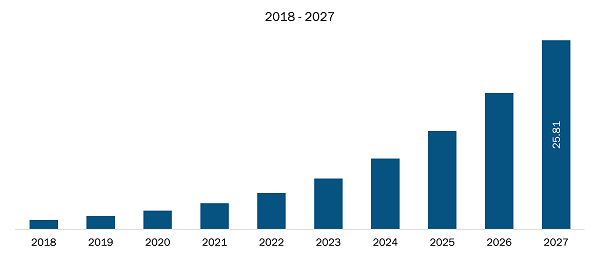

The Europe robotic refueling system market is expected to grow from US$ 6.47 millions in 2021 to US$ 59.74 millions by 2028; it is estimated to grow at a CAGR of 32.0% from 2021 to 2028.

A robotic refueling system has the advantage of preventing human contact with potentially dangerous fumes, avoiding driver’s exposure to extreme hot or cold temperatures during fueling, and reducing the labor costs associated with full-service fueling stations. The increasing number of EVs and autonomous cars is one of the major factors contributing toward the growth of Europe robotic refueling system market. Also, the increasing amount of mobility hubs, with a larger C-store, restaurant, and several energy forms and transportation are anticipated to propel the market growth in the coming years.

The main focus of robotic fuelling is to explore improvements over existing systems (manual) mainly by cost reduction (personnel cost) through automation. Simplification in robotic fueling can be achieved by redesigning the vehicle positioning and fuel dispensing systems. The Europe robotic refueling system market has been witnessing robust growth due to factors such as low cost of operation and flexibility of dispensing different fuels; adoption of this system by the mining industry owing to cost, flexibility, and safety; and increased productivity of mining operations. No requirement for operators on-site to refuel vehicles is considered the major driving factor for the robotic refueling system’s remarkable growth rate. Further, the growth of the European market is led by escalating spending by sectors, such as oil & gas and aerospace & defense. Fast turnaround time, low operating cost, and easily accessible service points are promoting the adoption of robotic refueling systems considerably.

The impact of COVID-19 pandemic differed from country to country across Europe. Various countries recorded an increase in the number of infected cases and subsequently imposed strict and extended lockdown periods or social isolation. Due to the decline in operations in several industries, the demand for robotic refueling systems decreased notably. For instance, the automotive industry in Europe was severely hit and witnessed decline in overall automotive production by over 20% from 2019 due to severe supply chain disruption caused by lockdowns globally. Similalry, domestic and international travel restrictions restrained the movement of passengers. Since operations at various airports were disrupted due to stringent restrictions, the requirement for robotic refueling systems was negatively affected to a drastic extent. However, the COVID-19 pandemic has compelled manufacturers to streamline their production processes to overcome the unexpected disruption. The demand for robotic refueling systems is expected to recover by 2022, as companies are investing in making operations efficient and productive.

Europe Robotic Refueling System Market Revenue and Forecast to 2028 (US$ Thousands)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Robotic Refueling System Market Segmentation

The Europe robotic refueling system market is segmented into component, fuel, and industry vertical. Based on component, the market is segmented into hardware and software. Based on fuel, the global Europe robotic refueling system market is segmented into gaseous fuel, gasoline, diesel, and others. Based on industry vertical, the market is categorized into aerospace and defense, automotive, construction, oil and gas, mining, and others. In terms of geography, the Europe robotic refueling system market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. A few of the key companies operating in the Europe robotic refueling system market are ABB Ltd, Fanuc Corporation, Fuelmatics AB, Gazprom Neft PJSC, Kuka AG, Rotec Engineering, Shaw Development LLC, Yaskawa Electric Corporation, Neste, and Scott Technology Ltd.

Europe Robotic Refueling System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6.47 Million |

| Market Size by 2028 | US$ 59.74 Million |

| CAGR (2021 - 2028) | 32.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

What are reasons behind Europe robotic refueling system market growth?

What are market opportunities for Europe robotic refueling system market?

Which component is expected to dominate the market in the forecast period?

Which fuel is expected to dominate the market in the forecast period?

Which industry vertical is expected to dominate the Europe robotic refueling system market in the forecast period?

What trends are expected to drive the demand for various robotic refueling system?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For