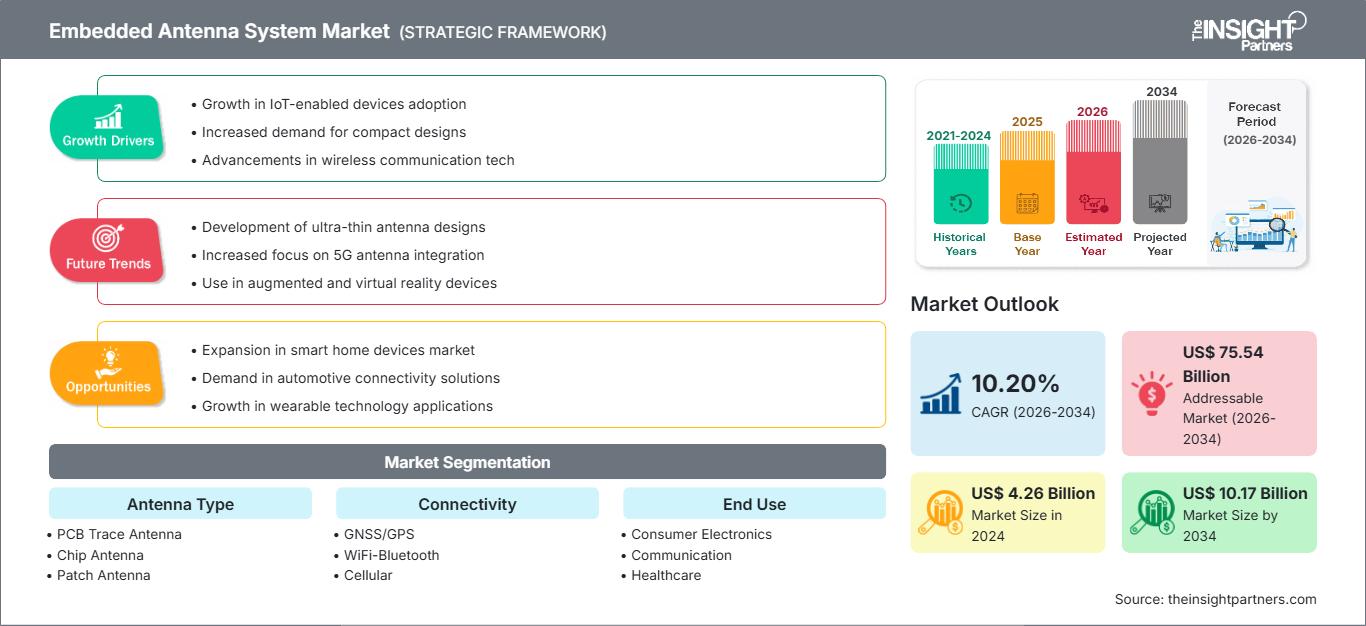

Embedded Antenna System Market Trends, Size & Forecast 2034

Embedded Antenna System Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Antenna Type (PCB Trace Antenna, Chip Antenna, Patch Antenna, Flexible Printed Circuit Antenna, and Others), Connectivity [GNSS/GPS, WiFi-Bluetooth, Cellular, mmWave (5G), LPWAn, RFID, and UWB], and End Use (Consumer Electronics, Communication, Healthcare, Aerospace & Defense, Industrial, Automotive & Transportation, and Others)

Historic Data: 2021-2024 | Base Year: 2024 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00027469

- Category : Electronics and Semiconductor

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

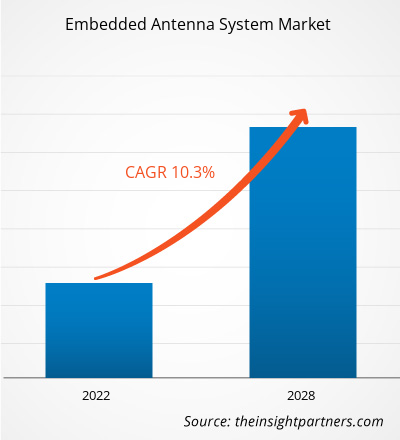

The embedded antenna system market size is expected to reach US$ 10.17 billion by 2034 from US$ 4.26 billion in 2024. The market is anticipated to register a CAGR of 10.20% during 2026–2034.

Embedded Antenna Systems Market Analysis

The embedded antenna systems market is experiencing strong growth due to the surging demand for compact, integrated antennas in wireless devices. Growth drivers include the proliferation of IoT devices, the rapid rollout of 5G networks that demand sophisticated multi-band antennas, and increasing miniaturization in consumer electronics. Embedded antennas are crucial for applications in smartphones, wearables, connected vehicles, industrial IoT sensors, and more. For instance, the automotive sector is increasingly integrating embedded antennas for V2X communication, GPS, and in-car connectivity.

Embedded Antenna Systems Market Overview

Embedded antenna systems are tiny, integrated antennas designed to be embedded within electronic devices, enabling seamless wireless communication. Unlike external antennas, embedded solutions conserve space, reduce production complexity, and improve reliability by being part of the device’s PCB or structure. These systems are especially valuable in modern devices due to their support for multiple communication standards (e.g., Wi-Fi/Bluetooth, cellular including 5G, GNSS), MIMO configurations, and their ability to adapt through smart tuning.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEmbedded Antenna System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Embedded Antenna Systems Market Drivers and Opportunities

Market Drivers:

- 5G Deployment: The global rollout of 5G (including sub-6 GHz and mmWave bands) is a major catalyst, driving demand for advanced embedded antennas capable of handling high frequencies and beamforming.

- IoT Proliferation: The explosion of IoT devices — from wearables to industrial sensors — requires compact, energy-efficient, high-performance antenna solutions.

- Miniaturization Needs: As electronic devices shrink, the need for small form factor antennas rises. Embedded antennas provide reliable connectivity without taking up external space.

Market Opportunities:

- Flexible / Conformal Antennas: FPC (Flexible Printed Circuit) antennas are gaining traction due to their flexibility and ability to conform to different device shapes.

- Automotive Connectivity: With connected vehicles, ADAS, V2X, and autonomous driving, embedded antennas are increasingly integrated in automobiles.

- Industrial & Healthcare IoT: Use in industrial sensors and medical telemetry opens new use cases, especially where antenna size and reliability are critical.

Embedded Antenna Systems Market Report Segmentation Analysis

The embedded antenna systems market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Antenna Type:

- PCB Trace Antenna

- Chip Antenna

- Patch Antenna

- Flexible Printed Circuit Antenna

By Connectivity:

- GNSS/GPS

- WiFi-Bluetooth

- Cellular

- mmWave

- LPWAn

- RFID

- UWB

By End-Use:

- Consumer Electronics

- Communication

- Healthcare

- Aerospace & Defense

- Industrial

- Automotive & Transportation

By Geography / Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Embedded Antenna System Market Regional Insights

The regional trends and factors influencing the Embedded Antenna System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Embedded Antenna System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Embedded Antenna System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4.26 Billion |

| Market Size by 2034 | US$ 10.17 Billion |

| Global CAGR (2026 - 2034) | 10.20% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Antenna Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Embedded Antenna System Market Players Density: Understanding Its Impact on Business Dynamics

The Embedded Antenna System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Embedded Antenna System Market top key players overview

Embedded Antenna Systems Market Share Analysis by Geography

North America the market benefits from strong technological advancements, widespread adoption of IoT, and increasing demand for wireless communication in industries like automotive, defense, and healthcare. Asia-Pacific is fastest fastest-growing region during the forecast period, driven by rapid industrialization, increased consumer electronics production, and expanding telecom infrastructure, particularly in countries like China, India, and Japan, which boost the market's growth.

The embedded antenna systems market shows a different growth trajectory in each region due to factors such as the expansion of IoT (Internet of Things) and smart devices. Below is a summary of market share and trends by region:

North America

- Market Share: The embedded antenna systems market benefits from strong technological advancements, widespread adoption of IoT, and increasing demand for wireless communication in industries like automotive, defense, and healthcare

- Key Drivers:

- Strong adoption in consumer electronics, industrial IoT, and automotive connectivity.

- Rapid 5G rollout and advanced telecommunications infrastructure.

- High integration of embedded antennas in wearable devices, telematics, and V2X systems, backed by significant R&D presence in the U.S. and Canada.

- Trends: Ongoing demand for miniaturization, multi-band antennas, and power-efficient IoT modules.

Europe

- Market Share: Significant demand driven by high-tech industries and connected infrastructure.

- Key Drivers:

- Strong uptake in automotive applications (connected cars, telematics) and industrial automation.

- Regulatory push for connectivity standards, safety compliance, and digital transformation (e.g., in smart factories).

- Trends: Growth in smart manufacturing, telemedicine, and embedded antennas for smart automotive modules.

Asia-Pacific (APAC)

- Market Share: Projected to be the fastest-growing region due to large electronics manufacturing in China, Taiwan, and South Korea.

- Key Drivers:

- Large-scale consumer electronics manufacturing.

- Extensive 5G deployment and government-backed smart city / IoT initiatives.

- Rapid industrialization and strong demand for embedded solutions in automotive and wearable devices.

- Trends: High-volume production of embedded antennas, growing use in EVs and smart devices, and increasing localization of design and manufacturing.

Latin America (South & Central America)

- Market Share: Emerging market with growth potential due to increasing smartphone penetration and digital modernization.

- Key Drivers:

- Rising smartphone penetration and growing digital infrastructure.

- Emerging IoT adoption in logistics, agriculture, and manufacturing.

- Trends: Gradual adoption of embedded antennas for telematics and consumer devices, though cost sensitivity and regulatory challenges remain.

Middle East & Africa (MEA)

- Key Drivers:

- Investment in smart city infrastructure and 5G rollout, especially in Gulf countries (e.g., UAE, Saudi Arabia).

- Growing demand in connected transportation, healthcare, and IoT.

- Trends: Partnerships with global technology players, import-dependence, and slowly increasing local integration of advanced embedded antenna modules.

Embedded Antenna Systems Market Players Density: Understanding Its Impact on Business Dynamics

The embedded antenna systems market is witnessing intensified competition due to the presence of major global technology providers alongside emerging niche players and specialized startups. Companies are actively innovating to strengthen their market position and meet the growing demand for intelligent decision-making platforms across industries.

The competitive landscape is driving vendors to differentiate through:

- Innovation in antenna miniaturization (chip antennas, flexible antennas)

- Multi-band support (5G, GNSS, Wi-Fi)

- Integration capability (OEMs want antennas that easily integrate into PCBs)

- Cost and power efficiency, especially for IoT use cases

Opportunities and Strategic Moves

- Partnerships: Antenna manufacturers may partner with smartphone OEMs and automotive companies to co-develop embedded antenna modules tailored to specific devices.

- R&D Investment: There is an opportunity for R&D into flexible and conformal antennas for wearable devices and curved surfaces.

- Emerging Markets: Expansion into rapidly growing regions such as Asia Pacific, Latin America, and the Middle East, where IoT adoption is picking up.

- Customization: Developing custom antenna solutions for specific industries (e.g., defense, healthcare) where performance and reliability are critical.

Major Companies Operating in the Embedded Antenna Systems Market

- Airgain, Inc

- Antenova ltd

- Infinite Electronics International, Inc

- Kyocera AVX Components Corporation

- Mitsubishi Materials Corporation

- MOLEX

- LINX Technologies

- TE Connectivity

- Walsin Technology Corporation

Embedded Antenna Systems Market News and Recent Developments

- For instance, on November 11, 2025, Airgain, Inc., a leading provider of wireless connectivity solutions, announced that it has secured a design win with a leading global CPE manufacturer for a next-generation Wi-Fi 7 fiber broadband gateway being developed for a major North American broadband operator.

- On July 30, 2025, Antenova Ltd, manufacturer of antennas and RF antenna modules for M2M and the Internet of Things, announced a new, embedded GNSS antenna named Sinica, which operates on the 1559-1609 MHZ satellite bands. This new antenna uses a novel design approach and new materials to achieve high performance from an ultra-low profile antenna.

- For instance, on June 19, 2025, Airgain, Inc., a leading provider of wireless connectivity solutions, announced the launch of the NimbeLink Skywire™ Cat 1 bis Embedded Modem, the industry’s first plug-and-play Cat 1 bis modem for end-application use in industrial IoT. Designed to streamline cellular integration for a wide range of applications, this new modem marks a major leap forward in simplifying and accelerating IoT deployments across industrial, healthcare, logistics, and smart city environments.

- In April 2024, Infinite Electronics, a global portfolio of leading in-stock connectivity solution brands, announced that it had completed the sale of its KP Performance Antennas and RadioWaves businesses to Alive Telecommunications, a global supplier of communications equipment, systems, and services.

Embedded Antenna Systems Market Report Coverage and Deliverables

The "Embedded Antenna Systems Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Embedded Antenna Systems Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Embedded Antenna Systems Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Embedded Antenna Systems Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Embedded Antenna Systems Market. Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For