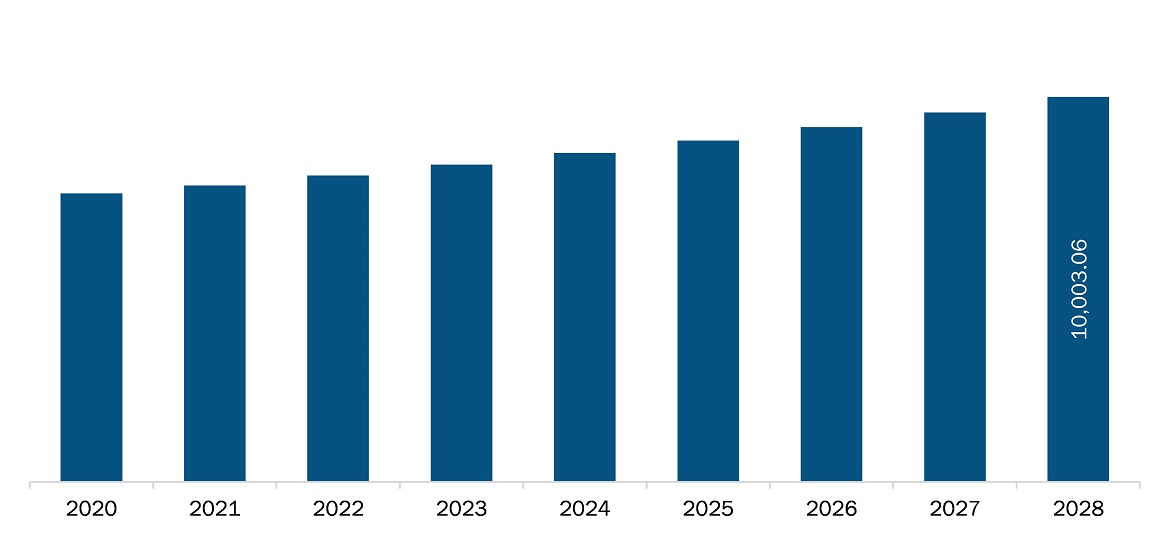

The medical imaging market in Europe is expected to grow from US$ 7,703.9 million in 2021 to US$ 10,003.1 million by 2028; it is estimated to grow at a CAGR of 3.8% from 2021 to 2028.

Diagnostic testing is an integral part of the healthcare system, providing essential information to enable providers and patients to make the right clinical decisions. Indeed, around 75% of clinical decisions are based on a diagnostic test. Demand for access to quicker and accurate diagnosis is rising at a rate of 10% per year, increasing the cost and putting pressure on the capacity and capability of diagnostic providers. From the patient point of view, early detection and diagnosis can prevent unnecessary pain and suffering. It can also reduce the scale and cost of treatment. A large body of research links early diagnosis to measurable health gains, such as improved survival rates and lower treatment costs. Further, government awareness will further propel the market growth. For instance, Be Clear on Cancer campaigns aim to improve early diagnosis of cancer by raising public awareness of signs and symptoms of cancer and encourage people to see their GP without delay. The programme is led by Public Health England, working in partnership with the Department of Health and NHS England.

Increasing COVID-19 has impacted the diagnosis and treatment of diseases, due to the diversification of the medical work force and decision to focus on treating the critically ill. Due to the current pandemic, many cancer research organizations which are dealing with Ultrasound Transducers treatment are not taking appointments to avoid anxiety associated with same. Due to new clinical practice breast oncologist are prioritizing their patients and making difficult choices by offering less treatment. The specificity and sensitivity in the chest were determined majorly with the help of computed tomography among COVID-19 positive patients. The scale of the COVID-19 pandemic has resulted in the acquisition of huge volumes of imaging data. Traditionally, research using imaging data constituted collation of data within single hospitals or groups of hospitals at most. Thus, the volumes of medical imaging performed by patients suffering with COVID-19 among various countries of Europe is likely to pose a positive impact on growth of the Europe Medical Imaging market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the medical imaging market. The Europe medical imaging market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Medical Imaging Market Segmentation

By Product

- CT Systems

- X-ray Systems

- PET Systems

- MRI systems

- Ultrasound Systems

- Others

By End User

- Hospitals

- OP Centres

- Clinicians Offices

- Emergency Care Centres

By Country

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

Companies Mentioned

- General Electric Company

- Siemens AG

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Hitachi, Ltd.

- Canon Inc.

- Hologic, Inc.

- Carestream Health Inc.

- ESAOTE SPA

- Samsung Group

Europe Medical Imaging Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 7,703.9 Million |

| Market Size by 2028 | US$ 10,003.1 Million |

| CAGR (2021 - 2028) | 3.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For