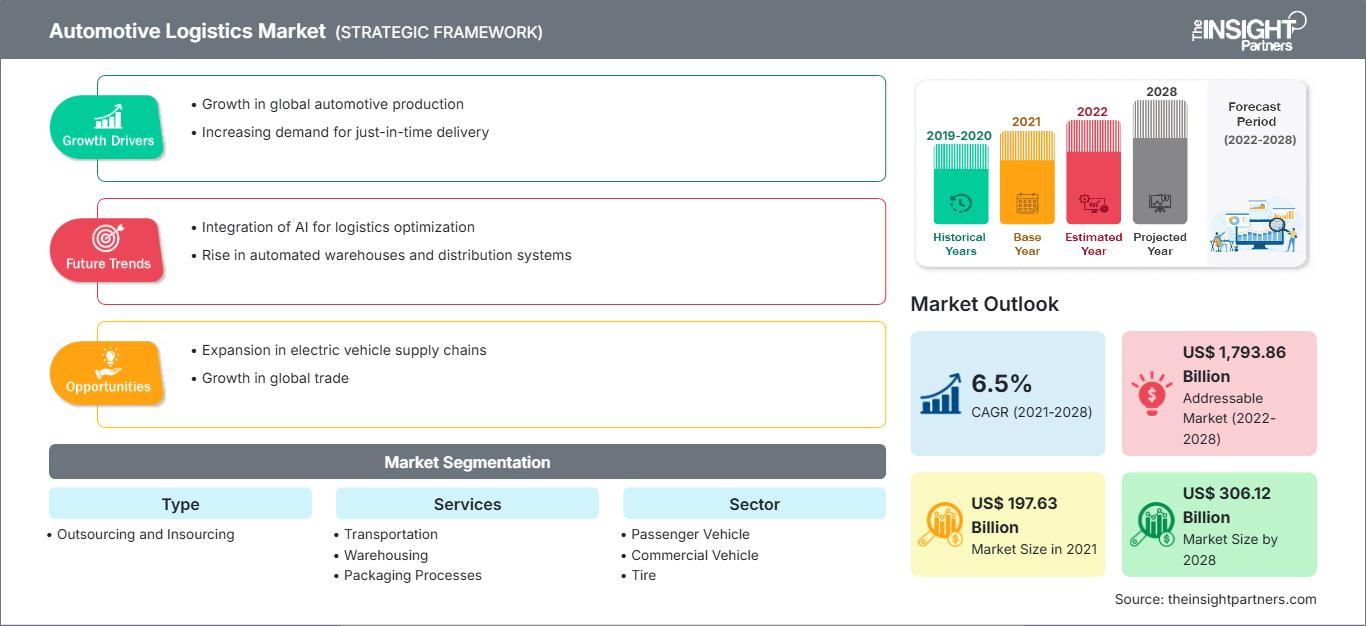

Automotive Logistics Market Growth and Analysis by 2028

Automotive Logistics Market Forecast to 2028 - Analysis By Type (Outsourcing and Insourcing), Services (Transportation, Warehousing, Packaging Processes, Integrated Service, and Reverse Logistics), and Sector (Passenger Vehicle, Commercial Vehicle, Tire, and Component)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Feb 2022

- Report Code : TIPRE00003366

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 195

[Research Report] The automotive logistics market is expected to grow from US$ 1,97,630.46 million in 2021 to US$ 3,06,121.54 million by 2028; it is estimated to grow at a CAGR of 6.5% from 2021 to 2028.

Analyst Perspective:

The automotive logistics market plays a crucial role in the efficient movement of vehicles, automotive parts, and spare parts throughout the industry. It encompasses various companies specializing in auto, vehicle, and car logistics, providing services such as transportation, storage, and distribution of automotive products. Automotive logistic companies are responsible for managing the intricate supply chains involved in the automotive industry. They ensure the seamless movement of vehicles from manufacturing plants to dealerships or directly to customers. These companies leverage their expertise in transportation and logistics to optimize routes, minimize delivery times, and enhance overall efficiency. Auto logistics companies also focus on transporting and distributing automotive parts and spare parts. They handle the complex task of sourcing, storing, and delivering these components to assembly plants or repair centers. By utilizing specialized systems and technologies, automotive parts logistics companies streamline the inventory flow, ensuring that the right parts are available at the right time.

Logistics is a critical component of the automotive and transportation sector that keeps the industry running smoothly. It encompasses various activities, including automotive warehousing, inventory management, packaging, and reverse logistics. Effective automotive logistics management reduces costs, improves customer satisfaction, and increases operational efficiency. The automotive logistics market also provides various job opportunities, including car logistics jobs. These roles involve coordinating and overseeing the transportation and delivery of vehicles or automotive parts. From managing logistics operations to optimizing supply chain processes, professionals in this field play a pivotal role in ensuring the timely and secure movement of automotive products. The global automobile spare parts logistics market is experiencing significant growth due to the increasing demand for efficient supply chain management and timely delivery of spare parts. A logistics consultant provides expertise and solutions to optimize the automotive spare parts logistics process, reducing costs and improving customer satisfaction. Automotive parts logistics ensure the seamless flow of spare parts across the supply chain. In contrast, auto logistics parts focus on efficiently transporting and distributing automotive components to meet market demands.

Market Overview:

Arranging and transporting resources, such as machinery, stock, and supplies related to finished automobiles and automotive parts, from one area to the intended location is known as automotive logistics. To fulfill client demands, it is the control of the flow of commodities from one point of origin to the point of consumption. Managing daily operations producing the company's completed goods and services is the main emphasis of logistics management. This sort of management efficiently and effectively moves things forward, backward, and into storage. The demand for an efficient and customized logistic service has become a differentiating feature among different logistic service providers and is essential to preserving market competition. Logistics service companies are also integrating disruptive technologies like Big Data, the Internet of Things (IoT), and linked ships to improve their supply chain management system.

These technologies help to save labor costs and do away with shipment delays. The demand created for the automotive industry significantly impacts the market's expansion. Due to increased purchasing power and higher living standards worldwide, the automotive sector is predicted to develop significantly in the next years. The increase in car sales across emerging nations due to this shift in lifestyle is expected to boost market growth over the forecast period. In addition, the necessity for vehicle spare parts for a sizable existing automobile logistics on the road is anticipated to fuel the market during the forecast period.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAutomotive Logistics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Expansion of the E-Commerce Industry Globally to Drive Growth of Automotive Logistics Market

The rapid expansion of the e-commerce industry has emerged as a significant driver of market growth in the automotive logistics sector. As consumers increasingly shift to online platforms to purchase vehicles, automotive parts, and spare parts, the demand for efficient logistics solutions has skyrocketed. This surge in e-commerce activities has directly influenced automotive, auto, and car logistics companies, transforming how they operate and expanding their market potential. E-commerce has created new avenues for automotive sales, with consumers now able to browse and purchase vehicles online. This trend has necessitated the development of specialized logistics services tailored to handle the transportation and delivery of vehicles purchased online. Vehicle logistics companies have stepped in to bridge the gap between online purchases and physical delivery, ensuring that vehicles are transported securely and efficiently to the buyers' locations.

Moreover, the e-commerce boom has fueled the demand for automotive parts and spare parts through online marketplaces. Customers now have the convenience of ordering specific components and spare parts from the comfort of their homes. This shift has led to the emergence of automotive parts logistics services that specialize in managing these items' storage, packaging, and delivery. These logistics providers leverage their expertise to streamline the supply chain, ensuring that the right parts are delivered to customers promptly. The expansion of the e-commerce industry has also prompted automotive logistics companies to adopt innovative technologies and automotive logistics solutions to enhance their operations.

Advanced tracking systems, route optimization software, and real-time inventory management tools have become crucial in meeting the demands of e-commerce customers. By leveraging these technologies, auto and car logistics companies can provide efficient and transparent services, ensuring timely deliveries and high customer satisfaction. Furthermore, the e-commerce industry's growth has opened up new job opportunities in the automotive logistics sector. Car logistics jobs, specifically in e-commerce fulfillment, have become increasingly important. Professionals with expertise in managing online orders, coordinating shipments, and optimizing logistics operations are in high demand. This trend has led to the expansion of the workforce in the automotive logistics market, contributing to its overall growth.

Segmental Analysis:

Based on type, the automotive logistics market is bifurcated into:

- Outsourcing

- Insourcing

The insourcing segment held the largest share of the market in 2020, whereas the outsourcing segment is anticipated to register the highest CAGR in the market during the forecast period. The insourcing segment in the automotive logistics market holds the largest share. This is because automotive companies and manufacturers choose to manage their logistics operations internally, allowing them greater control, visibility, and utilization of existing resources. Insourcing enables customization, differentiation, and access to real-time data and analytics. While outsourcing still plays a role, the dominance of insourcing drives the overall growth of the automotive logistics market.

Regional Analysis:

The Asia Pacific automotive logistics market was valued at US$ 86.77 billion in 2021 and is projected to reach US$ 142.34 billion by 2028; it is expected to grow at a CAGR of 7.3% during the forecast period. The Asia Pacific region has established its dominance in the automotive logistic market, emerging as the leading geographical segment. Several key factors contribute to the region's market domination, including its robust automotive manufacturing industry, rapid economic growth, and expanding consumer base.

Firstly, the Asia Pacific region is home to some of the world's largest automotive manufacturers and production hubs. Countries such as China, Japan, South Korea, and India have witnessed significant growth in their automotive sectors, attracting global automakers and fostering the establishment of extensive manufacturing facilities. This strong automotive manufacturing presence generates a substantial demand for automotive logistics services, driving market growth in the region. Secondly, the rapid economic growth observed in the Asia Pacific region has resulted in a surge in domestic consumption and increased demand for vehicles. As countries in the region experience rising disposable incomes, there has been a significant increase in the purchase of cars and other vehicles. This growth in vehicle ownership directly translates into higher demand for automotive logistics services, including transportation, storage, and distribution of vehicles and automotive parts.

Additionally, the expanding consumer base in the Asia Pacific region plays a pivotal role in the dominance of the market. With a population exceeding 4.6 billion, the region offers a vast customer base for automotive manufacturers and suppliers. The rising middle class and increasing urbanization in countries like China and India have created a substantial automobile market. This growth in vehicle demand necessitates efficient and reliable automotive logistics services to ensure timely delivery and meet consumer expectations. Furthermore, the Asia Pacific region has proactively adopted advanced technologies and digitalization in logistics operations. With the rise of e-commerce and the integration of technology-driven solutions, such as supply chain management systems, real-time tracking, and data analytics, the region has enhanced the efficiency and effectiveness of its automotive logistics services.

This technological advancement further strengthens the market dominance of the Asia Pacific region. Government initiatives and investments in infrastructure development also contribute to the region's market domination. Countries in the Asia Pacific region have been actively investing in transportation infrastructure, including road networks, ports, and rail systems, to support the growing automotive industry. These infrastructure developments facilitate seamless transportation and efficient logistics operations, making the region an attractive hub for automotive manufacturing and logistics activities.

The North America automotive logistics market, with a strong industry presence and advanced logistics infrastructure, is important in the automotive logistics market. In North America, automotive and car logistics companies benefit from a well-established automotive manufacturing sector, robust transportation networks, and a focus on technological advancements. North America is home to major automotive manufacturers and a thriving automotive market, with key players in the United States, Mexico, and Canada. These companies generate substantial demand for automotive logistics services, including transportation, storage, and distribution of vehicles and automotive parts.

The presence of renowned auto manufacturers and suppliers drives the growth of the automotive logistics market in the region. Regarding transportation infrastructure, North America boasts extensive road networks, rail systems, and well-connected ports. This infrastructure facilitates efficient movement and distribution of vehicles and automotive parts, allowing automotive logistic companies to optimize logistics operations. The region's transportation infrastructure ensures timely deliveries, enables cost-effective operations, and supports the overall growth of the automotive logistics market. Moreover, North America emphasizes technological advancements in the logistics industry, focusing on digitalization and automation. Auto logistics companies in the region leverage cutting-edge technologies such as supply chain management systems, real-time tracking, and data analytics to enhance operational efficiency and provide superior customer service. By adopting these advanced solutions, car logistics companies in North America optimize inventory management, streamline operations, and improve overall supply chain visibility.

Additionally, North America has witnessed the growing importance of e-commerce in the automotive industry. The rise of online platforms for vehicle sales and automotive parts distribution has spurred the demand for specialized logistics services. Automotive logistic companies in North America have responded to this trend by developing tailored solutions for transporting and delivering vehicles and automotive parts purchased through e-commerce platforms. This focus on e-commerce logistics further propels the growth of the automotive logistics market in the region. Government policies and initiatives also contribute to regional insights into the North American automotive logistics market. The United States, Mexico, and Canadian governments have implemented measures to support the automotive industry and enhance logistics infrastructure. These include investments in transportation infrastructure, promoting cross-border trade agreements, and fostering an environment conducive to automotive manufacturing and logistics operations.

Automotive Logistics

Automotive Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 197.63 Billion |

| Market Size by 2028 | US$ 306.12 Billion |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Key Player Analysis:

The automotive logistics market analysis consists of the players such as CEVA Logistics AG; DB Schenker; DSV A/S; DHL International GmbH (Deutsche Post DHL Group); GEODIS; Kuehne + Nagel Management AG; Nippon Express Co., Ltd.; Ryder System, Inc.; XPO Logistics, Inc.; and United Parcel Service of America, Inc. Among the players in the automotive logistics CEVA Logistics AG and Nippon Express Co., Ltd. are the top two players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the automotive logistics market. A few recent key market developments are listed below:

- In 2023, The State of Michigan has secured $13m in funding to develop a new charging hub for electric vehicle (EV) freight trucks, in partnership with Daimler Truck North America and DTE Energy.

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For