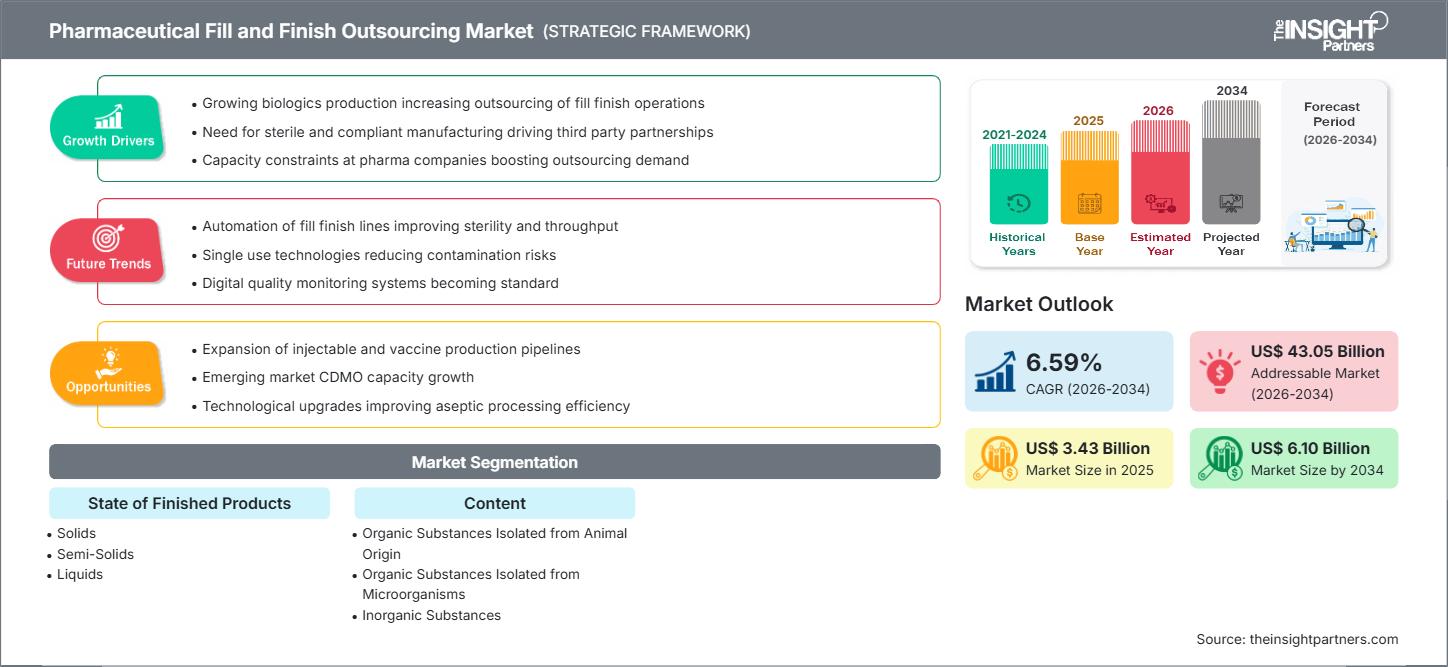

Pharmaceutical Fill and Finish Outsourcing Market Growth Analysis and Forecast by 2034

Pharmaceutical Fill and Finish Outsourcing Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By State of Finished Products (Solids, Semi-Solids, and Liquids) and Content (Organic Substances Isolated from Animal Origin, Organic Substances Isolated from Microorganisms, and Inorganic Substances), and geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00017482

- Category : Life Sciences

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The pharmaceutical fill and finish outsourcing market US$ 3.43 Bn in 2025 to US$ 6.10 Bn by 2034. Further, leading the CAGR to be around 6.59% between 2026-2034.

Pharmaceutical Fill and Finish Outsourcing Market Analysis

The forecast for the pharmaceutical fill and finish outsourcing market indicates strong growth, supported by the increasing biopharmaceutical pipeline, greater investment in biologics and vaccines, and the increasingly complex nature of sterile manufacturing processes. Outsourcing helps pharmaceutical companies speed up their time-to-market, maintain regulatory compliance, and decrease capital outlay associated with specialized fill-finish infrastructure.

Further, rapid technological advancements such as robotics, closed-system isolators, and single-use technologies are thus enabling higher sterility assurance and production efficiency. Growing demand for ready-to-use packaging components, increased contract manufacturing partnerships, and rising small-scale production for personalized medicines add to the impetus for market growth.

Overview of Pharmaceutical Fill and Finish Outsourcing Market

In pharmaceutical fill and finish outsourcing, the final steps of drug manufacturing, which include filling, sealing, labeling, and packaging, are outsourced to advanced contract development and manufacturing organizations. Advanced service providers support pharmaceutical and biotech companies in sterile drug product processing, filling in vials or syringes, lyophilization, and quality assurance.

Fill and finish is one of the most critical steps in the pharmaceutical manufacturing value chain, where product sterility, stability, and regulatory compliance are at stake. Outsourcing enables biopharma firms to take advantage of advanced aseptic technologies that offer low contamination risk and optimized production turnaround. This is particularly relevant for complex biologics, vaccines, and high-potency APIs. Fill and finish outsourcing will evolve into a strategic activity necessary for large manufacturers, emerging biotechs, and cell & gene therapy developers.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONPharmaceutical Fill and Finish Outsourcing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Pharmaceutical Fill and Finish Outsourcing Market Drivers and Opportunities

Market Drivers:

- Growing Biologics and Biosimilars Production: The global rise in monoclonal antibodies, cell therapies, and vaccines has significantly increased the demand for sterile fill–finish capabilities. Biologics require highly controlled environments, prompting many companies to outsource to advanced CDMOs.

- Increasing Complexity of Aseptic Manufacturing: Fill and finish operations involve strict sterility standards, specialized containment systems, and regulatory oversight. Many pharmaceutical firms lack in-house facilities, pushing greater reliance on outsourcing partners.

- Rising Demand for Cost-Efficient and Scalable Production: Pharmaceutical companies face growing pressure to reduce operational costs and avoid heavy capital investments in sophisticated aseptic machinery. Outsourcing enables scalability and flexibility without infrastructure burden.

Market Opportunities:

- Expansion of High-Growth Therapeutic Areas: Emerging markets in cell and gene therapy and personalized medicines require small-batch, high-precision fill–finish. CDMOs offering micro-batch capabilities and advanced automation stand to benefit substantially.

- Single-Use Technologies & Ready-to-Use Components: Adoption of RTU vials, syringes, and cartridges eliminates cleaning validation needs and enhances sterility assurance. CDMOs integrating these technologies gain a competitive advantage.

- Increasing Outsourcing in Emerging Markets: Growing pharmaceutical manufacturing in the Asia Pacific, Latin America, and Eastern Europe creates vast opportunities for CDMOs to expand capacity and offer region-specific regulatory expertise.

Pharmaceutical Fill and Finish Outsourcing Market Report Segmentation Analysis

The pharmaceutical fill and finish outsourcing market share is analyzed across multiple segments to understand structural dynamics and growth patterns.

By State of Finished Products

- Solids

- Semi-Solids

- Liquids

By Content

- Organic Substances Isolated from Animal Origin

- Organic Substances Isolated from Microorganisms

- Inorganic Substances

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The pharmaceutical fill and finish outsourcing market in the Asia Pacific is expected to witness the fastest growth due to expanding biologics manufacturing and supportive government initiatives.

Pharmaceutical Fill and Finish Outsourcing Market Regional Insights

The regional trends and factors influencing the Pharmaceutical Fill and Finish Outsourcing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Pharmaceutical Fill and Finish Outsourcing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Pharmaceutical Fill and Finish Outsourcing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 3.43 Billion |

| Market Size by 2034 | US$ 6.10 Billion |

| Global CAGR (2026 - 2034) | 6.59% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By State of Finished Products

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Pharmaceutical Fill and Finish Outsourcing Market Players Density: Understanding Its Impact on Business Dynamics

The Pharmaceutical Fill and Finish Outsourcing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Pharmaceutical Fill and Finish Outsourcing Market top key players overview

Pharmaceutical Fill and Finish Outsourcing Market Share Analysis by Geography

Asia Pacific is projected to grow at the highest CAGR during the forecast period. Rapid pharmaceutical production expansion and supportive regulatory environments drive significant opportunities for CDMOs.

North America

- Market Share: Currently, the largest market due to advanced biologics manufacturing and the strong presence of leading CDMOs.

- Key Drivers:

- High demand for sterile injectables

- Early adoption of automated filling systems

- Robust FDA regulatory oversight

- Trends: Growing preference for prefilled syringes and cartridge-based drug delivery to improve patient convenience.

Europe

- Market Share: Significant share supported by strong GMP standards, leading CDMOs, and increasing biologics development.

- Key Drivers:

- Strict EU sterility and quality guidelines

- Expansion of vaccine and biosimilar production

- Strong regional CDMO footprint

- Trends: Rapid adoption of isolator-based aseptic systems to reduce contamination risks.

Asia Pacific

- Market Share: Fastest-growing region with substantial investments in pharmaceutical infrastructure.

- Key Drivers:

- Growing biopharma clusters in India, China, and South Korea

- Cost-efficient manufacturing capacity

- Expanding adoption of contract manufacturing

- Trends: Use of single-use bioprocessing systems for flexible, contamination-free fill–finish operations.

South & Central America

- Market Share: Emerging market with rising outsourcing partnerships.

- Key Drivers:

- Public–private collaborations

- Growth of regional pharmaceutical manufacturing

- Increasing demand for sterile injectables

- Trends: Adoption of cost-effective aseptic fill–finish services among small-to-medium manufacturers.

Middle East & Africa

- Market Share: Developing market with notable long-term potential.

- Key Drivers:

- Government investment in pharma manufacturing

- Rising chronic disease burden

- Increasing need for sterile drug products

- Trends: Implementation of fill–finish capabilities within integrated health manufacturing hubs.

Pharmaceutical Fill and Finish Outsourcing Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The market is highly competitive due to the presence of major global CDMOs, mid-sized regional providers, and specialized lyophilization service companies. This competition encourages vendors to differentiate through:

- Advanced aseptic fill–finish lines with robotics

- Integration of single-use technologies

- Lyophilization cycle optimization and PAT tools

- Full-service CDMO offerings from formulation to packaging

Opportunities and Strategic Moves

- Partner with biotech startups to support early-phase sterile manufacturing

- Expand fill–finish capacity using modular, flexible cleanroom units

- Integrate AI-powered predictive maintenance and QC automation.

- Build specialized small-batch capabilities in personalized medicine and rare-disease drugs.

Major Companies Operating in the Pharmaceutical Fill and Finish Outsourcing Market

- Abbott

- Teva Pharmaceutical Industries Ltd

- Dr. Reddy's Laboratories

- Sun Pharmaceutical Industries Ltd

- Piramal Enterprises Ltd

- MabPlex International Ltd

- Wockhardt

- Cytovance Biologics

- Thermo Fisher Scientific Inc. (Patheon N.V.)

Other companies analysed during the course of research:

- Catalent Inc.

- Lonza Group

- Samsung Biologics

- Recipharm AB

- Baxter BioPharma Solutions

- Vetter Pharma International GmbH

- WuXi Biologics

- Siegfried Holding AG

Pharmaceutical Fill and Finish Outsourcing Market News and Recent Developments

- Samsung Biologics announced the expansion of its aseptic fill–finish capacity to support high-volume manufacturing of biologics, including mRNA vaccines and antibody therapeutics, further strengthening its position as a leading CDMO in sterile drug product manufacturing.

- Catalent Inc. has introduced a new high-speed vial filling line with integrated robotic automation and isolator technology, providing improved contamination control and faster turnaround times. The upgrade is in response to increasing demand for sterile injectable biologics and cell therapy products.

Pharmaceutical Fill and Finish Outsourcing Market Report Coverage and Deliverables

The "Pharmaceutical Fill and Finish Outsourcing Market Size and Forecast (2021–2034)" report includes:

- Market size and forecast at global, regional, and country levels across all key segments

- Detailed analysis of market dynamics: drivers, restraints, opportunities

- Comprehensive PEST and SWOT analysis

- Coverage of key market trends, regulatory landscape, and technological advancements

- Industry landscape, including market concentration, heat map analysis, and competitive benchmarking

- Detailed company profiles with financials, product offerings, and strategic initiatives

Frequently Asked Questions

1. High risk of contamination and sterility breaches

2. Shortage of skilled personnel for aseptic operations

3. Strict regulatory requirements for sterile drug manufacturing

2. Europe – Strong regulatory framework and CDMO presence

3. Asia-Pacific – Fastest-growing region with rising outsourcing demand

1. Growing biologics and biosimilar demand

2. Increasing complexity of aseptic manufacturing

3. Need for cost-efficient sterile drug production

4. Rising outsourcing among emerging biotech companies

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For