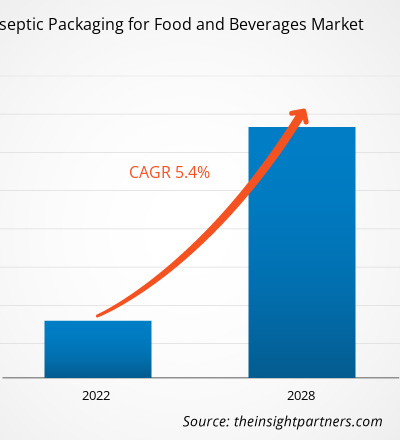

The aseptic packaging for food and beverages market is projected to reach US$ 24,782.33 million in 2028 from US$ 17,097.86 million in 2021; it is expected to grow at a CAGR of 5.4% from 2021 to 2028.

Aseptic packaging is a high-temperature-short-time thermal process used to commercially sterilize a product and fill the cooled, sterilized product into a pre-sterilized package under a sterilized environment. During the process, the aseptic filler is designed to sterilize the packaging material, fill the sterile product into the container under a sterilized environment, and then hermetically seal the package. Aseptic filler differs from traditional food packaging systems, as in this, the food product and the package are sterilized separately. The aseptic packaging is mainly used in the food & beverage industry. The global food & beverages industry's massive growth is due to the rising population, improving lifestyles, rising per capita income, and surging demand for convenience food and beverages, which is projected to open crucial opportunities for the aseptic packaging for food and beverages market over the forecast period.

North America held the largest share of the global aseptic packaging for food and beverages market in 2020, while Asia-Pacific is expected to grow significantly over the forecast period. The ready-to-eat or drink concept is trending in North America. Lately, the ready-to-drink beverages market has grown considerably due to the growing preference for convenience food and beverages that help save time and efforts. Aseptic packaging for food and beverages is essential to extend its shelf life. Thus, the rising trend of consuming ready-to-drink beverages is driving the growth of North America aseptic packaging for food and beverages market. Vendors are offering specialized aseptic packaging for ready-to-drink products. For instance, Graham Packaging offers recyclable plastic for aseptic packaging to provide longer shelf life for single-serve packaging. Thus, various emerging and well-established market players in the region that offer innovative aseptic packaging solutions are driving the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aseptic Packaging for Food and Beverages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Aseptic Packaging for Food and Beverages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Aseptic Packaging for Food and Beverages Market

During the COVID-19 pandemic, the chemicals & materials industry faced unprecedented challenges due to the shortage in raw material supply, the shutdown of factories, labor shortage, and other operational difficulties under pandemic safety protocols. The shutdown of manufacturing units, difficulty in the procurement of raw materials, and restrictions on logistics negatively impacted the global aseptic packaging for the food and beverages market. Due to the COVID-19 outbreak, the hygiene concerns of consumers increased significantly. Consumer preferences are rapidly evolving toward long shelf life and sterile packaging, which positively impacted the aseptic packaging for the food and beverages market. According to an e-commerce study in the Tetra Pak Index 2021, consumers increasingly rated aseptic cartons as the ideal packaging material for online purchases. Thus, the increased concern about food safety and hygiene due to the outbreak of COVID-19 is fueling the growth of aseptic packaging for food and beverage market. Thus, the COVID-19 pandemic had a mixed impact on the aseptic packaging for food and beverages market.

Market Insights

Benefits Associated with Aseptic Packaging is driving the Market Growth

There are various benefits associated with aseptic packaging for food and beverage products. Aseptic packaging helps to increase the shelf life of the food and beverage products by an estimated six to twelve months without refrigeration. The increased longevity of the product provides manufacturers with more time to ship and sell their products before they expire or lose flavor. This also reduced the costs of transportation and logistics. Aseptic packaging is lightweight and compact compared to more traditional packaging types, allowing the manufacturers to cut shipping costs by reducing shipping weight. There has been a growing demand for convenience food products with long shelf-life, which are either free of or can delay bacterial contamination. Food preservatives are vastly used in food production to increase the shelf life and preserve the quality of the product. However, consumers prefer more natural products that are free from synthetic additives. Aseptic packaging also complements natural ingredients, allowing a manufacturer to produce a completely natural product, and make them increasingly shelf-stable. Thus, various benefits of aseptic packaging are driving the aseptic packaging for food and beverages market growth.

Type Insights

Based on type, the aseptic packaging for food and beverages market is segmented into carton, bottles & cans, sachets & pouches, and others. The sachets & pouches segment is projected to grow at the fastest CAGR in the global aseptic packaging for food and beverages market over the forecast period. The aseptic pouch packaging includes an innovative spout and cap solution to enable a safe and convenient packaging solution. This pouch is developed to provide consumers with convenience and ease of use. It can have a shelf-life of up to 12 months while providing optimal nutrient retention, flavors, and textures. Sachets are small sealed flexible bags that include three or four-layer packaging made from a reeled or flat film. The rising demand for smaller quantity food and beverage products is driving the growth of aseptic sachets and pouches segment.

Aseptic Packaging for Food and Beverages Market Regional Insights

The regional trends and factors influencing the Aseptic Packaging for Food and Beverages Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Aseptic Packaging for Food and Beverages Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Aseptic Packaging for Food and Beverages Market

Aseptic Packaging for Food and Beverages Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 17.1 Billion |

| Market Size by 2028 | US$ 24.78 Billion |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Aseptic Packaging for Food and Beverages Market Players Density: Understanding Its Impact on Business Dynamics

The Aseptic Packaging for Food and Beverages Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Aseptic Packaging for Food and Beverages Market are:

- Tetra Pak International S.A

- Sealed Air

- Greatview Aseptic Packaging Company

- SIDEL GROUP

- ECOLEAN AB

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Aseptic Packaging for Food and Beverages Market top key players overview

Application Insights

Based on application, the aseptic packaging for food and beverages market is segmented into food and beverages. The food segment is further divided into dairy food; fruits & vegetables; meat, poultry & seafood; processed food; and others. The beverages segment is further segmented into dairy beverages, juices, ready-to-drink beverages, and others. The beverages segment held a larger share in the global market in 2020. Aseptic packaging is used for various beverages, including fruit-based, dairy-based, milk-based, protein shakes, ready-to-drink (RTD) tea and iced coffee, flavored waters, and cocktails. The growing demand from consumers for beverages without chemicals and preservatives is driving the growth of aseptic packaging for food and beverages market.

The key players operating in the aseptic packaging for food and beverages market include Tetra Pak International SA, Sealed Air, Greatview Aseptic Packaging Company, Sidel Group, ECOLEAN AB, Krones AG, Syntegon Technology GmbH (Bosch Packaging Technology), Amcor Group GmbH, IPI S.r.l., and SIG Combibloc Group AG. These players are engaged in developing innovative products to meet the emerging consumer trends. Moreover, they are involved in mergers & acquisitions, business expansion, and partnerships to expand their market share globally.

Report Spotlights

- Progressive industry trends in the aseptic packaging for food and beverages market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the aseptic packaging for food and beverages market from 2019 to 2028

- Estimation of global demand for aseptic packaging for food and beverages

- Porter's five forces analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the aseptic packaging for food and beverages market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the aseptic packaging for food and beverages market size at various nodes

- Detailed overview and segmentation of the market, as well as the aseptic packaging for food and beverages industry dynamics

- Size of the aseptic packaging for food and beverages market in various regions with promising growth opportunities

Frequently Asked Questions

What are the trends for the global aseptic packaging for food and beverage market?

Adoption of sustainable and environmental-friendly packaging is the key trend for the global aseptic packaging for food and beverage market. The increased use of plastic packaging in the food and beverage industry has harmful impacts on the environment. This has led to an increased focus on developing sustainable and environmental-friendly packaging.

Based on food & beverage, which segment led the global aseptic packaging for food and beverage market in 2020?

Based on food & beverage, the food segment led the global aseptic packaging for food and beverage market in 2020. In the food segment fruits & vegetable, product is increasing as it is perishable in nature and aseptic packaging helps to increase longer shelf life. Thus this increase demand for aseptic packaging for food and beverage.

Which type segment is the fastest growing in the aseptic packaging for food and beverage globally?

Based on the type segment, sachets & pouches was the fastest-growing segment in 2020. The aseptic sachets & pouch packaging is pre-made, sterilized spouted sachets & pouch packaging which is used to preserve the quality of the product. Aseptic sachets & pouch are shelf-stable and require no refrigeration.

In 2020 which region was held the largest share of the global aseptic packaging for food and beverage market?

In 2020, Asia Pacific accounted for the largest share of the global aseptic packaging for food and beverage market. The aseptic packaging for food and beverage market industry is anticipated to expand faster due to its benefits like longer shelf life of food and beverage.

What are the drivers for the growth of the global aseptic packaging for food and beverage market?

Surging demand for dairy products and benefits associated with aseptic packaging are the drivers for global aseptic packaging for food and beverage market. The growing demand for dairy products has led to an increased focus on developing safe and hygienic packaging for dairy products. Aseptic packaging is increasingly used as a packaging solution for ultra-high temperature (UHT) milk. Aseptic packaging helps increase the shelf life of the food and beverage products.

Can you list some major players operating in the global aseptic packaging for food and beverage market?

The major players operating in the global aseptic packaging for food and beverage market are Tetra Pak International S.A.; Sealed Air Corporation; Greatview Aseptic Packaging Co., Ltd.; Sidel International; Ecolean AB; Krones AG; Syntegon Technology GmbH; IPI S.r.l.; SIG Combibloc Group AG; Amcor plc.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Aseptic Packaging for Food and Beverage Market

- Tetra Pak International S.A

- Sealed Air

- Greatview Aseptic Packaging Company

- SIDEL GROUP

- ECOLEAN AB

- Krones AG

- Syntegon Technology GmbH (Bosch Packaging Technology)

- SIG Combibloc Group AG

- IPI S.R.L.

- Amcor plc

Get Free Sample For

Get Free Sample For