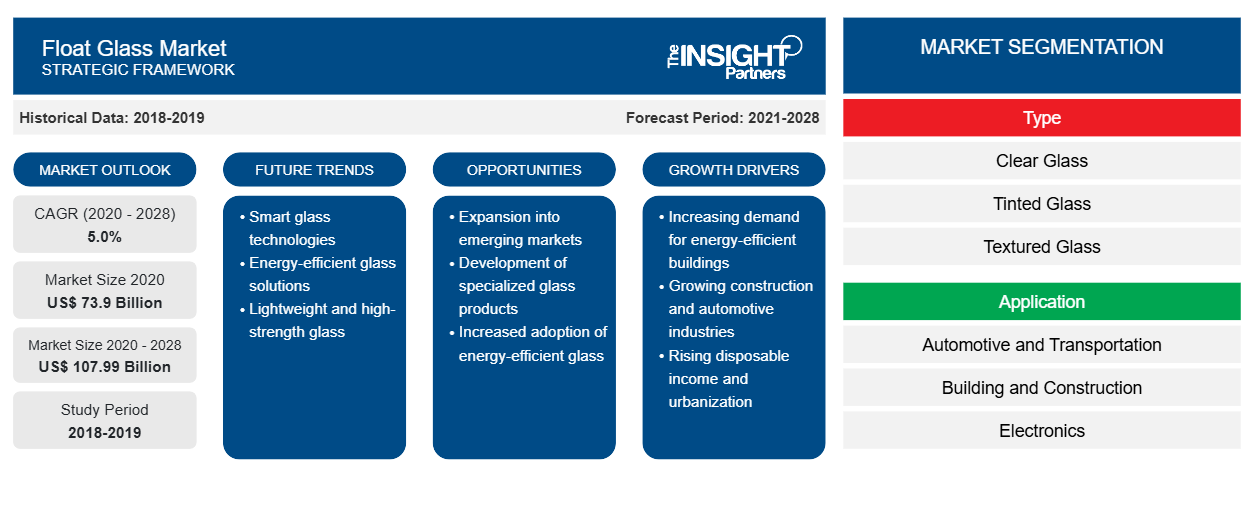

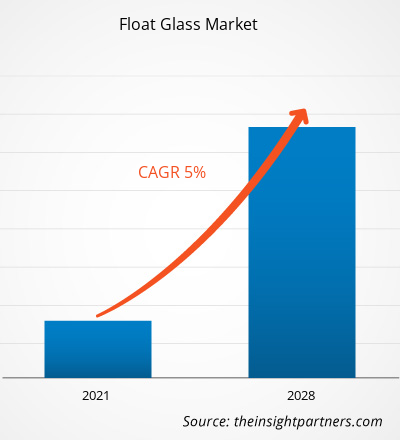

The float glass market was valued at US$ 73,897.83 million in 2020 and is projected to reach US$ 1,07,991.35 million by 2028; it is expected to grow at a CAGR of 5.0% from 2021 to 2028.

Float glass is an extremely smooth and distortion free glass which is being used in various end-use industries such as building and construction, automotive, electronics, solar, among others. It is basically made by pouring the molten glass from the furnace into a chamber which contains a bed of molten tin. The increase in the use of float glass in interior design and modern architecture has played a major role in increasing the demand of float glass and are used in other building and construction applications which includes ceiling, flooring, reflective, coated, windows, mirrors, tabletops, and insulated glass. In addition, the growing use of float in automotive applications is expected to drive the float glass industry over the forecasted period.

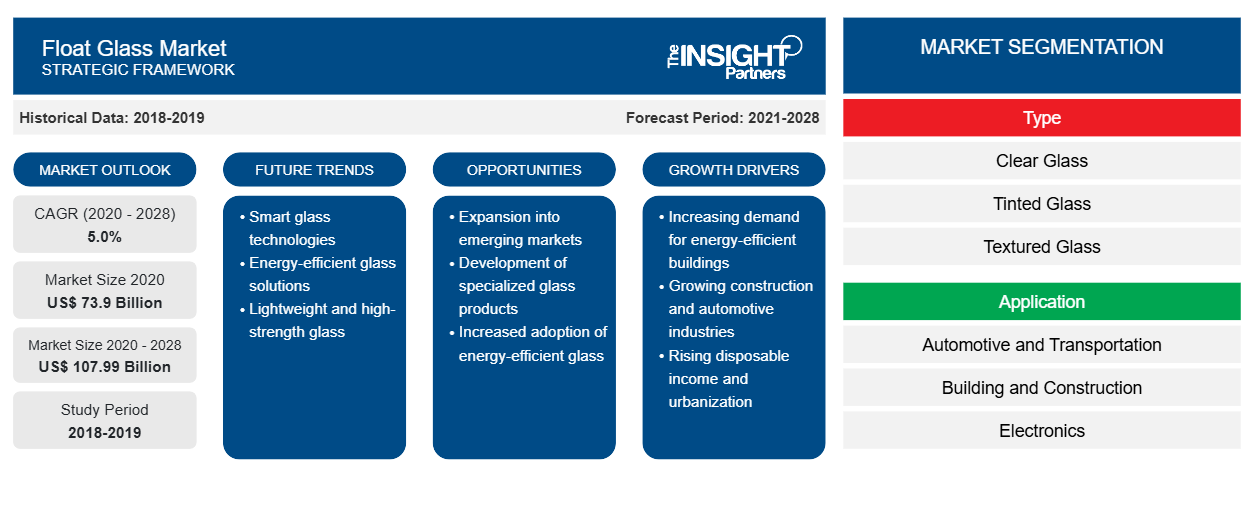

In 2020, Asia Pacific accounted for the largest share in the global float glass market. The increasing development of the automotive sector and the building and construction sector is driving the demand for float glasses in the region. The vast established automotive sector in countries such as China and India is also increasing the demand for float glasses in these countries. Along with this, the development and the increased penetration of solar industry in Asia Pacific is driving the growth of the float glass market in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Float Glass Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Float Glass Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The shutdown of various manufacturing plants and factories in North America, Europe, Asia Pacific, South America, and the Middle East & Africa due to the COVID-19 pandemic has hampered the global supply chain and manufacturing processes, delivery schedules, and product sales. In addition, the restrictions imposed by countries in Europe, Asia, and North America are affecting business collaboration and partnership opportunities. The ongoing COVID-19 pandemic has had a significant impact on the float glass market. The disruptions in the production and supply chain have had a negative impact on the float glass market. The glass shortfall is expected to last until 2021, causing disruptions in a variety of businesses. Glass supply is tightening and has become more costly to purchase because of a various issue, including the worldwide pandemic and international tariffs. As a result of the global pandemic, many factories and manufacturers have had to suspend or slow down glass production, making it exceedingly difficult to satisfy current demands. Restarting the factories after being closed or producing at a low level for an extended period of time may be exceptionally challenging, especially if the companies aren't operating at full capacity owing to health and safety regulations. Further, with COVID-19 vaccinations being a high priority for both the public and the health business, the availability of glass has been redirected to the cause which has led to the unavailability of glass for other industries, thus creating shortage of glass in the market.

Market Insights

Increase in Demand from Building and Construction Industry

Float glass is manufactured through a melting process, where recycled glass, lime, silica sand, potash, and soda are melted in a furnace and floated onto a bed of molten tin. Float glass is being increasingly used in the building & construction industry, which includes the residential, commercial, and industrial sectors. Float glass has a high degree of light transmission, the ability to produce a range of colors and opacities, and good chemical inertness, which increased its demand from the construction industry. The float glass is used for windows and doors in the residential sector, serving both aesthetic and functional applications. It is also being increasingly utilized in interior design and modern architecture. In the commercial sector, float glass is in demand as it provides an attractive and easy-to-maintain exterior surface. Float glass offers light and heat transmittance, influencing the amount of heating and cooling required inside a building according to different seasons and climates. The float glass is also being used as display windows in the retail outlets due to its transparent nature, hardness, and ease of cleaning. Due to the rise in environmental concerns, there has been an increased demand for float glass in the construction industry as it helps in achieving Leadership in Energy and Environment Design (LEED) certification for residential and commercial constructions. The rise in consumer awareness about the safety of buildings and an increased focus on maintaining the government's building codes are expected to increase the demand for float glass further. Thus, the increasing demand for float glass from the building & construction industry will fuel the growth of the float glass market during the forecast period.

Type Insights

Based on type, the float glass market is segmented into clear glass, tinted glass, textured glass, and others. The clear glass segment held the largest share in the market in 2020. Clear glass is a float glass, which is transparent and free from defects and optical distortions. Clear float glass provides superior quality when compared to other types of float glasses due to its unique characteristics, such as improved surface finishing, uniform thickness, high optical quality, flatness, and bright appearance. It is applied in areas requiring high visibility and clarity, such as windows, doors, mirrors, greenhouse, skylights, appliances, and solarium. As clear glass is free from any optical distortions or small defects, it allows a perfect view. The glass is also used for further processing to produce other glass types.

A few of the key market players operating in the float glass market are AGC Inc.; Nippon Sheet Glass Co., LTD (NSG Group); Xinyi Glass Holdings Limited; SCHOTT AG; Guardian Industries Holdings; Cardinal Glass Industries, Inc.; China Glass Holdings Limited; Shenzhen Sun Global Glass Co. Ltd.; Saint Gobain Glass India; and Qingdao Migo Glass Co. Ltd. Major players in the market are adopting strategies such as mergers & acquisitions and product launches to expand the geographic presence and consumer base.

Float Glass Market Regional Insights

Float Glass Market Regional Insights

The regional trends and factors influencing the Float Glass Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Float Glass Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Float Glass Market

Float Glass Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 73.9 Billion |

| Market Size by 2028 | US$ 107.99 Billion |

| Global CAGR (2020 - 2028) | 5.0% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

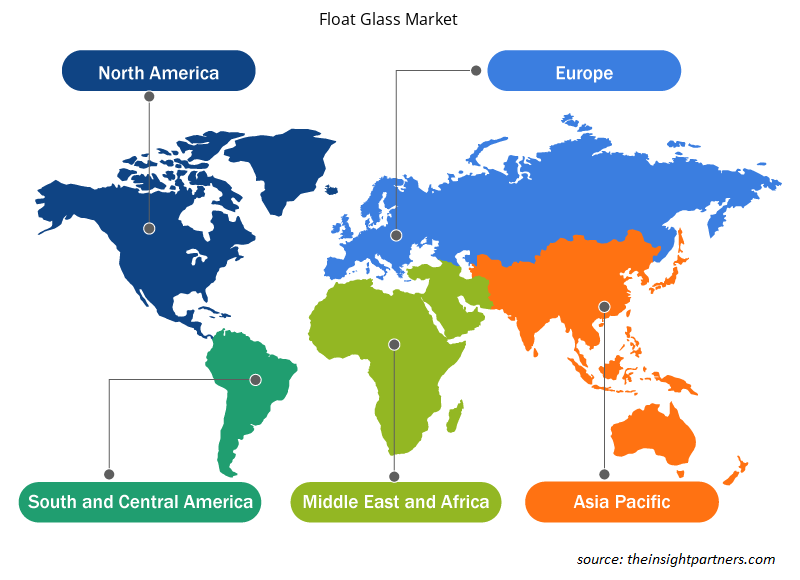

Float Glass Market Players Density: Understanding Its Impact on Business Dynamics

The Float Glass Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Float Glass Market are:

- AGC Inc

- CARDINAL GLASS INDUSTRIES, INC

- Nippon Sheet Glass Co., Ltd

- China Glass Holdings Limited

- Guardian Industries Holdings

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Float Glass Market top key players overview

Report Spotlights

- Progressive trends in the float glass industry to help players develop effective long-term strategies

- Business growth strategies adopted by companies to secure growth in developed and developing markets

- Quantitative analysis of the global float glass market from 2019 to 2028

- Estimation of the demand for float glass across various industries

- Porter analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for float glass

- Market trends and outlook coupled with factors driving and restraining the growth of the float glass market

- Understanding regarding the strategies that underpin commercial interest with regard to global float glass market growth, aiding in the decision-making process

- Float glass market size at various nodes of market

- Detailed overview and segmentation of the global float glass market as well as its industry dynamics

- Float Glass market size in various regions with promising growth opportunities

Float Glass Market, by Type

- Clear Glass

- Tinted Glass

- Textured Glass

- Others

Float Glass Market, by Application

- Automotive and Transportation

- Building and Construction

- Electronics

- Others

Company Profiles

- AGC Inc.

- Nippon Sheet Glass Co., LTD (NSG Group)

- Xinyi Glass Holdings Limited

- SCHOTT AG

- Guardian Industries Holdings

- Cardinal Glass Industries, Inc.

- China Glass Holdings Limited

- Shenzhen Sun Global Glass Co. Ltd.

- Saint Gobain Glass India

- Qingdao Migo Glass Co. Ltd

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

During the forecast period, Asia Pacific is the dominating region for float glass market over the forecast period. The growing building and construction industry along with the increasing projects related to the field of renewable energy source and development of solar industry is driving the growth of float glass market in Asia Pacific region. Asia-pacific region especially China, Japan and India are expected to increase the demand for float glass as compare to other geographical regions which is due to an expanded and established automotive, building and construction sector in this region. Along with this, increasing manufacturing industries coupled with growing industrialization which offers ample opportunities for key market players in the float glass market. Presence of various domestic and international players in the region will increased the focus of manufacturers on providing innovative products leading to increased opportunity for the float glass market top grow

The major players operating in the global float glass market are AGC Inc., CARDINAL GLASS INDUSTRIES, INC., Nippon Sheet Glass Co., Ltd., China Glass Holdings Limited., Guardian Industries Holdings., SHENZHEN SUN GLOBAL GLASS CO., LTD., Saint-Gobain Glass India., SCHOTT AG., QINGDAO MIGO GLASS CO.,LTD., and Xinyi Glass Holdings Limited, amongst ohers.

Based on application, the building and construction segment is anticipated to account for the largest share in the global float glass market. Clear float glass, tinted float glass, and textured float glass are used in residential and commercial applications such as windows and doors for aesthetic and functional purposes. The increase in the use of the glass in interior design and architecture has played a major role in increasing the demand of float glass along with being used towards the ceiling, flooring, reflective, coated, windows, mirrors, tabletops, and insulated glass.

On the basis of type, the clear glass segment led the global float glass market in 2020. Clear float glass is a super smooth, distortion-free glass used for production and designing other glass items, including laminated glass and heat-toughened glass. It has unique features such as uniform thickness, high optical quality, excellent surface finishing, and bright appearance. Clear float glass is made up of molten glass, which flows through tweel to a tin bath and then to the lehr. The clear windows are suitable for glazing windows and doors in various sizes and thicknesses. It is used in windows and doors, mirrors, curtain walls, shelving and display cases, skylights, atriums, and handrails. The clear float glass provides optical clarity, high light transmission, and stable chemical properties.

On the basis of geography, Europe region is the fastest growing region in the global float glass market during the forecasted period. The growth can be attributed growing automotive and building and construction industry. Along with this, Europe is one of the largest producers of flat glass including float glass as well. The presence of large numbers of float glass manufacturing sites across the European region is helping the float glass market to grow.

Rise in Preference for Float Glass in Electronic Industry is one of the key drivers for the growth of the global float glass market. There has been a rising preference for float glass in the electronic industry worldwide due to its various benefits. Through a series of processing on float glass, including cutting, coating, drilling, grinding, and screen printing, the glass can be used for electronic or electric equipment such as LCD screen, touch screen, advertising machine screen, flat panel, and electromagnetic oven.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Float Glass Market

- AGC Inc

- CARDINAL GLASS INDUSTRIES, INC

- Nippon Sheet Glass Co., Ltd

- China Glass Holdings Limited

- Guardian Industries Holdings

- SHENZHEN SUN GLOBAL GLASS CO., LTD

- Saint-Gobain Glass India

- SCHOTT AG

- QINGDAO MIGO GLASS CO.,LTD

- Xinyi Glass Holdings Limited

Get Free Sample For

Get Free Sample For