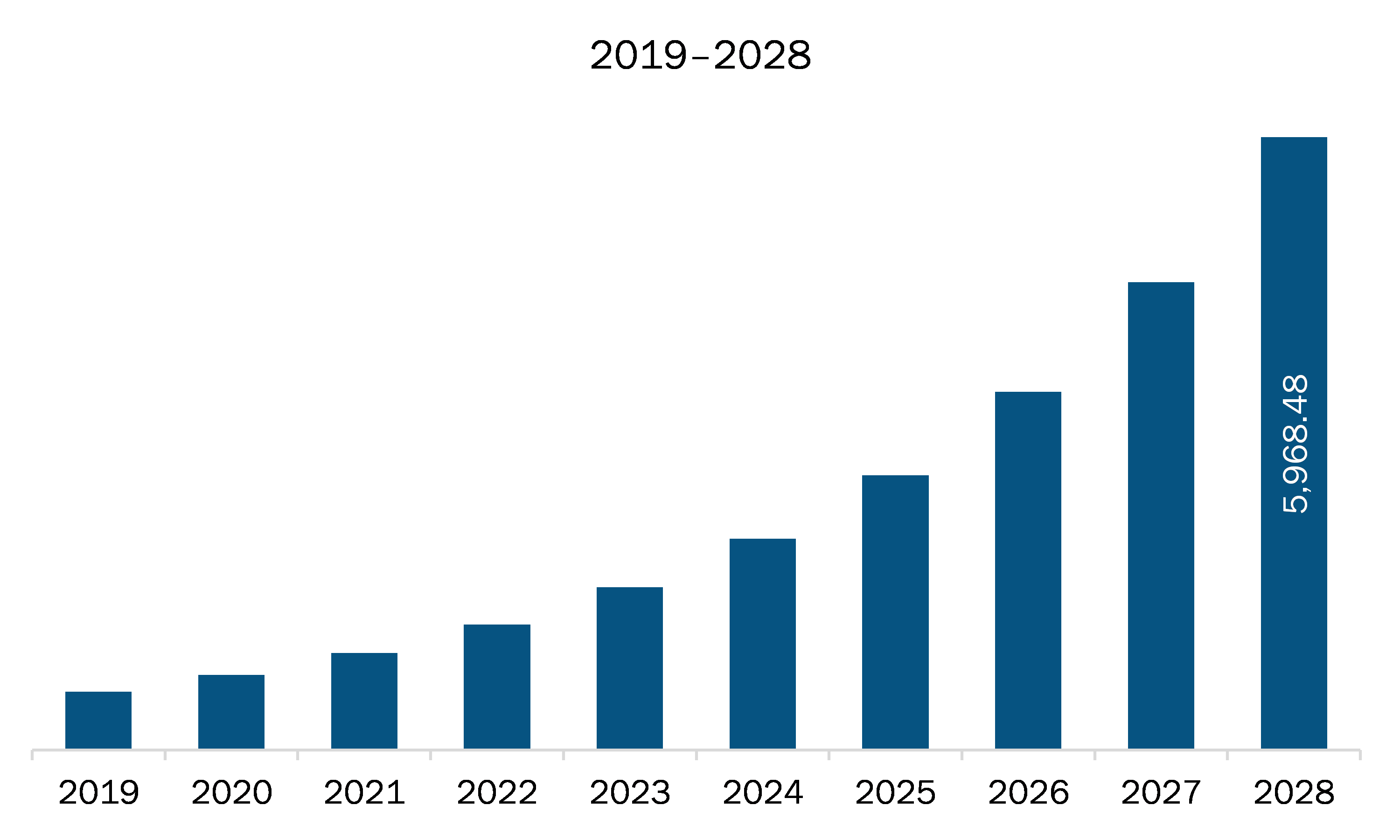

The remote cardiac monitoring market in Europe is expected to grow from US$ 943.41 million in 2021 to US$ 5,968.48 million by 2028; it is estimated to grow at a CAGR of 30.2% from 2021 to 2028.

Germany, France, and Italy are major economies in Europe. Increase in preference for remote patient monitoring during COVID-19 pandemic is the major factor driving the growth of the Europe remote cardiac monitoring market. A new era of cardiac management began in 1960 with the creation of the first implantable pacemaker, which has since saved countless lives and transformed the practice of medicine. Furthermore, the implementation of remote patient monitoring (RPM) was a pivotal step in this advancement. In the aftermath of COVID-19, remote monitoring has emerged as a promising solution. A growing number of healthcare providers are using technology-enabled solutions to manage diabetes, improve clinical outcomes, and enhance the patients’ quality of life. Amid the COVID-19 pandemic, compelling people to avoid crowds and going out at public places, healthcare providers are emphasizing providing patient-centered care through virtual medical treatments. Elderly populations suffering chronic diseases, among other people, require frequent check-ups and continuous health monitoring. It is time-consuming for them to drive back and forth to visit physicians, and alternatives such as in-house care are unreasonably expensive for the majority of them. Moreover, they can be at a high risk of COVID-19 infection during hospital visits. These factors have led to the increased adoption of remote patient monitoring. With the rise in the use of remote patient monitoring during the COVID-19 pandemic, many companies have redirected their focus on mergers and acquisitions. Philips has recently agreed to acquire BioTelemetry, a medical technology company that specializes in cardiac diagnostics and remote patient monitoring services. This deal would allow Philips to expand its remote patient monitoring business beyond hospitals and into patients' homes. Philips is already a major player providing remote patient monitoring devices for the hospitals segment. As telemedicine is becoming an integral part of various national healthcare strategies to combat COVID-19, the demand for remote patient monitoring devices that are interoperable with the service provider's telehealth infrastructure is bound to rise, which is further anticipated to drive the market in Europe.

Europe is highly affected by the outbreak of the COVID-19. Countries such as Spain, Italy, the UK, France, Germany, Switzerland, and Russia are highly affected. Most of the deaths were recorded in these nations in the initial phases of the pandemic onset. The EU countries are currently facing the second wave of the pandemic. Therefore, to manage the spread of COVID-19, governments of various countries have implemented lockdown. In the age of COVID-19, digital devices used by patients are increasingly being guided to monitor those who might need hospital admission or who have lately been discharged. In a scheme in northwest London, wearables received the vital signs of people quarantining before or after traveling abroad and healthcare staff who couldn’t isolate themselves at home. A trained team monitored round-the-clock data. If the team detected signs of decline, people could be transferred to the hospital when necessary. Reducing direct contact between people in quarantine and health workers could reduce transmission of SARS-CoV-2 and reduce the use of personal protective equipment.Reliable and timely COVID-19 observation of vital signs is an integral part of the monitoring, prevention, touch recording, and control of infections and clinical management. The outbreak of COVID-19 has led to an increase in the preference for remote monitoring of patients with cardiac diseases. This transformation has been utilized to reduce the chances of viruses due to frequent hospital and clinic visits. Various start-ups have also introduced products that can be used for monitoring cardiac patients. For instance, iRhythm, AliveCor, and medical device giants, such as Medtronic, are actively manufacturing heart-monitoring EKG devices for cardiac patients to use at house and for clinicians to use on COVID-19 patients. It is complex and critical for medical and nursing staff to control COVID-19 patients in person. Patients infected and symptomatic need to be separated in rooms with negative pressure. The new and advanced devices allow staff to monitor such patients more quickly from another room. Multiparametric remote monitoring of cases with heart failure (HF) can alleviate the health risks amid lockdowns. The lockdown restrictions caused a marked drop in healthcare use but did not affect the clinical status of HF patients under multiparametric remote monitoring. Thus, the COVID-19 pandemic increased the demand for healthcare monitoring and awareness, thereby boosting the remote patient monitoring market during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Remote Cardiac Monitoring Market Segmentation

Europe Remote Cardiac Monitoring Market – By Product Type

- Devices

- Vital Signs Monitors

- Heart Rate Monitors

- Blood Pressure Monitors

- Breath Monitors

- Holter Monitors

- Others

- Software

- Cloud Based Software

- On-Premise Software

- Services

Europe Remote Cardiac Monitoring Market – By End User

- Hospitals and Clinics

- Emergency Settings

- Homecare Settings

- Others

Europe Remote Cardiac Monitoring Market– By Country

- Germany

- France

- United Kingdom

- Italy

- Spain

- RoE

Europe Remote Cardiac Monitoring Market-Companies Mentioned

- Abbott

- Biotronik, Inc.

- Boston Scientific Corporation

- GE Healthcare

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Medtronic

- Nihon Kohden Corporation

- OSI Systems, Inc.

Europe Remote Cardiac Monitoring Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 943.41 Million |

| Market Size by 2028 | US$ 5,968.48 Million |

| CAGR (2021 - 2028) | 30.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For