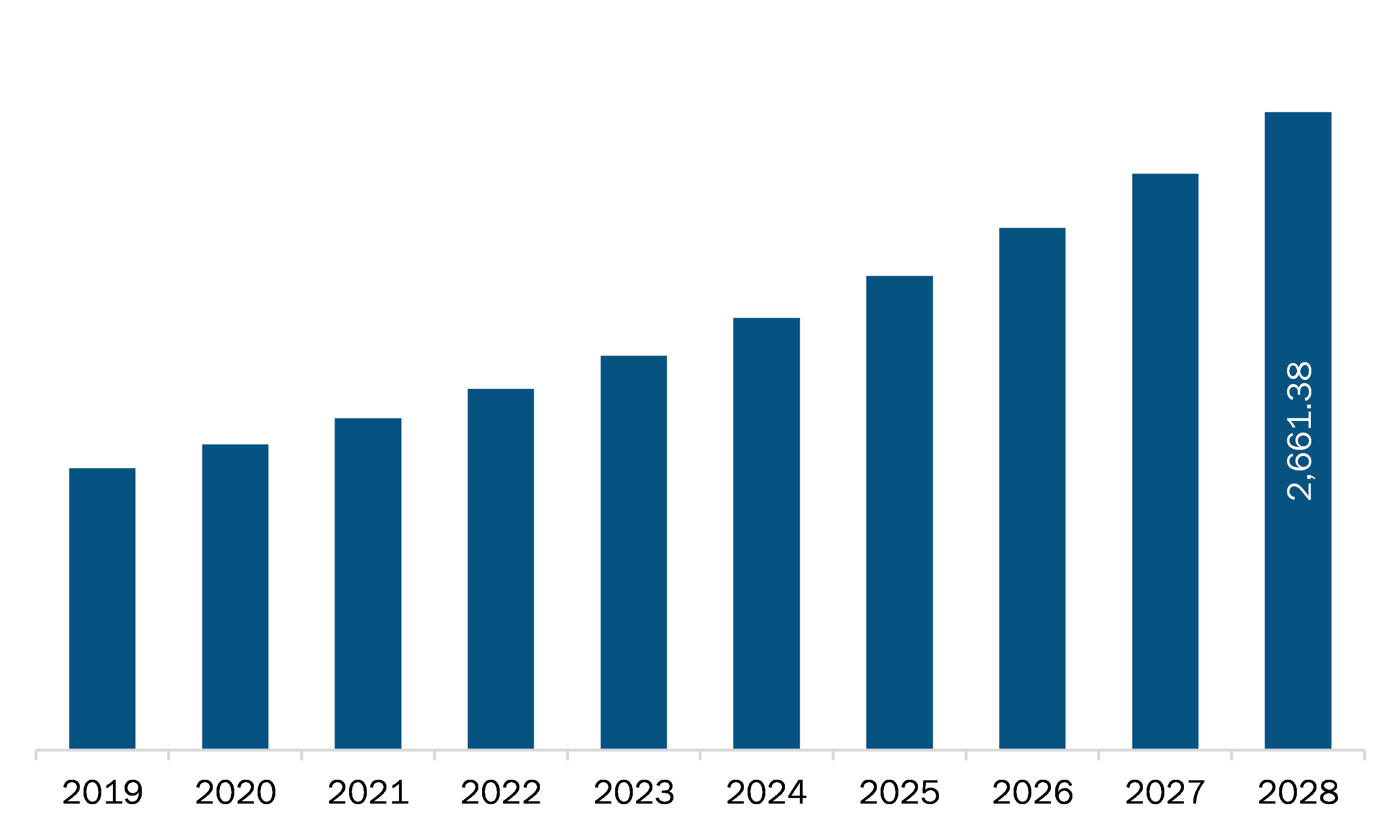

The APAC radiopharmaceuticals market is expected to grow from US$ 1,384.59 million in 2021 to US$ 2,661.38 million by 2028; it is estimated to grow at a CAGR of 9.8% from 2021 to 2028.

China, India, Japan, South Korea, and Australia are major economies in APAC. Soaring growth in emerging countries is expected to fuel the market growth. Many medical market players focus on emerging countries due to a rise in the prevalence of various diseases in these countries and low per capita income. Further, the prevalence of CVDs is rising significantly in several nations, which can be mainly attributed to the shift in lifestyle as well as the adoption of modern facilities. The modernization of residential, corporate, and commercial facilities is leading to reduction in physical activities, while the stress levels are continuously on the rise due to various factors related to livelihood. These conditions may trigger the possibility of developing CVDs among people, thus boosting the demand for various imaging instruments, including nuclear imaging techniques. Research organizations are engaged in the development of advanced diagnosis systems, including cost-effective and high-performance PET/SPECT systems. These developments are mainly aimed at extending their reach to remote areas where advanced medical IT facilities are not accessible. Emerging countries are spending heavily on the development of PET/SPECT machines to lower their costs as well as to offer hospitals and other medical organizations a better access to these machines. Countries in the region are significant targets for the companies to set up their financial operations and increase revenue generation through strategic planning such as mergers and acquisitions. Thus, several countries are offering significant opportunities to the market players to expand their reach and clientele, which will drive the APAC market in coming years.

In case of COVID-19, APAC is highly affected especially India. The medical practices in the region continue to adapt to the challenges of COVID-19. On the one hand, healthcare professionals are responding to the pandemic, and on the other, it ensures minimal disruption to non-COVID-related procedures and hospitalizations. Hospitals and other healthcare facilities worldwide are forced to postpone elective procedures, such as surgeries. Most non-urgent therapies have been postponed. The COVID-19 pandemic affected health care services in many dimensions, starting from interrupting the regular patient flow to health care facilities, stressing, and overwhelming the health care resources, and leading to the implementation of extra protective measures and social distancing with increased utilization of telehealth and virtual medicine. As a precautionary approach, oncology practices implemented specific measures to reduce the number of patients in outpatient clinics, reduce unnecessary or elective procedures, and discharge patients from inpatient services. This has negatively impacted the growth of the radiopharmaceuticals market in the region. In addition, market players have also been affected by the pandemic owing to supply chain contrarians and reduced demand. The Specialty Pharma segment, especially radiopharma, was impacted due to COVID-19 and competition in radiopharma. Even before the pandemic, Nuclear Medicine’s supply chain was highly complex, depending on the availability of raw materials, manufacturing facilities' operations, and air transportation reliability. Thus, the factors mentioned above are negatively impacting the radiopharmaceuticals market in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC radiopharmaceuticals market. The APAC radiopharmaceuticals market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Radiopharmaceuticals Market Segmentation

APAC Radiopharmaceuticals Market – By Type

- Diagnostic Nuclear Medicine

- SPECT

- PET

- Therapeutic Nuclear Medicine

- Alpha Emitters

- Beta Emitters

- Brachytherapy Isotopes

APAC Radiopharmaceuticals Market – By Application

- Oncology

- Cardiology

- Neurology

- Others

APAC Radiopharmaceuticals Market – By End User

- Hospitals

- Imaging Centers

- Academic and Research Centers

- Others

APAC Radiopharmaceuticals Market, by Country

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

APAC Radiopharmaceuticals Market -Companies Mentioned

- Advanced Accelerator Applications

- Bayer AG

- Bracco Imaging S.p.A

- Cardinal Health Inc

- Curium

- ECZACIBAŞI MONROL NUCLEAR PRODUCTS CO.

- GENERAL ELECTRIC

- Lantheus Medical Imaging, Inc.

- Nordion

- NTP RADIOISOTOPES

Asia Pacific Radiopharmaceuticals Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,384.59 Million |

| Market Size by 2028 | US$ 2,661.38 Million |

| CAGR (2021 - 2028) | 9.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For