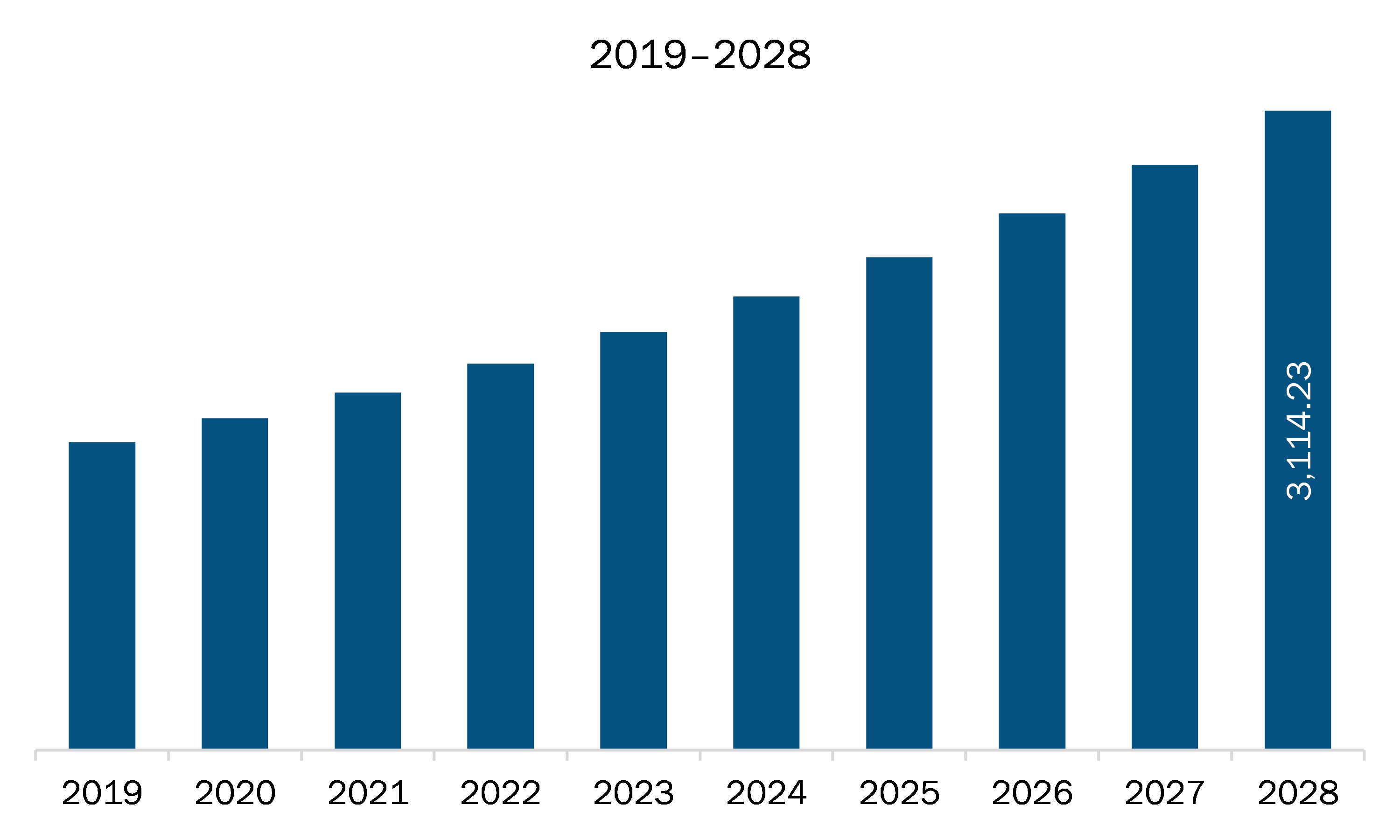

The Europe pharmaceutical isolator market is expected to grow from US$ 1,741.57 million in 2021 to US$ 3,114.23 million by 2028; it is estimated to grow at a CAGR of 8.7% from 2021 to 2028.

The UK, Germany, France, Italy, and Spain are major economies in Europe. Rules and regulations to support adoption of pharmaceutical isolators is expected to surge the market growth. A pharmaceutical isolator offers a superior sterile environment than conventional clean rooms. Positive or negative pressures inside the chamber prevent contamination due to operator interference. It ensures long-lasting sterility in accordance with pharmaceutical regulations related to the manufacturing of sterile medicine products. Moreover, most of the experts agree that regulatory agencies are no longer impeding progress when it comes to technologies such as pharmaceutical isolators. The guidelines set by the agencies have an important role in the adoption of isolators in comparison to cleanrooms. Administrations mentions isolators 55 times in its latest guideline of manufacturing in an aseptic environment. A well-designed positive pressure isolator, supported by adequate procedures for its maintenance, monitoring, and controls, offers significant advantages over traditional aseptic processing, including fewer opportunities for microbial contamination during processing. Isolators have become a core component of the pharmaceutical industry, as the cost of noncompliance with the regulatory guidelines is much high. Pharmaceutical isolators are critical for a range of processes to ensure aseptic conditions and containment. Stringent aseptic conditions are essential to maintain quality control and meet the administration current good manufacturing practice guidelines and other regulatory demands. WHO good manufacturing practices guidelines for sterile pharmaceutical products, section 8 of Annex 6 also mention the use of isolator technology to minimize human interventions in processing areas. All these regulatory guidelines fuel the adoption of pharmaceutical isolators in the Europe market.

In case of COVID-19, Europe is highly affected specially France and Russia. Europe has strengthened its efforts to serve through its pharmaceutical industry. For instance, On January 4, 2021, Moderna and Recipharm Announce COVID-19 vaccine supply agreement. The companies have entered into an agreement to support the formulation and fill/finish of Moderna’s COVID-19 vaccine supply outside of the United States. According to a Recipharm press release, the manufacturing will take place at Recipharm’s drug product manufacturing facility in France and, subject to regulatory approval in countries outside of the US, the supply will begin in early 2021. On December 9, 2020, CureVac N.V, a global clinical-stage biopharmaceutical company developing a new class of transformative medicines based on messenger ribonucleic acid (mRNA), and Fareva announced an agreement regarding the fill & finish manufacturing of CureVac´s COVID-19 vaccine candidate, CVnCoV, at Fareva’s Pau and Val-de-Reuil-sites in France. Wockhardt Ltd has entered into an agreement with the UK government to fill and finish covid-19 vaccine vials at its subsidiary CP Pharmaceuticals’ facility based in Wrexham, North Wales. As per the agreement, Wockhardt will fill finish the vaccines in vials after it receives the bulk products from the company manufacturing successful vaccines. All these developments will support the market growth for pharmaceutical isolators during the pandemic.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe pharmaceutical isolator market. The Europe pharmaceutical isolator market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Pharmaceutical Isolator Market Segmentation

Europe Pharmaceutical Isolator Market – By Type

- Open Isolators

- Closed Isolators

Europe Pharmaceutical Isolator Market – By Pressure

- Positive Pressure

- Negative Pressure

Europe Pharmaceutical Isolator Market – By Configuration

- Floor Standing

- Modular

- Compact

- Mobile

Europe Pharmaceutical Isolator Market – By Application

- Aseptic

- Sampling & Weighing

- Fluid Dispensing

- Containment

- Others

Europe Pharmaceutical Isolator Market – By End User

- Pharmaceutical and Biotechnology Companies

- Hospitals

- Research and Academic Laboratories

- Other

Europe Pharmaceutical Isolator Market, by Country

- Germany

- France

- Italy

- UK

- Spain

- Rest of Europe

Europe Pharmaceutical Isolator Market -Companies Mentioned

- Azbil Telstar

- Bioquell (Ecolab Solution)

- Comecer

- Fedegari Autoclavi S.p.A.

- Getinge AB

- Hosokawa Micron Group

- ITECO S.R.L.

- Nuaire Inc.

- Schematic Engineering Industries

Europe Pharmaceutical Isolator Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,741.57 Million |

| Market Size by 2028 | US$ 3,114.23 Million |

| CAGR (2021 - 2028) | 8.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For