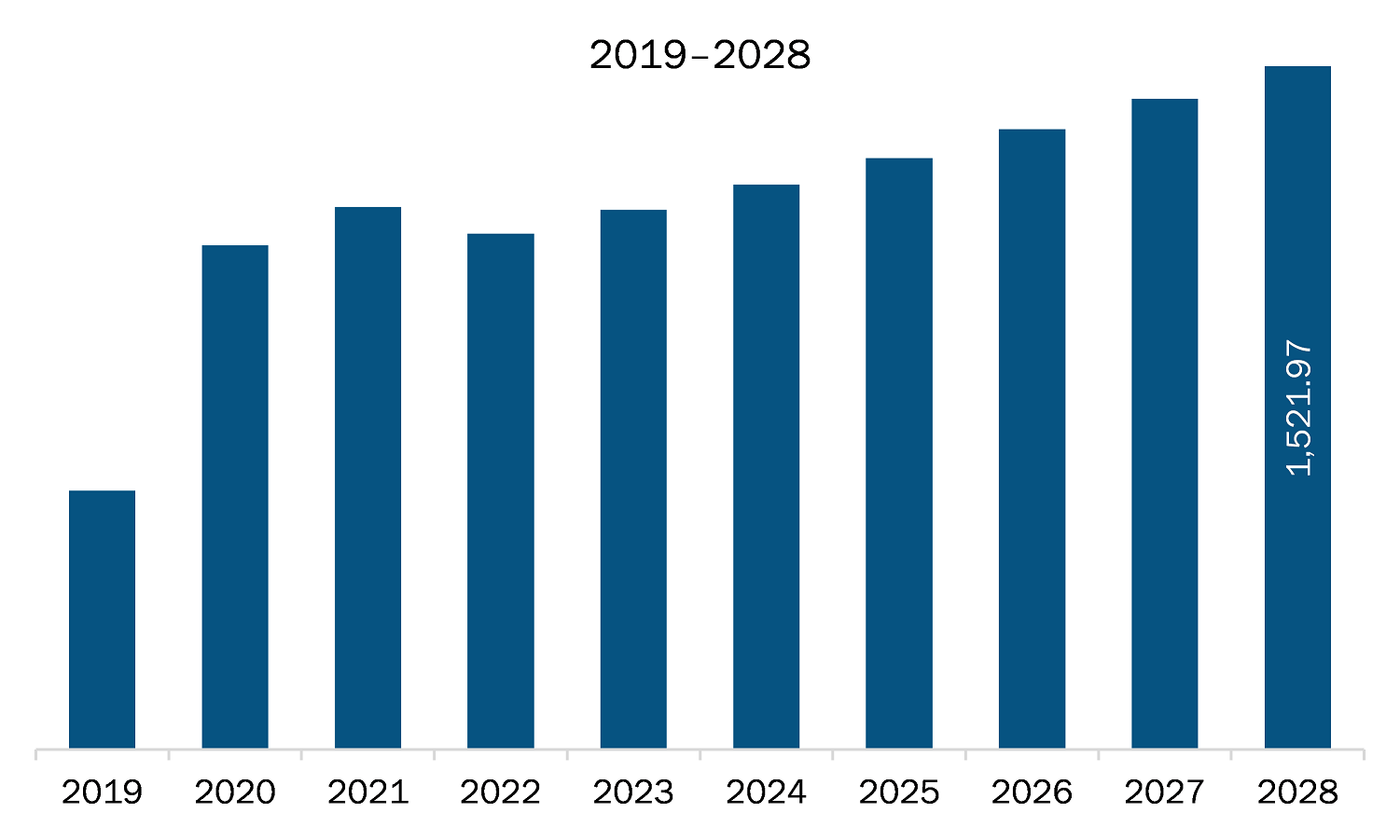

The virology market in Europe is expected to grow from US$ 1,208.26 million in 2021 to US$ 1,521.97 million by 2028; it is estimated to grow at a CAGR of 3.4% from 2021 to 2028.

The UK, Germany, France, Italy, and Spain are major economies in Europe. Virology is among the significant sections of the healthcare system. It has an extensive application in vaccine development, diagnostics, treatment therapies, and others. The market players are constantly involved in product innovations and developments to sustain the competition in the market. They explore various scopes for product innovations.For instance, for COVID-19, market players are investing significantly in the development of vaccines, testing kits, and other related products and services. Below are a few of the market developments related to the virology market:

- In August 2021, the U.S. Food and Drug Administration (FDA) approved the first COVID-19 vaccine known as the Pfizer-BioNTech COVID-19 Vaccine. It will be marketed as ComiRNAty (Koe-mir’-na-tee). The vaccine is intended to prevent COVID-19 disease in individuals aged 16 years and above. It is also available under emergency use authorization (EUA).

- In April 2021, CerTest Biotec launched its CE-marked COVID-19 diagnostic test for the BD MAX System.

- In May 2020, Bio-Rad received FDA approval for emergency use authorization for the COVID-19 total antibody test.

- In May 2020, Aalto Bio Reagents launched New Recombinant Eukaryotic SARS-CoV-2 S1-S2 Spike Proteins.

Thus, such active participation of the market players by product innovations and favourable governments support is expected to bolster the growth of the Europe virology market.

Emerging virus epidemics occur unexpectedly and demand rapid action to stop the disease from spreading. The most recent outbreak of COVID-19 worldwide highlights the need developing diagnostics, vaccines, and antiviral drugs on an urgent basis. As COVID-19 belongs to the coronavirus family, much research into MERS and the development of vaccines against it enabled the rapid advancement of vaccines against COVID-19. Therefore, developing prototype vaccines against potential viruses could greatly accelerate the development of vaccines against any emerging pandemic. For instance, Before COVID-19, The Coalition for Epidemic Preparedness Innovations (CEPI) had developed a robust portfolio of MERS vaccine candidates and invested more than US$140 million to MERS vaccine development, which later laid the groundwork for rapid response to COVID-19 and enabled rapid COVID-19 vaccine development, including the Oxford vaccine. Also, CEPI established a collaboration with the University of Oxford in 2018 to develop a vaccine against MERS using their ChadOx vaccine platform. CEPI provided additional funding to the University of Oxford to adapt this platform technology to develop a vaccine against COVID-19. To scale the manufacture of their COVID-19 vaccine candidate, the University of Oxford subsequently partnered with AstraZeneca, who committed to producing the vaccine on a non-profit basis during the pandemic. Therefore, the pandemic preparedness has helped launch vaccines in a short period, further emphasizing the need for more investment in emerging virus’s research. Europe has been investing in the research of emerging viruses for a long time. The Centre has contributed expertise to recent Ebola outbreaks and is now working on COVID-19. In addition, Vaccine approvals have raised hopes of eventually overcoming the pandemic. However, recent outbreaks and the emergence of new strains of the virus affect the economic outcomes, and a post-pandemic will require governments and the private sector to make long-lasting commitments to global epidemic and pandemic preparedness.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive virology market. The Europe virology market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Virology Market Segmentation

Europe Virology Market – By Type

- Diagnostic Test

- DNA Virus Testing

- RNA Virus Testing

- Others

- Viral Infection Controlling Techniques

- Active Prophylaxis

- Passive Prophylaxis

- Antiviral Therapeutics

- Virucidal Agents

- Antiviral Agents

- Immunomodulators

- Interferons

Europe Virology Market – By Application

- Skin and Soft Tissue Infections

- Respiratory Tract Infections

- GI Tract Infections

- Sexually Transmitted Diseases

- Urinary Tract Infections

- Others

Europe Virology Market – By End User

- Hospitals

- Diagnostic Laboratories

- Pharmaceutical and Biotechnological Companies

- Research and Academic Institutes

Europe Virology Market- By Country

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe

Europe Virology Market-Companies Mentioned

- Abbott

- AbbVie Inc.

- F. HOFFMANN-LA ROCHE LTD.

- Gilead Sciences, Inc.

- GlaxoSmithKline Plc

- Illumina, Inc.

- Johnson and Johnson Services, Inc.

- QIAGEN

- Siemens AG

- THERMO FISHER SCIENTIFIC INC.

Europe Virology Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,208.26 Million |

| Market Size by 2028 | US$ 1,521.97 Million |

| CAGR (2021 - 2028) | 3.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For