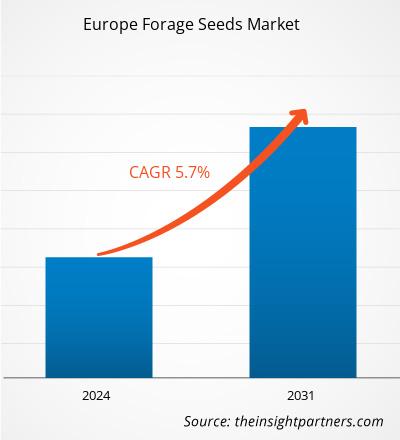

The Europe forage seeds market size was worth US$ 3.57 billion in 2023 and is expected to reach US$ 5.58 billion by 2031; the market is expected to register a CAGR of 5.7% during 2023–2031. A rising preference for certified organic animal feed is expected to become a significant trend in the forage seeds market in Europe during the forecast period.

Europe Forage Seeds Market Analysis

The forage seeds manufacturers across Europe are investing significantly in strategic development initiatives such as product innovation, mergers and acquisitions, and expansion of their businesses to attract many consumers and enhance their market position. To maintain their strategic position in the market, key players are investing significantly in quality enhancement of forage seeds. For instance, in January 2024, Cérience, the seed subsidiary of the Terrena cooperative, announced the total acquisition of the Dutch company Vandinter Semo. This acquisition aligns with the Terrena 2030 strategic plan, marking a new step in developing the seed company Cérience in an international market serving the cooperative and its members.

Further, technological improvements in seed genetics can open significant growth opportunities in the Europe forage seeds market in the coming years. Seed manufacturers are using new breeding techniques that allow the development of new seed varieties with desired traits by modifying the DNA of the seeds and plant cells. These technological improvements are helping address the challenges farmers face during the cultivation of forage seeds. Thus, the constant technological improvements are expected to create lucrative opportunities in the forage seeds market across Europe in the coming years.

Europe Forage Seeds Market Overview

The forage seeds market in Europe is witnessing strong growth due to the surging meat production and the increasing demand for nutritional animal feed. Livestock farms are adopting healthy animal feed to produce healthy, high-quality, and nutritious animal meat products. Furthermore, Europe is known for its large variety of animal stocks and high demand for meat. As per the Eurostat (European Union), in 2020, Europe had nearly 146 million pigs, 76 million bovine animals, and 75 million sheep and goat stock. Such a huge livestock requires sufficient animal feed, thereby increasing the demand for forage seeds.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Forage Seeds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Forage Seeds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Forage Seeds Market Drivers and Opportunities

Increasing Livestock Production

According to the European Commission, the European Union (EU) has a considerable livestock population. There were 133 million pigs, 74 million bovine animals, and 68 million sheep and goats by the end of 2023. Thus, the increasing consumption of livestock products such as meat and increasing milk production has encouraged manufacturers to focus on providing good quality forage crops for feeding livestock. An increasing shift toward sustainable livestock systems that prioritize animal welfare and environmental conservation is encouraging the development of the forage seeds market across Europe.

Further, manufacturers are adopting strategic initiatives such as mergers & acquisitions, partnerships, collaborations, and joint ventures to expand their geographic reach and customer base. For instance, In September 2023, DLF announced the acquisition of the Corteva Agriscience alfalfa breeding program, which includes Corteva’s global alfalfa germplasm and breeding program, the Alforex Seeds brand name and trademarks such as Hi-Gest alfalfa technology, Hi-Ton performance alfalfa, Hi-Salt salinity tolerant alfalfa, and msSuntra hybrid technology, as well as current commercial alfalfa varieties and select Corteva personnel supporting the alfalfa program.

Rising Preference for Organic Feed

People are becoming more conscious about their health; thus, they prefer consuming organic food as it does not contain pesticides. Organic milk and meat are richer in nutrients such as enzymes, bioflavonoids, and antioxidants. Thus, people prefer organic food and organic meat over inorganic. This has led to the demand for organic feed to supply organic meat to consumers. Dairy farms, the poultry sector, and animal husbandry have focused on purchasing high-quality organic forage feed due to the growing demand for organic meat and dairy products. Conventional feed often contains high amounts of chemicals that hamper meat quality when consumed by animals for a long term. To overcome this issue, manufacturers are developing organic feed that contains no chemical additives. Animals feeding on such feed offer meat that has high nutritional value. Thus, consumers often find organic and natural products as healthier alternatives to conventional products. Consumers are mainly inclined toward organic products, which has encouraged manufacturers to invest heavily in products produced with organic constituents. Further, access to infinite information with the help of the Internet has made consumers increasingly aware of their health needs, leading to the increasing demand for organic feed. Thus, a rising preference for organic feed is expected to become a significant trend in the forage seeds market in Europe during the forecast period.

Europe Forage Seeds Market Report Segmentation Analysis

Key segment that contributed to the derivation of the Europe forage seeds market analysis is species.

- Based on species, the Europe forage seeds market is segmented into alfalfa, white clover, red clover, hybrid clover, crimson clover, Egyptian clover, Persian clover, perennial ryegrass, timothy, birdsfoot trefoil, meadow fescue, tall fescue, forage mixtures, annual ryegrass, Italian ryegrass, hybrid ryegrass, Kentucky bluegrass, and others. The forage mixtures segment accounted for the largest share of the market in 2023.

Europe Forage Seeds Market Share Analysis by Country

The scope of the Europe forage seeds market report is mainly divided into Germany, France, Italy, Russia, Spain, the UK, and the Rest of Europe. Germany has one of the most significant livestock industries in Europe. High consumption of raw and processed meat in the country influences the growth of the livestock industry in Germany, which leads to increased demand for animal feed. Swine feed is the largest segment in the German feed industry. As per the Alltech Global data, in 2020, the country produced 27.4 million tons of animal feed. This production rate is expected to increase during the forecast period due to rising cattle and other animal livestock in the country. Moreover, the increasing awareness about the nutritional requirements of animals and improvements in the diets of farm animals by livestock farmers propel the demand for forages across the country. These factors drive the forage seeds market in Germany. France is also one of the significant markets for forage seeds in Europe. Increasing meat consumption and growing livestock farming in France boost the forage seeds market. French animal breeds are highly popular and preferred internationally for meat and other related products. This has led to higher export of animals from the country, propelling the demand for high nutritional animal feed such as forage in the country. As per the US Department of Agriculture (USDA), in France, the production quantity under sorghum forage doubled in the past few years and reached 422,900 metric tons in 2021. France’s extensive land area—of which more than half is arable or pastoral land, and plentiful rainfall across most of France increase the production of forages in the country.

Europe Forage Seeds Market Regional Insights

The regional trends and factors influencing the Europe Forage Seeds Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe Forage Seeds Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe Forage Seeds Market

Europe Forage Seeds Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.57 Billion |

| Market Size by 2031 | US$ 5.58 Billion |

| Global CAGR (2023 - 2031) | 5.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Species

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

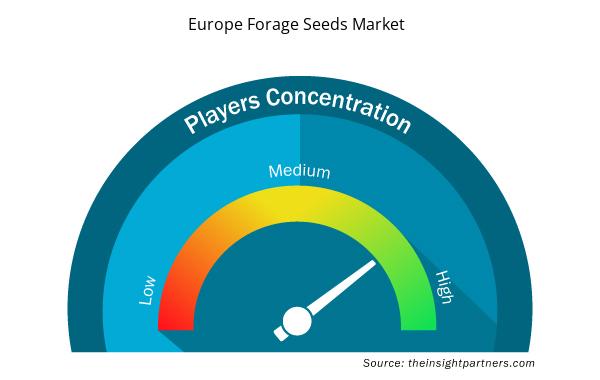

Europe Forage Seeds Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Forage Seeds Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe Forage Seeds Market are:

- Nutrien Ag Solutions

- KWS SAAT SE and Co. KGaA

- DLF Seeds AS

- LIDEA

- Deutsche Saatveredelung AG

- Lantmännen ek

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe Forage Seeds Market top key players overview

Europe Forage Seeds Market News and Recent Developments

The Europe forage seeds market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Cérience, the seed subsidiary of the Terrena cooperative, announced the total acquisition of the Dutch company Vandinter Semo. This acquisition, fully in line with the Terrena 2030 strategic plan, marks a new step in the development of the seed company Cérience in an international market serving the cooperative and its members. Through this acquisition, Cérience aims to accelerate its commercial dynamics in the markets of Northern Europe and strengthen its competitiveness in forage seeds. Cérience seeks to capitalize on these new seed production territories conducive to the multiplication of forage grasses and complementary to its cooperative anchorage in the western part of France (Source: Cerience, Company Website, January 2024)

Europe Forage Seeds Market Report Coverage and Deliverables

The "Europe Forage Seeds Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe forage seeds market size and forecast for all the key market segments covered under the scope

- Europe forage seeds market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Europe forage seeds market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe forage seeds market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What is the expected CAGR of the Europe forage seeds market?

The market is expected to register a CAGR of 5.7% during 2023–2031.

What are the future trends in the Europe forage seeds market?

Rising demand for organic feed is expected to emerge as a future trend in the market during the forecast period.

Which are the leading players operating in the Europe forage seeds market?

Nutrien Ag Solutions, KWS SAAT SE & Co. KGaA, DLF Seeds AS, LIDEA, Deutsche Saatveredelung AG, Lantmännen ek, Limagrain Uk Ltd, Feldsaaten Freudenberger GmbH & Co KG, and Nordic Seed AS are among the key players operating in the market.

What are the factors driving the Europe forage seeds market?

Increasing livestock population drives the market growth.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Europe Forage Seeds Market

- Nutrien Ag Solutions

- KWS SAAT SE & Co. KGaA

- DLF Seeds AS

- LIDEA

- Deutsche Saatveredelung AG

- Lantmännen ek

- Limagrain Uk Ltd

- Feldsaaten Freudenberger GmbH & Co KG

- Nordic Seed AS

- Cerience

Get Free Sample For

Get Free Sample For