GMP Cell Therapy Consumables Market Insights & Growth 2034

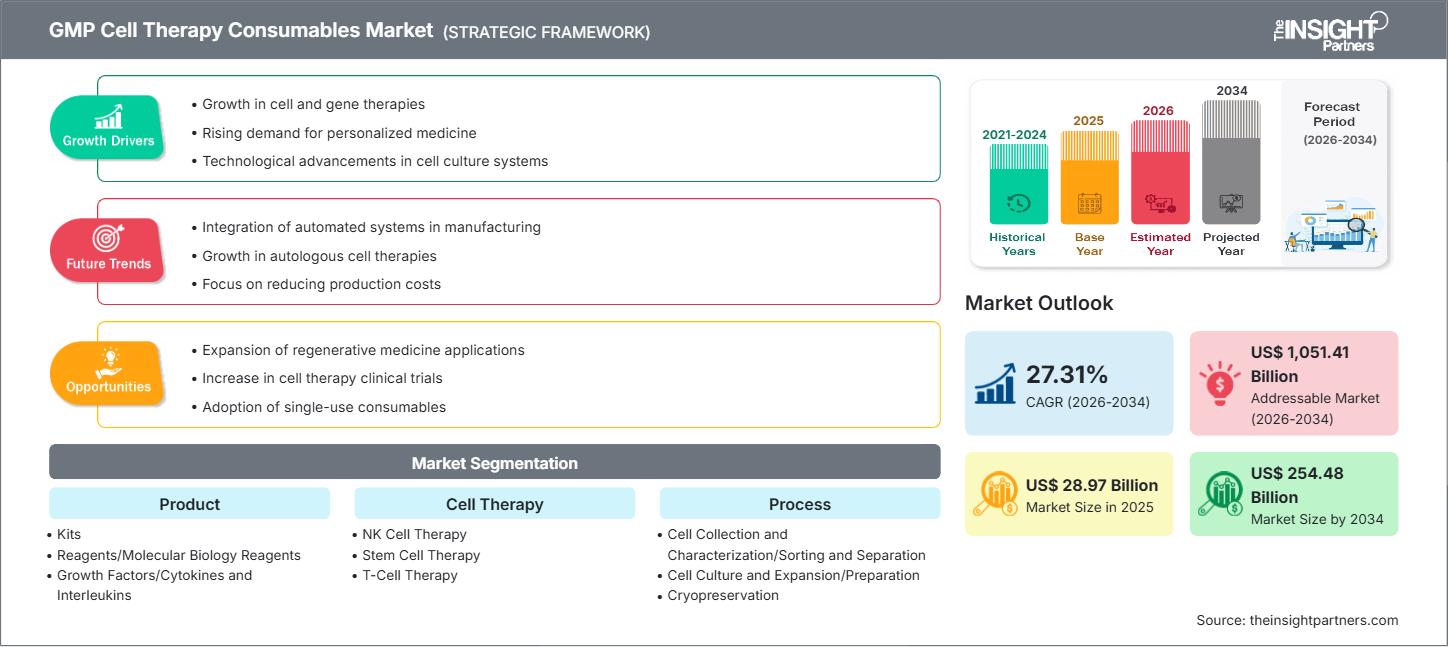

GMP Cell Therapy Consumables Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Kits, Reagents/Molecular Biology Reagents, Growth Factors/Cytokines and Interleukins); Cell Therapy (NK Cell Therapy, Stem Cell Therapy, T-Cell Therapy); Process (Cell Collection and Characterization/Sorting and Separation, Cell Culture and Expansion/Preparation, Cryopreservation, Cell Processing and Formulation, Cell Isolation and Activation, Cell Distribution/Handling, Process Monitoring and Control/Readministration/Quality Assurance); End User (Clinical, Commercial, Research); and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00029780

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

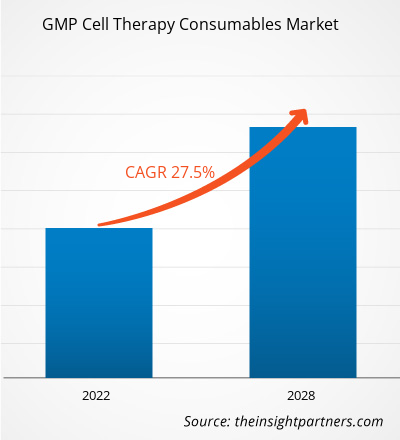

The GMP cell therapy consumables market size is expected to reach US$ 254.48 billion by 2034 from US$ 28.97 billion in 2025. The market is anticipated to register a CAGR of 27.31% during 2026–2034.

GMP Cell Therapy Consumables Market Analysis

The GMP Cell Therapy Consumables market is experiencing exponential growth, primarily driven by the rapid expansion of the cell and gene therapy sector and the subsequent need for high-quality, regulatory-compliant materials. Good Manufacturing Practice (GMP) consumables, such as specialized media, reagents, and single-use systems, are critical for maintaining the safety, purity, and efficacy of cell-based therapies throughout manufacturing and clinical trials. The market is benefiting from increasing investment in cellular research and development, a rising number of clinical trials for therapies like CAR-T, stem cell, and gene therapies, and the growing demand for personalized and regenerative medicine. Technological advancements, including the adoption of closed-system and automated manufacturing platforms, are further accelerating the demand for compatible GMP consumables.

GMP Cell Therapy Consumables Market Overview

The implementation of Good Manufacturing Practices (GMP) in cell therapy is essential for ensuring the safety and quality of therapeutic products. GMP cell therapy consumables are the single-use tools, reagents, and media that are manufactured under strict quality control standards to meet regulatory requirements. These consumables play a pivotal role in every stage of the cell therapy workflow, from cell isolation and expansion to cryopreservation and final formulation. The shift toward closed, automated manufacturing systems is a significant trend, as it minimizes human intervention, reduces the risk of contamination, and increases process reproducibility and scalability, all critical factors for commercial-scale production. The market is also seeing a greater focus on standardized, traceable raw materials as more therapies move toward late-stage clinical trials and commercialization.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGMP Cell Therapy Consumables Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

GMP Cell Therapy Consumables Market Drivers and Opportunities

Market Drivers:

- Growing Cell and Gene Therapy Pipeline: A significant increase in the number of cell therapy candidates entering clinical trials, particularly in oncology and regenerative medicine, directly drives the demand for GMP-grade consumables.

- Need for Regulatory Compliance and Standardization: Strict global regulatory bodies mandate the use of GMP-compliant materials to ensure product quality, patient safety, and traceability, pushing manufacturers toward certified consumables.

- Increasing Prevalence of Chronic and Genetic Diseases: The rising incidence of conditions like cancer, cardiovascular diseases, and neurological disorders is accelerating R&D and investment in innovative cell-based treatments, thereby boosting the consumables market.

Market Opportunities:

- Adoption of Single-Use and Closed-System Technologies: The shift toward disposable, closed-system consumables offers major opportunities by reducing cleaning validation, minimizing contamination risks, and improving manufacturing scalability.

- Development of Specialized, Defined Media: High-growth opportunity in customized, serum-free, and xeno-free cell culture media and supplements that optimize the expansion of specific cell types while meeting ethical and regulatory standards.

- Expansion into Emerging Markets and CDMOs: Growth in developing regions and the increasing reliance of biotech firms on Contract Development and Manufacturing Organizations (CDMOs) for scalable production create new avenues for consumable suppliers.

GMP Cell Therapy Consumables Market Report Segmentation Analysis

The GMP Cell Therapy Consumables market is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends.

By Product:

- Kits

- Reagents/Molecular Biology Reagents

- Growth Factors/Cytokines and Interleukins

By Cell Therapy:

- NK Cell Therapy

- Stem Cell Therapy

- T-Cell Therapy

By Process:

- Cell Collection and Characterization/Sorting and Separation

- Cell Culture and Expansion/Preparation

- Cryopreservation

- Cell Processing and Formulation

- Cell Isolation and Activation

- Cell Distribution/Handling

- Process Monitoring and Control/Readministration/Quality Assurance

By End User:

- Clinical

- Commercial

- Research

By Geography:

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

The regional trends and factors influencing the GMP Cell Therapy Consumables Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses GMP Cell Therapy Consumables Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

GMP Cell Therapy Consumables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 28.97 Billion |

| Market Size by 2034 | US$ 254.48 Billion |

| Global CAGR (2026 - 2034) | 27.31% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

GMP Cell Therapy Consumables Market Players Density: Understanding Its Impact on Business Dynamics

The GMP Cell Therapy Consumables Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the GMP Cell Therapy Consumables Market top key players overview

GMP Cell Therapy Consumables Market Share Analysis by Geography

North America dominated the GMP Cell Therapy Consumables market. The region’s dominance is driven by its robust healthcare infrastructure, the presence of major biotech and pharmaceutical companies, significant R&D investment, and a well-established, advanced regulatory framework for cell and gene therapies.

The Asia-Pacific region is anticipated to be the fastest-growing regional market. This growth is fueled by increasing government support for biotech R&D, rising investments in healthcare infrastructure, and the expansion of the biopharmaceutical industry in countries like China, Japan, and India.

Below is a summary of market share and trends by region:

North America

- Market Share: Holds the highest market share, driven by the concentration of cell therapy manufacturing and clinical trials, particularly in the U.S.

- Key Drivers: High R&D spending, strong regulatory support for novel therapies, and the presence of leading CDMOs and biotech firms.

- Trends: Rapid adoption of automated, closed manufacturing systems and high demand for customized GMP-grade media and single-use bioreactors.

Europe

- Market Share: Significant market share, supported by established pharmaceutical and biotech industries.

- Key Drivers: Government-backed initiatives to accelerate cell and gene therapy development (ATMPs), and a focus on standardizing raw material sourcing across member states.

- Trends: Increasing focus on decentralized manufacturing models and compliance with strict EU quality and traceability standards for therapeutic products.

Asia Pacific

- Market Share: Fastest-growing regional market.

- Key Drivers: Rising investments in healthcare infrastructure, a large patient pool, and supportive government policies for the domestic biopharmaceutical sector.

- Trends: Emergence of localized manufacturing hubs, increasing demand for affordable, scalable GMP solutions, and a growing number of clinical trials in countries like China and South Korea.

South and Central America

- Market Share: Emerging region with nascent but growing cell therapy activity.

- Key Drivers: Gradual modernization of healthcare and increasing awareness and clinical interest in regenerative medicine.

- Trends: Reliance on international suppliers for GMP consumables, with future growth tied to local investment in bioprocessing infrastructure.

Middle East and Africa

- Market Share: Emerging market with high growth potential, led by digital transformation initiatives in the UAE and Saudi Arabia.

- Key Drivers: Major national digital and AI strategies fostering innovation in life sciences, and increasing integration of advanced healthcare systems.

- Trends: Initial investments focused on setting up basic cell therapy research and clinical capabilities, driving demand for essential, high-quality GMP consumables.

GMP Cell Therapy Consumables Market Players Density: Understanding Its Impact on Business Dynamics

The GMP Cell Therapy Consumables market is moderately consolidated, featuring a mix of large, diversified life science and technology companies alongside niche players specializing in specific consumables like cell culture media or cryopreservation solutions. Competition is primarily focused on product quality, regulatory compliance, supply chain reliability, and customization capabilities.

The competitive landscape is driving vendors to differentiate through:

- Companies are launching consumables fully integrated with automated platforms to reduce contamination risks and improve consistency in large-scale GMP production.

- Vendors are expanding their offerings of defined, xeno-free media and specialized reagents for new cell types (e.g., NK cells, iPSCs) to support a broader pipeline of therapies.

- Ensuring a robust and traceable supply chain is a critical competitive advantage, especially for consumables that require strict cold-chain management.

Opportunities and Strategic Moves

- Strategic Partnerships: Collaborations between consumable manufacturers and CDMOs/Therapy Developers are crucial for co-developing customized consumables that meet specific process requirements and regulatory needs.

- Mergers and Acquisitions (M&A): Larger players are acquiring specialized startups to rapidly integrate innovative technologies (e.g., advanced cryopreservation or novel cell separation tools) into their GMP portfolio.

- Geographic Expansion: Establishing localized manufacturing and distribution hubs, particularly in the high-growth Asia-Pacific region, to ensure timely supply and reduce logistics costs for global customers.

Major Companies Operating in the GMP Cell Therapy Consumables Market Are:

- Sartorius AG

- Thermo Fisher Scientific Inc

- Miltenyi Biotec BV & Co KG

- Bio-Techne Corp

- Corning Inc

- FUJIFILM Irvine Scientific Inc

- Lonza Group AG

- BPS Bioscience Inc

- Merck KGaA

Disclaimer: The companies listed above are not ranked in any particular order.

GMP Cell Therapy Consumables Market News and Recent Developments

- On September 18, 2025, Sartorius expands production of key components for cell and gene therapies in France.

- On January 08, 2025, Bio-Techne Corporation announced it will showcase its new ProPak™ GMP cytokines, alongside its portfolio of innovative products and solutions supporting cell and gene therapy development and manufacturing

GMP Cell Therapy Consumables Market Report Coverage and Deliverables

The "GMP Cell Therapy Consumables Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- GMP Cell Therapy Consumables Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- GMP Cell Therapy Consumables Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- GMP Cell Therapy Consumables Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the GMP Cell Therapy Consumables Market. Detailed company profiles.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For