Viral Vector Manufacturing Market Insights & Growth Scope by 2031

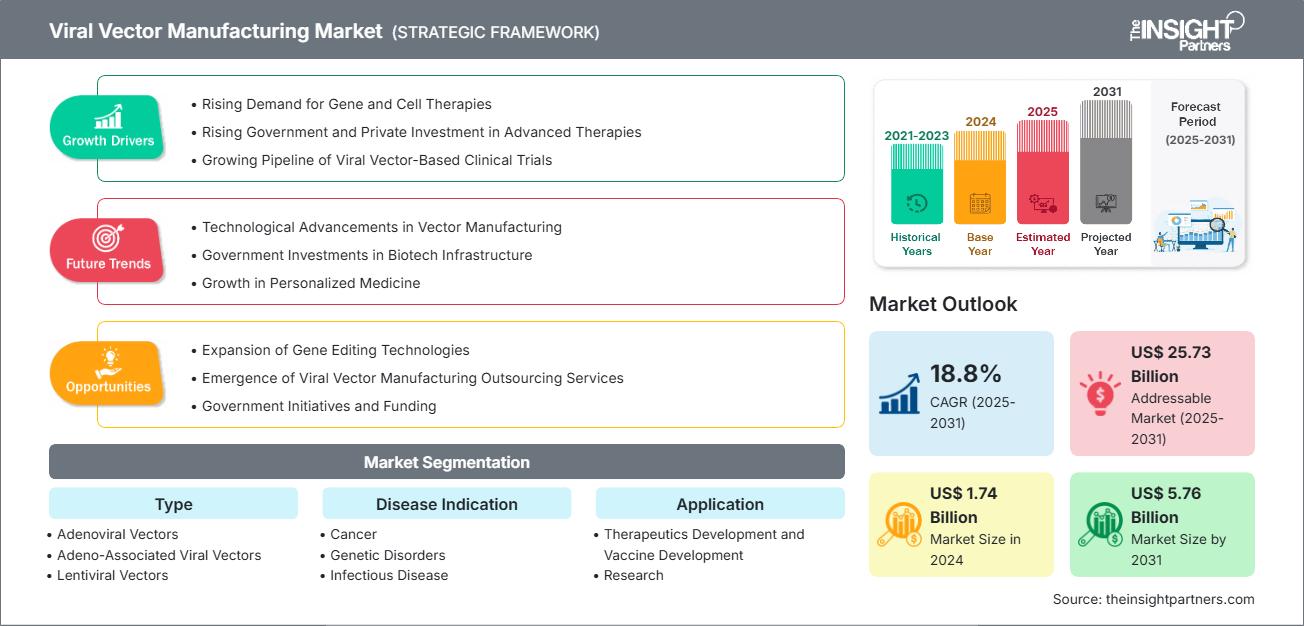

Viral Vector Manufacturing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Adenoviral Vectors, Adeno-Associated Viral Vectors, Lentiviral Vectors, Retroviral Vectors, and Others), Disease Indication (Cancer, Genetic Disorders, Infectious Disease, and Others), Application (Therapeutics Development and Vaccine Development, Research), End User (Pharmaceutical and Biotechnology Companies, CDMOs & CROs, and Research Institutes), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Nov 2025

- Report Code : TIPRE00038970

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 273

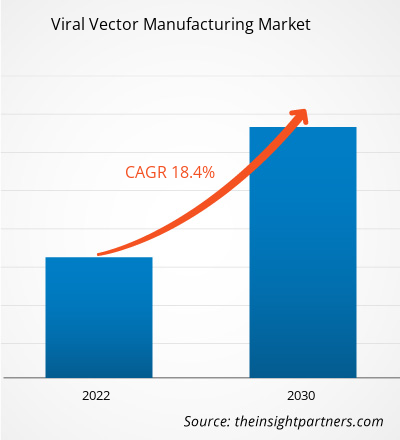

The viral vector manufacturing market size is expected to reach US$ 5.76 billion by 2031 from US$ 1.74 billion in 2024. The market is anticipated to register a CAGR of 18.8% during 2025–2031.

Viral Vector Manufacturing Market Analysis

The viral vector manufacturing market is experiencing rapid expansion, driven by increasing demand for gene therapies and vaccines. Key trends include technological advancements, increased investment, and strategic collaborations. Challenges include high production costs, scalability issues, and strict regulatory requirements.

Viral Vector Manufacturing Market Overview

Viral vectors are engineered viruses used to deliver genetic material in gene and cell therapies, vaccines, and research. Manufacturing involves design, cell growth, purification, quality control, and GMP-compliant formulation to ensure safety, potency, and stability.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONViral Vector Manufacturing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Viral Vector Manufacturing Market Drivers and Opportunities

Market Drivers:

- Rising Pipeline of Gene and Cell Therapies: The proliferation of gene therapy, cell therapy, and advanced therapeutic programs increases demand for GMP-grade viral vectors (AAV, lentivirus, etc.).

- Investment & Funding in Biomanufacturing Infrastructure: Governments, venture capital, and biopharma firms are funding facility expansions, technology upgrades, and CDMO scale‑ups.

- Technological Innovation: Use of single‑use bioreactors, closed systems, in‑line analytics, and modular platforms helps reduce contamination risk and improve yield/throughput.

- Outsourcing to CDMOs / Specialized Service Providers: Many biotech and pharma players prefer to outsource vector manufacturing rather than build in-house capacity. This trend supports CDMO growth.

- Regulatory Support & Streamlining for Advanced Therapies: Some regulatory bodies are introducing clearer guidelines for gene therapy and viral vector products, reducing uncertainty.

Market Opportunities:

- Expansion into Gene Therapy and Vaccine Development: With the increasing number of gene therapies and viral vector vaccine pipelines, the demand for specialized manufacturing is expected to rise, leading to opportunities for developing customized and scalable vector production.

- Increasing Demand in Rare Genetic Disorders and Cancer: With an increasing number of approvals and clinical trials for gene therapies targeting rare disorders and cancers, the demand for high-quality viral vectors is rising, expanding manufacturing requirements, and driving market growth across various therapeutic areas.

- Advancements in Manufacturing Technologies: Advancements in manufacturing technologies, including single-use bioreactors and continuous processing, maximize yields per batch and minimize contamination risks and manufacturing costs.

- Customizable and Scalable Manufacturing Options: Scale and grow, making them appealing to both start-ups and large pharmaceutical companies, resulting in improved global market expansion.

Viral Vector Manufacturing Market Report Segmentation Analysis

The viral vector manufacturing market is categorized into distinct segments to understand its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Adenoviral Vectors: Non-integrating vectors delivering large genes; cause strong immune responses; used in gene therapy and vaccines.

- Adeno-Associated Viral Vectors: It is nonpathogenic, capable of site-specific integration, providing long-term gene expression with low immunogenicity, ideal for treating nondividing cells in gene therapy.

- Lentiviral Vectors: They efficiently integrate into both dividing and nondividing cells’ genomes, allowing stable, long-term gene expression, commonly used in research and clinical gene therapy applications.

- Retroviral Vectors: They integrate into the genome of dividing cells only, enabling stable gene transfer, but with limited targeting scope and potential insertional mutagenesis risks.

- Others: Other viral vectors, such as herpesvirus and vaccinia virus, offer unique tissue targeting and larger genetic payload capacities, suited for specialized gene therapy and vaccine strategies.

By Technology:

- Cancer: Viral vectors induce targeted therapies and immunotherapies in the treatment of different cancers. This approach can potentially yield more specific treatments and better patient outcomes.

- Genetic Disorders: Viral vectors are used to deliver gene therapy approaches that correct defective genes and effectively treat inherited genetic disorders.

- Infectious Diseases: Viral vectors are leveraged in vaccine development and the delivery of therapeutics to address infectious diseases such as HIV, COVID-19, and hepatitis.

- Others: Includes indications, including neurological, cardiovascular, and rare diseases, where viral vectors will contribute to gene delivery and therapeutic interventions.

By Application:

- Therapeutics Development

- Vaccine Development

- Research

By End User:

- Pharmaceutical and Biotechnology Companies

- CDMOs & CROs

- Research Institutes

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Viral Vector Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.74 Billion |

| Market Size by 2031 | US$ 5.76 Billion |

| Global CAGR (2025 - 2031) | 18.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Viral Vector Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Viral Vector Manufacturing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Viral Vector Manufacturing Market Share Analysis by Geography

The viral vector manufacturing market in Asia Pacific is experiencing rapid growth driven by rising healthcare investments, technological advancements, and increasing demand for gene therapies and personalized medicine. Emerging markets in South & Central America, the Middle East, and Africa present untapped opportunities for viral vector manufacturing, enabling healthcare providers to expand access to advanced treatments and improve patient outcomes in these regions.

The viral vector manufacturing market growth differs in each region due to differences in healthcare infrastructure, regulatory environments, funding availability, technological adoption, and disease prevalence. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Advanced healthcare infrastructure: Advanced healthcare systems in North America support viral vector manufacturing by facilitating clinical trials, biomanufacturing, and regulatory compliance for gene therapies.

- Strong biotechnology and pharmaceutical ecosystem

- Robust funding and regulatory support for gene therapy development.

- Trends: Expansion of in-house manufacturing by biotech firms.

2. Europe

- Market Share: Substantial share owing to early, stringent EU regulations

-

Key Drivers:

- Focus on quality and safety in gene therapy production: Europe’s strict regulatory frameworks ensure high standards for viral vector production, accelerating trust and adoption in therapeutic applications.

- Government-backed initiatives for rare disease treatments

- Growing investments in research and development in academic and research institutions.

- Trends: Development of GMP-compliant viral vector facilities.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

-

Key Drivers:

- Expansion of biotech and pharma manufacturing hubs: Growing life sciences sector is driving demand for localized viral vector production to support clinical trials and commercialization.

- Government investments in precision and regenerative medicine

- Rising demand for affordable gene therapies in populous countries

- Trends: Surge in contract manufacturing organizations (CMOs).

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- National healthcare transformation

- Strategic national health plans promote biotech investments, including facilities for viral vectors to support future accessibility of gene therapy.

- Increasing collaborations with global biotech firms

- Trends: Early-stage infrastructure development and targeted investments in research hubs.

5. South & Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Investments in healthcare infrastructure and innovation

- Ongoing modernization of healthcare systems fuels demand for advanced, growing clinical trial activity

- Increased interest from private healthcare providers.

- Trends: Establishment of small-scale viral vector production units and pilot projects.

Viral Vector Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as Lonza Group AG; Merck KGaA; Thermo Fisher Scientific Inc., Catalent Inc., Charles River Laboratories International Inc., WuXi AppTec Co Ltd; FUJIFILM Holdings Corp; GenScript Biotech Corporation; Takara Bio Inc., and Novartis AG

This high level of competition urges companies to stand out by offering:

- GMP-compliant facilities

- Advanced technologies such as single-use systems and automation

- Integrated end-to-end services

- Scalable and flexible manufacturing capabilities

- Scalable and customizable platforms to meet diverse needs.

Opportunities and Strategic Moves

- Leveraging AI and data analytics to optimize viral vector production processes, predict batch outcomes, and enhance quality control and yield efficiency.

- Enhanced Patient Safety: Implementing real-time monitoring systems to ensure viral vector purity, reduce contamination risks, and comply with stringent global regulatory standards.

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Addgene, Inc.

- Advanced BioScience Laboratories, Inc.

- Aldevron, L.L.C.

- AstraZeneca

- Audentes Therapeutics

- Batavia Biosciences B.V.

- BioMarin Pharmaceutical

- BioNTech IMFS GmbH

- Biovion Oy

- CEVEC Pharmaceuticals GmbH

- CGT Catapult

- Danaher

Viral Vector Manufacturing Market News and Recent Developments

- Lonza acquires the Genentech large-scale biologics manufacturing site, March 2024: Lonza, a global manufacturing partner to the pharmaceutical, biotech, and nutraceutical markets, announced the signing of an agreement to acquire the Genentech large-scale biologics manufacturing site in Vacaville, California (US) from Roche for US$1.2 billion.

- Siren Biotechnology entered a strategic partnership with Catalent Inc., May 2024: Siren Biotechnology, pioneers of Universal AAV Immuno-Gene Therapy for Cancer, and Catalent Inc., the leader in enabling the development and supply of better treatments for patients worldwide, entered a strategic partnership to support the development and manufacturing of Siren Biotechnology’s AAV immuno-gene therapies.

Viral Vector Manufacturing Market Report Coverage and Deliverables

The "Viral Vector Manufacturing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Viral Vector Manufacturing Market size and forecast at global, regional, and country levels for key market segments covered under the scope

- Viral Vector Manufacturing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Real-time Location Systems Market For Healthcare analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the viral vector manufacturing market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For