Antibody Drug Conjugates Market Analysis, Size, and Share by 2031

Antibody Drug Conjugates Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Cleavable Linker and Non-Cleavable Linker), Application (Blood Cancer, Brain Cancer, Breast Cancer, Ovarian Cancer, Lung Cancer, and Others), Target (HER2, CD22, CD30, and Others), Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Dec 2024

- Report Code : TIPRE00003494

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 293

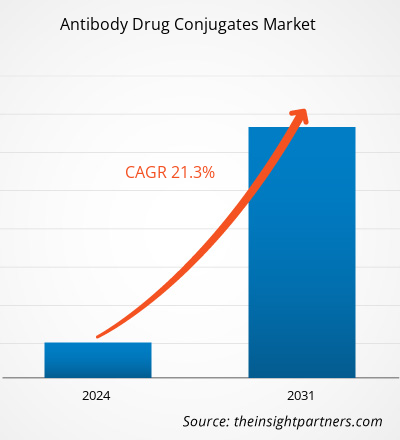

The antibody drug conjugates market size is projected to reach US$ 38,077.45 million by 2031 from US$ 8,105.65 million in 2023. The market is estimated to record a CAGR of 21.3% during 2023–2031. Expanding clinical trial pipeline is likely to bring new trends to the market in the coming years.

Antibody Drug Conjugates Market Analysis

The regulatory landscape has evolved to support the faster approval of antibody-drug conjugates. Regulatory agencies are increasingly recognizing the unique benefits of these therapies, which has led to streamlined approval processes for promising candidates. This shift is crucial in a market where time-to-market can significantly impact the commercial success of products. Thus, the increased availability of approved antibody-drug conjugates with significant investments in research and development, the expansion of approved indications, supportive regulatory frameworks, and a rising demand for targeted biologic therapies propel the growth of the market. As the demand for more effective and targeted treatment options continues to grow, pharmaceutical companies and biotechnology firms are channeling substantial resources into the R&D of antibody-drug conjugates. Pfizer Inc., Genentech, Gilead Sciences, and many other pharmaceutical companies invest significantly in antibody-drug conjugate development projects. According to Novotech, globally, there were over 900 industry-initiated, ongoing antibody-drug conjugate trials from 2018 to 2022; Asia Pacific accounted for over a third of these trials. Next to the US and Europe, Mainland China, South Korea, Australia, Japan, and Taiwan were the frequently involved Asian locations, and nearly 60% of Asian trials were led by Mainland China. Thus, robust research and development investments are expected to create significant trends in the antibody-drug conjugates market in the future.

Antibody Drug Conjugates Market Overview

The antibody-drug conjugates market is experiencing robust growth, driven by advancements in targeted therapies and increasing investments in oncology. Integrating innovative technologies, such as linker chemistry and payload development, is pivotal in improving antibody drug conjugates performance. Additionally, the expanding pipeline of ADC candidates in clinical trials for autoimmune diseases, among other conditions beyond cancer, indicates a promising future. Overall, the ADC market is poised for significant expansion, reflecting a shift toward more precise and effective therapeutic options in modern medicine. The withdrawal of Blenrep (belantamab mafodotin) by the US US Food and Drug Administration (FDA) in December 2022 due to severe ocular toxicity concerns has significantly impacted the multiple myeloma treatment landscape. Overall, the loss of this product could hinder innovation and investments in the oncology segment, affecting long-term growth prospects.

Several antibody-drug conjugates are currently in Phase 3 trials, focusing on validating their efficacy and safety in larger patient populations. The future launch of ADCs that are in Phase 3 trials by 2028 will significantly reshape the oncology landscape, providing patients with innovative treatment options and potentially increasing market revenues.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAntibody Drug Conjugates Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Antibody Drug Conjugates Market Drivers and Opportunities

Increase in Availability of Approved Products Drives Market Growth

Investments in antibody-drug conjugates facilitate the discovery of new therapeutic targets and accelerate the development of innovative antibody-drug conjugates that have greater effectiveness and fewer side effects than traditional therapies. The approval of new products enhances treatment options for patients, particularly in oncology, where antibody-drug conjugates are increasingly recognized for delivering cytotoxic agents directly to cancer cells, minimizing damage to healthy tissues. In April 2024, Pfizer Inc. and Genmab A/S received full approval from the FDA on supplemental Biologics License Application (sBLA) for TIVDAK (tisotumab vedotin-TFTV) for the treatment of patients suffering from recurrent or metastatic cervical cancer with disease progression on or after chemotherapy.

The extension of indications approved for existing antibody-drug conjugates also contributes significantly to market growth. As more indications are approved, the potential patient population for these therapies increases, leading to higher sales and market penetration. Moreover, this trend boosts the market size and encourages further research and development by creating a positive feedback loop that fosters innovation and approval of new products. In October 2023, Daiichi Sankyo and Merck & Co., Inc. entered into a global development and commercialization agreement for Daiichi Sankyo's DXd antibody-drug conjugate candidates: patritumab deruxtecan (HER3-DXd), ifinatamab deruxtecan (I-DXd), and raludotatug deruxtecan (R-DXd). The companies will jointly develop and potentially commercialize these antibody-drug conjugate candidates worldwide, except in Japan, where Daiichi Sankyo will maintain exclusive rights. Daiichi Sankyo will be solely responsible for manufacturing and supply.

Expansion into New Indications to Generate Significant Growth Opportunities

The expansion into new indications is creating significant opportunities in the antibody-drug conjugates market. As antibody-drug conjugates are primarily designed to deliver cytotoxic agents directly to cancer cells while sparing healthy tissues, their ability to target specific tumor-associated antigens makes them highly versatile. This versatility allows for exploring antibody-drug conjugate applications beyond their initial indications, i.e., hematological malignancies and certain solid tumors.

Many cancers currently lack adequate treatment options, and antibody-drug conjugates targeting new biomarkers can serve as innovative therapies against these challenging conditions. For instance, antibody-drug conjugates are being investigated for treating breast, lung, and bladder cancers, among others, where traditional therapies may not yield satisfactory results. AstraZeneca and Daiichi Sankyo's Biologics License Application (BLA) for datopotamab deruxtecan (Dato-DXd) has been accepted in the US for the treatment of adult patients who have received prior systemic therapy for locally advanced or metastatic nonsquamous non-small cell lung cancer (NSCLC).

Collaborations between pharmaceutical companies and research institutions foster further innovation in antibody-drug conjugate development. These partnerships often focus on identifying novel targets and optimizing linker technologies to enhance the efficacy and safety profiles of conjugates. Moreover, with the discovery and validation of new targets, antibody-drug conjugates are further being investigated for their potential utilization in the treatment of a broader range of cancer types. In June 2024, ArriVent BioPharma, Inc., a clinical-stage company dedicated to accelerating the development of innovative biopharmaceutical therapeutics, entered into a collaboration agreement with Jiangsu Alphamab Biopharmaceuticals Co., Ltd., a wholly owned subsidiary of Alphamab Oncology, to discover, develop, and commercialize novel antibody-drug conjugates for the treatment of cancers. Antibody-drug conjugates are poised to play a pivotal role in the future of targeted cancer therapies by capitalizing on the rising prevalence of cancer, addressing unmet medical needs, and fostering collaborative innovations. Thus, an expansion into new indications presents a wealth of opportunities for the antibody-drug conjugates market.

Antibody Drug Conjugates Market Report Segmentation Analysis

Key segments that contributed to the derivation of the antibody drug conjugates market analysis are technology, application, target, distribution channel, and geography.

- The antibody drug conjugates market, based on technology, is segmented into cleavable linker and non-cleavable linker. The cleavable linker segment held a larger share of the market in 2023, and it is expected to register a significant CAGR during 2023–2031.

- Based on application, the antibody drug conjugates market is segmented into blood cancer, brain cancer, breast cancer, ovarian cancer, lung cancer, and others. The breast cancer segment held the largest share of the market in 2023.

- The antibody drug conjugates market, based on target, is segmented into HER2, CD22, CD30, and others. The HER2 segment held the largest share of the market in 2023, and it is expected to register a significant CAGR during 2023–2031.

- The antibody drug conjugates market, based on distribution channel, is segmented into retail pharmacies, hospital pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share of the market in 2023, and it is expected to register a significant CAGR during 2023–2031.

Antibody Drug Conjugates Market Share Analysis by Geography

The geographic scope of the antibody drug conjugates market report is divided into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. The burgeoning incidence of cancer is a leading factor propelling the demand for antibody-drug conjugates in these countries. In addition, market growth in the region is attributed to increasing research and development; rising product approvals; growing awareness about novel conjugates; and a surge in mergers, collaborations, and partnerships. The highest number of antibody-drug conjugates have been approved in the US. Several antibody-drug conjugates are in the pipeline in the US. Several conjugates have been developed with advanced conjugate and linker technologies, more potent payloads, and new antigen targets. According to the FDA’s data published in May 2021, 113 clinical trials were in studies for 77 novel antibody-drug conjugates that targeted over 40 different targets. As of January 2021, the US FDA had approved Mylotarg, Lumoxiti, Adcetris, Kadcyla, Enhertu, Trodelvy, Besponsa, Polivy, Padcev, and Blenrep for several cancer indications. In September 2021, the FDA expedited the approval of Tivdak (tisotumab vedotin-tftv), developed by Seagen and Genmab. This treatment is a conjugate that combines a tissue factor-directed antibody with a microtubule inhibitor. It is administered as an intravenous infusion and is intended for women with recurrent or metastatic cervical cancer that has progressed during or after chemotherapy. Further, in 2023, AstraZeneca's Truqap (capivasertib) and Faslodex (fulvestrant) received regulatory approval in the US for the treatment of adult patients suffering from HR-positive and HER2-negative locally advanced or metastatic breast cancer with biomarker alterations (PIK3CA, AKT1, or PTEN).

Growing business expansion activities by companies in the antibody-drug conjugate market in the US to strengthen their market positions in different regions further support the market growth. In September 2020, Merck announced an expansion plan for its highly potent active pharmaceutical ingredient (HPAPI) and antibody-drug conjugate manufacturing capabilities with a valuation of US$ 62.02 million (€59 million) at its Madison, Wisconsin facility. With this investment, the company aimed to enhance the large-scale production of potent compounds for cancer therapies, alongside creating ~50 full-time jobs starting in 2021 after the anticipated completion by mid-2022.

Antibody Drug Conjugates

Antibody Drug Conjugates Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 8,105.65 Million |

| Market Size by 2031 | US$ 38,077.45 Million |

| Global CAGR (2023 - 2031) | 21.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Antibody Drug Conjugates Market Players Density: Understanding Its Impact on Business Dynamics

The Antibody Drug Conjugates Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Antibody Drug Conjugates Market News and Recent Developments

The antibody drug conjugates market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- AstraZeneca constructed a manufacturing facility dedicated to antibody drug conjugates in Singapore. Valued at US$ 1.5 billion, the facility will work to improve the global supply of its antibody drug conjugates portfolio. Antibody drug conjugates are advanced treatments designed to deliver powerful cancer-fighting agents directly to cancer cells using targeted antibodies. (Source: AstraZeneca, Company Website, November 2024).

- Daiichi Sankyo and AstraZeneca received conditional approval for ENHERTU (trastuzumab deruxtecan) in China. This treatment is indicated for adult patients with unresectable, locally advanced, or metastatic NSCLC that have HER2 (ERBB2) mutations and have received prior systemic therapy. Full approval will depend on the results of a confirmatory trial. (Source: Daiichi Sankyo, Company Website, October 2024)

Antibody Drug Conjugates Market Report Coverage and Deliverables

The "Antibody Drug Conjugates Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Antibody drug conjugates market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Antibody drug conjugates market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Antibody drug conjugates market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the antibody drug conjugates market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For