Blood Transfusion Diagnostics Market Key Players and Opportunities by 2028

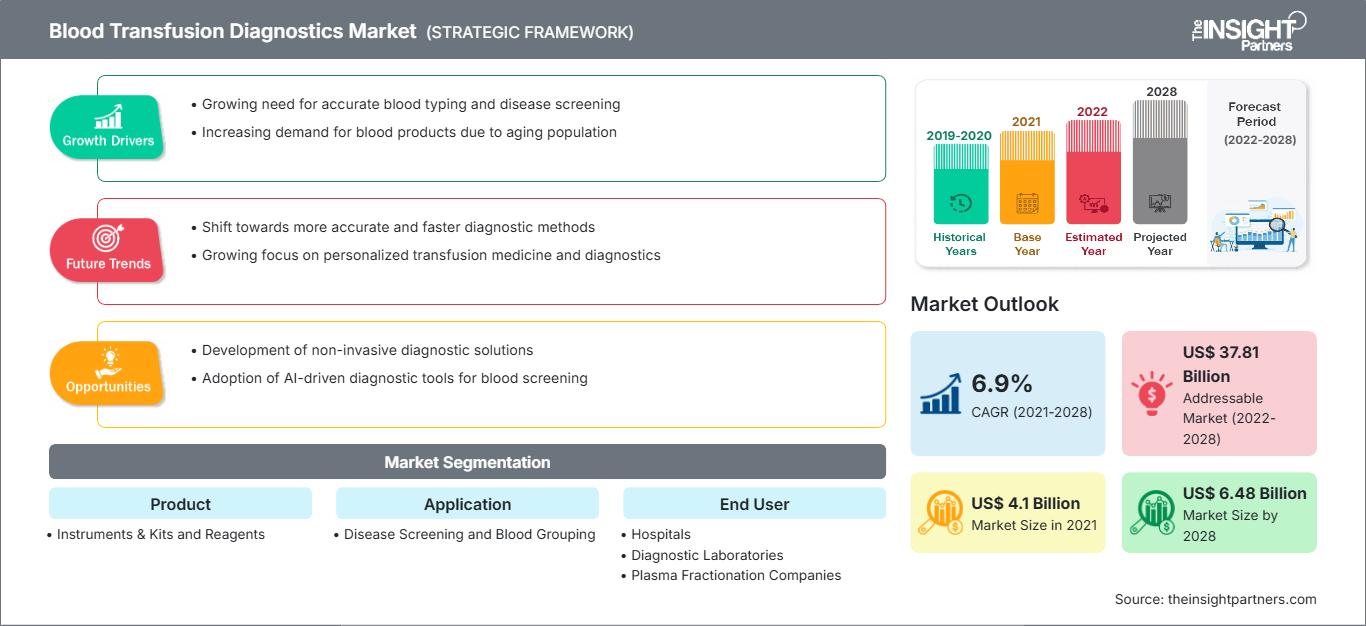

Blood Transfusion Diagnostics Market Forecast to 2028 - Analysis By Product (Instruments & Kits and Reagents), Application (Disease Screening and Blood Grouping), and End User (Hospitals, Diagnostic Laboratories, and Plasma Fractionation Companies)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Status : Published

- Report Code : TIPRE00005176

- Category : Life Sciences

- No. of Pages : 183

- Available Report Formats :

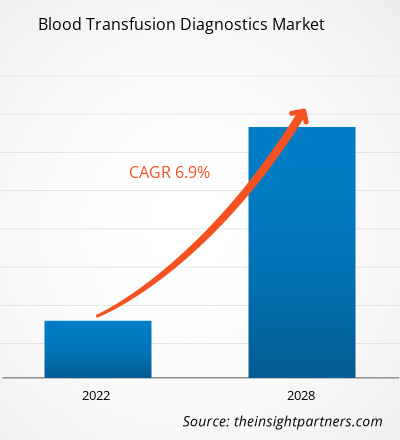

[Research Report] The blood transfusion diagnostics market is expected to grow from US$ 4,096.93 million in 2021 to US$ 6,483.75 million by 2028. It is estimated to grow at a CAGR of 6.9% from 2022 to 2028.

Blood transfusion diagnostics are tests performed on blood before they are transfused to patients. A blood transfusion is a common procedure in which the donated blood or its components are transfused into the patient’s body through an intravenous route of administration. Each unit of blood must undergo blood typing, which refers to identification of blood type and blood screening, including disease detection tests to avoid side effects or transmission of infection.

The report offers insights and in-depth analysis of the global blood transfusion diagnostics market, emphasizing various parameters, including market trends, technological advancements, market dynamics, and competitive landscape analysis of global leading market players. It also includes the impact of the COVID-19 pandemic on the market across all regions. The COVID-19 pandemic negatively impacted the global blood transfusion diagnostics market growth. It showcased a huge decline in revenue due to stringent restrictions imposed by the government resulting in decreasing number of surgical procedures performed. These services are mainly used in surgeries with high blood loss, such as orthopedic and cardiac surgeries. Due to decreasing number of surgeries performed, the demand for blood transfusion has reduced. For Instance: According to the data published by American Medical Association, it was estimated that there was a 48% reduction in total surgical procedures performed in the US due to the COVID-19 pandemic. However, after the pandemic restrictions normalized, the volume of surgical procedures returned to normal levels.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBlood Transfusion Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Geography-Based Insights

By geography, the global blood transfusion diagnostics market is segmented into North America (the US, Canada, and Mexico), Europe (France, Germany, the UK, Spain, Italy, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and the Rest of APAC), the Middle East & Africa (Saudi Arabia, the UAE, South Africa, and the Rest of the MEA), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Market Insights

Need for Blood Transfusion due to Rise in Organ Transplants Surgeries

Organ transplant is a surgical procedure performed in case of organ failure. Usually, organ transplant surgeries are conducted for the heart, liver, kidney, and various other organs due to the rising cases of chronic diseases, such as chronic kidney disease (CKD), polycystic kidney disease, cystic fibrosis, and congenital heart disease, which require transplants. These procedures generally take hours, and there is a lot of blood loss and requires the need for blood transfusion. For instance, according to the United Network for Organ Sharing (UNOS), organ transplants conducted in the US have continuously increased, with over 41,000 transplants performed in 2021. Similarly, according to World Transplant Registry data, Spain accounted for 20% of all organ donations in Europe in 2019 and 6% worldwide. Australia's organ donor rate has improved recently, rising to 21.8 donors per million population in 2019.

Similarly, Canada has 22.2 donors per million population and is steadily improving, partially attributed to the "Donation Physicians" figure—intensive care doctors responsible for organ donation. According to the World Transplant Registry, China had 5,818 donors in 2019, or 4.1 per million population, and India had 715 donors, or 0.5 per million population in 2019. On the other hand, Russia had a slightly higher rate of 5.1 donors per million people. The public-private partnership, in collaboration with transplant coordinators, has significantly contributed to the improvement of organ transplants requiring constant blood transfusion. Both developing and developed countries have seen an increase in organ transplant surgeries. For example, developing countries, such as India and Singapore, are emerging as medical tourism destinations in Asia Pacific. Countries are progressing in terms of providing better and advanced medical treatments. The rising need for organ transplants is among the key factors driving the demand for blood transfusion diagnostics worldwide.

Product-Based Insights

Based on product, the global blood transfusion diagnostics market is bifurcated into instruments & kits and reagents. In 2021, the instruments & kits segment accounted for a larger market share. The same segment is expected to register a higher CAGR in the market from 2022 to 2028.

Application-Based Insights

Based on application, the global blood transfusion diagnostics market is bifurcated into disease screening and blood grouping. The disease screening segment held a larger market share in 2021 and is expected to register a higher CAGR during the forecast period.

Blood Transfusion Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.1 Billion |

| Market Size by 2028 | US$ 6.48 Billion |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Blood Transfusion Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Blood Transfusion Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

End User-Based Insights

Based on end user, the global blood transfusion diagnostics market is segmented into blood banks, hospitals, diagnostic laboratories, and plasma fractionation companies. The blood banks segment held the largest market share in 2021. The same segment is expected to register the highest CAGR in the market from 2022 to 2028.

The global blood transfusion diagnostics market players take up organic strategies, including product launch and expansion, to expand their footprint and product portfolio worldwide and meet the growing demand. The key players in the market are Grifols, S.A.; F. Hoffmann-La Roche Ltd; Immucor, Inc.; Bio-Rad Laboratories, Inc.; Abbott; Thermo Fisher Scientific Inc.; Ortho Clinical Diagnostics; DiaSorin S.p.A.; Quotient Limited; and BAG Diagnostics GmbH.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For