Corn and Wheat-Based Feed Market Growth and Analysis by 2030

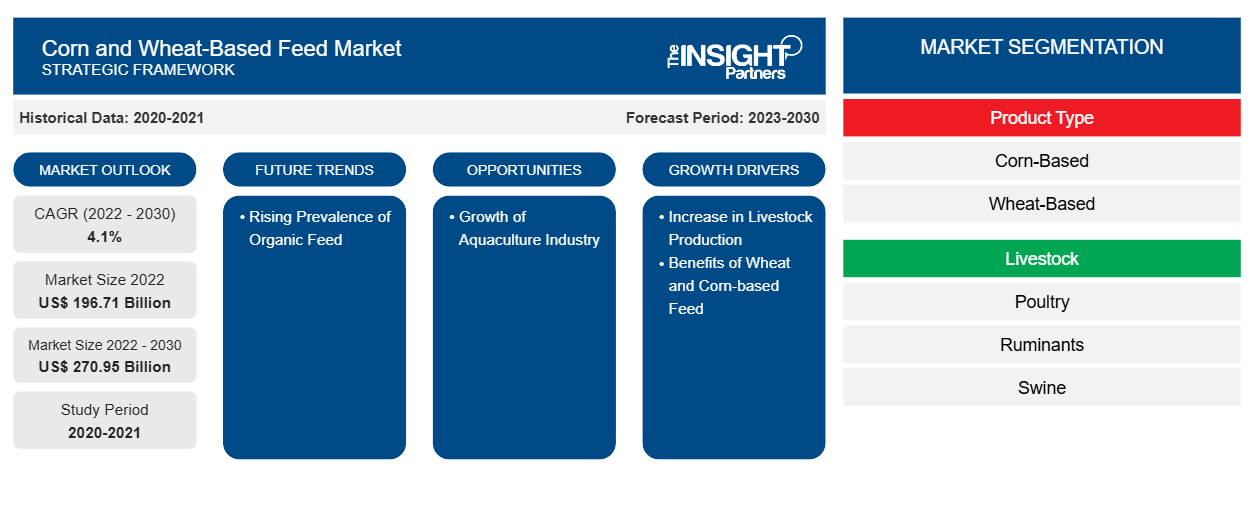

Corn and Wheat-Based Feed Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Corn-Based (Corn Gluten Meal, Corn Gluten Feed, and Other Corn-Based Feed) and Wheat-Based (Wheat Gluten, Wheat Bran, and Other Wheat-Based Feed)], Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Mar 2024

- Report Code : TIPRE00039014

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 157

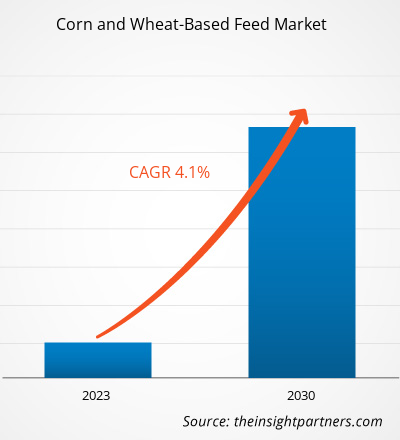

[Research Report] The corn and wheat-based feed market size is projected to grow from US$ 196.71 billion in 2022 to US$ 270.95 billion by 2030; it is expected to register a CAGR of 4.1% during 2022–2030. The report highlights key factors driving the market growth and prominent players along with their developments in the market.

MARKET ANALYSIS

Corn and wheat-based feed products include corn gluten meal, corn gluten feed, whole corn kernels, corn distillers grains, wheat gluten, wheat bran, wheat pollard, wheat distillers grains, and other products. In terms of revenue, corn gluten meal held a significant share of the corn and wheat-based feed market in 2022. Corn gluten meal is the byproduct of ethanol and corn starch manufacturing process. It is one of the significant sources of energy and protein for livestock animals, including aquatic animals, supplying more than 65% of the crude protein. In manufacturing corn starch, the corn kernels are cleaned, and the foreign materials are removed. The kernels are steeped in water containing sulfur dioxide for 24–40 hours at 48 to 52 ℃, which weakens the gluten matrix. After steeping, the corn kernels are coarsely ground to separate the endosperm to obtain corn germ oil. The endosperm undergoes further screening that separates fiber from gluten and starch slurry. The fiber-free endosperm undergoes centrifugation, which separates starch from gluten, resulting in 99% pure corn starch and corn gluten meal. Corn gluten meal is available as dry and wet feed. Due to its high-protein and low-fiber content, corn gluten meal is widely replacing fishmeal in aquatic animals’ diets. The rising demand for corn gluten meal in livestock feed due to high energy and protein content drives the market growth. Further, rising preference for organic corn and wheat-based feed is one of the emerging corn and wheat-based feed market trends owing to the rising popularity of organic feed over conventional feed as organic feed is free from pesticides, chemical fertilizers, and genetically modified organisms (GMOs).

GROWTH DRIVERS AND CHALLENGES

Corn and wheat are considered important protein and energy sources in animal feed. Corn-based feed is a high-energy food that provides animals with essential nutrients such as protein, fats, and carbohydrates. The feed is easily digestible. Corn fibers help reduce the cholesterol level and enhance the digestive health of animals. It is a major source of Vitamin A. Owing to the mentioned benefits, corn-based feed improves meat quality and aids milk production among cows and sheep.

Wheat is one of the cereals used to make animal feed with the highest protein content. Wheat has a high energy value with 3.0 to 3.5 Mcal ME (Megacalories of Metabolizable Energy), considered an important energy source in animal feed. Wheat-based feed is mainly used for polygastric animals such as ruminants. Wheat bran is an important source of minerals such as selenium, zinc, iodine, and potassium, which helps in multiple physiological functions such as the immune system. Wheat has a large amount of fiber that facilitates animal digestive processes. Further, wheat has moisture values below 14%; it aids in avoiding problems related to digestibility and contamination by mycotoxin-producing fungi. Such nutritional benefits influence livestock owners to prefer corn and wheat-based feed to maintain or enhance the health of animals. Thus, the benefits associated with corn and wheat-based feed boost the corn and wheat-based feed market growth.

On the other hand, the price sensitivity among livestock owners negatively impacts the demand for corn and wheat-based feed products as the prices can fluctuate according to the weather conditions. The prices of wheat have fluctuated in 2021 due to the adverse weather conditions in the wheat producing countries. For instance, droughts in Canada have affected part of the wheat production, and the rainy season in France affected wheat production. China is a major importer of wheat. In September 2021, China reduced imports compared to the same period last year, owing to the high prices recorded. Additionally, Brazil and Argentina—two major corn and wheat producing countries—have decreased their wheat production capacity due to unfavorable weather conditions. Thus, challenges associated with the production of wheat and corn hamper the corn and wheat-based feed market growth worldwide. Also, the fluctuating raw material prices due to external factors such as extreme weather conditions negatively impact the market growth.

With the rising sustainability concerns, aquaculture farmers are significantly replacing animal-sourced feed with plant-sourced feed. Thus, the demand for wheat and corn-based feed is increasing due to their high quality and nutritional performance. Roquette Frères, a key market player in the corn and wheat-based feed market, offers wheat-based feed for aquaculture. Thus, the growth of aquaculture is expected to create massive opportunities in the corn and wheat-based feed market across the world in the coming years. Thus, the rising demand for corn and wheat-based feed for aquaculture feed is expected to provide lucrative opportunities in the corn and wheat-based feed market during the forecast period.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCorn and Wheat-Based Feed Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Corn and Wheat-Based Feed Market Analysis and Forecast to 2030" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report includes corn and wheat-based feed market forecast by product type, livestock, and geography from 2022 to 2030. It provides key statistics on the consumption of corn and wheat-based feed across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting corn and wheat-based feed market performance in major regions and countries. It also includes a comprehensive analysis of the leading market players and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities, which, in turn, aids in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global corn and wheat-based feed market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The corn and wheat-based feed market is segmented on the basis of product type and livestock. Based on product type, the market is bifurcated into corn-based and wheat-based. The market for the corn-based segment is subsegmented into corn gluten meal, corn gluten feed, and other corn-based feed. The market for the wheat-based segment is further divided into wheat gluten, wheat bran, and other wheat-based feed. The corn-based segment accounted for over 91% of the corn and wheat-based feed market share in 2022. The wheat-based segment is expected to register a higher CAGR from 2022 to 2030.

Wheat is one of the popular feed ingredients due to its high starch and fiber content. It is one of the significant sources of energy for ruminants, poultry, swine, and even pet animals. According to the International Grains Council, 780.2 million tons of wheat was produced globally in 2021, of which 147.9 million tons was used by the feed industry. After corn, wheat is the dominant grain used for animal feeding due to its significant nutritional profile. The rising demand for wheat-based feed ingredients such as wheat gluten, wheat bran, wheat middling, and wheat pollard for manufacturing high-quality animal feed drives the corn and wheat-based feed market for the wheat-based segment.

REGIONAL ANALYSIS

The global corn and wheat-based feed market report provides a detailed overview of the market with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. In terms of revenue, Asia Pacific dominated the corn and wheat-based feed market share, accounting for US$ 74,751.60 million in 2022. South & Central America is projected to register a significant CAGR of 5.1% from 2022 to 2030.

The corn and wheat-based feed market in South & Central America is experiencing growth due to the expansion of the livestock industry in response to growing domestic and international demand for meat products. Corn and wheat-based feed are preferred due to their nutritional value and cost-effectiveness. In South & Central America, Brazil and Argentina are major beef, poultry, and pork exporters. Paraná, a Brazilian state, exported 2.3 million metric ton of meat in 2023, an increase of 9.5% compared to last year, with a prominent increase seen in poultry shipments. Animal protein is the primary commodity transported by the Paraná terminal. Of the total exported in 2023, nearly 181,878 twenty-foot equivalent units (TEUs) were chicken meat, 37,169 twenty-foot equivalent units (TEUs) were beef, and 14,369 twenty-foot equivalent units (TEUs) were pork. Thus, the expanding livestock sector drives the demand for animal feed.

South & Central America’s rich agricultural resources and favorable climatic conditions make it well-suited for grain production. The region is a significant producer of corn and wheat. Countries such as Brazil, Argentina, and Paraguay are significant exporters of these commodities. For instance, Brazil produced 116 million metric ton of corn in 2021–2022. Argentina is also a significant corn producer and exporter. Its 2021–2022 corn production was 49.50 million metric tons. The availability of vast tracts of arable land and abundant water resources allows for the cultivation of large-scale grain crops. This abundance of locally produced corn and wheat provides a competitive advantage for the livestock industry, as feed manufacturers can source these grains domestically, reducing dependence on imports and ensuring a steady supply to meet the growing demand for feed.

Corn and Wheat-Based Feed Market Regional InsightsThe regional trends and factors influencing the Corn and Wheat-Based Feed Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Corn and Wheat-Based Feed Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Corn and Wheat-Based Feed Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 196.71 Billion |

| Market Size by 2030 | US$ 270.95 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Corn and Wheat-Based Feed Market Players Density: Understanding Its Impact on Business Dynamics

The Corn and Wheat-Based Feed Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Corn and Wheat-Based Feed Market top key players overview

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Initiatives taken by the key players operating in the corn and wheat-based feed market, as per company press releases, are listed below:

In October 2023, Solugen and Archer Daniels Midland Company announced a strategic partnership to scale a range of innovative, plant-based specialty chemicals and bio-based building block molecules in a new manufacturing facility in Marshall, Minnesota. Under the terms of the agreement, Solugen will build a new 500,000-square-foot biomanufacturing facility adjacent to ADM's existing corn complex in Marshall. The facility will utilize ADM-provided dextrose to scale its current line of lower-carbon organic acids and develop new, innovative molecules to replace existing fossil fuel-based materials.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Associated British Foods Plc, Jungbunzlauer Suisse AG, Nordfeed, Roquette Freres SA, BENEO GmbH, International Nutritionals Ltd, Interstarch Ukraine LLC, Agrana Beteiligungs AG, Grain St Laurent Inc, and Archer Daniels Midland Company are among the prominent companies profiled in the corn and wheat-based feed market report.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For