Maritime Analytics Market 2025-2031: Size, Share, Growth Trends and Forecast

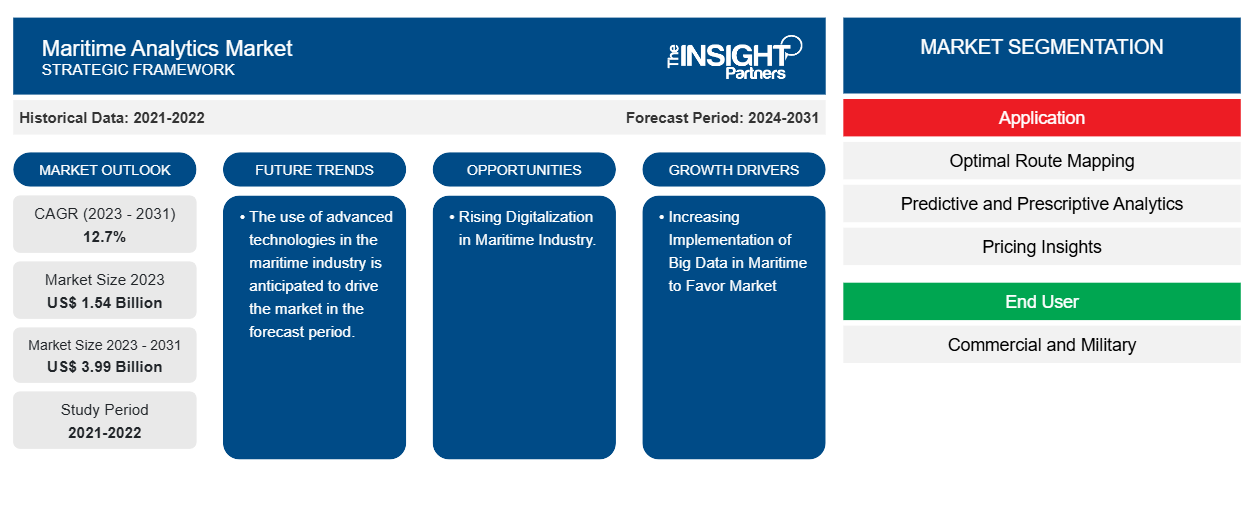

Maritime Analytics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software and Services), Deployment (Cloud and On-Premises), Application (Predictive and Prescriptive Analytics, Optimal Route Mapping, Pricing Insights, Vessel Safety and Security, and Others), End User (Commercial and Military), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Apr 2025

- Report Code : TIPRE00003041

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 227

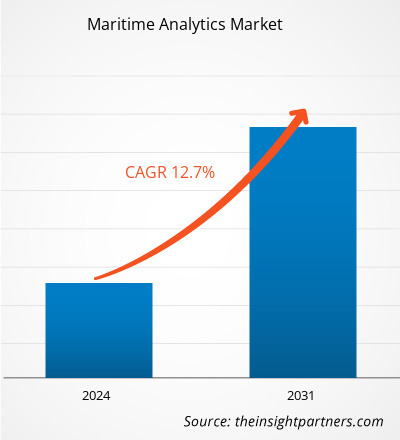

The maritime analytics market size was valued at US$ 1.27 billion in 2024 and is expected to reach US$ 2.56 billion by 2031; it is estimated to record a CAGR of 10.6% from 2025 to 2031. Integration of AI and ML with maritime analytics software is likely to remain a key market trend.

Maritime Analytics Market Analysis

One of the key benefits of maritime analytics is its ability to help companies comply with stringent environmental regulations. It can assist in monitoring emissions, optimizing fuel usage, and ensuring compliance with international environmental standards, such as the International Maritime Organization's (IMO) regulations on carbon emissions. Among the primary drivers contributing to the adoption of maritime analytics is the need for operational optimization. It helps companies streamline processes such as fleet management, route optimization, fuel consumption, and maintenance scheduling. By leveraging real-time data, businesses can make data-driven decisions to reduce fuel usage, improve fleet performance, and lower operational costs, contributing to more efficient and profitable operations. The rapid advancements in artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and cloud computing fuel the growth of the maritime analytics market. These technologies enable the collection, processing, and analysis of vast amounts of data from ships, ports, and supply chains, offering businesses the tools to improve decision-making, predict trends, and enhance overall operational performance.

Maritime Analytics Market Overview

Maritime analytics refers to the use of advanced data analytics, AI, and ML technologies to optimize and enhance operations within the maritime industry. The process involves collecting, processing, and analyzing vast amounts of data generated by ships, ports, and other maritime assets to improve decision-making, streamline processes, and drive efficiencies. Maritime analytics provides shipping companies, logistics providers, and port authorities with actionable insights that can reduce operational costs, improve safety, and increase overall efficiency. These analytical tools can track vessel performance, monitor fuel consumption, optimize shipping routes, predict maintenance needs, and enhance crew management. By leveraging real-time data, maritime analytics allows companies to proactively address potential issues such as equipment failures, route inefficiencies, or safety risks, thereby reducing downtime and increasing profitability.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMaritime Analytics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Maritime Analytics Market Drivers and Opportunities

Increasing Maritime Logistics and Digitization

As global trade continues its upward trajectory, the maritime industry is under increasing pressure to deliver enhanced efficiency, sustainability, and real-time operational transparency. Maritime analytics has emerged as a pivotal enabler in addressing these challenges by offering actionable, data-driven insights that streamline shipping operations, optimize fleet management, and drive significant cost efficiencies. According to the United Nations Conference on Trade and Development (UNCTAD), global maritime trade witnessed a 2.4% growth in 2023, reaching 12.3 billion tons—a notable recovery following the contraction experienced in 2022. Projections indicate that the sector will sustain growth, expanding from an estimated 2% in 2024 to an average annual growth rate of 2.4% through 2029.

To capitalize on this expanding market and strengthen maritime transportation, logistics, and supply chain infrastructure, major industry players are making substantial investments. In a landmark announcement in March 2025, CMA CGM Group—a global leader in maritime, land, air, and logistics services and owner of the US flag carrier American President Lines (APL)—revealed plans to invest US$ 20 billion over the next four years. This strategic capital injection aims to fortify the U.S. maritime economy and facilitate the transformation of America’s domestic supply chain. Building on a 35-year presence in the US, CMA CGM currently operates across 40 states, employing approximately 15,000 personnel nationwide. The Group is a vital partner in U.S. trade, managing the transport of over five million shipping containers annually to and from the country.

Digital transformation is accelerating within the maritime sector, with data analytics and advanced digital technologies reshaping vessel operations, maintenance, and overall supply chain management. These innovations are instrumental in enhancing operational reliability, extending asset lifecycles, and reducing operational expenditures. The adoption of automation, Internet of Things (IoT), and artificial intelligence (AI)-driven platforms is enabling maritime operators to gain unprecedented visibility into fleet performance and logistics workflows, thereby optimizing decision-making processes and elevating service quality. Moreover, digitalization is a critical catalyst for the industry’s sustainability agenda, particularly in advancing decarbonization objectives. The maritime sector is committed to achieving net-zero greenhouse gas emissions in international shipping by 2050. Collaborative initiatives like the March 2025 Letter of Intent (LoI) signed between India and Singapore underscore this commitment, focusing on maritime digitalization and decarbonization efforts. This partnership aims to identify key stakeholders and formalize a framework through a memorandum of understanding to develop the Singapore-India Green and Digital Shipping Corridor (GDSC), which will serve as a model for sustainable and technologically advanced maritime trade routes. The convergence of rising trade volumes, increasing demand for operational efficiency, and a robust push toward environmental sustainability are collectively driving robust growth in the maritime analytics market. Companies are leveraging advanced analytics to optimize route planning, fuel consumption, and predictive maintenance, thereby enhancing profitability while aligning with global regulatory standards. Looking ahead, the maritime analytics market is poised for significant expansion fueled by continuous investments in digital infrastructure, the proliferation of smart shipping technologies, and strategic partnerships aimed at creating greener and more efficient maritime ecosystems. As stakeholders across the value chain prioritize innovation and sustainability, maritime analytics will remain indispensable in shaping the future of global trade logistics.

Regulatory Compliance and Sustainability Initiatives

Regulatory bodies have implemented proactive measures to reduce the environmental footprint ofmaritime transport. For example, the International Maritime Organization (IMO) introduced the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII) to enforce stricter environmental standards. Effective January 1, 2023, these initiatives aim for a 50% reduction in greenhouse gas (GHG) emissions from ships by 2050, based on 2008 levels. The EEXI and CII set benchmarks to measure carbon dioxide emissions per ton of cargo transported per nautical mile. Additionally, the European Union's 'Fit for 55' program targets a 55% reduction in GHG emissions by 2030 compared to 1990 levels.

As governments and international organizations are implementing stringent emission reduction targets and sustainability regulations, shipping companies are turning to advanced analytics solutions to ensure compliance. These analytics tools enable companies to monitor and manage their environmental impact, track emission levels, optimize fuel usage, and improve fleet sustainability. By adopting these solutions, firms can meet current and future regulations while simultaneously advancing their corporate social responsibility (CSR) objectives. This increasing demand for sustainability and compliance-driven solutions creates a strong market opportunity for providers of maritime analytics technologies as shipping companies focus on enhancing operational efficiency and reducing their environmental footprint.

Maritime Analytics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the maritime analytics market analysis are component, deployment mode, application, and end user.

- Based on component, the market is bifurcated into software and services. The software segment dominated the market in 2024.

- By deployment mode, the market is bifurcated into on-premises and cloud. The cloud segment dominated the market in 2024.

- In terms of application, the market is divided into optimal route mapping, predictive and prescriptive analytics, pricing insights, vessel safety and security, and others. The predictive and prescriptive analytics segment dominated the market in 2024.

- Based on end user, the market is bifurcated into commercial and military. The commercial segment dominated the market in 2024.

Maritime Analytics Market Share Analysis by Geography

The maritime analytics market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023, followed by Europe and North America.

In the North American region, the US is known for its advanced port infrastructure and robust maritime sector, largely driven by the country's reliance on imported goods industries. Based on the US Maritime Shipping Import-Export Trade Data for 2023, the US has a total trade volume of US$ 5.21 trillion, with a trade deficit of US$ 1.19 trillion. The outsourcing of manufacturing and production to Asian economies has strengthened this dependency. The US maritime industry depends on specialized technical solutions and services to ensure the efficient operation, maintenance, and growth of its infrastructure. The availability of financial support, coupled with the early adoption of advanced technological solutions, has accelerated the uptake of maritime analytics software among US businesses. This shift has resulted in the widespread adoption of modern tools focused on predictive maintenance, route optimization, security, and risk management within the maritime sector, creating opportunities for market players. In November 2024, Kpler, a data and analytics platform for seaborne trade intelligence, signed an agreement to acquire Spire Maritime, a provider of satellite-powered data for real-time global vessel tracking, from Spire Global. The deal, valued at US$ 241 million, includes a US$ 233.5 million purchase price and an additional US$ 7.5 million for services over 12 months following the closure. This acquisition underscores the growing demand for maritime analytics in the region.

Maritime Analytics Market Regional InsightsThe regional trends and factors influencing the Maritime Analytics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Maritime Analytics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Maritime Analytics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1.27 Billion |

| Market Size by 2031 | US$ 2.56 Billion |

| Global CAGR (2025 - 2031) | 10.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Maritime Analytics Market Players Density: Understanding Its Impact on Business Dynamics

The Maritime Analytics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Maritime Analytics Market top key players overview

Maritime Analytics Market News and Recent Developments

The maritime analytics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the maritime analytics market are listed below:

- Maritech Holdings Limited brand Sea migrated all customers from the latest acquisitions of Chinsay and MarDocs onto the Sea contract management solution. In doing so, Sea reached an important milestone in its ambition to create a consolidated platform for managing and concluding recaps and charter parties, benefiting all participants across the global maritime trade ecosystem.(Source: Maritech Holdings Limited, Press Release, June 2025)

- Windward unveiled its groundbreaking Critical Maritime Infrastructure Protection solution. This AI-powered innovation is specifically designed to safeguard crucial global maritime infrastructure, including cables, pipelines, and rigs, from escalating security threats.(Source: Windward, Press Release, February 2025)

Maritime Analytics Market Report Coverage and Deliverables

The "Maritime Analytics Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Maritime analytics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Maritime analytics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Maritime analytics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the maritime analytics market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For