Blockchain Market Overview and Growth by 2028

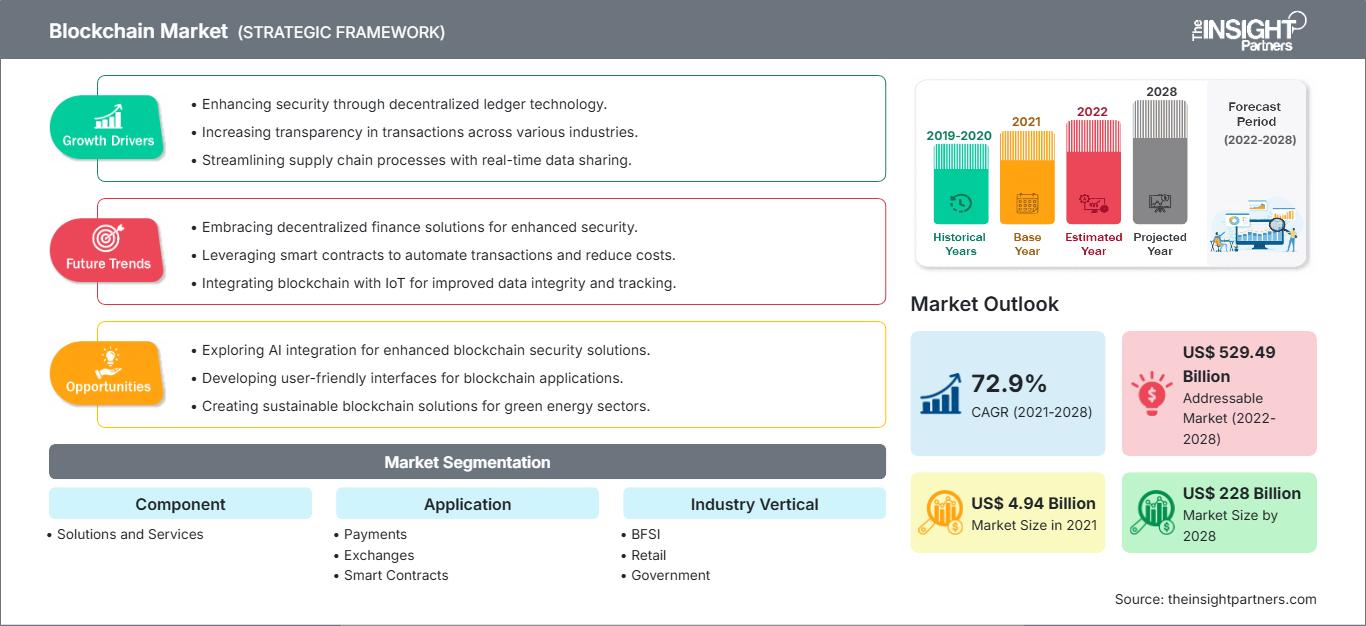

Blockchain Market Forecast to 2028 - Analysis By Component (Solutions and Services), Application (Payments, Exchanges, Smart Contracts, Documentation, Digital Identity, Governance, Risk and Compliance, and Others), and Industry Vertical (BFSI, Retail, Government, Transportation and Logistics, Healthcare, Automotive, Media and Entertainment, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Jan 2022

- Report Code : TIPTE100002172

- Category : Banking, Financial Services, and Insurance

- Status : Published

- Available Report Formats :

- No. of Pages : 190

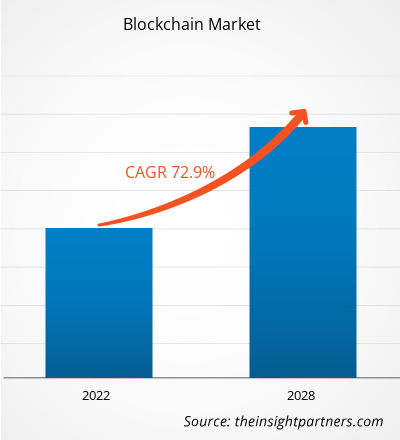

The blockchain market is expected to grow from US$ 4,935.0 million in 2021 to US$ 227,996.6 million by 2028; it is estimated to grow at a CAGR of 72.9% from 2021 to 2028.

Blockchain technology and its applications in the banking, financial services, and insurance (BFSI) sector have attracted a lot of attention in the past few years, majorly due to its ability to transform existing industries' foundations and business models. Presently, apart from cryptocurrency applications, the other major practical applications of Blockchain are still in the banking and financial sector; however, various companies and institutions are now rapidly developing Blockchain-based solutions to solve complex business problems. In general terms, Blockchain is a subset of a broader distributed ledger technology (DLT), and it combines three significant concepts – cryptography, smart contracts, and distributed ledger design. Distributed ledger technology (DLT) is a fast-emerging approach that records and shares data across various data stores/ledgers. DLT facilitates the recording, sharing, and synchronization of transactions and data across a distributed network of different network participants.

The global Blockchain market is anticipated to exhibit very high growth in the near future. Major driving factors contributing to the market growth include extensive adoption of Blockchain solutions in the BFSI sector; advantages such as higher transparency, higher operational efficiency, and substantial cost savings; and an increase in the number of innovative startups. During the forecast period, trends such as rising government support and initiatives and a combination of Blockchain and artificial intelligence for advanced applications are expected to provide exciting opportunities for the players operating in the Blockchain market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBlockchain Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Blockchain Market

While the COVID-19 pandemic has posed significant issues for organizations worldwide, the Blockchain market has grown steadily during the crisis. Most crucially, throughout the epidemic, healthcare workers have moved to use chats, emails, phones, and video conversations to treat patients remotely, preventing the virus from spreading. The use of penetration testing tools for safe online transactions and conversational data increased due to this. The adoption of the Blockchain market by various firms to give optimal security during a chaotic environment is also a crucial element driving the Blockchain market vertical. The COVID-19 pandemic has impacted all aspects of society, including individuals and corporations. The internet ecosystem has become increasingly important globally. The reliance on online enterprises has expanded dramatically due to the COVID-19 outbreak. The internet is being used by BFSI, healthcare and life sciences, manufacturing, retail, transportation and logistics, and other industries to provide critical services to consumers. The demand for a Blockchain has surged among vendors. Various governments and regulatory agencies have forced both public and private organizations to accept new techniques of teleworking and preserving social distance in the wake of the COVID-19 pandemic. Since then, digital business practices and the use of emails on home servers have become the new business continuity plan (BCP) for a variety of enterprises.Blockchain Market Insights

Leading industries worldwide—including banking, financial services, and insurance (BFSI); retail; logistics and transportation; healthcare; automotive; media and entertainment; and public sector organizations—are increasingly integrating disruptive technologies such as blockchain, artificial intelligence (AI), the Internet of Things (IoT), big data, and predictive analytics into their operations. Among these, blockchain has emerged as a transformative force, gaining widespread adoption due to its proven ability to deliver greater transparency, enhance operational efficiency, and reduce transactional and administrative costs. The accelerating adoption of blockchain is underpinned by a growing number of successful deployments and pilot programs that demonstrate real-world benefits. Enterprises face mounting pressure to maintain competitiveness in a rapidly evolving digital economy, and blockchain offers a decentralized, secure, and tamper-resistant infrastructure that supports this imperative. Moreover, businesses are recognizing the strategic value of blockchain as it enables more agile, data-driven operations and fosters trust among stakeholders.

In the financial services sector, blockchain has found extensive application across areas such as cross-border payments, capital markets, trade finance, investment and wealth management, and securities clearing and settlement. Its ability to streamline and automate traditionally manual, time-intensive processes reduces reliance on intermediaries, significantly lowers processing times, and minimizes the risk of errors and fraud. Moreover, organizations handling sensitive data—such as healthcare and government—leverage blockchain to ensure data integrity and secure information sharing. By offering immutable audit trails and real-time data access, blockchain enhances regulatory compliance and fosters confidence among all participants in any market ecosystem.

The reduction of operational costs remains a central goal for enterprises worldwide. Blockchain contributes to this objective by optimizing workflow efficiencies and eliminating redundant verification processes. As businesses continue to pursue digital transformation strategies, blockchain is positioned as a key enabler of innovation. It facilitates improved customer experiences through faster services, better data accuracy, and enhanced accountability, positioning it as a long-term asset for business resilience and scalability.

Component Segment Insights

Based on component, the blockchain market can be bifurcated into services and solution. The solution segment led the blockchain market. The increasing adoption of blockchain solutions due to their capacity to provide more transparency in financial transaction management in bitcoin, as well as increasing digitization, is propelling the blockchain market forward. Customers can use the market's blockchain platform to create private, public, and consortium-based blockchain environments and construct their own blockchain applications and solutions. People, products, apps, and services can interact across the blockchain network, cloud providers, and enterprises using these platforms.Blockchain

Blockchain Market Regional InsightsThe regional trends and factors influencing the Blockchain Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Blockchain Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Blockchain Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.94 Billion |

| Market Size by 2028 | US$ 228 Billion |

| Global CAGR (2021 - 2028) | 72.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Blockchain Market Players Density: Understanding Its Impact on Business Dynamics

The Blockchain Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Application Segment Insights

The global blockchain market is segmented into payments, exchanges, smart contracts, documentation, digital identity, governance, risk & compliance, and others. The payment segment led the blockchain market. The others segment includes digital voting, ride-sharing, advertising, and many others. Blockchain reduces cost, increases security, increases transparency, and decreases transaction time while reducing the need for a trusted third party. Blockchain handles a varying set of rules and configurations. An application such as smart contracts, can greatly improve process efficiency, reliability, transparency, and reduce risk. The prospective uses of blockchain are varied and wide, and the technology is becoming more prevailing.

Industry Vertical Type Segment Insights

Blockchain is a distributed ledger capable of automatically verifying and recording a high volume of digital transactions, regardless of location. As startups use blockchain technology to drive greater transparency across the digital information network, they are increasing the awareness of blockchain technology in various sectors. Based on industry vertical, the global Blockchain market is categorized into BFSI, retail, government, transportation & logistics, healthcare, automotive, media & entertainment, and others. The others segment includes manufacturing, real estate, power and utilities, telecom, and sports.The Blockchain market players focus on new product innovations and developments by integrating advanced technologies and features to compete. For instance, in 2019, Carrefour and Nestle Partnered with IBM to use blockchain technology in food categories. The partnership would enable a rapid expansion of a blockchain-based network that brings more transparency to the global food supply chain of retailers, growers, wholesalers, processors, distributors, and manufacturers.

Blockchain Market – Company Profiles

IBM Corporation, Microsoft Corporation, Accenture, Amazon, SAP Se, Hewlett Packard Enterprise Development LP (HPE), Oracle Corporation, Intel Corporation, Ripple, Bitfury Group

Frequently Asked Questions

High Transparency and Operational Efficiency with Substantial Cost Savings

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For