Homeopathy Market Size and Growth 2031

Homeopathy Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: Source (Plants, Minerals and Animals), Type (Dilutions, Tinctures, Biochemics, Tablets, Ointments, and Others), Application (Neurology, Gastroenterology, Respiratory, Dermatology, Immunology, and Others), End User (Homeopathic Clinics, Retail Pharmacies, e-Retailers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Status : Published

- Report Code : TIPRE00007419

- Category : Life Sciences

- No. of Pages : 257

- Available Report Formats :

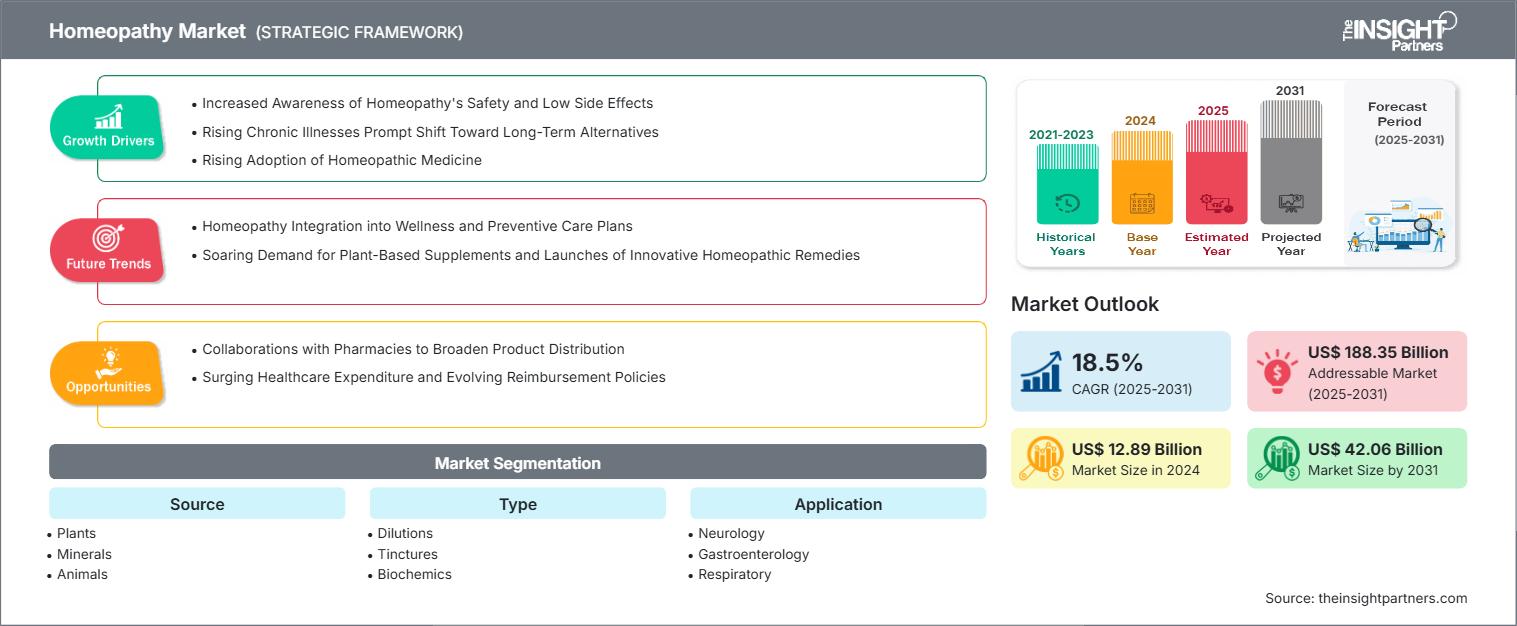

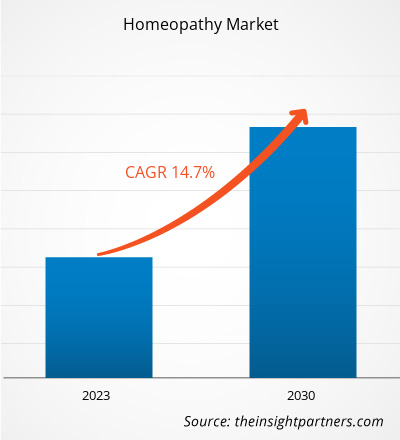

The homeopathy market size is projected to reach US$ 42.06 billion by 2031 from US$ 12.89 billion in 2024. The market is expected to register a CAGR of 18.50% from 2025 to 2031. The mounting demand for plant-based supplements and launches of innovative homeopathic remedies are likely to bring new trends in the homeopathy market in the coming years.

Homeopathy Market Analysis

The surging prevalence of lifestyle-related and chronic diseases is propelling the adoption of homeopathic medicines. Additionally, the increasing adoption of plant-based supplements and the launch of new homeopathic medicines are key factors contributing to market growth. Evolving reimbursement policies and rising healthcare expenditure are expected to create ample opportunities in the coming years.

Homeopathy Market Overview

North America is projected to dominate the homeopathy market with the largest share, and Asia Pacific is expected to register a significant CAGR during the forecast period. The demand for homeopathy is surging, driven by increasing public awareness of its natural, noninvasive approach and the perception of fewer side effects than conventional pharmaceuticals. National surveys estimate that up to 10% of Indian households regularly use homeopathic remedies, and the country’s homeopathic market is projected to reach a value of over US$1.2 billion by 2025. In India, the Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha & Homeopathy) plays a pivotal role in the advancement of homeopathic medicine by promoting and regulating the field, investing in research and development, establishing over 200 recognized homeopathic colleges, and integrating homeopathy into public health programs. As of 2023, India has more than 285,000 registered homeopathic practitioners, the highest in the world. According to India’s Ministry of AYUSH, the AYUSH sector, which includes homeopathy, has grown by over 17% annually, and the market value was projected to reach ~US$23 billion by 2023.

By promoting homeopathy through investments and establishing dedicated institutions, India is expanding its homeopathic healthcare capacity, aligning with the rising demand for alternative and preventive healthcare approaches.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHomeopathy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Homeopathy Market Drivers and Opportunities

Surging Adoption of Homeopathy Treatments

According to the World Health Organization (WHO), homeopathy is recognized as the fastest-growing and the second-largest system of medicine. According to the WHO, homeopathy is practiced and available in 40 out of 42 European countries. In France, 95% of general practitioners, pediatricians, and dermatologists incorporate homeopathic remedies into their practices. The Swiss government has recently concluded that homeopathy is “effective, cost-effective, and safe,” and now recognizes it as having the same status as conventional medicine. Additionally, the British Medical Journal reports that an impressive 57% of people in Germany use homeopathic treatments.

India leads the world in the number of people relying on homeopathy for medical care, with 100 million individuals depending solely on this form of treatment. Homeopathy is the second-highest funded and most utilized category under AYUSH by the Indian government and the public. The Ministry of AYUSH actively promotes and regulates homeopathy by investing in infrastructure and education. In March 2024, India established its first government homeopathic college in North India, supported by an investment of INR 80 crore. Thus, the increasing number of homeopathy practitioners and government initiatives to promote the adoption of homeopathic medicine bolsters the growth of the homeopathy market.

Surging Healthcare Expenditure and Evolving Reimbursement Policies

Homeopathy is increasingly integrated into national healthcare systems and insurance frameworks, particularly in Asian and European countries. In nations such as Germany, France, and India, a significant portion of the population can access homeopathic treatments through public or private health insurance. However, the level of reimbursement varies across Europe.

India, in particular, serves as a major hub for homeopathy within its public health network. Homeopathy is the second most widely used AYUSH modality, following Ayurveda. Homeopathic health centers comprise 31% of all AYUSH centers across India. Over 7,000 diseases are officially recognized as treatable by homeopathy under India’s national health framework.

In the Middle East, insurance companies have traditionally hesitated to cover homeopathic treatments; however, this attitude is changing. Middle Eastern nations, such as the UAE, have started registering homeopathy practitioners with the Ministry of Health and the Dubai Health Authority (DHA), promoting broader inclusion and regulation. Growing public demand for alternative medicine, an increasing number of licensed practitioners, and evidence supporting the cost-effectiveness of homeopathy (especially for chronic diseases) may encourage insurers to begin reimbursing homeopathic care more frequently, even when used alongside conventional treatments.

Therefore, the increasing inclusion in national health systems driven by rising healthcare spending and growing insurance coverage is expected to create ample opportunities for the homeopathy market in the coming years.

Homeopathy Market Report Segmentation Analysis

Key segments that form the foundation of the homeopathy market analysis are source, type, application, and end user.

- Based on source, the homeopathy market is segmented into plants, minerals, and animals. The plants segment held the largest share of the homeopathy market in 2024 and is expected to register a higher CAGR during 2025–2031.

- By type, the homeopathy market is classified into dilutions, tinctures, biochemics, tablets, ointments, and others. The dilutions segment held the largest share of the homeopathy market in 2024, and it is expected to register the highest CAGR during 2025–2031.

- According to application, the homeopathy market is categorized into neurology, gastroenterology, respiratory, dermatology, and immunology. The neurology segment held the largest share of the homeopathy market in 2024.

- Per end user, the homeopathy market is segmented into homeopathic clinics, retail pharmacies, e-retailers, and others. The homeopathic clinics segment held the largest share of the homeopathy market in 2024 and is anticipated to register the highest CAGR during 2025–2031.

Homeopathy Market Share Analysis by Geography

The geographical scope of the homeopathy market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East and Africa, and South and Central America. North America held a significant share of the market in 2024. In North America, there is a growing demand for innovative homeopathic therapies, including gene-targeted medicines and formulations that have proven effective in managing respiratory disorders. In the US, a significant number of adults and children utilize homeopathy to address health concerns, indicating a broader acceptance of alternative approaches. Major regional retailers now offer a wide selection of homeopathic products alongside traditional medicines. In both the US and Canada, patients are turning to homeopathic remedies to help with chronic illnesses, stress management, and preventive health care. Leading companies such as Boiron Co. and Homeocan Inc. provide a comprehensive range of products, including homeopathic tablets, tinctures, creams, and ointments. These companies emphasize regulatory compliance and quality assurance, ensuring their products meet safety and efficacy standards. The holistic nature of homeopathy, which focuses on principles such as individualized care, resonates with consumers interested in early symptom treatment and disease prevention.

Patient education plays a vital role in the market's expansion. Licensed homeopaths, naturopathic doctors, and online consultation platforms now offer expert guidance on using and selecting homeopathic remedies. Dedicated pharmacies such as Daleila Medica and scientific clinical trials help reinforce the credibility of homeopathic treatments, boosting consumer confidence. Herbal extracts and other natural products are frequently incorporated, reflecting the broader movement toward natural health solutions. Ongoing research continues to explore the effectiveness of homeopathy for conditions such as allergies, respiratory illnesses, sleep disorders, and immune health.

The expanding homeopathy market attracts consumers seeking to prevent illness, manage chronic health conditions, and promote overall well-being through a combination of homeopathic therapies, herbal remedies, and lifestyle adjustments. Additionally, education regarding traditional Chinese medicine and homeopathy is enhancing consumer knowledge and shaping the expertise of healthcare providers in this sector.

Homeopathy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 12.89 Billion |

| Market Size by 2031 | US$ 42.06 Billion |

| Global CAGR (2025 - 2031) | 18.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Homeopathy Market Players Density: Understanding Its Impact on Business Dynamics

The Homeopathy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Homeopathy Market News and Recent Developments

The homeopathy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Key developments in the market are listed below:

- Dr. Schwabe Holding SE & Co. KG increased its shares in Braineffect, acquired in 2020, and now holds the majority in the Berlin-based company that develops nutritional supplements and functional foods. Dr. Schwabe Holding SE & Co. KG aims to strengthen its product offerings through this acquisition. (Source: Dr. Schwabe Holding SE & Co. KG, Company Website, 2025)

- Boiron expanded its product line with the launch of ThroatCalm Spray, the latest addition to its trusted ThroatCalm line. This product launch enables the company to strengthen its product portfolio further. (Source: Boiron, Company Website, 2024)

- EW Healthcare Partners announced that it acquired a 25% minority stake in Boiron to help further accelerate Boiron's growth by expanding its offering into additional healthcare verticals and capitalizing on the existing platform to launch additional products, particularly in the US. (Source: EW Healthcare Partners, Company Website, 2023)

Homeopathy Market Report Coverage and Deliverables

The “Homeopathy Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Homeopathy market size and forecast at the global, regional, and country levels for all the key market segments covered under the scope

- Homeopathy market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Homeopathy market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the homeopathy market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For