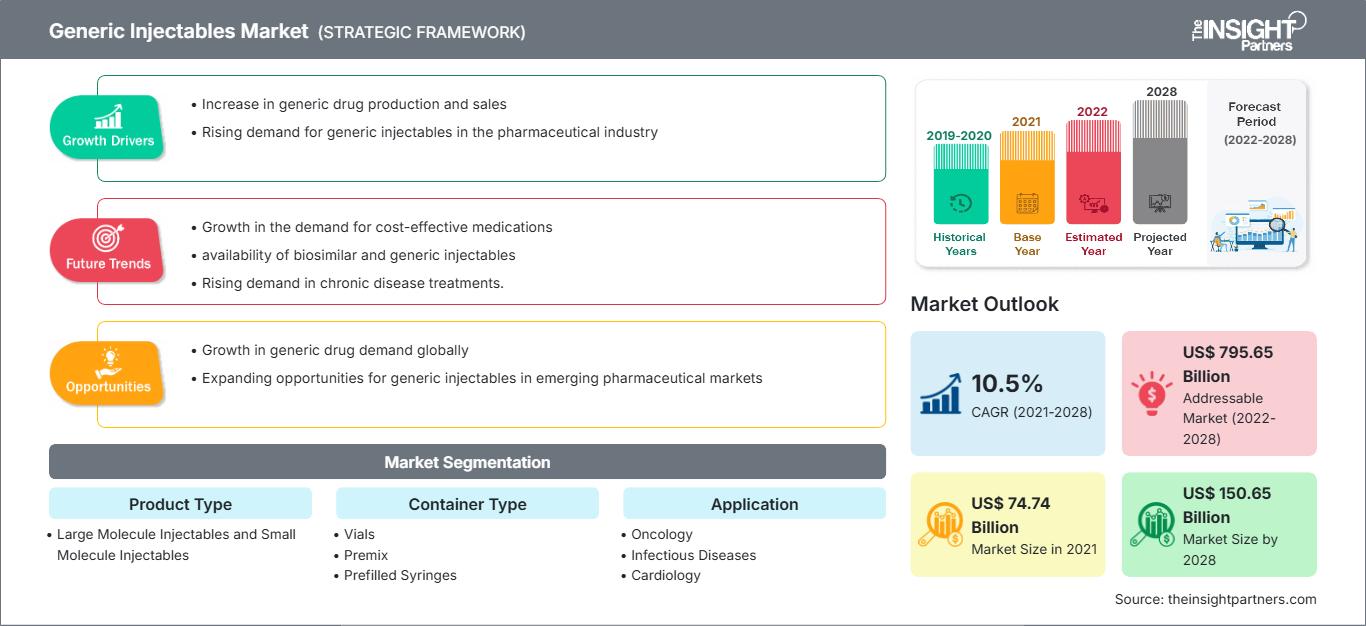

Generic Injectables Market Growth and Forecast by 2028

Generic Injectables Market Forecast to 2028 - Analysis By Product Type (Large Molecule Injectables and Small Molecule Injectables), Container Type (Vials, Premix, Prefilled Syringes, Ampoules, and Others), Application (Oncology, Infectious Diseases, Cardiology, Diabetes, Immunology, and Others), and Route of Administration (Intravenous, Intramuscular, Subcutaneous, and Others), and Geography

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Mar 2022

- Report Code : TIPRE00004765

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 217

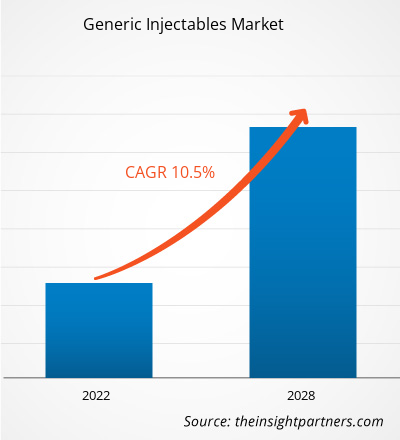

The generic injectables market is projected to reach US$ 150.65 billion by 2028 from US$ 74.74 billion in 2021; it is expected to register a CAGR of 10.5% from 2021 to 2028.

Generic injectables are the bioequivalents of their branded counterparts and are not protected by patents. They are safe and effective as the innovator drugs since they have similar active ingredients, dosages, strength, qualities, form, etc.

The report offers insights and in-depth analysis of the generic injectables market, emphasizing various parameters such as market trends, technological advancements, and market dynamics; it also provides the competitive landscape analysis of leading market players and the impact of the COVID-19 pandemic on the market across all major regions. The COVID-19 pandemic has disrupted the socioeconomic conditions of various countries across the world. As per the recent WHO statistics, the US is the world's worst-affected country due to the pandemic with the highest number of cases. The high number of COVID cases has negatively impacted the economy of the US, and consequently that of North America. There has been a decline in overall business activities and growth of various industries operating in the region.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGeneric Injectables Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

However, there was an unusual demand for Remdesivir, an antiviral medicine used to treat patients, when the outbreak was at its peak. Thus, manufacturers in the generic injectables market are now prepared for the future as they focus on keeping adequate stock for keeping supply chain operations unaffected dur to any type of vulnerabilities. Gilead Sciences and other big pharma companies, for example, have reduced the prices of their generic versions of remdesivir considerably. Companies are utilizing government programs and financing schemes offered by the BFSI industries to streamline their operations. In May 2020, the US government entered into an agreement, worth US$ 812 million, with a group of American generic medicine manufacturers, with the goal of bolstering the country's drug supply amid the global COVID-19 pandemic.

Furthermore, the pandemic strained pharmaceutical industries globally, interrupting and delaying supply of various critical drugs. Many market players came to rescue with immediate actions. For instance, in January 2021, Civica Rx teamed up with the brand-new Phlow Corp. in an effort to support drug manufacturing in the US and supply critical medications to hospitals fighting the pandemic. Civica invested US$ 124.5 million in the construction of a sterile injectable manufacturing facility in Petersburg, Virginia, which rose to prominence last year owing to a large government contract to produce COVID-19-related drugs.

Based on region, the generic injectables market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Market Insights

High Demand for Affordable Drugs Drives Generic Injectables Market

Innovator drugs are expensive owing to high investments made in the research & development of molecules; these drugs are specifically unaffordable for a large share of the population in developing countries. However, generic drugs are affordable and provide greater access to healthcare. As published by the Association for Accessible Medicines (AAM), the average primary copay (the amount set by the insurance plans) of a generic drug is US$ 6.06 and US$ 40.30 for branded drugs. This fact indicates the falling prices of generic medicines by at least ~7%. According to the American Association of Retired Person (AARP), branded drug prices continue to increase at a pace that is 100-times greater than inflation. Moreover, as mentioned by the USFDA, 9/10 prescriptions filled in the US are for generic drugs. Additionally, the generic drug’s average manufacturer prices (AMP) are ~39% lower than the branded drug’s AMP. For instance, as published by Association for Accessible Medicines (AAM), 93% of generic prescriptions are filled for US$ 20 or less. The facts mentioned above boost the demand and availability of generic injectables, thus driving the entry of more players into the generic injectables market.

Further, low prices of generic injectables contribute to greater and effective chronic illness treatments. As per the World Health Organization (WHO), ~422 million people worldwide were diabetic in 2021. Generic injectables such as insulin injections offer immediate solutions for such ailments, alongside ensuring affordable treatments in developing countries.

Product Type-Based Insights

Based on product type, the generic injectables market is segmented into large molecule injectables and small molecule injectables. In 2021, the large molecule injectables segment accounted for a greater market share. The market position of this segment is credited to a surge in the adoption of biologics in the healthcare sector, and the progress of monoclonal antibody and antibody-drug conjugates (ADCs) into the drug development.

Container Type-Based Insights

Based on container type, the generic injectables market is segmented into vials, premix, prefilled syringes, ampoules, and others. The vials segment is likely to dominate the market in 2021.

Application-Based Insights

The generic injectables market, based on application, has been categorized into oncology, infectious diseases, cardiology, diabetes, immunology, and others. The oncology segment is likely to hold the largest share of the market in 2021. An increase in cancer incidences and rise in the launch of drugs is anticipated drives the growth of the oncology market segment.

Generic Injectables Market Regional InsightsThe regional trends and factors influencing the Generic Injectables Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Generic Injectables Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Generic Injectables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 74.74 Billion |

| Market Size by 2028 | US$ 150.65 Billion |

| Global CAGR (2021 - 2028) | 10.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Generic Injectables Market Players Density: Understanding Its Impact on Business Dynamics

The Generic Injectables Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Generic Injectables Market top key players overview

Route of Administration-Based Insights

Based on the route of administration, the generic injectables market has been categorized into intravenous, intramuscular, subcutaneous, and others. The intravenous segment held the largest market share in 2021.

The generic injectables market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide.

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

-

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

-

South and Central America (SCAM)

- Brazil

- Argentina

- Rest of SCAM

Company Profiles

- Astrazeneca

- Baxter International, Inc.

- Biocon

- Fresenius SE & Co. KGaA

- GlaxoSmithKline Plc

- Hikma Pharmaceuticals

- Johnson & Johnson Services, Inc.

- Lupin, Ltd.

- Merck & Co., Inc.

- Mylan N.V.

- Pfizer, Inc

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For