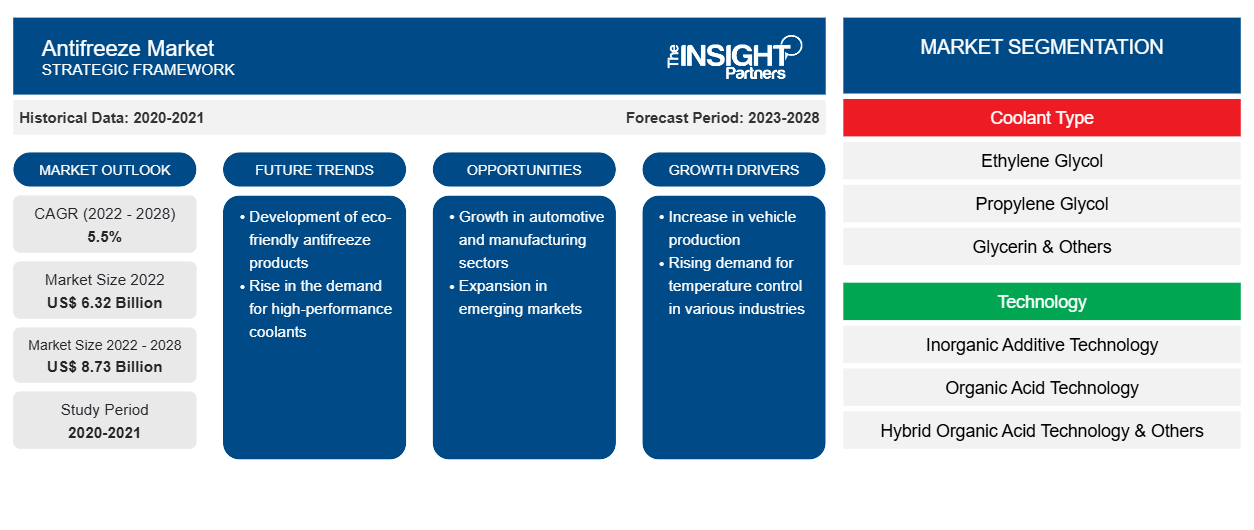

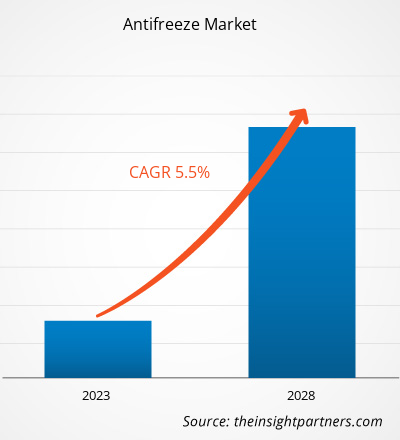

[Research Report] The antifreeze market size was valued at US$ 6,322.39 million in 2022 and is projected to reach US$ 8,731.11 million by 2028. It is expected to grow at a CAGR of 5.5% from 2022 to 2028.

The market is highly competitive due to the presence of several regional and global players. Players operating in the antifreeze market are competing on the basis of product quality, price, and product differentiation. Market players focus on adopting different strategies, such as investments in research and development activities, partnerships, and expansion, on standing out as strong competitors. Many researchers are focusing on developing bio-based and eco-friendly antifreeze, which also helps reduce carbon footprints.

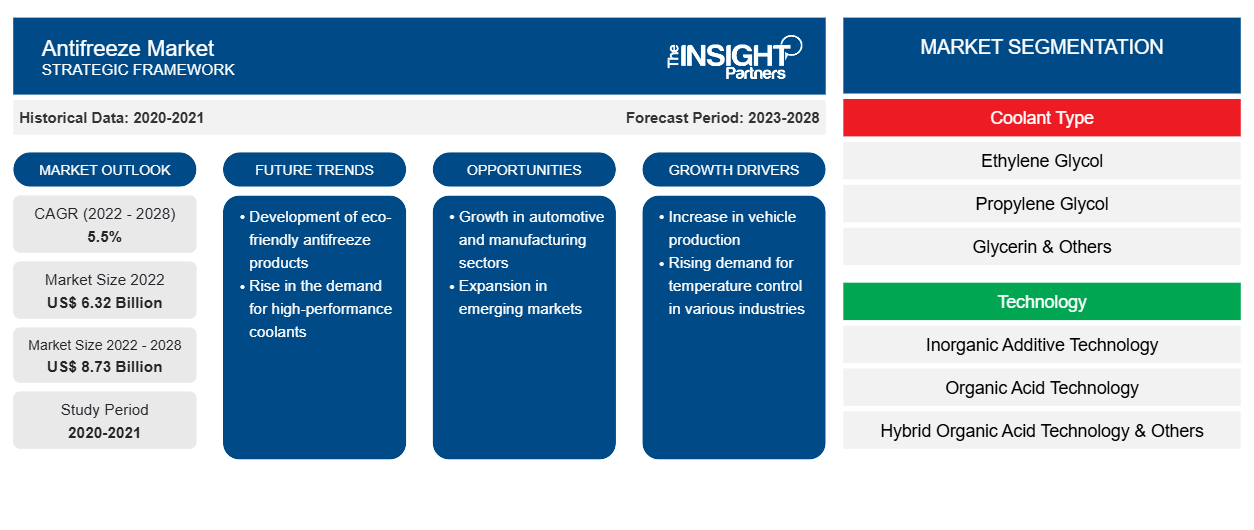

In 2021, Asia Pacific held the largest revenue share of the global antifreeze market. The antifreezemarket in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The major factor driving the antifreeze market growth in the region is the increasing use of antifreeze in the automotive industry. The increasing automotive sales in the region is creating a huge demand for antifreeze. According to the India Brand Equity Foundation, in India, the automobile industry contributes almost 6.4% of the country's gross domestic product (GDP). According to the same source, the passenger car market in India was valued at US$ 32.70 billion in 2021, and it is expected to reach a value of US$ 54.84 billion by 2027.

Further, there is increasing use of solar energy in the region. Antifreeze is used in solar water heating systems as heat transfer fluid. All these factors positively influence the antifreeze market in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antifreeze Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Antifreeze Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on the global Antifreeze Market

The demand for antifreeze was mainly driven by industries, such as automotive, industrial heating, energy manufacturing, and construction equipment, before the COVID-19 pandemic. However, the COVID-19 pandemic has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns.

In 2020, various industries had to slow down their operations due to supply chain disruptions caused by the shutdown of national and international borders upon the onset of the COVID-19 pandemic. The automotive industry is one of the major end-users of antifreeze. China leads the automotive industry both in terms of production and consumption. In the automotive industry, consumer demand has declined dramatically. The COVID-19 pandemic has negatively impacted the construction and infrastructure sectors globally.

However, with the uplift of COVID-19 guidelines, the demand for antifreeze is increasing in various sectors, including the automotive sector. Various industries are resuming their operations, including the automotive industry. This, in turn, is creating demand for antifreeze.

Market Insights

Increasing Vehicle Production and Aftermarket for Antifreeze and Engine Coolants

In the automotive industry, antifreeze is used in the internal combustion of liquid-cooled engines that can adjust the freezing and boiling points. The automotive sector has witnessed tremendous growth in the last decade. The growth of the automotive industry in various economies such as the UK, Germany, France, China, India, and Italy has mainly driven the global antifreeze market growth. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the number of commercial and passenger cars produced in American countries increased from ~16.2 million to ~20 million from 2010 to 2019, at a rate of more than 23%. Further, China contributes significantly to the global automotive market. Companies operating in the automotive market are also investing heavily in the automobile manufacturing sector.

Coolant Type Insights

Based on coolant type, the global antifreeze market has been segmented into ethylene glycol, propylene glycol, and glycerin & others.The global market share for the ethylene glycol segment was largest in 2021. Ethylene glycol is an odorless, colorless, viscous liquid with superior heat transfer properties. It is poisonous and needs to be handled cautiously to avoid human or animal exposure. Ethylene glycol helps to prevent coolant liquid from freezing within the radiator by lowering its freezing temperature, lubricating the water pump, and inhibiting corrosion. It also finds application as a coolant to reduce overheating car engines in the summer.

Technology Insights

Based on technology, the global antifreeze market has been segmented into inorganic additive technology, organic acid technology, and hybrid organic acid technology & others. The market share for the organic acid technology segment was largest in 2021. Organic acid technology coolants are originally marketed as permanent or long-life antifreeze. Propylene glycol is used as the base in organic acid technology products. Hence, they are less harmful to pets, kids, and the environment in case of spillover. Various organic acid technology coolant type includes nitrated organic acid technology, phosphate organic acid technology, and silicated organic acid technology.

Wacker Chemie AG, BASF SE, Chevron Corporation, Dow Inc., EXXON MOBIL CORPORATION, CCI Corporation, Old World Industries, Prestone Products Corporation, Valvoline LLC, and Shell plc are some of the major players operating in the global antifreeze market. Players operating in the global market are constantly focusing on strategies, such as investments in research and development activities and new product launches. These market players are highly focused on the development of high-quality and innovative product offerings to fulfill the customer’s requirements.

Report Spotlights

- Progressive industry trends in the global antifreeze market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global antifreeze market from 2020 to 2028

- Estimation of demand for antifreeze globally

- Recent developments to understand the competitive market scenario

- Market trends and outlook and factors driving and restraining the global antifreeze market growth

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the global market growth

- The global antifreeze market size at various nodes

- Detailed overview and segmentation of the market and the global antifreeze market industry dynamics

- The global antifreeze market size in various regions with promising growth opportunities

Antifreeze Market Regional Insights

The regional trends and factors influencing the Antifreeze Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Antifreeze Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Antifreeze Market

Antifreeze Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.32 Billion |

| Market Size by 2028 | US$ 8.73 Billion |

| Global CAGR (2022 - 2028) | 5.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Coolant Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Antifreeze Market Players Density: Understanding Its Impact on Business Dynamics

The Antifreeze Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Antifreeze Market are:

- BASF SE

- Chevron Corporation

- CCI Corporation

- Dow

- Old World Industries, LLC

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Antifreeze Market top key players overview

Global Antifreeze market

The global market is segmented based on coolant type into ethylene glycol, propylene glycol, and glycerin & others. Based on technology, the market is segmented into inorganic additive technology, organic acid technology, and hybrid organic acid technology & others. Based on application, the market is segmented into automobiles, industrial heating/cooling, energy, and manufacturing & others. The market is segmented based on distribution channels into original equipment manufacturers (OEMs), aftermarket, and retail & others.

Company Profiles

Wacker Chemie AG, BASF SE, Chevron Corporation, Dow Inc., EXXON MOBIL CORPORATION, CCI Corporation, Old World Industries, Prestone Products Corporation, Valvoline LLC, and Shell PLC are some of the major players operating in the global antifreeze market.

Frequently Asked Questions

Which region held the fastest CAGR in the global antifreeze market?

Europe is estimated to register the fastest CAGR in the antifreeze market over the forecast period. Players operating in Europe antifreeze market are focusing on different strategies such as investment in research and development activities and new product launches. For instance, in August 2021, Valvoline Inc. has launched new coolants technology in Europe specifically designed for modern engines. It includes, Valvoline Antifreeze Coolant HT-12 Pink which is approved by Volkswagen according to VW TL 774-L (G12evo) and Valvoline Antifreeze Coolant HT-12 Green approved according to BMW Lifetime-Coolant 18 (BMW LC-18). With the release of these coolants, aftermarket customers have access to the latest patented coolant technology.

Based on distribution channel, which segment is among the leading segment in the market global antifreeze market during the forecast period?

The original equipment manufacturers (OEMs) segment held the largest share of the market in 2022. Original equipment manufacturer (OEM) is a company that manufactures/produces and sells products or parts of a product that their buyer, another company, sells to its own customers while putting the products under their own branding. Theses original equipment manufacturers offers coolant (antifreeze) suitable for passenger cars, light trucks, buses, and heavy-duty and off-road applications. They offer formulations that meets explicit performance requirements and are recommended for use in certain vehicles.

Which region held the largest share of the global antifreeze market?

In 2022, Europe held the largest share of the antifreeze market. An increasing use of antifreeze in the automotive, industrial heating/cooling, and energy sector is mainly driving the antifreeze market growth in Europe. Countries such as Germany, France, Italy, and the UK have strong presence of the automotive industry. Growing automotive sales in the region creates a huge demand for antifreeze.

Can you list some of the major players operating in the Global Antifreeze market?

The major players operating in the global antifreeze market are BASF SE, Chevron Corporation, CCI Corporation, Dow, Old World Industries, L.L.C., Prestone Products Corporation, Royal Dutch Shell Plc, ExxonMobil Corporation, Trychem Fzco, Sumitomo Chemical Co., Ltd.

Based on application, which segment is leading the global antifreeze market during the forecast period?

The automotive segment held the largest market share. Automobiles is one of the major application areas of antifreeze (coolant). Antifreeze (coolant) is used in cars, trucks, boats, and buses. It is used in car engine to prevent the engine’s cooling system from freezing and prevent it from overheating. By using antifreeze (coolant), the water in car’s engine will not freeze in normal cold weather conditions, neither it will overheat in warm weather. The combustion chamber creates intense heat, depending on operating conditions, ambient weather and engine configuration. Metal expands when they become hot.

Based on coolant type, which segment is leading the global antifreeze market during the forecast period?

The ethylene glycol segment held the largest market share. Ethylene glycol is an alcohol-based organic compound. It is an odorless, colorless, viscous liquid, known to have a sweet taste. Ethylene glycol possess superior heat transfer properties. It is poisonous and must be handled with caution to avoid any human or animal exposure. Ethylene glycol is commonly used in various commercial and industrial applications including antifreeze and coolant. It is an important ingredient in automotive antifreeze and coolant.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Antifreeze Market

- BASF SE

- Chevron Corporation

- CCI Corporation

- Dow

- Old World Industries, LLC

- Prestone Products Corporation

- Royal Dutch Shell Plc

- ExxonMobil Corporation

- Trychem FZCO

- Sumitomo Chemical Co., Ltd.

Get Free Sample For

Get Free Sample For