Insurance Third-Party Administrator Market Size and Growth 2031

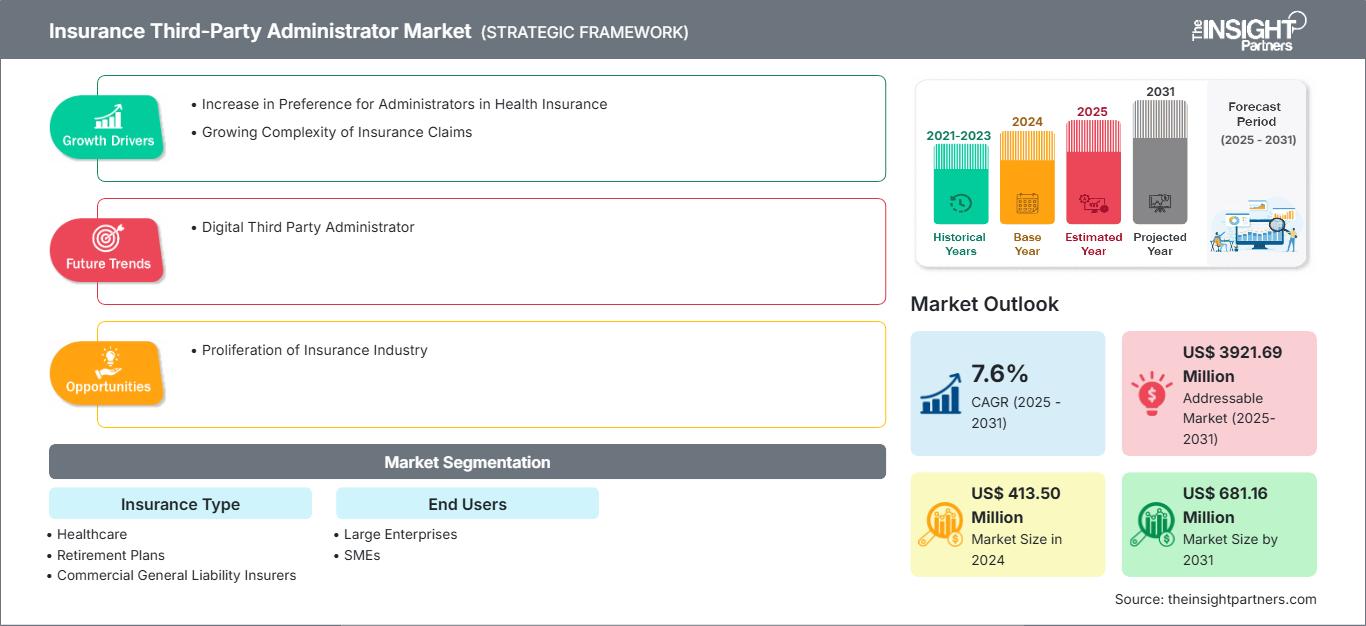

Insurance Third-Party Administrator Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: by Insurance Type (Healthcare, Retirement Plans, Commercial General Liability Insurers, and Other Insurance Types), End Users (Large Enterprises and SMEs), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Jul 2025

- Report Code : TIPRE00039066

- Category : Banking, Financial Services, and Insurance

- Status : Published

- Available Report Formats :

- No. of Pages : 168

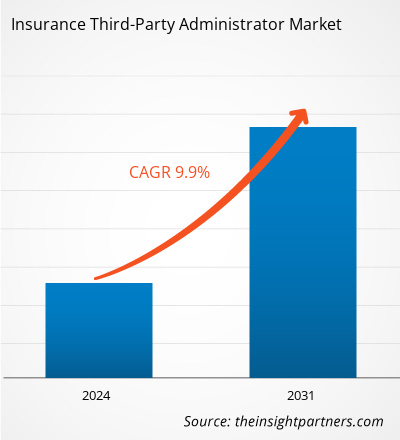

The Insurance Third-Party Administrator market size is projected to reach US$ 681.16 million by 2031 from US$ 413.50 million in 2024. The market is expected to register a CAGR of 7.6% during 2025–2031. The digital third-party administrator is likely to bring new trends into the market in the coming years.

Insurance Third-Party Administrator Market Analysis

A third-party administrator handles administrative and operational tasks associated with an insurance plan. Administrative duties include processing claims, enrolling consumers, and collecting premiums, while adhering to federal rules. Third-party administrator do not create the policies of health insurance plans, but help guarantee their implementation. A single third-party administrator may work with multiple insurers, while third-party administrators are typically linked with health insurance; they are employed in a wide range of other segments of the insurance industry. Commercial liability insurers and retirement plan administrators frequently hire third-party administrators to serve as claims adjusters or customer service representatives. Third-party administrator companies can be major multinational corporations, while individuals having third-party administrator certification can also work as independent contractors.

Insurance Third-Party Administrator Market Overview

The insurance claim process can be complex and time-consuming. In such cases, a third-party administrator can help policyholders claim benefits. The administrator guides policyholders throughout the claim procedure and files claims on their behalf. Once a claim is filed, the third-party administrator investigates and verifies it. Moreover, insurers can customize their agreements with third-party administrator based on their specific needs. These services also provide health benefits reporting and analytics, adjudicating claims, customer service for plan members, healthcare provider network access, detailed healthcare expense reporting, and collaborations with brokers and health insurance consultants.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONInsurance Third-Party Administrator Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Insurance Third-Party Administrator Market Drivers and Opportunities

Growing Complexity of Insurance Claims

Claims management in insurance refers to the systematic process of handling and settling insurance claims filed by policyholders. Claim commencement, appraisal, adjustment, and final settlement are typical stages in the claim process. Each level is critical, necessitating precise documentation and discussions with insurance companies. This involves handling the initial claim filing through to the payout or denial. Insurance claim settlement is required to ensure that policyholders receive the compensation and other benefits they are entitled to. Business owners struggle to negotiate insurance claims due to multiple insurance policies. Moreover, a large number of individuals suffer delays, arguments, and denial in the claim process. Investigators are hired to evaluate complex claims involving big losses or alleged fraud. The claims process can be difficult as it requires extensive documentation, communication with insurance adjusters, and adherence to specific dates. A thorough documentation of the claim includes gathering evidence, witness statements, and other pertinent details.

Proliferation of Insurance Industry

The value of insurance products such as life, health, and property insurance plans is growing with the rise in discretionary income. The awareness of the possibility of financial loss due to unforeseen circumstances such as illness, accidents, or natural catastrophes is growing. As a result, individuals, businesses, and other entities seek insurance policies to safeguard themselves from the repercussions, which fuels the demand for insurance solutions that can assist in managing these risks. According to the Federal Insurance Office (FIO), the US had 667 licensed L&H insurers, 2,656 P&C insurers, and 1,355 health insurers in 2022. According to the India Brand Equity Foundation (IBEF), the insurance industry is one of the premium segments seeing significant expansion in India. This upward trend in the insurance sector can be ascribed to rising revenues and increased awareness of the profession. India has the sixth-largest life insurance market among emerging economies, growing at 32–34% per year. The industry has experienced vigorous competition among rival businesses. Moreover, the insurance sector faces numerous constraints, including highly dynamic regulatory complications, which present organizations with considerable threats to financial and operational stability. Thus, the ongoing proliferation of the insurance industry is creating opportunities for the growth of the insurance third-party administrator market in the coming years.

Insurance Third-Party Administrator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Insurance Third-Party Administrator market analysis are insurance type and end users.

- Based on type, the market is segmented into healthcare, retirement plans, commercial general liability insurance, and others. The healthcare segment held the largest share in the insurance third party administrator market in 2024.

- In terms of end user, the market is bifurcated into large enterprises and small and medium-sized enterprises. The large enterprises segment held a larger share in the Insurance Third-Party Administrator market in 2024.

Insurance Third-Party Administrator Market Share Analysis by Geography

The geographic scope of the Insurance Third-Party Administrator market report is divided into five regions: North America, Asia Pacific, Europe, Middle East and Africa, and South and Central America.

Europe held a significant market share in 2024. The insurance third-party administrator market in Europe is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. Global macroeconomic uncertainties and cost pressure on insurance carriers across the UK and the European Union have led to unfavorable economic conditions in Europe. Therefore, insurers focus on cutting down discretionary spending to save costs. However, they are inclined toward embracing digital transformation and outsourcing practices to gain long-term benefits. According to Everest Group Life and Annuities Insurance BPS and PEAK Matrix Assessment 2023, insurance companies opting to outsource their tasks create huge opportunities for the insurance third-party administrators operating in Europe. Moreover, insurance carriers are widely adopting end-to-end solutions to cater to changing customer preferences and satisfaction.

In January 2021, bolttech (a fast-growing InsurTech company) partnered with Drei Austria for its device protection services after the launch of its first mobile device insurance program, Direkt-Schutz, in Europe. This expansion followed the successful launch of bolttech’s innovative device protection switch solutions in Italy, Austria, and Ireland. Direkt-Schutz was introduced into the Austrian market as a result of bolttech’s appointment as an accredited third-party administrator to AIG, a leading global insurer. This milestone established a robust platform for bolttech’s growing business to provide similar insurance offerings across Europe.

Insurance Third-Party Administrator Market Regional InsightsThe regional trends and factors influencing the Insurance Third-Party Administrator Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Insurance Third-Party Administrator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Insurance Third-Party Administrator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 413.50 Million |

| Market Size by 2031 | US$ 681.16 Million |

| Global CAGR (2025 - 2031) | 7.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Insurance Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Insurance Third-Party Administrator Market Players Density: Understanding Its Impact on Business Dynamics

The Insurance Third-Party Administrator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Insurance Third-Party Administrator Market top key players overview

Insurance Third-Party Administrator Market News and Recent Developments

The Insurance Third-Party Administrator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Insurance Third-Party Administrator market are listed below:

- Sedgwick announced a strategic investment from Altas Partners. Current investors, including funds managed by global investment firm Carlyle (NASDAQ: CG) and Stone Point Capital LLC, will remain as investors and continue to make significant new investments in the business. Carlyle will maintain its control position in partnership with the investor group and the Sedgwick management team. (Source: Sedgwick, Press Release, September 2024)

- ExlService Holdings, Inc. announced an alliance to deliver property and casualty claims and digital TPA services to insurers, including an enhanced, modern claims servicing experience. The alliance enables EXL clients in the US market to access the digital-first claims TPA offering and a full team of licensed desk adjusters from Xceedance to enrich policyholder service delivery. (Source: ExlService Holdings, Inc., Press Release, July 2024)

Insurance Third-Party Administrator Market Report Coverage and Deliverables

The "Insurance Third-Party Administrator Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Insurance third-party administrator market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Insurance Third-Party Administrator market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Insurance Third-Party Administrator market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Insurance Third-Party Administrator market

- Detailed company profiles

Frequently Asked Questions

2. Worker compensation continues steady growth (~4.6–10% CAGR)

3. Travel and SME insurance are rising in emerging markets .

Sedgwick, Crawford and Company, CorVel Corp., United Healthcare Services LLC, Helmsman Management Services, LLC, Charles Tayler, ExlService Holdings, Inc., Gallagher Bassett Services LLC, and Meritain Health, Inc., and many region-specific specialists

2. Fraud detection demand, using AI/ML analytics

3. Digital transformation, including cloud, AI, and automation

4. Growing insurance penetration and rising healthcare costs

2. Tightening regulatory compliance, like GDPR and health privacy laws

3. Fee pressures necessitating adoption of AI and automation

2. AI/ML-powered analytics—fastest-growing tech segment (~12.3% CAGR) .

3. Emerging blockchain pilots for secure, automated claims

2. Asia-Pacific growing rapidly (~7–7.2% CAGR)

3. Europe, South America, and MEA also show steady growth

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For