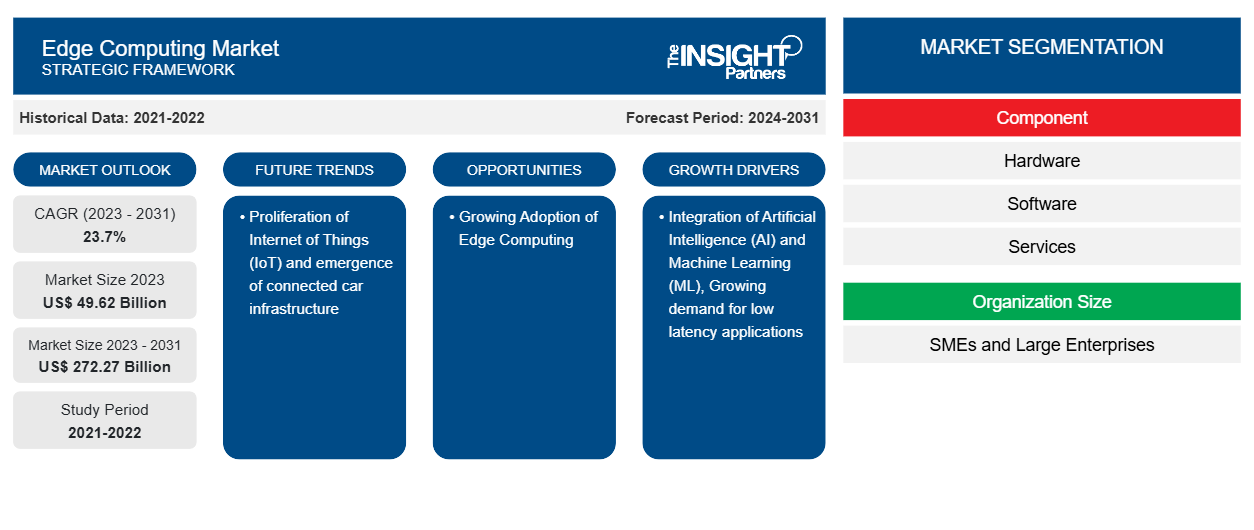

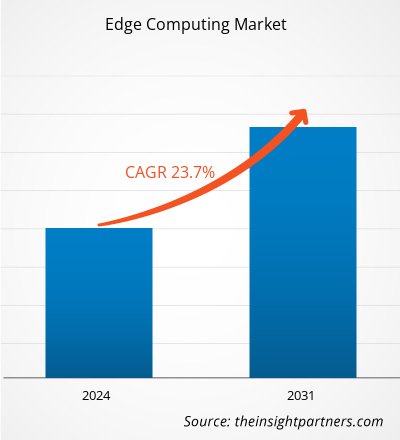

The Edge Computing market is projected to grow from US$ 49.62 billion in 2023 to US$ 272.27 billion by 2031; it is expected to expand at a CAGR of 23.7% from 2023 to 2031. The proliferation of the Internet of Things (IoT) and the emergence of connected car infrastructure are expected to be a key trend in the market.

Edge Computing Market Analysis

The rise of edge computing represents a significant shift in the way we process and manage data. Its potential to provide real-time computing, increased bandwidth efficiency, and improved security has far-reaching consequences for many industries. Edge computing's disruptive impact is evident in fields ranging from healthcare to smart cities and industry. Edge computing has developed into a key architecture that supports distributed computing and Edge AI. In other words, edge computing maintains computational data and storage close to the user, whether by network or geographical distance. Data processing can often be done on the device itself. Thus, the demand for edge computing is expected to grow during the forecast period.

Edge Computing Market Industry Overview

Edge computing is a new computing paradigm that refers to a set of networks and devices located at or near the user. Edge processing brings data closer to where it is generated, allowing for faster and larger processing rates and volumes, resulting in more actionable answers in real-time. Edge computing has certain distinct advantages over traditional models in which computer capacity is concentrated in an on-premise data center. Putting computation at the edge enables businesses to better how they manage and use physical assets while also creating new interactive, human experiences. Edge computing usage scenarios include self-driving cars, autonomous robots, and smart equipment data, among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Edge Computing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Edge Computing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Edge Computing Market Driver and Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning (ML) to Favor Market Growth

In recent years, the Internet of Things (IoT) has gained significant acceptance. IoT has significantly accelerated the development of artificial intelligence (AI) by supplying adequate data for model training and inference. With the continued development and widespread deployment of IoT, cloud computing has begun to disclose an increasing number of issues. For example, if data created by global terminal devices is computed and stored in a centralized cloud, it would cause a series of problems, such as low throughput, high latency, bandwidth bottlenecks, data privacy, centralized vulnerabilities, and additional costs. To solve the difficulties of cloud computing outlined above, a new computing paradigm known as edge computing (EC) has gained extensive interest. Expressed, the EC model's central notion is to move data processing, storage, and computing processes that were previously required by the cloud to the network's edge, near terminal devices. This reduces data transmission time and device response times, relieves network bandwidth pressure, lowers data transmission costs, and achieves decentralization. Thus, the integration of AI and ML is expected to boost the edge computing market growth during the forecast period.

Growing Adoption of Edge Computing

Edge computing is expected to have a big impact across industries. While some verticals have already seen the impact, others are more likely to be late adopters of edge computing. Over the last few years, firms from various industries have turned to Edge Computing to empower both operations technology (OT) and information technology (IT) teams, support mission essential applications and data, and cut costs. Edge Computing has recently acquired appeal due to its scalability, powerful analytics management, and ability to prevent downtime. Edge OTs are powerful computing devices that will fuel the smart factory by managing machines and equipment, focusing on advanced analytics, maintenance, and augmented reality. On the IT side, as these applications have become more sophisticated and essential, relying just on OT teams to manage them is insufficient. Because IT teams are specialists in data governance, management, and security, they guarantee that all of these variables occur at the edge and that scalable technologies are deployed to save money and reduce business risk.

Edge Computing Market Report Segmentation Analysis

The key segments that contributed to the derivation of the Edge Computing market analysis are component, application, enterprise size, and industry.

- Based on component, the market is segmented into hardware, software, and services. The hardware segment accounted for the largest share of the edge computing market in 2023, owing to the increasing adoption of IoT-based systems owing to the increase in the number of connected devices.

- The edge computing market, by application, is segmented into smart cities, Industrial Internet of Things (IIoT), content delivery, augmented reality and virtual reality, and others. The smart cities segment is projected to grow at a faster pace during the forecast period due to growing initiatives in the development of smart infrastructure.

- The market, by enterprise size, is segmented into small and medium enterprises, and large enterprises.

- The edge computing market, based on industry, is segmented into manufacturing, energy & utility, government, IT and telecom, healthcare, retail and consumer goods, and others.

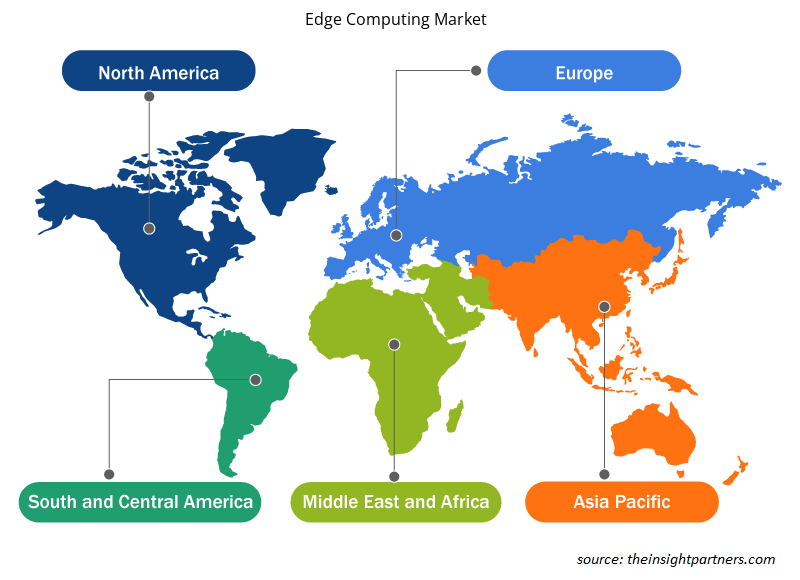

Edge Computing Market Share Analysis By Geography

Based on region, the market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America.

Technology advancements such as the Industrial Internet of Things (IIoT), Industry 4.0, and 5G network services, as well as the expansion of the connected device ecosystem, have resulted in massive amounts of data being generated, necessitating the use of a powerful computational infrastructure. This, in turn, is anticipated to boost the growth of the edge computing market in the Asia Pacific region during the forecast period.

Edge Computing Market Regional Insights

Edge Computing Market Regional Insights

The regional trends and factors influencing the Edge Computing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Edge Computing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Edge Computing Market

Edge Computing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 49.62 Billion |

| Market Size by 2031 | US$ 272.27 Billion |

| Global CAGR (2023 - 2031) | 23.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

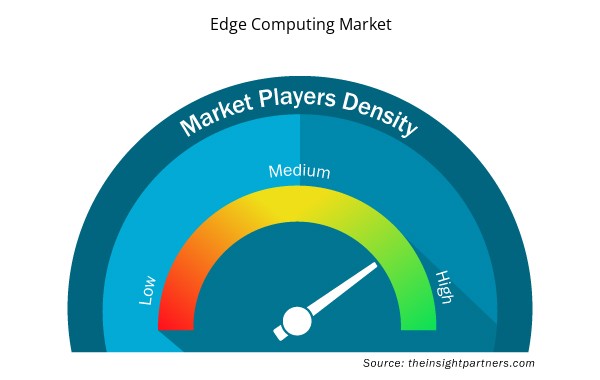

Edge Computing Market Players Density: Understanding Its Impact on Business Dynamics

The Edge Computing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Edge Computing Market are:

- ADLINK Technology

- Amazon Web Services, Inc.

- Dell Technologies

- EdgeConnex Inc.

- FogHorn Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Edge Computing Market top key players overview

Edge Computing Market News and Recent Developments

The Edge Computing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Edge Computing Market are listed below:

- Dell Technologies introduced Dell NativeEdge, an edge operations software platform designed to help businesses simplify and optimize secure edge deployments. With this, customers can streamline edge operations across thousands of devices and locations from the edge to core data centers and multiple clouds. (Source: Dell Technologies, Press Release, May 2023)

Edge Computing Market Report Coverage & Deliverables

The Edge Computing market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Edge Computing Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Edge Computing Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Edge Computing Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Edge Computing Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Edge Computing Market

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hot Melt Adhesives Market

- Small Internal Combustion Engine Market

- Data Center Cooling Market

- Asset Integrity Management Market

- Electronic Toll Collection System Market

- Broth Market

- Sterilization Services Market

- Latent TB Detection Market

- Medical and Research Grade Collagen Market

- Playout Solutions Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Organization Size, Application, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and a country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

ADLINK Technology, Amazon Web Services, Inc., EdgeConnex Inc., Dell Technologies, FogHorn Systems, The Hewlett Packard Enterprise Company, Litmus Corporation, International Business Machine Corporation, Microsoft Corporation, and Vapor IO, Inc. are the major market players.

The proliferation of the Internet of Things (IoT) and the emergence of connected car infrastructure are the major trends in the market.

The global Edge Computing market was estimated to grow at a CAGR of 23.7% during 2023 - 2031.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) and growing demand for low latency applications are the major factors that drive the global Edge Computing market.

Get Free Sample For

Get Free Sample For