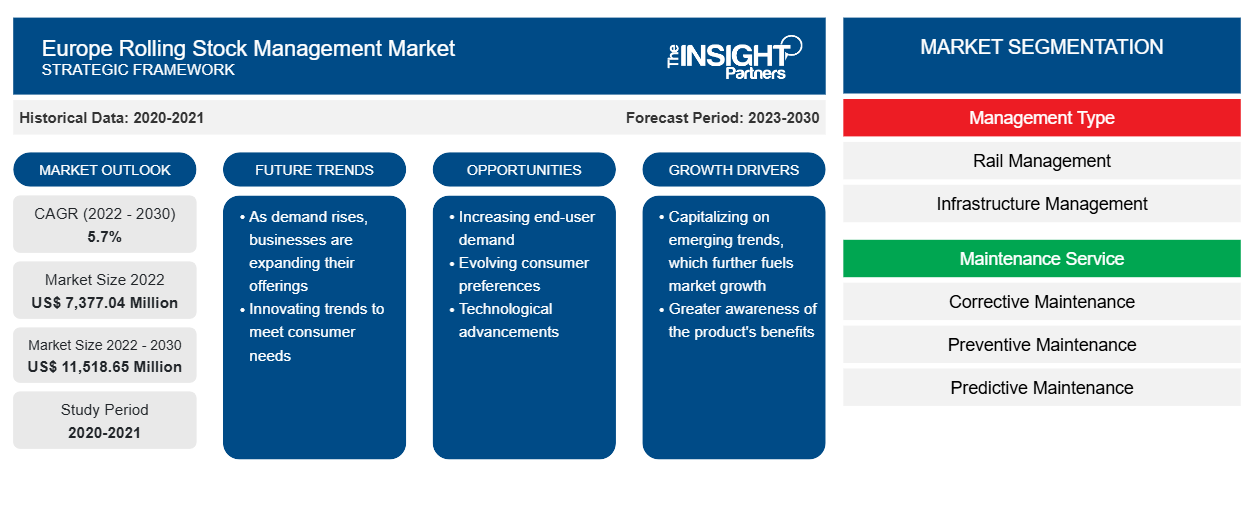

Europe Rolling Stock Management Market Drivers and Forecasts by 2030

Europe Rolling Stock Management Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Management Type (Rail Management and Infrastructure Management) and Maintenance Service (Corrective Maintenance, Preventive Maintenance, and Predictive Maintenance)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00030078

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 96

Europe rolling stock management market accounted for US$ 7,377.04 million in the year 2022 and is expected to account for US$ 11,518.65 million in the year 2030; it is expected to grow at a CAGR of 5.7% during the period 2022–2030.

Analyst Perspective:

Europe has one of the world's largest train networks. The European Union has been planning to double freight rail's model share by 2030 to ease the congestion of major road connections and reduce the transport sector's CO2 emissions. Countries in the region are signing contracts with various companies for rail or infrastructure expansion. Rail transportation plays a key part in Europe's development. As per the International Energy Agency (IEA) report, in 2020, passengers traveled ~378 billion passenger kilometers on European railways, making this region the massive market for rail passenger traffic. This, in turn, will result in a rise in demand for rolling stock management market in Europe.

Market Overview:

Rolling stock refers to railway vehicles that include both powered and unpowered vehicles. It is referred to any railway vehicle that can move on the rail tracks. The rolling stock's maintenance, information tracking, and management are the key features of the rolling stock management system. It maintains the information regarding the running as well as breakdown and inspection records of the rolling stocks. It also stores the records of the rolling stock from its manufacturing to the information regarding its main fittings. The management of the history log of the rolling stock helps the workers, during its inspection and breakdown, to efficiently manage their work.

For instance, in January 2023, UK-based Transport for Wales (TfW) announced the start of its construction of a new Butetown railway station and overhaul of Cardiff Bay station. Therefore, with the expansion of the railway network and infrastructure, the rolling stock management market is expected to grow significantly in the coming years. Similarly, Sinara Transport Machines Holding (STM) established a new railway infrastructure division to offer infrastructure maintenance services in Russia starting in 2022.

The rise in the rail industry is also one of the significant contributors to the rolling stock management market. The rise in the launch of new rail stations and expansion of the rail network generates the need for an efficient rolling stock management system to manage the rolling stock, its route, and maintenance. New station and rail expansion projects are key factors accelerating the rolling stock management market growth.

Based on management type, the rolling stock management market is bifurcated into rail management and infrastructure management. Based on maintenance service, the rolling stock management market is categorized into corrective maintenance, preventive maintenance, and predictive maintenance. The rolling stock management market share, based on region, is categorized into the UK, Russia, and Poland.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Rolling Stock Management Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Digital transformation of rolling stock management Boosting The rolling Stock Management Market Growth

Digital technologies enable rail operators to streamline operations, improving efficiency. This includes digital scheduling, route optimization, and real-time tracking of rolling stock. As efficiency increases, operators can get more out of their existing rolling stock, reducing the need for additional investments in new trains. Digital technologies enhance the passenger experience. Real-time updates, Wi-Fi connectivity, and digital ticketing systems make rail travel more convenient and attractive to passengers. Satisfied passengers are more likely to use rail services, driving demand for rolling stock. Digital systems also help manage rail infrastructure more effectively as it helps to monitor track conditions, switches, and signals. Improved infrastructure management ensures that rolling stock can operate on well-maintained tracks, reducing wear and tear. Digitalization promotes interoperability between different rail networks and systems. This is crucial in Europe, where cross-border rail travel is common. Interoperable systems facilitate seamless travel and trade, increasing the importance of well-managed rolling stock. The digital transformation of rail transportation in Europe offers numerous benefits, including operational efficiency, safety improvements, enhanced passenger experience, and environmental sustainability. These advantages drive the demand for advanced rolling stock management solutions that leverage digital technologies to optimize operations and asset management. Thus, the increasing awareness regarding the benefits of digital transformation drives the rolling stock management market in Europe.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on management type, the Europe rolling stock management market share is segmented into rail management and infrastructure management.

Efficient rail management is crucial in optimizing the performance of the rolling stock. The implementation of rail management provides conditioning-based monitoring and predictive analytics that help rail operators reduce downtime, improve reliability, and extend the rolling stock's lifespan. These management systems are focused on enhancing operational efficiency by optimizing train schedules and minimizing delays. Therefore, rolling stock management market players are deploying solutions for better rail management. For instance, in May 2021, MV Technology Solutions Pty Ltd, in partnership with HaslerRail AG, provided a real-time remote diagnostics system to Adelaide train fleets. The HaslerRails EVAplus software for rail data management provides real-time remote monitoring of maintainers and operators. The demand for such solutions is increasing with the rise in fleet size. For instance, according to Indian Railways, the locomotive fleet size was 12,734 units as of March 2021 and increased to 13,215 units as of March 2022. Such an increase in the rolling stock fleet leads to an increase in operation and movements, further rolling stock management market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The rolling stock management market in the UK is primarily focused on ensuring the safe, reliable, and efficient operation of trains and rail vehicles. It includes maintenance, servicing, repair, refurbishment, and rolling stock upgrades. Several companies and organizations are involved in rolling stock management in the UK. These include train operating companies (TOCs), rolling stock leasing companies (ROSCOs), maintenance and repair providers, and government agencies such as Network Rail. Further, the UK government is also focusing on improving the railway infrastructure of the UK, which is one of the significant drivers of the Europe rolling stock management market share. For instance, in May 2023, the UK government unveiled a US$ 77.17 million funding initiative to enhance train reliability in Manchester. This financial package will be directed toward constructing a third platform at Salford Crescent Station and the comprehensive improvement of rail tracks in Northern Manchester. The funding will be used to construct a third platform at Salford Crescent station and complete track improvement work across North Manchester. These initiatives are part of ongoing maintenance, upgrades, and modernization efforts for rail infrastructure, which are essential for rolling stock management. Thus, the government's funding package for rail infrastructure in Manchester significantly contributes to the UK rolling stock management market.

Key Player Analysis:

Alstom SA, Hitachi Rail Ltd, ABB Ltd, Mitsubishi Electric Corp, Siemens Mobility GmbH, Talgo SA, Thales SA, Toshiba Infrastructure Systems and Solutions Corp, Trimble Inc, and LocoTech LLC are the prominent market participants in the rolling stock management market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the rolling stock management market. The market initiative is a strategy adopted by businesses to expand their footprint and to meet the growing customer demand. The key rolling stock management market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key rolling stock management market players are listed below:

Year |

News |

|

Mar-2023 |

Alstom has inked a contract with the Port Authority of New York and New Jersey and Newark Liberty International Airport to provide operations and maintenance services for its Innovia monorail system, known as AirTrain Newark, for the next seven years, until January 2030. The contract is valued at ~ US$ 263.15 million and includes an option for one additional year. |

|

Jan 2022 |

Alstom was awarded a renewed contract with VR Sweden to maintain 30 regional trains in Sweden. Alstom will provide fleet maintenance to VR Sweden, the new operator of the trains, for Tåg I Bergslagen's fleet, which links the four Bergslag counties. |

Europe Rolling Stock Management Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7,377.04 Million |

| Market Size by 2030 | US$ 11,518.65 Million |

| CAGR (2022 - 2030) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Management Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For