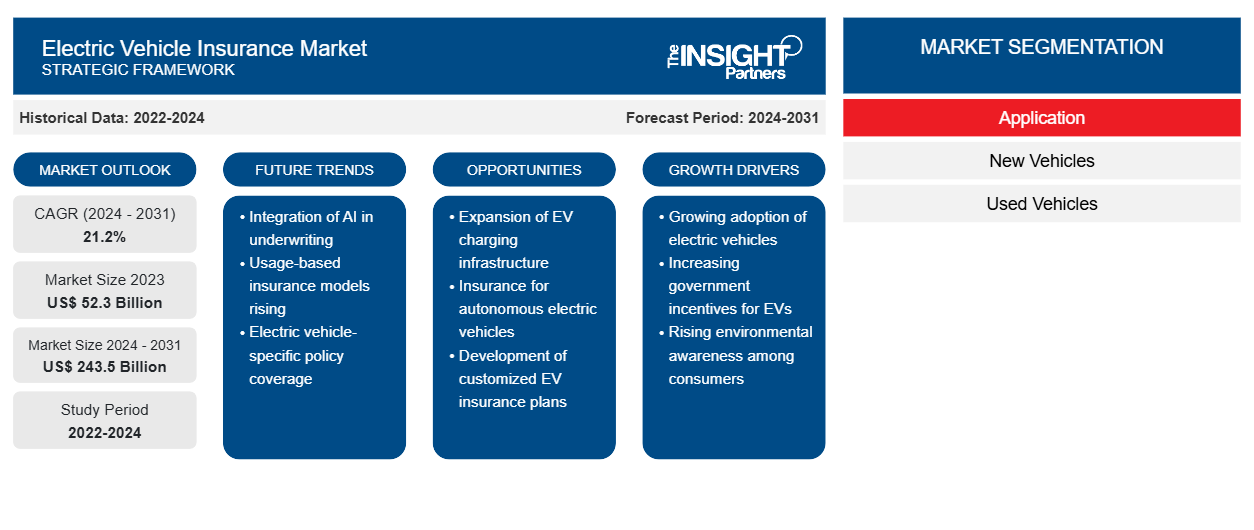

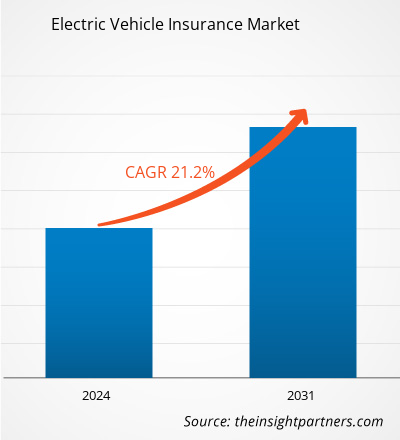

The electric vehicle insurance market size is expected to grow from US$ 52.3 billion in 2023 to US$ 243.5 billion by 2031; it is anticipated to expand at a CAGR of 21.2% from 2024 to 2031. The market's expansion can be attributed to several key factors, including the rising demand for convenient and environmentally friendly transportation solutions. Additionally, there is a global trend towards sustainability and a reduction in carbon emissions, which is further fueling the electric vehicle insurance market growth.

Electric Vehicle Insurance

Market Analysis

The electric vehicle insurance market growth is driven by the increasing adoption of electric vehicles. The growing embrace of EVs by consumers, propelled by environmental awareness, government incentives, and technological advancements, has resulted in a surge in demand for customized insurance products that cater specifically to the unique requirements of electric vehicle owners.

Electric Vehicle Insurance

Industry Overview

- Electric vehicle insurance refers to insurance coverage specifically designed for electric vehicles (EVs). As the adoption of EVs continues to surge, there is a growing need for insurance products that cater to the unique requirements of electric vehicle owners.

- The cost of electric vehicle insurance can vary depending on several factors, including the specific model of the EV, the driver's history, claims history, driving experience, location, coverage choices, deductible amount, and credit-based insurance score.

- Insuring an electric vehicle can be more expensive compared to insuring a conventional vehicle. This is primarily due to the higher MSRP (Manufacturer's Suggested Retail Price) of electric vehicles and the potentially higher repair costs associated with their advanced technology features.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Vehicle Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Vehicle Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Vehicle Insurance

Market Drivers and Opportunities

Growing adoption of electric vehicles (EVs) to Drive the Electric Vehicle Insurance

Market Growth

- The electric vehicle insurance market is experiencing significant growth due to the increasing adoption of electric vehicles. This trend is driven by factors such as environmental awareness, government incentives, and technological advancements. As more consumers embrace EVs, there is a growing demand for insurance products that cater to the unique needs of electric vehicle owners. These needs include coverage for battery replacement costs and charging infrastructure damage, prompting the development of specialized insurance policies.

- Furthermore, the global shift towards sustainability and reduced carbon emissions is motivating consumers to choose EVs, creating a substantial market for insurers to serve environmentally conscious drivers. Government regulations, including tax credits and rebates for EV owners, further encourage the transition to electric vehicles and, consequently, the need for EV insurance.

- With the expansion and maturation of the EV market, competition among insurance providers is intensifying, leading to the introduction of innovative coverage options and competitive pricing. This competition ultimately drives the growth of the EV insurance market.

Electric Vehicle Insurance

Market Report Segmentation Analysis

- Based on coverage type, the electric vehicle insurance market forecast is segmented into first party liability coverage, third party liability coverage, and comprehensive.

- The third party liability coverage segment is expected to hold a substantial electric vehicle insurance market share in 2023. The growth of the third party liability coverage segment is strongly influenced by the requirement of third-party liability coverage mandated by the Motor Vehicles Act. This coverage is compulsory for both new and existing vehicle owners during the registration process, serving as a key driver for market expansion. Additionally, the mandatory nature of third-party insurance compels all non-life insurance companies to offer this coverage, contributing significantly to the overall growth of the market on a global scale.

- Moreover, the implementation of digitalized workplaces and streamlined operations, combined with enhanced performance, is anticipated to bring new electric vehicle insurance market trends.

Electric Vehicle Insurance

Market Share Analysis by Geography

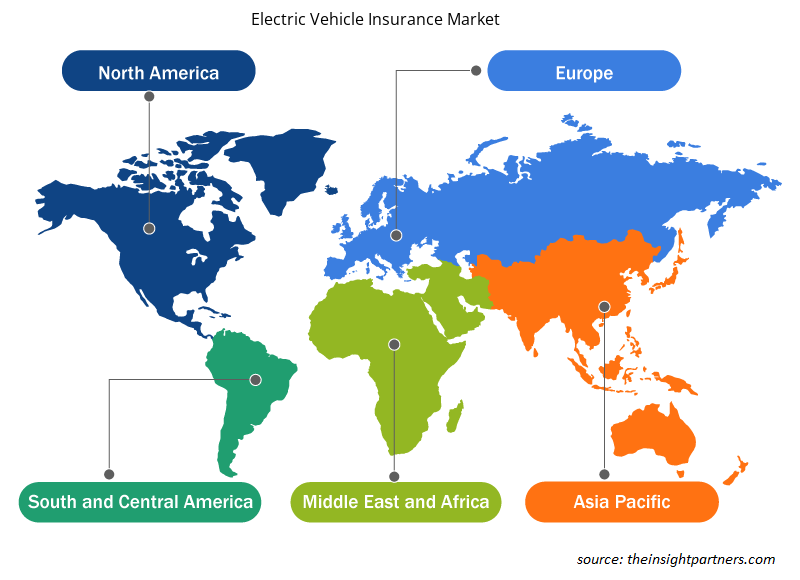

The scope of the electric vehicle insurance market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific is experiencing rapid growth and is anticipated to hold a significant electric vehicle insurance market share in 2023. The rapid electrification of passenger and commercial transport, particularly in China, Japan, South Korea, and India, is expected to drive the growth of the global EV insurance market. In China, the government's initiatives to limit conventional car sales, coupled with the development of EV infrastructure and connectivity, are accelerating the adoption of EVs and increasing the demand for EV insurance. Similarly, the increasing penetration of EVs in developing economies like India is anticipated to boost the demand for this type of insurance in the coming years. These factors, combined with the mandatory requirement of third-party liability coverage under the Motor Vehicles Act, create a favorable environment for the growth of the EV insurance market in the region.

Electric Vehicle Insurance

Electric Vehicle Insurance Market Regional Insights

The regional trends and factors influencing the Electric Vehicle Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Vehicle Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Vehicle Insurance Market

Electric Vehicle Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 52.3 Billion |

| Market Size by 2031 | US$ 243.5 Billion |

| Global CAGR (2024 - 2031) | 21.2% |

| Historical Data | 2022-2024 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Electric Vehicle Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Vehicle Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Vehicle Insurance Market are:

- HDFC ERGO

- Beinsure Digital Media

- Bajaj Allianz General Insurance Company

- Lemonade, Inc.

- Allstate Insurance Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Vehicle Insurance Market top key players overview

The "Electric Vehicle Insurance Market Analysis" was carried out based on coverage type, distribution channel, application, and geography. Based on coverage type, the market is segmented into first party liability coverage, third party liability coverage, and comprehensive. Based on distribution channel, the market is segmented into insurance companies, banks, insurance agents/ brokers, and others. Based on application, the market is segmented into new vehicles and used vehicles. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Electric Vehicle Insurance

Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the electric vehicle insurance market. A few recent key market developments are listed below:

- In April 2023, the prominent Chinese electric vehicle (EV) company BYD acquired Yi'an P&C Insurance Co. This strategic move reflects BYD's intent to expand its operations in the insurance sector and potentially capitalize on synergies between the EV industry and the insurance market.

[Source: BYD, Company Website]

- In September 2022, Singlife, in collaboration with Aviva, commenced offering coverage for electric vehicles (EVs) as part of its car insurance policies, featuring exclusive discounts for EV owners. Singlife emerges as one of the select local providers offering tailored insurance solutions for EVs in line with Singapore's efforts to foster a sustainable land transport hub and expand its EV ecosystem. The Singlife Car Insurance will grant a 10% Go Green discount specifically for EV owners. Additionally, Singlife will extend EV-specific peripheral services, including arranging replacement EVs in case of accidents and providing breakdown assistance for instances of insufficient battery power. Notably, Singlife's comprehensive coverage will encompass insurability for accidental damage to charging cables, batteries, and private charging stations, thus instilling a greater sense of security for EV owners. Presently, Singlife Car Insurance encompasses a wide range of EV classes available for purchase in Singapore.

[Source: Singlife, Company Website]

Electric Vehicle Insurance

Market Report Coverage & Deliverables

The market report on “Electric Vehicle Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, recent developments.

- Detailed company profiles.

Frequently Asked Questions

What are the driving factors impacting the global electric vehicle insurance market?

The electric vehicle insurance industry has experienced significant growth in recent years, primarily driven by the increasing focus on sustainability and the expansion of eco-friendly modes of transportation, which are among the major factors that propel the global electric vehicle insurance market.

What is the estimated market size for the global electric vehicle insurance market in 2023?

The electric vehicle insurance market size is expected to grow from US$ 52.3 billion in 2023 to US$ 243.5 billion by 2031; it is anticipated to expand at a CAGR of 21.2% from 2024 to 2031.

What are the future trends of the global electric vehicle insurance market?

The emergence of EV-specific insurance policies is impacting electric vehicle insurance, which is anticipated to play a significant role in the global electric vehicle insurance market in the coming years.

Which are the key players holding the major market share of the global electric vehicle insurance market?

The key players holding majority shares in the global electric vehicle insurance market are HDFC ERGO, Beinsure Digital Media, Bajaj Allianz General Insurance Company, Lemonade, Inc., and AXA.

What will be the market size of the global electric vehicle insurance market by 2031?

The global electric vehicle insurance market is expected to reach US$ 243.5 billion by 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

- HDFC ERGO

- Beinsure Digital Media

- Bajaj Allianz General Insurance Company

- Lemonade, Inc.

- Allstate Insurance Company

- AXA

- ACKO GENERAL INSURANCE LIMITED

- Esure Group plc

- Allianz SE

- Progressive Casualty Insurance Company

Get Free Sample For

Get Free Sample For