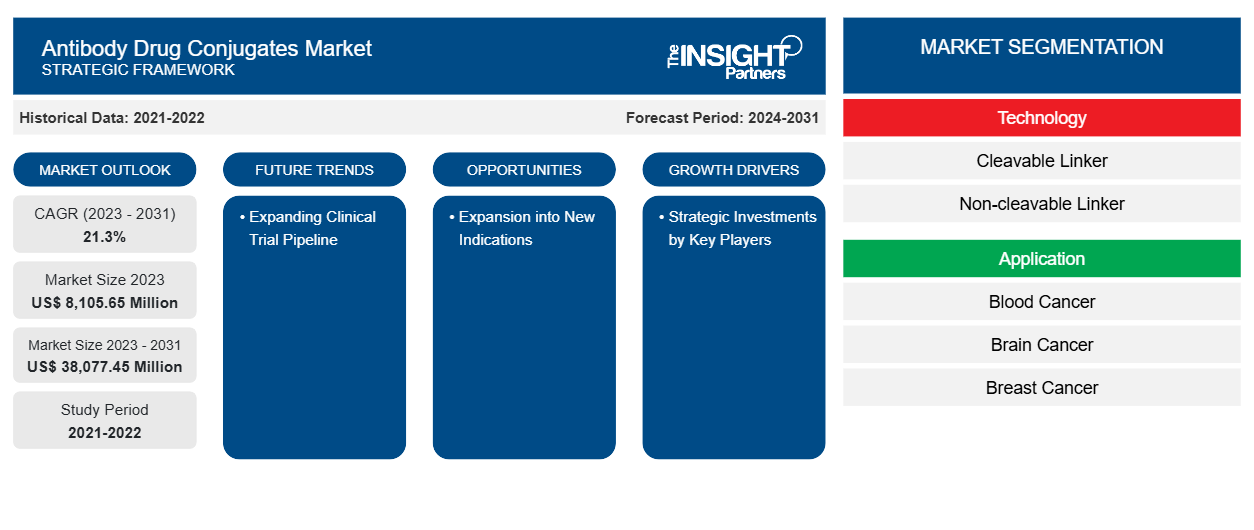

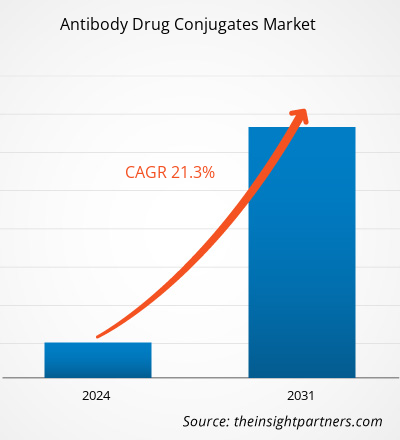

The antibody drug conjugates market size is projected to reach US$ 38,077.45 million by 2031 from US$ 8,105.65 million in 2023. The market is estimated to record a CAGR of 21.3% during 2023–2031. Expanding clinical trial pipeline is likely to bring new trends to the market in the coming years.

Antibody Drug Conjugates Market Analysis

The regulatory landscape has evolved to support the faster approval of antibody-drug conjugates. Regulatory agencies are increasingly recognizing the unique benefits of these therapies, which has led to streamlined approval processes for promising candidates. This shift is crucial in a market where time-to-market can significantly impact the commercial success of products. Thus, the increased availability of approved antibody-drug conjugates with significant investments in research and development, the expansion of approved indications, supportive regulatory frameworks, and a rising demand for targeted biologic therapies propel the growth of the market. As the demand for more effective and targeted treatment options continues to grow, pharmaceutical companies and biotechnology firms are channeling substantial resources into the R&D of antibody-drug conjugates. Pfizer Inc., Genentech, Gilead Sciences, and many other pharmaceutical companies invest significantly in antibody-drug conjugate development projects. According to Novotech, globally, there were over 900 industry-initiated, ongoing antibody-drug conjugate trials from 2018 to 2022; Asia Pacific accounted for over a third of these trials. Next to the US and Europe, Mainland China, South Korea, Australia, Japan, and Taiwan were the frequently involved Asian locations, and nearly 60% of Asian trials were led by Mainland China. Thus, robust research and development investments are expected to create significant trends in the antibody-drug conjugates market in the future.

Antibody Drug Conjugates Market Overview

The antibody-drug conjugates market is experiencing robust growth, driven by advancements in targeted therapies and increasing investments in oncology. Integrating innovative technologies, such as linker chemistry and payload development, is pivotal in improving antibody drug conjugates performance. Additionally, the expanding pipeline of ADC candidates in clinical trials for autoimmune diseases, among other conditions beyond cancer, indicates a promising future. Overall, the ADC market is poised for significant expansion, reflecting a shift toward more precise and effective therapeutic options in modern medicine. The withdrawal of Blenrep (belantamab mafodotin) by the US US Food and Drug Administration (FDA) in December 2022 due to severe ocular toxicity concerns has significantly impacted the multiple myeloma treatment landscape. Overall, the loss of this product could hinder innovation and investments in the oncology segment, affecting long-term growth prospects.

Several antibody-drug conjugates are currently in Phase 3 trials, focusing on validating their efficacy and safety in larger patient populations. The future launch of ADCs that are in Phase 3 trials by 2028 will significantly reshape the oncology landscape, providing patients with innovative treatment options and potentially increasing market revenues.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antibody Drug Conjugates Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antibody Drug Conjugates Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Antibody Drug Conjugates Market Drivers and Opportunities

Increase in Availability of Approved Products Drives Market Growth

Investments in antibody-drug conjugates facilitate the discovery of new therapeutic targets and accelerate the development of innovative antibody-drug conjugates that have greater effectiveness and fewer side effects than traditional therapies. The approval of new products enhances treatment options for patients, particularly in oncology, where antibody-drug conjugates are increasingly recognized for delivering cytotoxic agents directly to cancer cells, minimizing damage to healthy tissues. In April 2024, Pfizer Inc. and Genmab A/S received full approval from the FDA on supplemental Biologics License Application (sBLA) for TIVDAK (tisotumab vedotin-TFTV) for the treatment of patients suffering from recurrent or metastatic cervical cancer with disease progression on or after chemotherapy.

The extension of indications approved for existing antibody-drug conjugates also contributes significantly to market growth. As more indications are approved, the potential patient population for these therapies increases, leading to higher sales and market penetration. Moreover, this trend boosts the market size and encourages further research and development by creating a positive feedback loop that fosters innovation and approval of new products. In October 2023, Daiichi Sankyo and Merck & Co., Inc. entered into a global development and commercialization agreement for Daiichi Sankyo's DXd antibody-drug conjugate candidates: patritumab deruxtecan (HER3-DXd), ifinatamab deruxtecan (I-DXd), and raludotatug deruxtecan (R-DXd). The companies will jointly develop and potentially commercialize these antibody-drug conjugate candidates worldwide, except in Japan, where Daiichi Sankyo will maintain exclusive rights. Daiichi Sankyo will be solely responsible for manufacturing and supply.

Expansion into New Indications to Generate Significant Growth Opportunities

The expansion into new indications is creating significant opportunities in the antibody-drug conjugates market. As antibody-drug conjugates are primarily designed to deliver cytotoxic agents directly to cancer cells while sparing healthy tissues, their ability to target specific tumor-associated antigens makes them highly versatile. This versatility allows for exploring antibody-drug conjugate applications beyond their initial indications, i.e., hematological malignancies and certain solid tumors.

Many cancers currently lack adequate treatment options, and antibody-drug conjugates targeting new biomarkers can serve as innovative therapies against these challenging conditions. For instance, antibody-drug conjugates are being investigated for treating breast, lung, and bladder cancers, among others, where traditional therapies may not yield satisfactory results. AstraZeneca and Daiichi Sankyo's Biologics License Application (BLA) for datopotamab deruxtecan (Dato-DXd) has been accepted in the US for the treatment of adult patients who have received prior systemic therapy for locally advanced or metastatic nonsquamous non-small cell lung cancer (NSCLC).

Collaborations between pharmaceutical companies and research institutions foster further innovation in antibody-drug conjugate development. These partnerships often focus on identifying novel targets and optimizing linker technologies to enhance the efficacy and safety profiles of conjugates. Moreover, with the discovery and validation of new targets, antibody-drug conjugates are further being investigated for their potential utilization in the treatment of a broader range of cancer types. In June 2024, ArriVent BioPharma, Inc., a clinical-stage company dedicated to accelerating the development of innovative biopharmaceutical therapeutics, entered into a collaboration agreement with Jiangsu Alphamab Biopharmaceuticals Co., Ltd., a wholly owned subsidiary of Alphamab Oncology, to discover, develop, and commercialize novel antibody-drug conjugates for the treatment of cancers. Antibody-drug conjugates are poised to play a pivotal role in the future of targeted cancer therapies by capitalizing on the rising prevalence of cancer, addressing unmet medical needs, and fostering collaborative innovations. Thus, an expansion into new indications presents a wealth of opportunities for the antibody-drug conjugates market.

Antibody Drug Conjugates Market Report Segmentation Analysis

Key segments that contributed to the derivation of the antibody drug conjugates market analysis are technology, application, target, distribution channel, and geography.

- The antibody drug conjugates market, based on technology, is segmented into cleavable linker and non-cleavable linker. The cleavable linker segment held a larger share of the market in 2023, and it is expected to register a significant CAGR during 2023–2031.

- Based on application, the antibody drug conjugates market is segmented into blood cancer, brain cancer, breast cancer, ovarian cancer, lung cancer, and others. The breast cancer segment held the largest share of the market in 2023.

- The antibody drug conjugates market, based on target, is segmented into HER2, CD22, CD30, and others. The HER2 segment held the largest share of the market in 2023, and it is expected to register a significant CAGR during 2023–2031.

- The antibody drug conjugates market, based on distribution channel, is segmented into retail pharmacies, hospital pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share of the market in 2023, and it is expected to register a significant CAGR during 2023–2031.

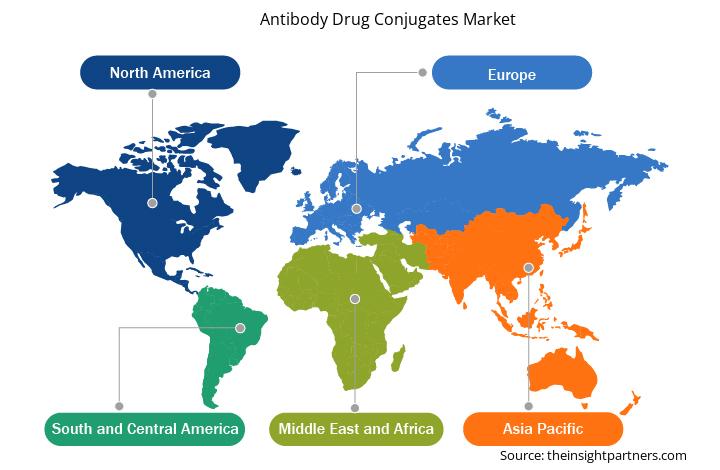

Antibody Drug Conjugates Market Share Analysis by Geography

The geographic scope of the antibody drug conjugates market report is divided into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. The burgeoning incidence of cancer is a leading factor propelling the demand for antibody-drug conjugates in these countries. In addition, market growth in the region is attributed to increasing research and development; rising product approvals; growing awareness about novel conjugates; and a surge in mergers, collaborations, and partnerships. The highest number of antibody-drug conjugates have been approved in the US. Several antibody-drug conjugates are in the pipeline in the US. Several conjugates have been developed with advanced conjugate and linker technologies, more potent payloads, and new antigen targets. According to the FDA’s data published in May 2021, 113 clinical trials were in studies for 77 novel antibody-drug conjugates that targeted over 40 different targets. As of January 2021, the US FDA had approved Mylotarg, Lumoxiti, Adcetris, Kadcyla, Enhertu, Trodelvy, Besponsa, Polivy, Padcev, and Blenrep for several cancer indications. In September 2021, the FDA expedited the approval of Tivdak (tisotumab vedotin-tftv), developed by Seagen and Genmab. This treatment is a conjugate that combines a tissue factor-directed antibody with a microtubule inhibitor. It is administered as an intravenous infusion and is intended for women with recurrent or metastatic cervical cancer that has progressed during or after chemotherapy. Further, in 2023, AstraZeneca's Truqap (capivasertib) and Faslodex (fulvestrant) received regulatory approval in the US for the treatment of adult patients suffering from HR-positive and HER2-negative locally advanced or metastatic breast cancer with biomarker alterations (PIK3CA, AKT1, or PTEN).

Growing business expansion activities by companies in the antibody-drug conjugate market in the US to strengthen their market positions in different regions further support the market growth. In September 2020, Merck announced an expansion plan for its highly potent active pharmaceutical ingredient (HPAPI) and antibody-drug conjugate manufacturing capabilities with a valuation of US$ 62.02 million (€59 million) at its Madison, Wisconsin facility. With this investment, the company aimed to enhance the large-scale production of potent compounds for cancer therapies, alongside creating ~50 full-time jobs starting in 2021 after the anticipated completion by mid-2022.

Antibody Drug Conjugates Market Regional Insights

The regional trends and factors influencing the Antibody Drug Conjugates Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Antibody Drug Conjugates Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Antibody Drug Conjugates Market

Antibody Drug Conjugates Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8,105.65 Million |

| Market Size by 2031 | US$ 38,077.45 Million |

| Global CAGR (2023 - 2031) | 21.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

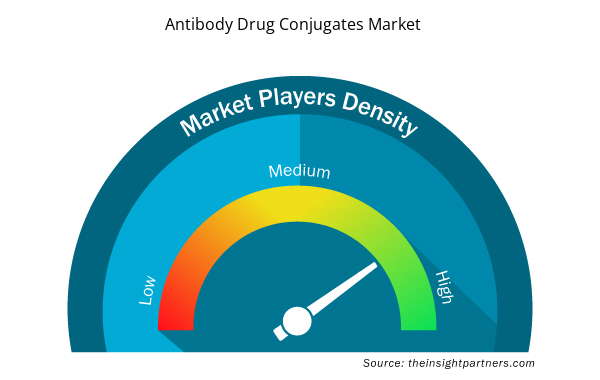

Antibody Drug Conjugates Market Players Density: Understanding Its Impact on Business Dynamics

The Antibody Drug Conjugates Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Antibody Drug Conjugates Market are:

- ADC Therapeutics SA

- Pfizer Inc

- F. Hoffmann-La Roche Ltd

- Daiichi Sankyo Co Ltd

- GSK Plc

- Gilead Sciences Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Antibody Drug Conjugates Market top key players overview

Antibody Drug Conjugates Market News and Recent Developments

The antibody drug conjugates market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- AstraZeneca constructed a manufacturing facility dedicated to antibody drug conjugates in Singapore. Valued at US$ 1.5 billion, the facility will work to improve the global supply of its antibody drug conjugates portfolio. Antibody drug conjugates are advanced treatments designed to deliver powerful cancer-fighting agents directly to cancer cells using targeted antibodies. (Source: AstraZeneca, Company Website, November 2024).

- Daiichi Sankyo and AstraZeneca received conditional approval for ENHERTU (trastuzumab deruxtecan) in China. This treatment is indicated for adult patients with unresectable, locally advanced, or metastatic NSCLC that have HER2 (ERBB2) mutations and have received prior systemic therapy. Full approval will depend on the results of a confirmatory trial. (Source: Daiichi Sankyo, Company Website, October 2024)

Antibody Drug Conjugates Market Report Coverage and Deliverables

The "Antibody Drug Conjugates Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Antibody drug conjugates market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Antibody drug conjugates market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Antibody drug conjugates market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the antibody drug conjugates market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Application, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 21.3% during 2023–2031.

North America dominated the market in 2023.

Strategic investments by key players and an increase in the availability of approved products are among the significant factors fueling the market growth.

Expanding clinical trial pipeline is expected to emerge as a prime trend in the market in the coming years.

ADC Therapeutics SA, Pfizer Inc, F. Hoffmann-La Roche Ltd, Daiichi Sankyo Co Ltd, GSK Plc, Gilead Sciences Inc, AstraZeneca Plc, Astellas Pharma Inc, RemeGen Co Ltd, Takeda Pharmaceutical Co Ltd, Merck KGaA, Johnson & Johnson, Bristol-Myers Squibb Co, BioNTech SE, and AbbVie Inc are among the key players in the market.

The antibody drug conjugates market value is expected to reach US$ 38,077.45 million by 2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Antibody Drug Conjugates Market

- ADC Therapeutics SA

- Pfizer Inc

- F. Hoffmann-La Roche Ltd

- Daiichi Sankyo Co Ltd

- GSK Plc

- Gilead Sciences Inc

- AstraZeneca Plc

- Astellas Pharma Inc

- RemeGen Co Ltd

- Takeda

- Pharmaceutical Co Ltd

- Merck KGaA

- Johnson & Johnson

- Bristol-Myers Squibb Co

- BioNTech SE

- AbbVie Inc

Get Free Sample For

Get Free Sample For