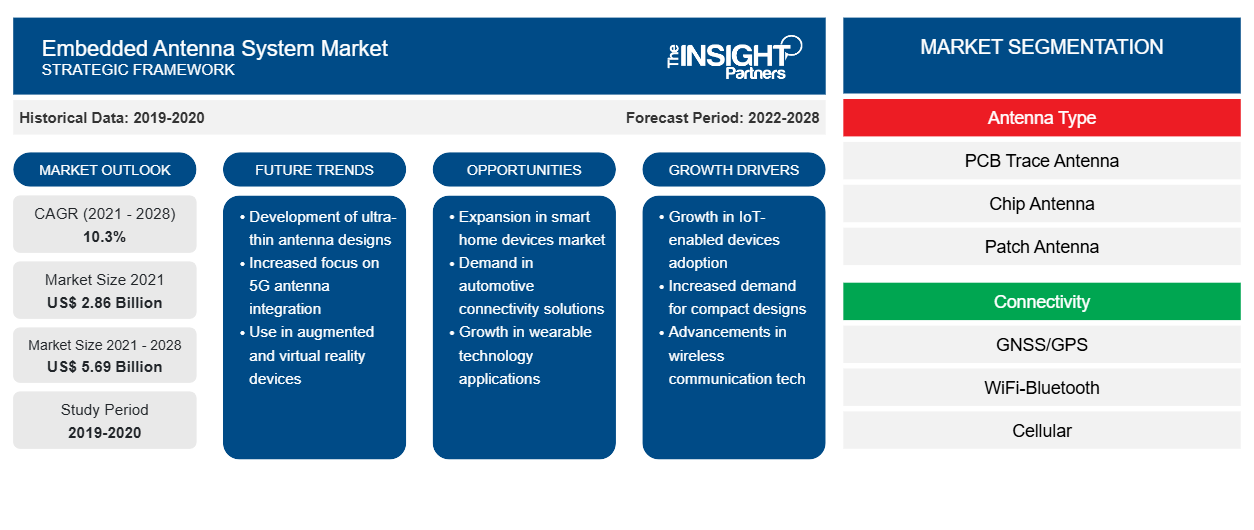

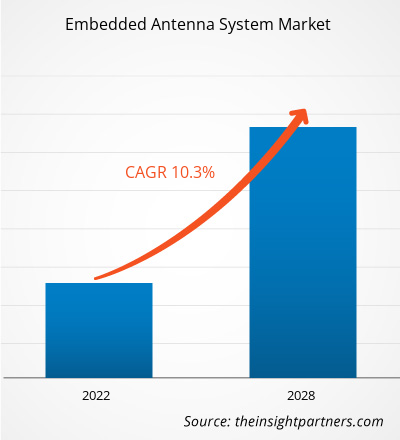

The embedded antenna system market is expected to grow from US$ 5,685.63 million by 2028 from US$ 2,858.37 million in 2021; it is estimated to grow at a CAGR of 10.3% from 2021 to 2028.

An embedded antenna uses metamaterials to improve the performance of small antenna systems. The embedded antenna system uses an electromagnetic antenna to generate energy into free space. Metamaterials are designed with unique, typically microscopic structures to produce unexpected physical properties. The increasing penetration of advanced technologies, such as the Internet of Things (IoT), 5G, and artificial intelligence, supports the growth of the embedded antenna system market. The increasing use of embedded systems in IoT devices, growing demand for smart antennas for remote working in the healthcare sector, rising prevalence of the internet, surge in the number of smartphone users, and advancements in 5G technologies are major forces driving the market growth. Furthermore, the growing need for embedded antenna systems in smart homes, smart grids, linked automobiles, smart thermostats, etc., is expected to boost the market growth throughout the forecast period. The increasing use of consumer electronics such as smartphones and laptops in developed and developing countries is mainly attributed to rising disposable income, increasing population, and growing internet penetration. Advancements in smartphone technologies and increasing digitalization are among other significant factors propelling the embedded antenna system market growth.

The embedded antenna system market is segmented on the basis of antenna type, connectivity, end use, and geography. Based on antenna type, the market is segmented into PCB trace antenna, chip antenna, patch antenna, flexible printed circuit antenna, and others. On the bases of connectivity, the market is segmented into GNSS/GPS, WiFi-Bluetooth, cellular, mmWave (5G), LPWAn, RFID, and UWB. Based on end use, the embedded antenna system market is segmented into consumer electronics, communication, healthcare, aerospace & defense, industrial, automotive & transportation, and others. Based on geography, the overall embedded antenna system market size is primarily segregated into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America.

Airgain, Inc.; Antenova ltd.; Infinite Electronics International, inc.; Kyocera AVX Components Corporation; Mitsubishi Materials Corporation; MOLEX; LINX Technologies; TE Connectivity; Walsin Technology Corporation; YAGEO Group; TAOGLAS; Tallysman; Panorama Antennas ltd; Mobile Mark, inc.; and 2J Antennas S.R.O. are the key players profiled during the embedded antenna system market study. In addition, several other significant embedded antenna system makers are analyzed and studied during the course of market analysis to get a holistic view of the global embedded antenna system market and its ecosystem.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Embedded Antenna System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Embedded Antenna System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Embedded Antenna System Market

Over the years, the adoption of embedded antenna systems has increased substantially across industries to enhance product performance and offer design flexibility. However, the onset of the COVID-19 pandemic disrupted various industries, such as industrial equipment manufacturing, automotive & transportation, and consumer electronics. Governments enacted travel restrictions and social distancing, among other measures, to combat the spread of the novel coronavirus, which led to the temporary shutdown of manufacturing units in Q1 and Q2 of 2020. However, with the normalization of economic activities, manufacturing facilities started to operate with 50% capacity in the third quarter of 2020. According to the Federal Statistical Office of Europe, the retail sector in the region experienced adverse effects of the pandemic. According to the organization, as a result of the second wave of the COVID-19 outbreak, Germany experienced a decline of 9% in total retail turnover in February 2021. This decline led to a reduction in the need for retail POS systems, which hindered the demand for embedded antenna systems from the POS system manufacturers. However, with lowering infection rates, rapid vaccination drives, and government initiatives promoting economic recovery, various industries began operating normally from the Q3 of 2020. Thus, the embedded antenna systems market is reviving rapidly to overcome the negative effects caused by the COVID-19 pandemic.

Embedded Antenna System Market Insights

Increasing Adoption of Embedded Antenna Systems in Consumer Electronics Industry Driving Market Growth

Consumer electronics devices, such as smartphones, laptops, smart TVs, wearables, tablets, gaming consoles, and peripheral devices, use embedded antenna systems for wireless applications, including Bluetooth, WLAN, Wi-Fi, and GPS. The increasing use of smartphones and laptops, among others, in developed and developing countries is mainly attributed to rising disposable income, increasing population, and growing Internet penetration. Advancements in smartphone technologies and increase in digitalization propel the growth of the embedded antenna system market. In addition, with the surge in popularity of Bluetooth, the demand for headsets, smartphones, wearables, game consoles, and other consumer electronics is also on rise, which contributes to the embedded antenna market growth.

The ongoing technological advancements have led to a rise in the penetration of consumer electronic devices across several economies. As per the Consumer Technology Association (CTA), the sales of smartphones in the US accounted for 152 million units in 2020. In addition, according to the International Data Corporation (IDC), smartphone shipments increased by 5.3% year on year and reached 1.35 billion units in 2021.

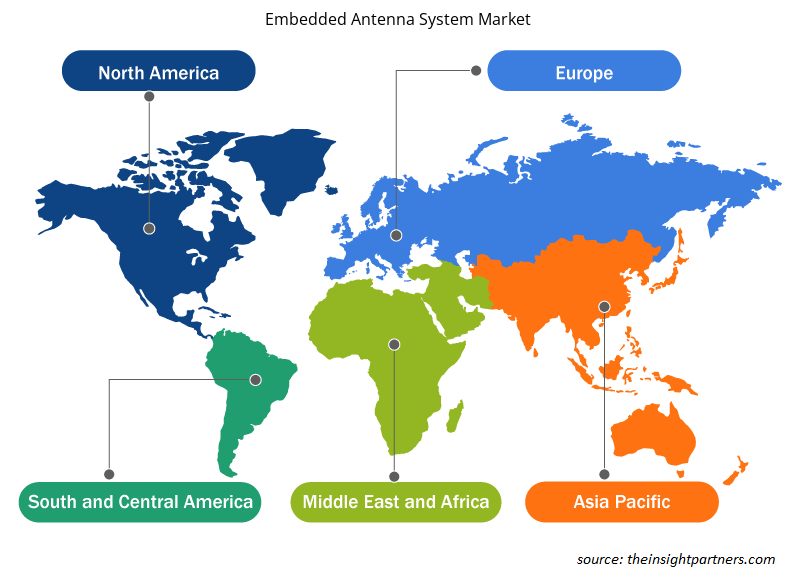

Embedded Antenna System Market Regional Insights

The regional trends and factors influencing the Embedded Antenna System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Embedded Antenna System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Embedded Antenna System Market

Embedded Antenna System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.86 Billion |

| Market Size by 2028 | US$ 5.69 Billion |

| Global CAGR (2021 - 2028) | 10.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Antenna Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Embedded Antenna System Market Players Density: Understanding Its Impact on Business Dynamics

The Embedded Antenna System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Embedded Antenna System Market are:

- Airgain, Inc

- Antenova ltd

- Infinite Electronics International, inc

- Kyocera AVX Components Corporation

- Mitsubishi Materials Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Embedded Antenna System Market top key players overview

Antenna Type-Based Market Insights

Based on antenna type, the embedded antenna system market is segmented into PCB trace antenna, chip antenna, patch antenna, flexible printed circuit antenna, and others. In 2020, the PCB trace antenna segment accounted for the largest market share.

End Use-Based Market Insights

Based on end use, the embedded antenna system market is segmented into consumer electronics, communication, healthcare, aerospace & defense, industrial, automotive & transportation, and others. In 2020, the consumer electronics segment accounted for the largest market share.

The players operating in the embedded antenna system market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In January 2022, KYOCERA AVX launched the evaluation board for testing antenna band switching performance at CES 2022 in Las Vegas.

- In August 2021, TE Connectivity TE signed a definitive agreement to acquire the Antennas business from Laird Connectivity.

Frequently Asked Questions

What are key market opportunities for the embedded antenna system market?

The increasing number of connected devices and high-speed internet connectivity has increased the adoption of 5G network. Also, telecommunications companies use 5G antennas to handle the high speed, capacity, and bandwidth of 5G networks. Therefore, the development of 5G is likely to present attractive prospects for the embedded antenna systems market players during the forecast period.

What are key driving factors behind embedded antenna system market growth?

The embedded antenna system has been in use for several years worldwide, however, the technology has been experiencing immense demand in recent years Increasing adoption of the embedded antenna system in the consumer electronics industry and the rising emergence of IoT-based devices/technology are supporting the growth of embedded antenna system market.

Which antenna type dominated the market in 2021?

The global embedded antenna system market was dominated by the PCB trace antenna segment accounted for the largest share in 2021 during the forecast period. PCB trace antenna is anticipated to continue driving the embedded antenna system market by antenna type segment due to the significant adoption in various applications such as consumer electronics, industrial, and others.

Which region has dominated the embedded antenna system market in 2021?

In 2021, APAC led the market with a substantial revenue share, followed by North America and Europe. China is the leading country in APAC for embedded antenna systems, and it is expected to rise rapidly over the projection period, followed by the Rest of APAC and Japan. With the elevating internet penetration rate, consumer electronics manufacturers are poised to launch advanced connected appliances in the region.

Which are the major companies operating in the embedded antenna system market?

The major companies in embedded antenna system market include TE Connectivity, Kyocera AVX Components Corporation, Amphenol, Yageo Group, and Molex. The ranking has been derived by analyzing multiple parameters such as annual revenue earned from embedded antenna system portfolio, client base, geographic locations, R&D expenditure, brand image, and the number of employees, among others. These companies are actively participating in developing embedded antenna systems for various applications.

Which country dominated the APAC region embedded antenna system market?

China held the largest share in the APAC region. The country is the largest consumer electronics market. All major consumer electronics companies have a strong manufacturing presence in the country owing to which the adoption rate of the embedded antenna system is on the higher side. Also, the country is the second-largest arms manufacturer in the world. Aviation Industry Corporation of China, China North Industries Group Corporation Limited, China Aerospace Science and Industry Corporation, and China South Industries Group are the leading defense contractors in the country which produces a notable number of advanced military communication, weapons, aircraft, and an armored vehicle. Thus, these factors are driving the growth of the embedded antenna system market in China.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

TheList of Companies - Embedded Antenna System Market

- Airgain, Inc

- Antenova ltd

- Infinite Electronics International, inc

- Kyocera AVX Components Corporation

- Mitsubishi Materials Corporation

- MOLEX

- LINX Technologies

- TE Connectivity

- Walsin Technology Corporation

- YAGEO Group

- TAOGLAS

- Tallysman

- Panorama Antennas ltd

- Mobile Mark, inc

- 2J Antennas, S.R.O.

Get Free Sample For

Get Free Sample For