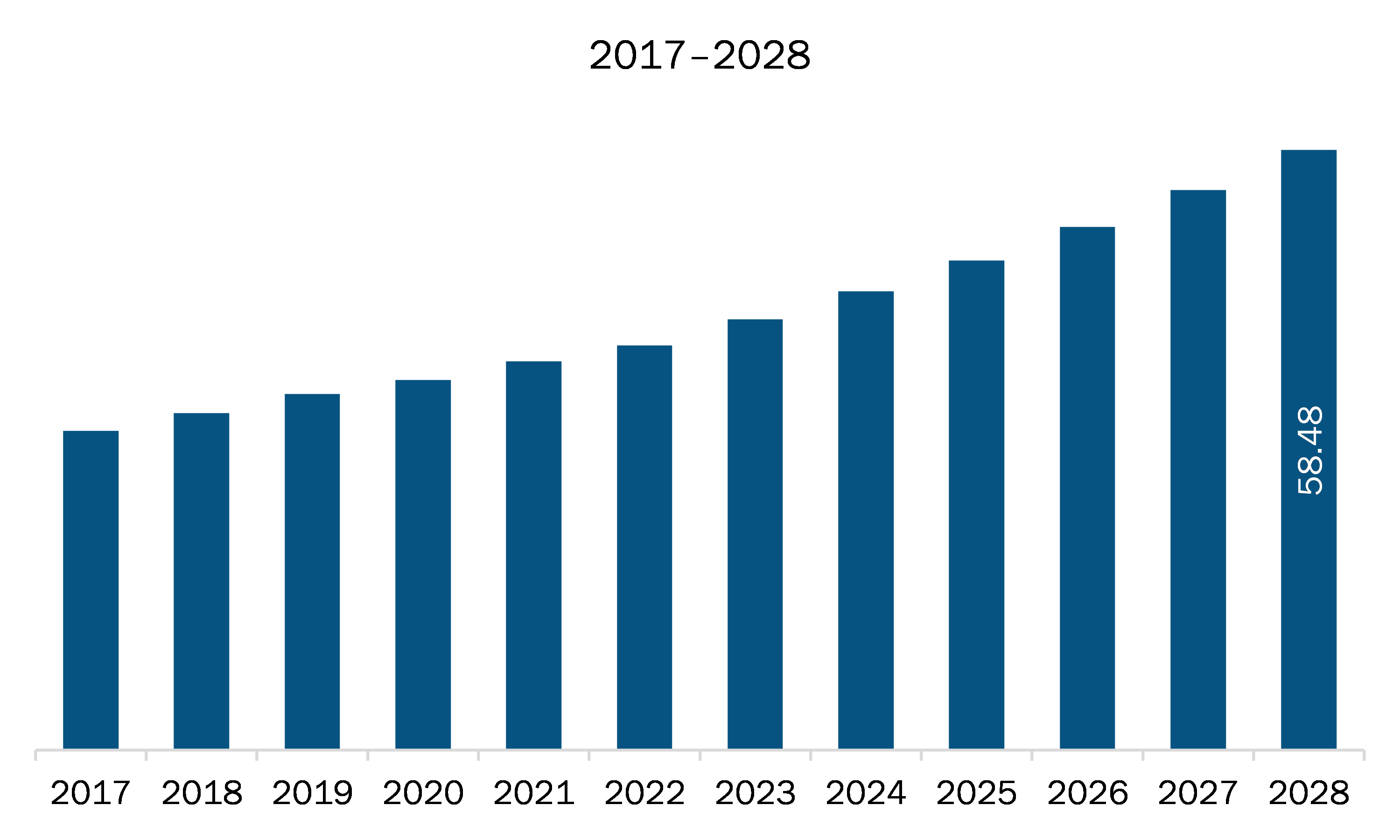

The glass wafers market in Europe is expected to grow from US$ 36.03 million in 2020 to US$ 58.48 million by 2028; it is estimated to grow at a CAGR of 6.1% from 2021 to 2028.

The market for Europe includes Germany, France, Italy, the UK, Russia, and the rest of Europe. Europe has matured the automotive, aerospace, medical, and consumer electronics sector, and it is further supported by high technology connectivity environment. Additionally, the consumers' rising personal disposable income has led to increasing demand for consumer electronic products. These factors boost the glass wafer market in Europe. Moreover, the usage of glass wafers in healthcare and biotechnology products has further propelled the Europe glass wafer market growth. This is also projected to provide substantial growth opportunities for the key players operating in Europe.

In case of COVID-19, in Europe, especially France, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of glass wafers manufacturing activities; other glass components manufacturing sector has subsequently impacted the demand for glass wafers during the early months of 2020. Moreover, decline in the overall manufacturing activities has led to discontinuation of glass equipment manufacturing projects, thereby reducing the demand for glass wafers. Similar trend was witnessed in other European countries, i.e., Russia, UK, Italy, Spain and Germany. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe glass wafers market. The Europe glass wafers market is expected to grow at a good CAGR during the forecast period. Glass wafers have now increasingly been used in various industries such as consumer electronics, healthcare and biotechnology, automotive, aerospace and defense, IT and telecommunications, and many more. The rise in demand for compact electronics across the world has led to a high degree of miniaturization. Glass wafers are used as a carrier substrate in the production of semiconductor wafers which has become an essential part of most electronic products such as tablets, mobiles, wearable devices, etc. There are many electronic devices such as laptops, smartphones which use integrated circuits and semiconductors, which increases the demand for glass wafer. In the automotive industry, the glass wafer is mostly used for the protection of exterior lights, used in the automated driving system, and also in the communication systems of vehicles. In the aerospace and defense sector, the glass wafer is mostly used in commercial sensing. It is also used for navigation and displays, as well as for electronics and sensors. The increase in the demand for high memory applications in industries is going to drive the glass wafer market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Glass Wafers Market Segmentation

E

urope Glass Wafers Market – By Application

- CMOS Image Sensor

- Integrated Circuit (IC) Packaging

- LED

- Microfluidics

- FO-WLP

- Mems and RF

- Others

Europe Glass wafers Market – By End Use

- Energy

- IT and Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Automotive

- Healthcare and Biotechnology

- Others

Europe Glass Wafers Market, by Country

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Rest of Europe

Europe Glass Wafers Market-Companies Mentioned

- Schott AG

- AGC Inc.

- Corning Incorporated

- Plan Optik AG

- Bullen

- Nippon Electric Glass Co. Ltd.

- Samtec Inc.

- Shin-Etsu Chemical Co., Ltd.

Europe Glass Wafers Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 36.03 Million |

| Market Size by 2028 | US$ 58.48 Million |

| CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For