Mobile Phone Insurance Market Size, Trends & Forecast 2034

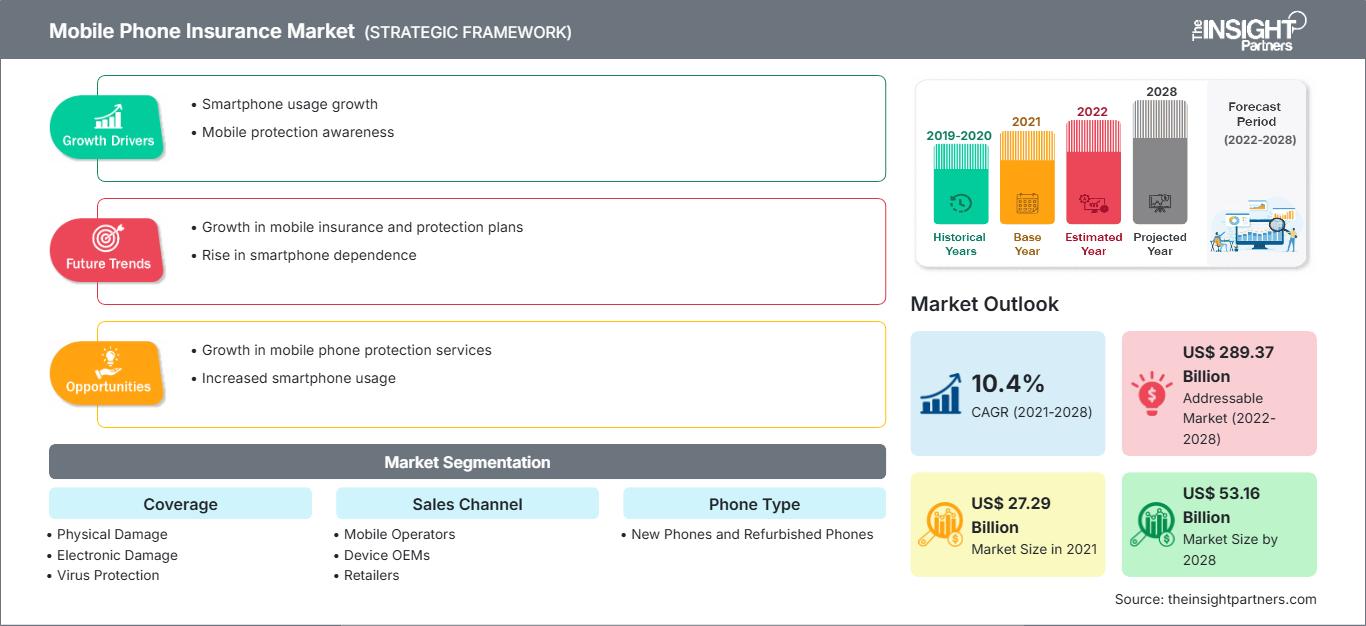

Mobile Phone Insurance Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Coverage (Physical Damage, Electronic Damage, Virus Protection, and Theft Protection), Sales Channel (Mobile Operators, Device OEMs, Retailers, and Others), Phone Type (New Phones and Refurbished Phones), and End User (Corporate and Personal)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPTE100000940

- Category : Banking, Financial Services, and Insurance

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

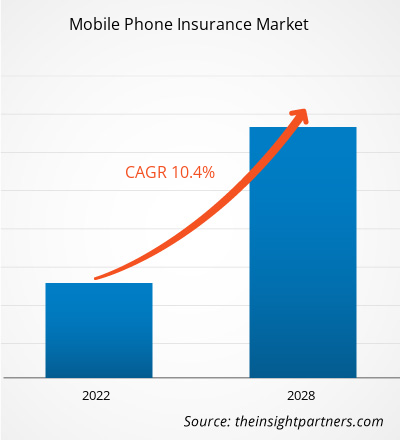

The mobile phone insurance market size is expected to reach US$88.43 billion by 2034 from US$46.12 billion in 2025. The market is anticipated to register a CAGR of 8.48% during 2026–2034.

Mobile Phone Insurance Market Analysis

The mobile phone insurance market forecast indicates steady growth, driven by the rising adoption of premium smartphones, increasing repair and replacement costs, and the surge in accidental damage and theft incidents. Digital distribution channels, insurtech partnerships, and bundling strategies with mobile operators and OEMs support the market expansion. Additionally, technological advancements such as AI-driven claims processing, app-based policy management, and integration of value-added services like data protection and cybersecurity further accelerate market growth. Emerging opportunities include coverage for refurbished devices, microinsurance models for developing markets, and blockchain-enabled claim verification systems.

Mobile Phone Insurance Market Overview

Mobile phone insurance provides financial protection against risks such as physical damage, theft, electronic malfunction, and virus attacks. These policies are offered through multiple channels, including mobile operators, device OEMs, retailers, and online platforms. The market has gained prominence due to the rising cost of smartphones, frequent accidental damage, and growing consumer awareness about device protection. With the proliferation of premium devices and increasing smartphone penetration in emerging economies, mobile phone insurance has become a critical component of the digital lifestyle. The shift toward online distribution and app-based claims management is reshaping the industry, making policies more accessible and customizable.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMobile Phone Insurance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mobile Phone Insurance Market Drivers and Opportunities

Market Drivers

- High-Cost Device Adoption and Repair Expenses: The global surge in premium smartphone adoption, featuring advanced technologies like foldable screens, high-resolution cameras, and 5G connectivity, has significantly increased the cost of ownership. Repairing or replacing these devices often involves expenses that can exceed 30–50% of the device's original price. This economic burden is compelling consumers to opt for insurance coverage as a preventive measure. Additionally, the growing popularity of flagship models from brands such as Apple, Samsung, and Google has amplified the need for comprehensive protection plans, especially in regions with high disposable incomes.

- Rising Incidents of Theft and Accidental Damage: Mobile phones have become indispensable, leading to increased exposure to risks such as accidental drops, liquid damage, and theft. Urban areas and densely populated regions report higher theft rates, while accidental damage remains the most common claim category globally. For instance, cracked screens and water damage account for over 60% of insurance claims. This trend is further fueled by the fact that consumers are retaining devices for longer periods, increasing the likelihood of damage over time. Consequently, insurers are designing policies that cover multiple risk factors, including loss, theft, and accidental damage, to meet evolving consumer needs.

- Digital Distribution and Insurtech Integration: The insurance industry is undergoing a digital transformation, with mobile phone insurance increasingly sold through online platforms and integrated into e-commerce and telecom ecosystems. Insurtech innovations such as AI-driven claims processing, automated fraud detection, and app-based policy management have streamlined the customer experience, reducing claim settlement times from weeks to hours. This convenience, combined with the ability to purchase policies instantly during device checkout, is driving adoption across both developed and emerging markets. Partnerships between insurers, telecom operators, and device OEMs further strengthen distribution networks and enhance customer trust.

Market Opportunities

- Bundling of Value-Added Services: Insurers are moving beyond basic coverage to offer bundled services that enhance customer value and retention. These include cloud storage for data backup, identity theft protection, cybersecurity features, and device diagnostics. Such offerings not only differentiate providers in a competitive market but also create recurring revenue streams. For example, integrating antivirus protection and privacy tools into mobile insurance plans appeals to consumers concerned about digital security, especially in regions with rising cybercrime rates.

- Coverage for Premium and Refurbished Devices: While premium smartphones dominate the insurance landscape, refurbished devices represent a rapidly growing segment, particularly in price-sensitive markets. Consumers purchasing refurbished phones seek affordable protection plans that cover both hardware and software issues. Insurers that develop flexible, tiered coverage options for these segments can tap into a large, underserved customer base. Additionally, the rise of subscription-based device ownership models creates opportunities for insurers to offer bundled monthly protection plans aligned with consumer payment preferences.

- Expansion in Emerging Markets: Asia Pacific, Latin America, and Africa present significant growth potential due to increasing smartphone penetration, rising disposable incomes, and government-led financial inclusion initiatives. In these regions, microinsurance models, offering low-cost, short-term coverage, are gaining traction among first-time smartphone users. Localization of policies to support regional languages, payment methods, and cultural preferences will be critical for success. Furthermore, partnerships with local telecom operators and fintech platforms can accelerate market entry and build trust among consumers unfamiliar with traditional insurance products.

Mobile Phone Insurance Market Report Segmentation Analysis

By Coverage:

- Physical Damage

- Electronic Damage

- Virus Protection

- Theft Protection

By Sales Channel:

- Mobile Operators

- Device OEMs

- Retailers

- Others

By Phone Type:

- New Phones

- Refurbished Phones

By End User:

- Corporate

- Personal

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Mobile Phone Insurance Market Regional Insights

The regional trends and factors influencing the Mobile Phone Insurance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Mobile Phone Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Mobile Phone Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 46.12 Billion |

| Market Size by 2034 | US$ 88.43 Billion |

| Global CAGR (2026 - 2034) | 8.48% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Coverage

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Mobile Phone Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Mobile Phone Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Mobile Phone Insurance Market top key players overview

Mobile Phone Insurance Market Share Analysis by Geography

North America

- Market Share: Holds the largest share (~35–38%) due to advanced digital infrastructure and high smartphone penetration.

- Key Drivers:

- High adoption of premium smartphones

- Strong carrier and OEM bundling strategies

- Frequent accidental damage and theft incidents

- Trends: AI-driven claims automation, app-based policy management, and integration of cybersecurity features.

Europe

- Market Share: Significant share driven by regulatory compliance and high device costs.

- Key Drivers:

- GDPR-compliant data handling

- Strong presence of telecom operators offering bundled insurance

- Increasing demand for multi-device coverage

- Trends: Standardized disclosures, privacy-focused add-ons, and growth in refurbished device coverage.

Asia Pacific

- Market Share: Fastest-growing region due to smartphone boom and digital adoption.

- Key Drivers:

- Rising smartphone penetration

- Government-led financial inclusion programs

- Growth of online insurance platforms

- Trends: Mobile-first insurance models, partnerships with super-apps, and microinsurance offerings.

Central & South America

- Market Share: Emerging region with strong growth potential.

- Key Drivers:

- Increasing smartphone adoption

- High theft rates in urban areas

- Expansion of carrier-led insurance programs

- Trends: Localization of policies, flexible payment options, and integration with mobile wallets.

Middle East & Africa

- Market Share: Developing market with rising demand.

- Key Drivers:

- Growing smartphone usage

- Government initiatives for digital security

- Expansion of fintech ecosystems

- Trends: App-based claims, low-cost microinsurance, and blockchain-enabled fraud prevention.

Mobile Phone Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The market is highly fragmented, with global and regional players competing on pricing, coverage options, and digital capabilities. Differentiation strategies include:

- AI-powered claims processing

- Bundled services with carriers and OEMs

- Value-added features like cybersecurity and identity protection

- Blockchain-based fraud prevention

Opportunities and Strategic Moves:

- Partnerships with telecom operators and e-commerce platforms

- Expansion into emerging markets with localized offerings

- Integration of insurtech solutions for seamless digital experiences

Major Companies Operating in the Mobile Phone Insurance Market Are:

- American International Group, Inc.

- Allianz SE

- Apple Inc.

- AT&T Inc.

- Aviva Insurance Limited

- Better Buy Insurance

- Gadget Cover

- Insurance2go

- Telefónica Limited

Disclaimer: The companies listed above are not ranked in any particular order.

Mobile Phone Insurance Market News and Recent Developments

- In July 2025, Apple announced AppleCare One, a new Mobile Phone Insurance plan that allowed customers to cover multiple Apple products under one simple subscription. For US$19.99 per month, customers could protect up to three devices in a single plan, with the option to add more at any time for US$5.99 per month per device. With AppleCare One, customers received one-stop service and support from Apple experts across all covered products, ensuring simple and affordable peace of mind. Starting the following day, customers in the U.S. were able to sign up for AppleCare One directly on their iPhone, iPad, or Mac, or by visiting their nearest Apple Store.

- In September 2025, Allianz Commercial reported 2025 that the cyber risk and insurance landscape had become increasingly complex and dynamic. Large insured companies had strengthened their cybersecurity measures and improved preparedness and response capabilities, which helped mitigate the impact of major cyber losses during the year. However, reliance on digital supply chains, expanding privacy regulations, and sophisticated social engineering attacks targeting employees had broadened the scope of potential losses for all businesses. These developments also influenced Allianz's Mobile Phone Insurance offerings, prompting the integration of enhanced cyber protection features to safeguard mobile devices against emerging digital threats.

Mobile Phone Insurance Market Report Coverage and Deliverables

The "Mobile Phone Insurance Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Mobile Phone Insurance Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Mobile Phone Insurance Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Mobile Phone Insurance Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Mobile Phone Insurance Market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For