Enterprise Generative AI Market Size, Share & Opportunities by 2031

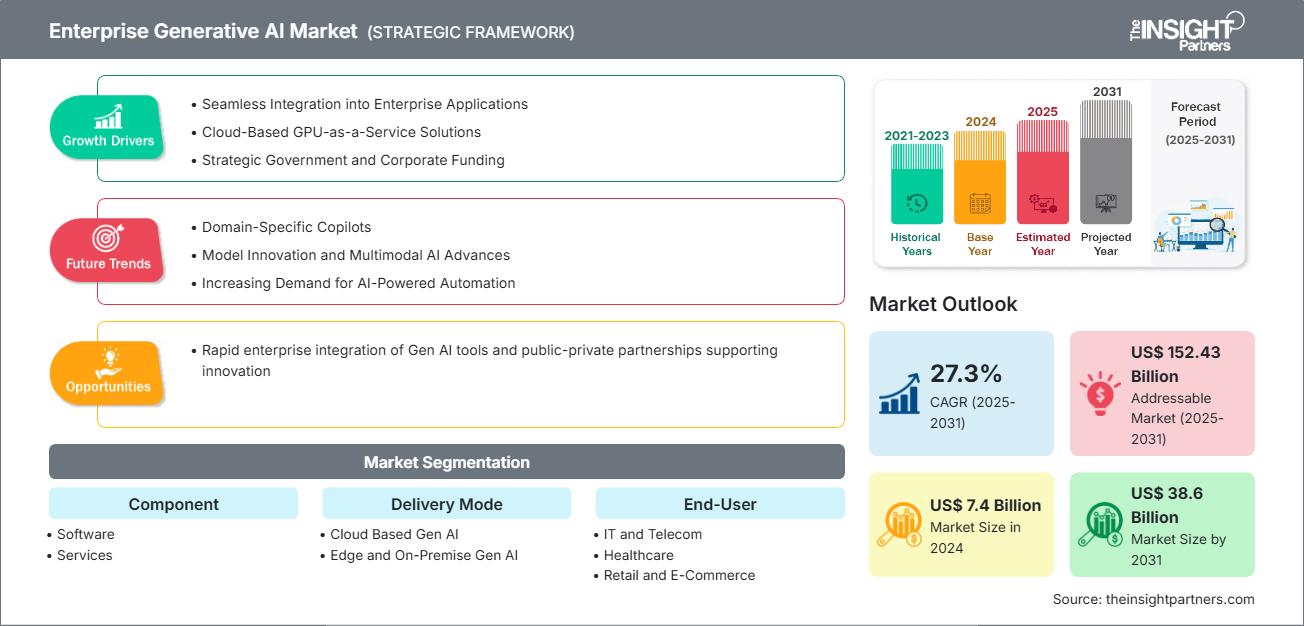

Enterprise Generative AI Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Report Coverage : by Component (Software, Services), Delivery Mode (Cloud Based Gen AI, Edge and On-Premise Gen AI), End-User (IT and Telecom, Healthcare, Retail and E-Commerce, Finance and BFSI, Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Data Released

- Report Code : TIPRE00042063

- Category : Technology, Media and Telecommunications

- No. of Pages : 150

- Available Report Formats :

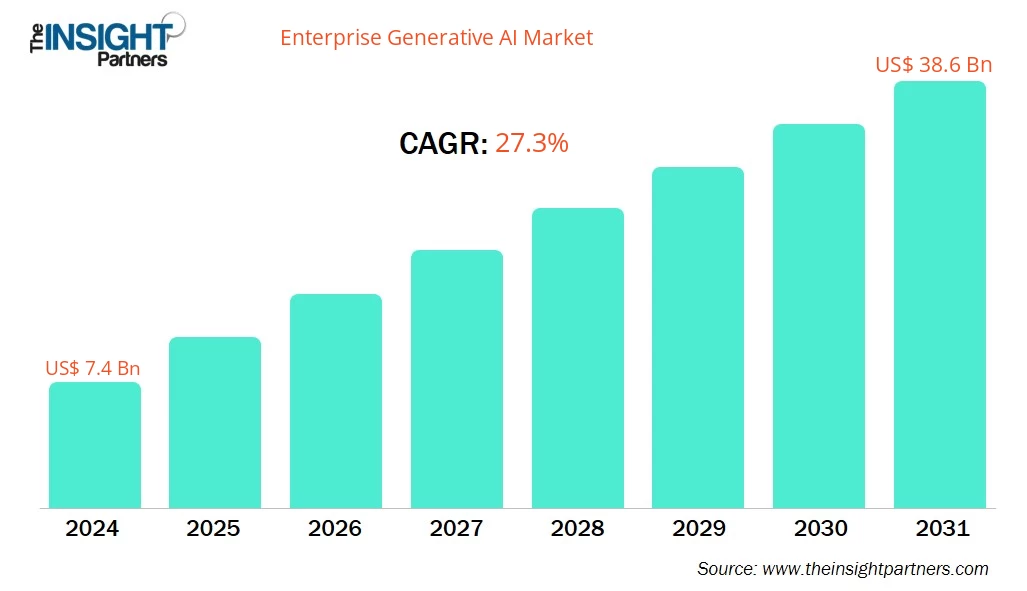

The Enterprise Generative AI Market size is projected to reach US$ 38.6 billion by 2031 from US$ 7.4 billion in 2024. The market is expected to register a CAGR of 27.3% during 2025–2031.

Enterprise Generative AI Market Analysis

The enterprise generative AI market is experiencing rapid Expansion, propelled by Gen AI being integrated into enterprise software platforms, high levels of demand for smart automation, and rising investments from corporations and governments. Cloud GPU-as-a-service offerings have opened up access to compute power, allowing startups and SMEs to deploy Gen AI solutions at scale. Enterprises are integrating Gen AI into productivity applications, customer support software, and decision-making platforms, delivering tangible ROI and business efficiency.

Enterprise Generative AI Market Overview

Enterprise generative AI is the application of AI models with the ability to produce text, images, code, and other types of content in business settings. Such models, based on extensive datasets, facilitate content creation, data analysis, customer engagement, and automation. Organizations boost productivity, tailor experiences, and automate processes by incorporating Gen AI into processes. The technology is being widely used in industries like healthcare, finance, retail, and IT.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEnterprise Generative AI Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Enterprise Generative AI Market Drivers and Opportunities

Market Drivers:

- Seamless Integration into Enterprise Applications: Leading platforms like Microsoft Copilot, Salesforce Einstein GPT, and Adobe Firefly are revolutionizing business workflows by embedding generative AI directly into core enterprise tools. These integrations allow AI to assist in customer relationship management, creative design, data analysis, and team collaboration, enabling employees to automate repetitive tasks and make faster, data-driven decisions.

- Cloud-Based GPU-as-a-Service Solutions: Companies such as AWS, Microsoft Azure, and CoreWeave provide on-demand, scalable GPU resources via the cloud. This model allows enterprises to train and deploy large generative AI models efficiently, without the need for costly, dedicated hardware. Businesses can now experiment with complex AI workloads, scale operations as needed, and reduce infrastructure overhead.

- Strategic Government and Corporate Funding: Both public and private sectors are fueling the rapid adoption of generative AI. Initiatives such as IndiaAI Mission and massive investments like AWS's $230 million startup fund are extending financial backing, technological capabilities, and ecosystem establishment support for AI businesses and companies globally. Such investments enable fastened innovation, lowered entry barriers, and increased Gen AI deployment across various industries.

Market Opportunities:

- Domain-Specific Copilots: Businesses are increasingly embracing domain-trained AI copilots designed for industries like law, finance, and medicine. These domain-specific aides deliver extremely precise, compliance-ready answers while automating sophisticated workflows. By understanding the nuances of specific industries, these copilots help organizations improve decision-making, reduce errors, and achieve significant return on Investment.

- Model Innovation and Multimodal AI Advances: Progress in multimodal AI systems, such as diffusion models and combined agents, is deepening generative AI's capacity to create and process content in various forms, text, images, sound, and video. This technology is enabling companies to deploy more adaptable AI applications, ranging from creative content creation to data analysis automation, expanding Gen AI's real-world significance.

- Increasing Demand for AI-Powered Automation: Companies are applying generative AI in automating activities such as smart searching, summarizing documents, predictive analysis, and decision-making support. Through the integration of AI into these procedures, organizations are able to streamline operational efficiency, minimize manual intervention, and achieve more relevant insights sooner, thus making automation a primary driver of productivity and business expansion.

Enterprise Generative AI Market Report Segmentation Analysis

The enterprise generative AI market size is broken down along different segments to facilitate a better understanding of its composition, growth prospects, and future trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Software Platforms: Enterprise generative AI market software platforms involve foundation models, orchestration tools, and SaaS-based Gen AI solutions focused on particular enterprise applications. They allow companies to embed generative AI in workflows like content generation, customer support, and decision-making.

- Services: Services encompass consulting, model customization, training data provisioning, and managed Gen AI services. These offerings are particularly valuable in regulated industries where compliance, governance, and domain-specific expertise are critical.

By Component:

- Software: The enterprise generative AI market is led by the software segment, with more than 72% of the total share. This is because of the need for scalable, configurable platforms with multimodal generation support, API integration, and enterprise-class security.

- Services: The services segment is the fastest-growing component as enterprises lack in-house AI skills. Enterprises increasingly turn to third-party vendors for deployment, tuning, and governance of generative AI systems.

By Delivery Mode:

- Cloud-based Gen AI: Cloud-based generative AI is the most popular deployment method for enterprises; as a result, it is scalable, cost-effective, and remote-friendly. It enables quick experimentation and integration with existing cloud environments.

- Edge and On-Premise Gen AI: Edge and on-premise deployments are increasing in popularity for latency-critical applications as well as industries with strong data sovereignty requirements. These deployments enable organizations to stay in control of data and infrastructure.

By End-Use Industry:

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Finance and BFSI

- Others (Manufacturing, Media, etc.)

Each sector has specific generative AI requirements, influencing model architecture, data handling, and integration strategies.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The enterprise generative AI market in the Asia Pacific is expected to witness the fastest growth during the forecast period, driven by government-backed AI initiatives, startup innovation, and increasing enterprise adoption in countries such as India, China, and Japan.

Enterprise Generative AI Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 7.4 Billion |

| Market Size by 2031 | US$ 38.6 Billion |

| Global CAGR (2025 - 2031) | 27.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Enterprise Generative AI Market Players Density: Understanding Its Impact on Business Dynamics

The Enterprise Generative AI Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Enterprise Generative AI Market Share Analysis by Geography

Asia Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for enterprise generative AI providers to expand.

The enterprise generative AI market shows a different growth trajectory in each region due to factors such as digital infrastructure, regulatory frameworks, AI readiness, and government initiatives. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds the largest market share due to early adoption, strong infrastructure, and leading AI vendors.

- Key Drivers:

- Integration of Gen AI into productivity and enterprise platforms

- Robust cloud infrastructure and GPU availability

- Strategic partnerships between tech giants and enterprises

- Trends: Rapid enterprise integration of Gen AI tools and public-private partnerships supporting innovation.

2. Europe

- Market Share: Maintains a significant share driven by ethical AI regulations and industrial Digitization.

- Key Drivers:

- GDPR-compliant AI deployment

- EU AI Act and responsible AI frameworks

- Digitization of manufacturing and public services

- Trends: Focus on responsible AI deployment and cross-border data governance.

3. Asia Pacific

- Market Share: Fastest-growing region owing to government initiatives and startup activity.

- Key Drivers:

- National AI missions and public compute infrastructure

- Rise of Gen AI startups and developer ecosystems

- Localization of AI models for regional languages

- Trends: Localization of Gen AI models and public compute infrastructure supporting SME adoption.

4. South and Central America

- Market Share: Emerging market with growing digital transformation.

- Key Drivers:

- Expansion of cloud services and AI education programs

- Adoption of Gen AI in marketing and customer service

- Government-backed innovation hubs

- Trends: Adoption of cost-effective Gen AI solutions for marketing and customer service.

5. Middle East and Africa

- Market Share: Developing market with strong growth potential due to rising AI investments.

- Key Drivers:

- National AI strategies and smart city initiatives

- Investment in digital infrastructure and cloud computing

- Demand for AI in healthcare, education, and public services

- Trends: Integration of Gen AI into national e-health and smart city initiatives.

Enterprise Generative AI Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The enterprise generative AI market is highly competitive, with major players including OpenAI, Microsoft, Google, AWS, IBM, Oracle, Adobe, and NVIDIA. These companies dominate through proprietary models, cloud platforms, and strategic partnerships.

Differentiation Strategies:

- Vertical-specific copilots

- Scalable APIs

- Integration with enterprise software ecosystems

Opportunities and Strategic Moves:

- Strategic partnerships with consulting firms and cloud providers are accelerating Gen AI deployment across industries.

- Companies are investing in AI training, ethical frameworks, and multimodal capabilities to enhance usability and compliance.

Major Companies Operating in the Enterprise Generative AI Market

- OpenAI – United States

- Microsoft Corporation – United States

- Google LLC – United States

- Amazon Web Services – United States

- IBM Corporation – United States

- Oracle Corporation – United States

- Adobe Inc. – United States

- NVIDIA Corporation – United States

- Jasper.ai – United States

- H2O.ai – United States

- Synthesis AI – United States

Disclaimer: The companies listed above are not ranked in any particular order.

Enterprise Generative AI Market News and Recent Developments

- OpenAI released GPT-5 Pro, with upgraded reasoning abilities, Sora 2 for large-scale video creation, and AgentKit to enable developers to create independent AI agents. All of these products represent a strategic direction towards turning ChatGPT into a platform for enterprise-level applications and integrations.

- Microsoft's Fall 2025 Copilot update added Mico, a friendly AI avatar, and capabilities such as Groups, Real Talk, and Imagine. These new updates improve collaboration, workflow automation, and user experience personalization across Microsoft 365 and Edge.

- AWS announced a $230 million investment in 40 generative AI startups and introduced AgentCore via Amazon Bedrock, enabling enterprises to deploy secure AI agents at scale. Use cases in financial services have shown up to 30% productivity gains.

- H2O.ai's h2oGPTe Agent ranked #1 on the GAIA benchmark, outperforming OpenAI. The company also launched LLM Studio, Driverless AI, and a GenAI App Store to support scalable enterprise adoption across sectors.

- Oracle's AI Agent Studio allows enterprises to build custom agents for finance, HR, and supply chain. The company also announced the deployment of 50,000 AMD MI450 chips to strengthen its AI cloud infrastructure and compete with NVIDIA.

Enterprise Generative AI Market Report Coverage and Deliverables

The "Enterprise Generative AI Market Size and Forecast (2025–2031)" report provides a detailed analysis of the market covering below areas:

- Enterprise Generative AI Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Enterprise Generative AI Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Enterprise Generative AI Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Enterprise Generative AI Market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For