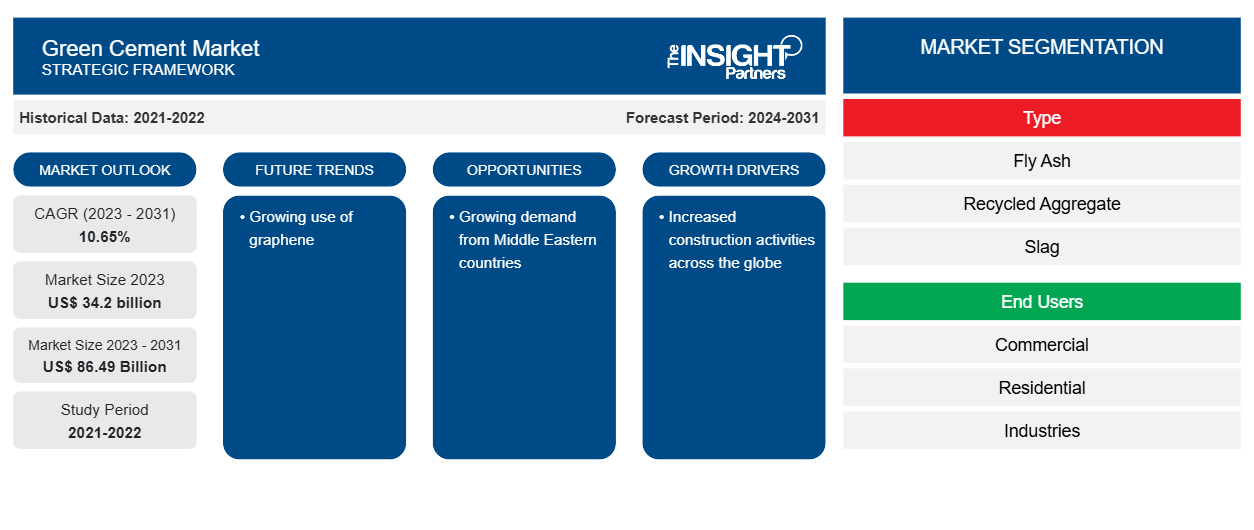

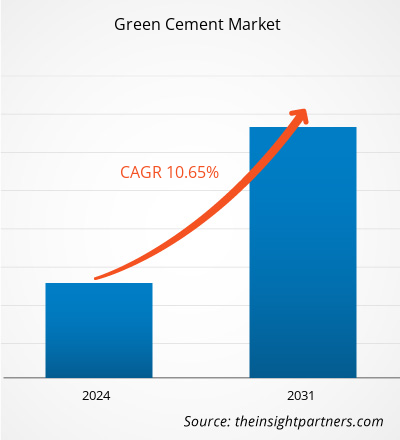

The Green Cement Market size is projected to reach US$ 86.49 billion by 2031 from US$ 34.2 billion in 2023. The market is expected to register a CAGR of 10.65% in 2023–2031. Many manufacturers are now focusing on using innovative materials for the production of green cement. Graphene has emerged as one of the most sustainable materials for green cement compared to fly ash, recycled aggregate, slag, and others.

Green Cement Market Analysis

The increased demand for decarbonization mainly drives the adoption of green cement as the cement industries are among the most difficult to decarbonize. Many companies and governments across the world are taking various initiatives to reduce carbon emissions from the cement industry. Many of the European Union’s large cement manufacturers are taking various steps to reduce their carbon footprint by 30% by 2030. Further, the US government has taken various initiatives to reduce its carbon footprint. One of the projects is the Mitchell Cement Plant Decarbonization Project, with a funding of US$ 500 million. Such government and company initiatives are driving the green cement industry.

Green Cement Market Overview

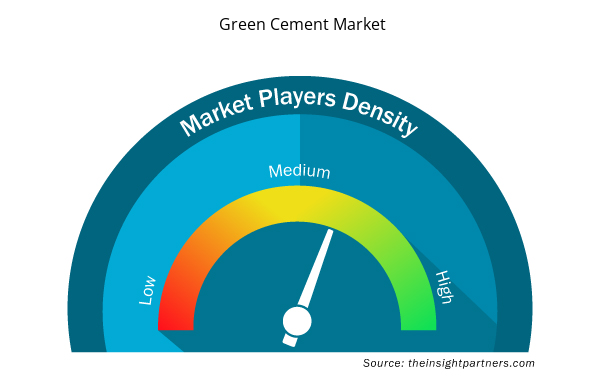

The global green cement market is highly competitive and is dominated by very key players. Approximately 30% of the total global green cement market is acquired by the key players. Players in the industry are focusing on strategies such as geography expansion, acquisition, and product development.

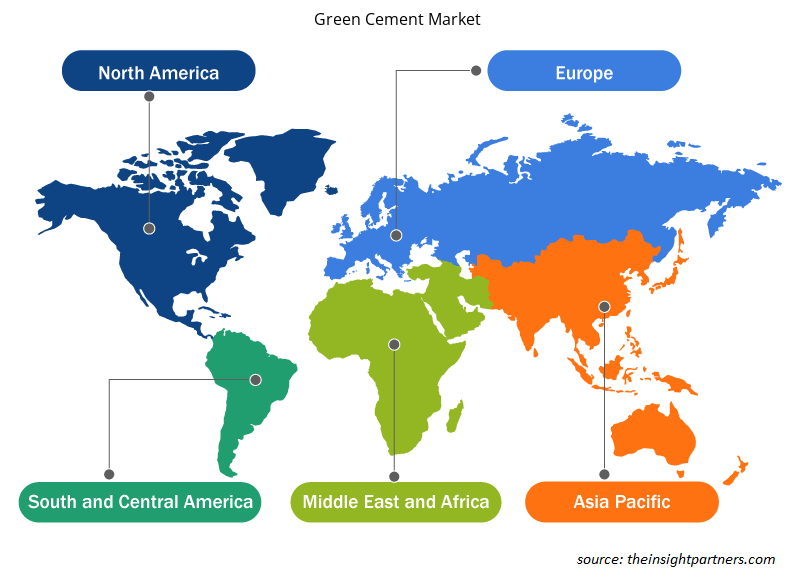

The adoption of green cement is higher in developed nations compared to developing nations owing to low awareness of carbon emissions. However, the growth of the Middle East and Asia Pacific is lucrative and expected to grow with a higher growth rate as the construction industry is continuously growing.

The US market acquired a larger market share in the North American green cement industry owing to increased government initiatives and programs to reduce carbon emissions from the construction industry. Germany, in the European region, dominated the European green cement industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Green Cement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Green Cement Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Green Cement Market Drivers and Opportunities

Increased construction activities across the globe

As per the data published by Ryfan Electric in 2018, the global construction sector's GDP was approximately 13%, generating revenue of US$ 10 trillion. In 2024, the construction sector is generating revenue of approximately US$ 15 trillion. This shows increased construction sector and demand for residential and commercial construction growth. As per the data provided by the National Association of Home Builders in 2024, the spending on residential construction increased by 1.4% in December 2023 in the US. Such growth in the construction industry has led to increased demand for construction materials, ultimately driving the green cement industry.

Growing demand from Middle Eastern countries

The construction activities in the UAE and Saudi Arabia are driving the demand for green cement. As per the construction industry experts, construction activities are expected to grow with a growth rate of 4.5% during the forecast period. Currently, the UAE is undertaking various construction activities. UAE is undertaking approximately 20 construction projects in 2024 alone. Further, as per the data published by the IEA in 2023, the Saudi Arabian market is estimated to reach approximately US$ 90 billion by 2029. Such growth of the construction is projected to generate lucrative opportunities for the green cement market in Middle Eastern countries.

Green Cement Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Green Cement Market analysis are type, cause, disorder type, category, and end user.

Based on type, the Green Cement Market is divided into fly ash, recycled aggregate, slag, and others. The fly ash segment held a larger market share in 2023.

- By end users, the market is segmented into commercial, residential, and industries. The residential segment held the largest share of the market in 2023.

Green Cement Market Share Analysis by Geography

The geographic scope of the Green Cement Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

Asia Pacific has dominated the Green Cement Market in 2023. The Asia Pacific region includes Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Countries such as China and India, Japan are undertaking various infrastructure and commercial construction activities. As per the data published by the Indian government in 2024, India allocated approximately 3.3% of its GDP to the infrastructure development project. The majority of the investments are allocated to the road and highway sectors. India has set a target of development of a 2 lakh-km roadway network by 2025. Such activities are projected to increase the consumption of construction materials, ultimately driving the green cement industry in the region.

Green Cement Market News and Recent Developments

The Green Cement Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for green cement and strategies:

- Cemvision, a Swedish startup company received approximately US$ 12 million funding for producing green cement with industrial waste. (Source: Cemvision, Press Release/Company Website/Newsletter, 2024)

- ACC Cement, a subsidiary of Adani Group, launched ACC ECOMaxX in India. (Source: ACC Cement, Press Release/Company Website/Newsletter, 2023)

Green Cement Market Regional Insights

The regional trends and factors influencing the Green Cement Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Green Cement Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Green Cement Market

Green Cement Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 34.2 billion |

| Market Size by 2031 | US$ 86.49 Billion |

| Global CAGR (2023 - 2031) | 10.65% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Green Cement Market Players Density: Understanding Its Impact on Business Dynamics

The Green Cement Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Green Cement Market are:

- Anhui Conch Cement Company Limited

- CEMEX

- S.A.B. DE C.V.

- China National Building Material Co.

- Ltd.

- China Resources Cement Holdings Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Green Cement Market top key players overview

Green Cement Market Report Coverage and Deliverables

The “Green Cement Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; End Users ;

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For