Cloud Infrastructure Entitlements Management (CIEM) Market Growth and Recent Trends by 2031

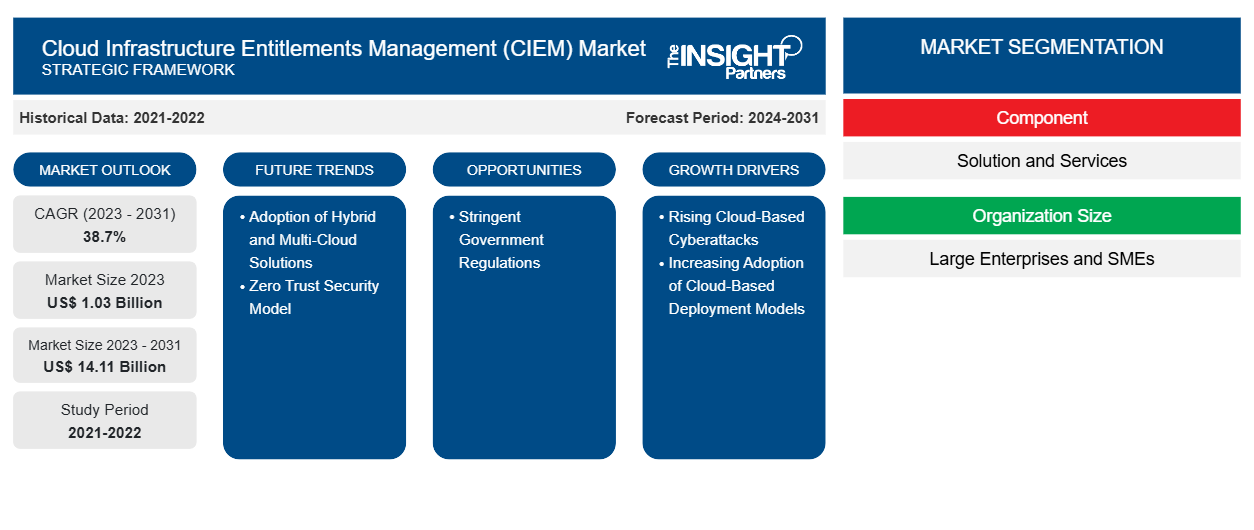

Cloud Infrastructure Entitlements Management (CIEM) Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Organization Size (Large Enterprises and SMEs), and End User (IT & Telecom, Healthcare, BFSI, Manufacturing, Retail & E-commerce, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Aug 2024

- Report Code : TIPRE00039034

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 183

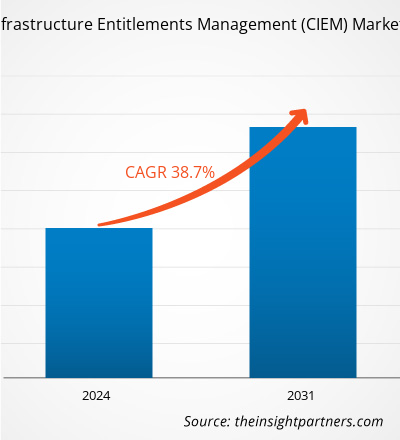

The cloud infrastructure entitlements management (CIEM) market size is expected to reach US$ 14.11 billion by 2031 from US$ 1.03 billion in 2023. The market is estimated to record a CAGR of 38.7% during 2023–2031. are likely to bring new trends to the market.

Cloud Infrastructure Entitlements Management (CIEM) Market Analysis

The need for cloud infrastructure entitlements management (CIEM) is being driven by the growing necessity for enterprises to enhance their cloud security. The increasing use of cloud solutions and services, digital transformation projects, and an increased number of cloud-based cyberattacks are a few of the factors driving the market. The COVID-19 pandemic caused many firms to switch from on-premise to cloud computing, which led to the cloud infrastructure entitlements management (CIEM) market expansion. The report includes growth prospects owing to the current cloud infrastructure entitlements management (CIEM) market trends and their foreseeable impact during the forecast period.

Cloud Infrastructure Entitlements Management (CIEM) Market Overview

Cloud infrastructure entitlements management (CIEM), or cloud entitlements management solutions or cloud permissions management solutions, is a cloud security solution that mitigates the risk of data breaches in public cloud environments. Cloud infrastructure entitlements management solutions are specifically developed to manage privilege tightly and consistently in complex and dynamic environments. Cloud infrastructure entitlements management solutions continuously monitor the permissions and activity of entities to prevent excessive entitlements. The main functions of CIEM are entitlement visibility, rightsizing permissions, advanced analytics, and compliance.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCloud Infrastructure Entitlements Management (CIEM) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cloud Infrastructure Entitlements Management (CIEM) Market Drivers and Opportunities

Rising Cloud-Based Cyberattacks

The adoption of cloud computing has gained massive traction in recent years with key players such as Amazon, Google, and Microsoft. Cloud computing has altered how enterprises use, store, and share data and information. However, anything that operates digitally will inevitably become a target of cyber actors. The shift of organizations toward cloud computing has created new avenues for cybercriminals to exploit vulnerabilities, compromise data, and wreak havoc on organizations of all sizes. Data stored in the cloud environment is more vulnerable than data on on-site servers. Misconfiguration, compromised user accounts, API vulnerabilities, malicious insider activity, and others are among the major causes of cloud computing cyberattacks. In recent years, the number of attacks on cloud platforms has increased rapidly. Cloud-based cyberattacks accounted for 20% of all cyberattacks in 2020, making cloud-based platforms the third most-targeted cyber environment. In January 2020, Microsoft announced that one of its cloud databases was breached in December 2019, which resulted in the exposure of 250 million entries, including email addresses, IP addresses, and support case details. Cloud infrastructure entitlement management (CIEM) is an automated cloud security solution that mitigates the risk of data breaches in public cloud environments by implementing cloud security. Thus, the rise in cloud-based cyberattacks propels the cloud infrastructure entitlements management market growth.

Stringent Government Regulations

Various industry and government regulations require businesses to adhere to strict security controls. In such a scenario, cloud infrastructure entitlements management is a crucial aspect of an organization's cybersecurity strategy. In industries such as healthcare, finance, and government that handle sensitive data, organizations of all sizes must comply with complex regulations such as GDPR, HIPAA, PCI-DSS, and SOX to protect the sensitive data of consumers and businesses. Failure to comply with these regulations can lead to heavy fines and damage to the organization's reputation. For instance, the General Data Protection Regulation (GDPR), established in 2018, imposes fines ranging up to US$ 21.68 million (EUR 20 million) or 4% of the company's global annual revenue, whichever is higher. Similarly, the Health Insurance Portability and Accountability Act (HIPAA) violations fines can range up to US$ 1.5 million per violation. The Securities and Exchange Commission (SEC) imposes fines from tens of thousands to millions of dollars. The Occupational Safety and Health Administration (OSHA) violations fines can range up to US$ 134,937 per violation, whereas the Foreign Corrupt Practices Act (FCPA) violations can require a fine of a total of US$ 25 million or more. The Environmental Protection Agency (EPA) can fine up to US$ 50,000 per day per violation. Companies worldwide have faced huge fines due to the violation of these regulations. For instance, according to a survey of 500 organizations worldwide by Kaspersky, the average loss of a company from a violation is US$ 551,000, of which the average loss of small and medium-sized companies from a violation is US$ 38,000. Thus, organizations are required to implement cloud infrastructure entitlements management solutions to comply with stringent government regulations such as PCI DSS, CCPA, HIPAA, SOX, and GDPR, providing lucrative opportunities for market growth.

Cloud Infrastructure Entitlements Management (CIEM) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cloud infrastructure entitlements management (CIEM) market analysis are component, organization size, end user, and geography.

- Based on component, the market is bifurcated into solution and services. The solution segment dominated the market in 2023.

- In terms of organization size, the market is divided into large enterprises and SMEs. The large enterprises segment dominated the market in 2023.

- Based on end user, the market is segmented into IT & telecom, healthcare, manufacturing, BFSI, retail & e-commerce, and others. The IT & telecom segment held a larger share of the market in 2023.

Cloud Infrastructure Entitlements Management (CIEM) Market Share Analysis by Geography

The cloud infrastructure entitlements management (CIEM) market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

North America is one of the fastest-growing regions in terms of both technological innovations and the adoption of advanced technologies. The region's expanding IT infrastructure and the accelerated shift to cloud services necessitate advanced security measures. In 2023, North America held the largest market share in the cloud infrastructure entitlements management (CIEM) market. The increasing prevalence of mobile services and the rising number of security breaches linked to identity and privileged access abuse contribute to the adoption of CIEM solutions in the region. CIEM solutions in North America aim to manage identities and privileges in cloud environments. They aim to understand the access entitlements that exist across cloud and multi-cloud environments and then identify and mitigate the risk from entitlements.

Cloud Infrastructure Entitlements Management (CIEM)

Cloud Infrastructure Entitlements Management (CIEM) Market Regional Insights

The regional trends and factors influencing the Cloud Infrastructure Entitlements Management (CIEM) Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cloud Infrastructure Entitlements Management (CIEM) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Cloud Infrastructure Entitlements Management (CIEM) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.03 Billion |

| Market Size by 2031 | US$ 14.11 Billion |

| Global CAGR (2023 - 2031) | 38.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cloud Infrastructure Entitlements Management (CIEM) Market Players Density: Understanding Its Impact on Business Dynamics

The Cloud Infrastructure Entitlements Management (CIEM) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Cloud Infrastructure Entitlements Management (CIEM) Market News and Recent Developments

The cloud infrastructure entitlements management (CIEM) market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the cloud infrastructure entitlements management (CIEM) market are listed below:

- Lacework announced the launch of cloud entitlement management capability to its cloud-native application protection platform (CNAPP). With this new set of capabilities, organizations can enforce the principle of least privilege when building, deploying, using, and managing cloud infrastructure services. (Source: Lacework, Press Release, June 2023)

- Tenable announced the acquisition of Ermetic, Ltd. Under this acquisition, Tenable and Ermetic will help organizations address a few of the difficult challenges in cybersecurity. (Source: Tenable, Press Release, October 2023)

- Uptycs announced the launch of cloud infrastructure entitlement management (CIEM) capabilities that strengthen its cloud security posture management (CSPM) offering. In addition, Uptycs announced CSPM support for Google Cloud Platform (GCP) and Microsoft Azure, as well as PCI compliance coverage. These new capabilities provide security and governance, risk, and compliance teams with continuous monitoring of cloud services, identities, and entitlements in order to reduce their cloud attack risk. (Source: Uptycs, Press Release, May 2022)

Cloud Infrastructure Entitlements Management (CIEM) Market Report Coverage and Deliverables

The "Cloud Infrastructure Entitlements Management (CIEM) Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Cloud infrastructure entitlements management (CIEM) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cloud infrastructure entitlements management (CIEM) market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cloud infrastructure entitlements management (CIEM) market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the cloud infrastructure entitlements management (CIEM) market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For