Frozen Food Market Growth, Analysis, and Forecast by 2031

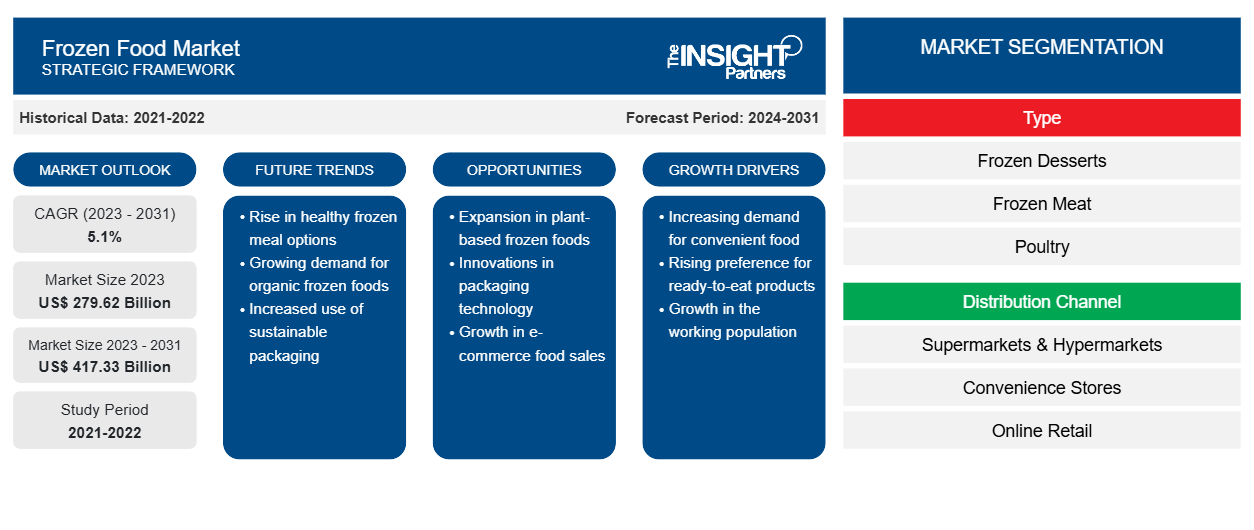

Frozen Food Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Frozen Desserts; Frozen Meat, Poultry, & Seafood; Frozen Bakery; Frozen Snacks & Appetizers; Frozen Meals; and Others), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Apr 2026

- Report Code : TIPRE00004541

- Category : Food and Beverages

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

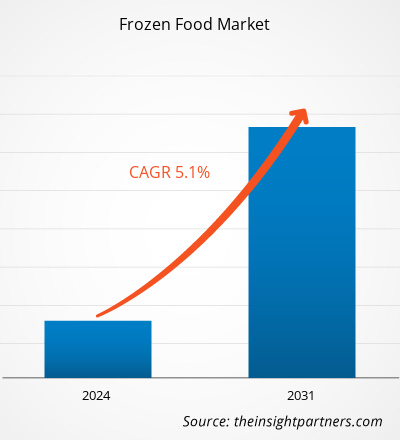

The frozen food market size is expected to reach US$ 444.22 million by 2031 from US$ 295.39 million in 2024; it is likely to register a CAGR of 6.0% during the forecast period. Veganism has gained significant momentum in recent years. Consumers are highly inclined toward plant-based products as they perceive them to be healthier than conventional products. Additionally, increasing awareness regarding animal protection and environmental sustainability is adding to the popularity of these food products. The proliferation of the veganism wave across the world is highly influencing innovations in the frozen food market.

Frozen Food Market Analysis

Over the past few years, the lifestyles of people across the world have evolved dramatically. Due to hectic work schedules, people’s dependency on products saving time and effort has increased. The surge in the consumption of high-quality convenience food is one of the biggest trends in the food industry. Convenience food, such as frozen snacks, frozen meals, cold cuts, and ready-to-eat products, allows consumers to save time and efforts associated with ingredient shopping, meal preparation and cooking, consumption, and post-meal activities. The development and popularity of these food items are ascribed to many social changes; the most notable of these are the increasing number of smaller households and the rising millennial population across the world. Due to hectic work schedules, millennials prefer to be efficient with their time, rather than spending it on tedious tasks. Thus, they are more likely to spend their money on convenience food. These factors are significantly boosting the demand for convenience food among consumers, eventually boosting the growth of the frozen food market.

Frozen Food Market Overview

Frozen food includes ice cream, frozen yogurt, frozen meat, frozen seafood, frozen ready meals, snacks, appetizers, soups, fruits, and vegetables. These products are preserved by freezing them around -25 degree Celsius. Frozen food products do not contain artificial preservatives making them healthier than other processed food. Moreover, they can be easily stored in home freezers with temperature at 0-degree Fahrenheit. The rising demand for convenience food owing to the hectic lifestyle of people is driving the growth of frozen food market. Moreover, rapid urbanization, rising per capita income, and changing retail scenario are some of the key factors driving the frozen food market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFrozen Food Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Frozen Food Market Drivers and Opportunities

Flourishment of E-Commerce to Favor Market

People are increasingly preferring online retail platforms for purchasing frozen foods. According to American Frozen Food Institute, online sales of frozen food products increased by 75% in 2020. The online sales of food and beverages rose significantly during the pandemic due to the shutdown of brick-and-mortar stores and the imposition of social restrictions by governments. As people’s movement was constrained by lockdowns and they were compelled to work from their homes, there was a substantial shift to online shopping. Moreover, heavy discounts, wide availability of different brands under one roof, and home delivery options have been other notable factors driving consumers’ focus toward online shopping. With the rising penetration of e-commerce across different geographies, the manufacturers of frozen foods such as Kellogg's Company, Conagra Brandsare also enlarging their online presence by selling their products through well-known e-commerce platforms such as Amazon.com, Lidl, and Walmart. This factor contributes to the growth of the frozen food market by eliminating the dependency on offline retail stores.

Strategic Development Initiatives by Manufacturers– An Opportunity

Manufacturers of frozen food are making significant investments in product innovation to expand their customer base and meet emerging consumer trends. They are launching gluten-free, plant-based, sugar-free, organic, and clean-labeled products, as well as products suitable for a keto diet, which meet the varied requirements of consumers. For instance, in August 2021, Real Good Foods Company, a known name in the frozen foods industry, announced the launch of 7 new protein-rich, low-carb, grain-free, and gluten-free frozen product categories in 1,500 Kroger stores across the US. Similarly, in 2022, Indian leading brand Prasuma, which offers frozen food, has launched frozen snacks products to its frozen food product portfolio. The newly launched products are Frozen Veg and Chicken Spring Rolls, frozen Chicken Nuggets, Chicken and Veg Mini Samosas, Chicken and Mutton Shammi Kababs and Seekh Kababs along with Bacon to its frozen snack’s product portfolio. These products were launched to help consumers stay on track with their health goals and enjoy a good meal at the same time as health became a priority for consumers worldwide during the global crisis. Because people have started focusing on convenience food products while maintaining the nutritional balance in their diets, manufacturers are launching nutritionally enriched frozen products. Such product innovations help them extend their reach and gain a competitive edge in international markets.

Frozen Food Market Report Segmentation Analysis

Key segments that contributed to the derivation of the frozen food market analysis are type and distribution channel.

- Based on type, the frozen food market is divided into frozen desserts; frozen meat, poultry, & seafood; frozen bakery; frozen snacks & appetizers; frozen meals; and others.

- In terms of distribution channel, the market is divided into supermarkets and hypermarkets, convenience stores, online retail, and others.

Frozen Food Market Share Analysis by Geography

The geographic scope of the Frozen Food Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Europe has dominated the frozen food market. The Europe frozen food market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The market growth is mainly attributed to the rising demand for convenience food, extensive retail infrastructure, and availability of a wide range of products of different brands across different distribution channels. Moreover, the presence of consumers with high per-capita income is also driving the demand for frozen food, such as frozen meals, and snacks. Consumers are seeking nutritional benefits from the products they consume. Therefore, the demand for clean, organic, gluten-free, and minimally processed frozen food has increased significantly, which is boosting the market growth in the region.

Frozen Food

Frozen Food Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 295.39 Million |

| Market Size by 2031 | US$ 444.22 Million |

| Global CAGR (2025 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frozen Food Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen Food Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Frozen Food Market News and Recent Developments

The frozen food market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- In 2022, White Castle expands retail food offering via partnership with Bellisio Foods; to bring iconic chicken rings to retailers nationwide (Whistle Castle/ Company Website)

Frozen Food Market Report Coverage and Deliverables

The “Frozen Food Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For