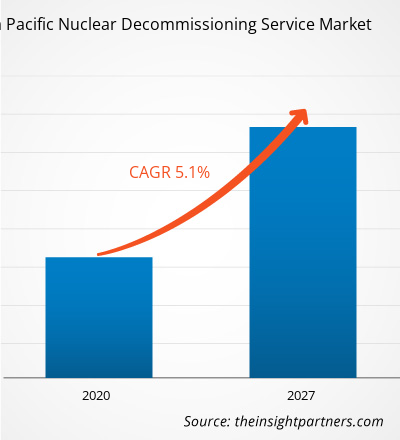

The nuclear decommissioning service market in Asia-Pacific was valued US$ 1.22 billion in 2019 and is projected to reach US$ 1.80 billion by 2027; it is expected to grow at a CAGR of 5.1% from 2020 to 2027.

The Asia-Pacific (APAC) region comprises a notable number of nuclear facilities, mainly in Japan and South Korea. The Japanese government has expressed its plans to phase out 40–50% of its nuclear facilities over the next decade. China and India, on the other hand, are still maturing in the field of nuclear decommissioning, which holds a promising future for several Asia Pacific nuclear decommissioning services market players in the countries and internationally.

The decommissioning of these plants is set to be executed through 2040. As of 2017, a total of 10 commercial nuclear reactors in the US have been successfully decommissioned, and another 20 US nuclear reactors are currently in different stages of the decommissioning process.

On the other hand, the South Korean government is focusing heavily on developing itself as one of the pioneers in nuclear decommissioning services market players as the government foresees the decommissioning services to be mainstream in the near future. Additionally, the country is phasing out its nuclear power plants year-on-year, which is catalyzing the nuclear decommissioning services market in the country. China and India nuclear decommissioning services market is relatively niche, with less emphasis on decommissioning existing older plants as compared with focus on commissioning newer projects. However, the aging infrastructures are expected to drive the nuclear decommissioning services market in the two countries over the next couple of decades.

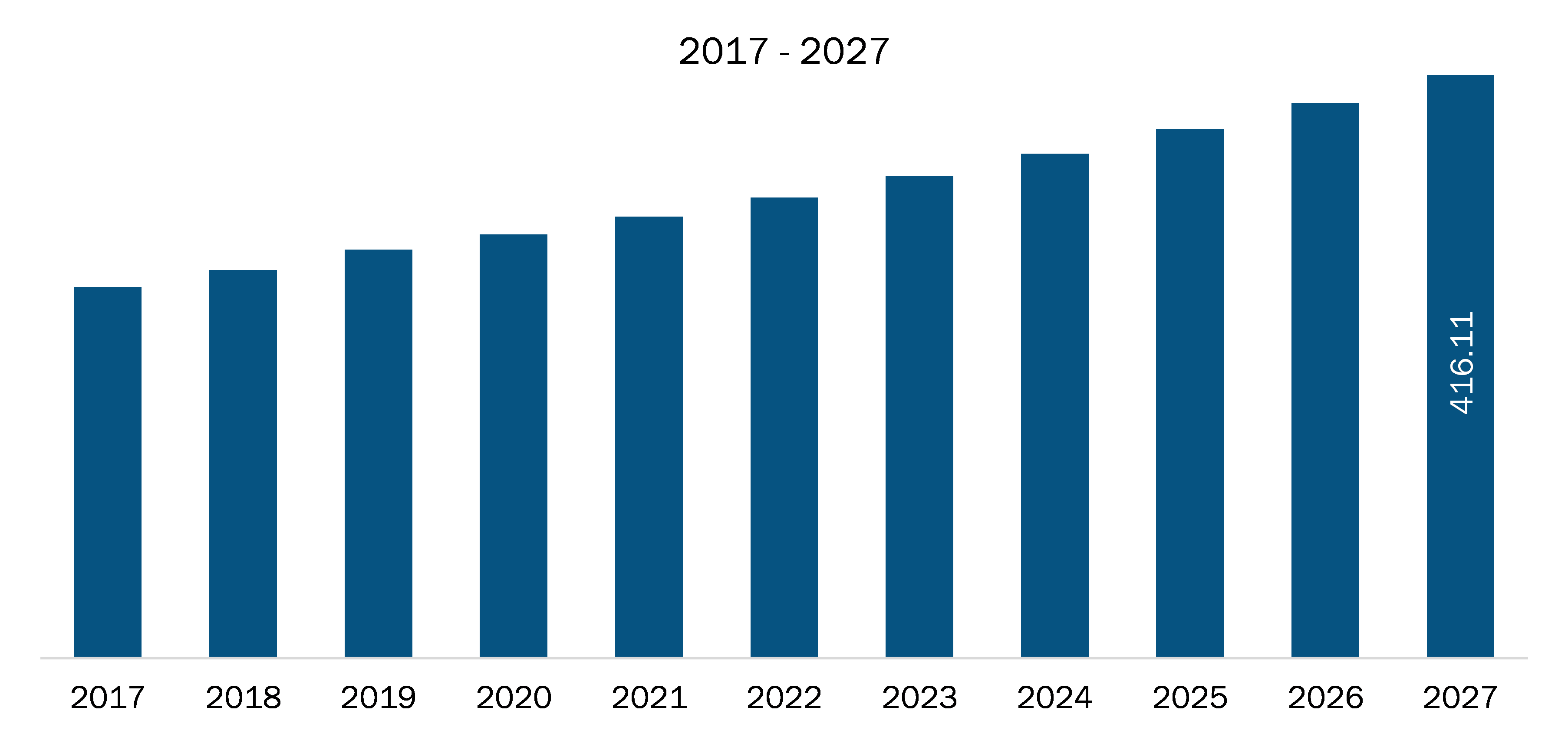

The nuclear decommissioning services market in Japan is projected to reach US$ 416.11 million in 2027. According to the World Nuclear Association, Japan is among the leading countries with higher numbers of nuclear power plants. Also, the country ranks top in the list of decommissioning its nuclear power projects. According to the organization, the country has 33 nuclear power plants in operation, 2 new constructions are underway, and 27 projects have been decommissioned, as of March 2020. The country has plans to decommission more numbers of nuclear power plants in the coming years. This factor project lucrative business opportunities for the nuclear-decommissioning services market players to acquire contracts from the Japanese government.Asia-Pacific Nuclear Decommissioning Service Market–Segmentation

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia-Pacific Nuclear Decommissioning Service Market, by Reactor Type

- Pressurized Water Reactor

- Boiling Water Reactor

- Gas Cooled Reactor

Asia-Pacific Nuclear Decommissioning Service Market, by Strategy

- Immediate Dismantling

- Deferred Dismantling

- Entombment

Asia-Pacific Nuclear Decommissioning Service Market, by Application

- Commercial Power Reactor

- Prototype Power Reactor

- Research Reactor

Asia-Pacific Nuclear Decommissioning Service Market, by Capacity

- Below 100 MW

- 100 – 1,000 MW

- Above 1,000 MW

Asia-Pacific Nuclear Decommissioning Service Market, by Country

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

Asia-Pacific Nuclear Decommissioning Service Market-Companies Mentioned

- AECOM

- Ansaldo Energia S.p.A.

- Babcock International Group PLC

- Bechtel Corporation

- EnergySolutions

- GE Hitachi Nuclear Energy (GEH)

- Orano

- Studsvik AB

- Fluor Corporation

- Korea Hydro & Nuclear Power Co. Ltd

Asia Pacific Nuclear Decommissioning Service Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 1.22 Billion |

| Market Size by 2027 | US$US$ 416.11 Million |

| Global CAGR (2020 - 2027) | 5.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Reactor Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Reactor Type, Strategy, Application, Capacity and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Energy and Power : READ MORE..

- AECOM

- Ansaldo Energia S.p.A.

- Babcock International Group PLC

- Bechtel Corporation

- EnergySolutions

- GE Hitachi Nuclear Energy (GEH)

- Orano

- Studsvik AB

- Fluor Corporation

- Korea Hydro & Nuclear Power Co. Ltd

Get Free Sample For

Get Free Sample For