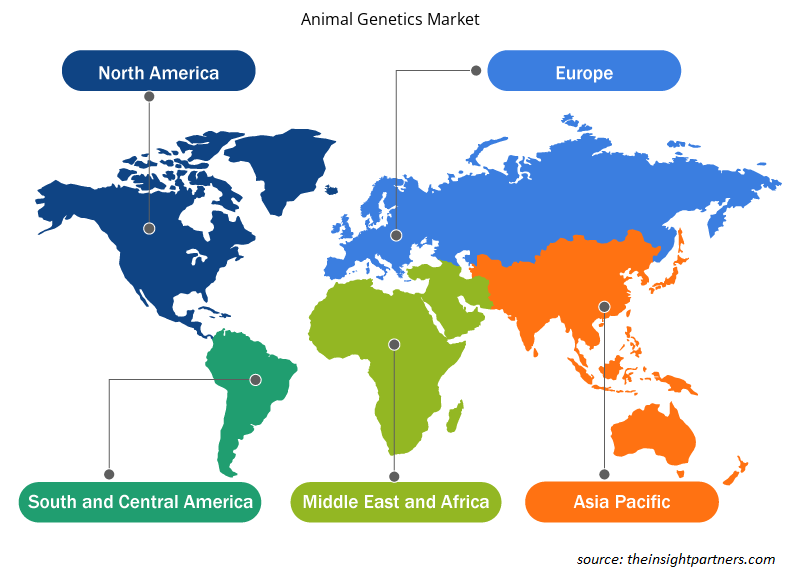

Regional Analysis:

Based on geography, the animal genetics market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America is the most significant region in the global animal genetics market. The US, Canada, and Mexico are the major contributors to the market in this region. The market growth in North America is attributed to growing investments in animal genetics projects, rising livestock production and farming, and increasing initiatives to protect and preserve livestock animals. The US holds the largest share of the market in this region, followed by Canada. Further, Mexico holds vital opportunities for the market growth in the future. In Mexico, livestock activities are perceived as a socioeconomic aspect, which offers attractive business opportunities for companies operating in the livestock genetics business. 60% of the Mexican land is devoted to livestock activities, i.e., more than 3 million livestock production units. Over the last decades, beef, pork, and dairy production in the country has undergone valuable developments. Mexican businesses or organizations engaged in the expansion of livestock-intensive systems embrace modern technologies such as artificial insemination and embryo transfer for the genetic improvement of livestock. Nearly 53% of bovine breeders in Mexico use artificial insemination and 18% use embryo transfers.

Asia Pacific is expected to register the fastest CAGR in the global animal genetics market during the forecast period. The projected market growth is attributed to the rising preference for animal-derived protein supplements and food products, and the increasing adoption of progressive genetic practices such as artificial insemination and embryo transfer in the region. China is the leading country in the animal genetics market in Asia Pacific. In China, animal production has been growing dramatically over the past three decades. In 2021, the Ministry of Agriculture and Rural Affairs announced that the National Committee for Livestock and Poultry Genetics had approved three new varieties—Guangming 2, Shengze 901, and Wode 188—of white-feather broiler breeds on the Chinese market. According to the same source, chicken is the most consumed meat in Chinese households, and in 2020, chicken production in the country totaled 18.6 million tons, of which 52.4% were white-feather broilers. Further, consumers prefer high-quality chicken, which is achieved through breeding in animal farms. Thus, increasing animal breeding promotes the growth of animal genetics in China. Per the USDA Foreign Agricultural Service, poultry exports in China are expected to increase by 5% and reach 575 thousand metric tons by the end of 2023, compared to the previous year. Advancements in animal genetics are increasing animal breeding to enhance the quality of animal-based products.

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the animal genetics market are listed below:

- In June 2023, Charles River expanded its Triple-Immunodeficient Mouse Model Portfolio. The new NCG mouse strains are best suited for studies in oncology, immunology, and infectious disease. NCG Plus portfolio expands the scope of preclinical research by including humanized mice. It can be used to recapitulate the human immune system using human peripheral blood mononuclear cells (PBMCs) and human hematopoietic stem cells (HSCs), which makes this model ideal for cancer immunotherapy research.

- In October 2022, Genus Plc and Tropic extended their trait development collaboration for the application of Tropic’s Gene Editing induced Gene Silencing (GEiGS) technology in porcine and bovine genetics. The extended collaboration will enable the two to explore additional traits based on the GEiGS platform to expand animal welfare traits in bovine and porcine species.

- In June 2022, Hendrix Genetics partnered with CSIRO, a national science agency in Australia, to test the viability of an innovative point-of-lay sex sorting technology for the egg-laying industry. The project focuses on studying a technology developed by CSIRO that uses a biomarker protein that is only found in male embryos and not in female embryos. This allows the research group to identify male embryos during the very early stages of development that occur before egg incubation. This exploratory research is an important first step that could lead to a solution for a major animal ethics and welfare challenge, alongside improving the carbon footprint and sustainability of the egg industry.

The developments made by the companies are helping the players to contribute actively to the growth of the animal genetic industry.

Animal Genetics Market Regional Insights

The regional trends and factors influencing the Animal Genetics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Animal Genetics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Animal Genetics Market

Animal Genetics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.13 Billion |

| Market Size by 2028 | US$ 8.94 Billion |

| Global CAGR (2022 - 2028) | 6.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Animal Genetics Market Players Density: Understanding Its Impact on Business Dynamics

The Animal Genetics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Animal Genetics Market are:

- Neogen Corp

- Genus Plc

- Topigs Norsvin Nederland B.V.

- Zoetis Inc.

- Hendrix Genetics B.V.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Animal Genetics Market top key players overview

COVID-19 Impact:

Research activities in genomic laboratories were widely affected in 2020 during the COVID-19 pandemic. Many animal laboratories conducting molecular testing in worldwide shifted their focus toward COVID-19 testing. With a rise in demand for PCR-based COVID-19 tests during the pandemic, animal laboratories had to shift their focus to this diagnostic area, which resulted in delayed animal genomic services. On the other hand, post-pandemic, the animal genetics market experienced good growth opportunities as SARS-CoV-2 is a zoonotic virus. A few animals, such as dogs, cats, ferrets, and minks, were tested positive for COVID-19. Thus, the lack of evidence of the origin of the transmission of COVID-19 from animals to humans, and insufficient insights into pathogenicity have provided vital growth opportunityi for research in animal genetics.

Competitive Landscape and Key Companies:

A few of the prominent players operating in the global animal genetics market include Neogen Corp, Genus Plc, Topigs Norsvin Nederland B.V, Zoetis Inc, Hendrix Genetics B.V, Inotiv Inc, Animal Genetics Inc, Alta Genetics Inc, GROUPE GRIMAUD LA CORBIERE, and Charles River Laboratories International Inc. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

Frequently Asked Questions

Which region is dominating animal genetics market?

North America holds the major market share with US being the major contributor however, Asia Pacific is expected to develop significantly with the CAGR of 7.0% over the forecast period.

Which segment is dominating animal genetics market?

Animal genetics is analyzed on the basis of type, genetic material, and animal. Based on type, the market is segmented into product and services. The services segment is the dominating segment by type and is expected to retain its dominance during the forecast period. Based on genetic material, the growth of the market is segmented into embryos and semen. And based on animals, the market is categorized into poultry, porcine, bovine, canine, and others.

What are the restraining factors for global animal genetics across the world?

The lack of skilled professionals in veterinary research and stringent government regulations for animal genetics are likely to hamper the growth of the market to a certain extent.

What are the driving factors for global animal genetics across the world?

The factors driving the growth of the market are a growing preference for animal-derived food products and rising adoption of progressive genetic practices expected to augment the growth of the market primarily.

Who are the major players in the market the animal genetics?

Animal genetics majorly consists of the players such as Neogen Corp, Genus Plc, Topigs Norsvin Nederland B.V, Zoetis Inc, Hendrix Genetics B.V, Inotiv Inc, Animal Genetics Inc, Alta Genetics Inc, GROUPE GRIMAUD LA CORBIERE, and Charles River Laboratories International Inc.

What is Animal Genetics?

Animal genetics is the study of animal genes. It provides information about the animal’s genetic makeup that is responsible for appearance and function. Animal genetics are used for genetic traits, DNA, and genetic disease testing. The animal genetics market is expected to increase in the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Animal Genetics Market

- Neogen Corp

- Genus Plc

- Topigs Norsvin Nederland B.V.

- Zoetis Inc.

- Hendrix Genetics B.V.

- Inotiv Inc.

- Animal Genetics Inc.

- Alta Genetics Inc.

- Groupe Grimaud LA Corbiere

- Charles River Laboratories International Inc.

Get Free Sample For

Get Free Sample For